Venture Capital Investment Advice

The investment management business of GRI Equity involves risk management and asset allocation. Investors recognise the particular nature of GRI Equity's investment business and have agreed that they are suitably qualified to evaluate their participation in the business; they should be sophisticated investors. GRI Equity is not regulated and operates as a hedge fund. Each investment is subject to the finance and securities laws, as well as other laws, relevant to the jurisdiction in which the investment is made.

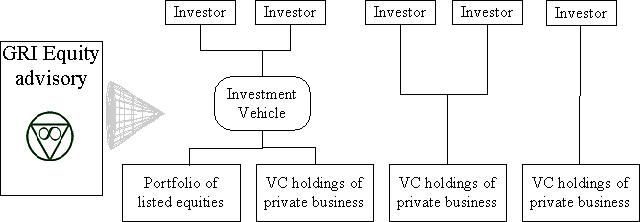

GRI Equity provides advice and management of venture capital investment and discretionary advice on portfolios of listed equities.

Focus

We invest in business demonstrating good business practice and enlightened management. We help small and medium sized businesses grow.

Our approach is built on an international track record of private equity and venture capital management and industrial operations experience. We offer attractive returns while also managing business and financing risks. Our deal flow is global.

Our strength is built on our proprietary business model, investment method and on experience. Today we are one of a very few private equity managers that have captured the technology to build financially successful and sustainable businesses while also serving the demands of other stakeholders, community and environment. We have comfortably combined the rigour of institutional management, parallel decision making and alignment of structure, compensation and approach among non-capital providing stakeholders. While many SRI managers dysfunctionally dissociate financial and environmental/ethical reviews, we believe these must be integrated to provide authentic service. We combine venture capital management experience with direct, hands-on entrepreneurial experience.

If you are already convinced of the competitive strengths of a sustainable investment management, we would be happy to discuss specific investment parameters with you. If you would like to understand the powerful investment rationale underlying our business we would be pleased to present to you a wealth of research compelling our business. You will find that we, and our partners, operate with great integrity and unusual frankness.

Please contact us if you would like to discuss this opportunity further. An example prospectus may be viewed here.

Style and Selection

GRI Equity invests equity in private businesses.

We invest globally, managing disparate holdings through web based systems and supported by a global network of advisors and regular site visits. We have invested in Europe, Asia and America, having reviewed hundreds of opportunities and invested successfully in the growth of businesses from early stage through to listed.

We are emotionally and economically committed to our partners' success - investment managers invest equity in the same pool as investors.

We are privately founded and are comfortable working with private clients, particularly those with family dynamics. Our realisation strategy is predominantly to exit through private sales, rather than listing. Both financial and business investors are welcome.

We work with individuals or teams of entrepreneurs or executives to embed sustainable success in their ventures. We have developed and implemented business improvements in various industries including primary, secondary and tertiary sectors. We work with clients of integrity.

Target Investment Selection Criteria

Key investment selection criteria are:

-

A management team with a relevant track record and demonstrated complementary team skills and competencies. An understanding by target management of global management issues. We look for management teams displaying visioning and inspirational coaching approach.

-

A business proposition that is distinctive and commercially attractive.

-

Demonstrated globally responsible initiative.

We look for businesses that show a commitment to providing authentic, value for money goods or services for customers, employees, owners, and the community at large. These companies are built upon traditional principles of "do to others what you want them to do to you" and do not thoughtlessly pursue whimsical market demand at the cost of medium and long term viability. Businesses may demonstrate a desire to adopt sustainable business principles in their product/service offerings or in their operations. (So, for example, we might invest in a traditional non-sustainable product because the business is adopting cooperative operations management and wishes to substitute production with sustainable alternatives.)

Though we will consider all sectors, except military and nuclear, we focus on businesses serving the following markets:

-

Industrial and consumer LOHAS goods and services. In particular, sustainable substitutes for modern needs and conveniences: food, clothing, household, leisure and entertainment.

-

Information, communications and management technology.

-

Education.

-

Energy.

-

Transport.

-

Waste Management

Dealflow is diverse and provides the ability to select a diverse portfolio of businesses strengthened by the common culture of sustainable business excellence.

We invest to finance product development, market development and business systems improvement. We are not likely to invest in a business without sales, although we would consider helping develop these businesses to bring them to the point of being viable investments.

If you are interested in investing with GRI Equity, please contact Tom Butler to discuss your requirements.

Investment Policy and Restrictions

The general approach of the Investment Policy is open rather than restrictive, that is, it tends to present positive screens rather than negative screens. This global approach is necessary to optimise risk diversification of the portfolio. In addition flexibility in accessing opportunities increases the opportunities for appreciation of the Company.

Investment Policy

The Company will invest in businesses demonstrating globally responsible initiatives, either in product or service delivery or in business method.

The Company's geographic investment focus is global. Current deal flow and expected transactions are expected to be in Asia, Europe and North America.

The Company's investment policy is inclusive and intends to invest in a diverse range of industries. However, particular interest is focused on LOHAS, IT and management tech, energy, transport, waste and related businesses. (Restrictions are indicated below.)

-

Industrial and consumer LOHAS goods and services. In particular, sustainable substitutes for modern needs and conveniences: food, clothing, household, leisure, education and entertainment.

Food - organic, catering, convenience/low packaging, local life cycle...

Clothing - organic, local, handmade, sustainable ...

Appliances - low energy, eco-tech, no-chemical ...

Furniture and fixtures - low energy, design, materials, local life cycle ...

Building - materials, design ...

Leisure - eco-toys, educational toys, eco-hotels, eco-tourism/holidays, learning holidays ...

Education - Online learning, learning to .learn, adult education, vocational training ...

Living - banks, insurance, retailing ... -

Information, communications and management technology.

Lower IT cost/risk, WBEM, open source or cross-platform software, materials, telecom services, chaordic systems ... -

Energy.

Alternative energy especially water, wind, biofuels, solar ... -

Transport.

Eco eg cycles, independent modules, low energy, community systems, -

Waste Management.

Reduction, recycling, reuse, natural purification, eco- cleaning ...

Restrictions

The Company will not:

-

invest in businesses involved in armaments or military activity;

-

invest in nuclear power businesses,

-

invest in businesses contravening human rights practices.

Administration and Expenses

Structure of Investment Holding

Assets may be held in special purpose vehicles or individually. Assets may be warehoused for transfer to a fund. An agency arrangement may exist between GRI Equity and our client. Investment assets are not normally held by GRI Equity.

Currently we manage a portfolio of listed equities that are held by a neutral administrator on behalf of investors. As these assets accumulate private investment opportunities will be considered more actively.

Regulation

The advisor is not regulated. Investments are generally made through third parties that are regulated, thus reducing the conflict of interests that might arise from the Manager having discretionary authority to execute trades.

Advisor

Astraea Ltd is the advisor to the investors and will make investment recommendations from time to time requested by investors. The Advisor is authorised to enter into agreements, subject to approval by investors.

Reporting

Summary quarterly reports and full annual reports.

Valuation of Holdings

Valuation of Holdings is made regularly and at least quarterly.

Valuation of Holdings is performed by the advisor and the administrator.

In general, listed investments are valued at market price and unlisted investments are valued at either acquisition cost, the most recent third party transaction price, or a value recognising any permanent appreciation or depreciation in the value of the business. Valuations will generally follow the norms below:

Early stage investments:

-

at cost, less any provision required, until no longer "early stage".

Development stage investments:

-

at cost less any provision required (most common).

-

earnings multiple (next most common) - generally a minimum of 25% discount to the price/earnings multiple of the lowest rated comparable quoted companies.

-

third party valuation (price at which subsequent issue of capital is made).

-

net assets less discount (rare).

Quoted investments:

-

mid-market price.

-

if holding significant or other restrictions - discounts range from 5-25%.

Custody

Securities relating to Holdings and Liquid Assets are held by the Custodian and are held in segregated accounts or deposits. Some investments may be registered in the name of a nominee company owned by The Company.

Indemnities

The Advisor [and Administrator] and their employees and agents and members of the Board are entitled to be indemnified out of The Company's assets against all claims, actions and demands made against them in relation to The Company unless arising from bad faith, fraud or reckless or intentional wrongdoing.

The Advisor and others are excused liability for actions taken in good faith for a purpose that was reasonably believed to be in the best interest of The Company and when acting on professional advice where appropriate.

The terms of the agreement appointing the Custodian contains provisions indemnifying or limiting the liability of the Custodian.

Taxation

Investors should seek their own advice from professional tax advisors as to their tax status and the likely liabilities that may result from investment.

Governing Law

All investors, in subscribing, agree to be subject to arbitration at international law or at European Law in that order of priority in the event of any dispute. The Advisor is governed by Irish Law.

Expenses

Fees

The Advisor's fees are negotiated with each client. In general a fixed fee for establishment and a fixed annual management fee is agreeable.

All costs, except the costs of the administrator and custodian, are for the account of the advisor.

A performance fee is payable if the net return of investments exceeds 15% per annum, 20% of the excess return is payable to the advisor.

The fees of the Administrator and Custodian will be paid by the investors.

Arrangement, introduction or monitoring fees received by the advisor in respect of the making of an investment in or monitoring a Holding are for the account of the advisor.

Company Expenses

Expenses chargeable to investors include:

-

stamp, transfer and registration duties on investments,

-

all legal, accounting and other expenses in relation to dealings in investments,

-

bank charges,

-

fees of the advisor and

-

fees and costs of the Auditors, Administrator and Custodian.

Subscription

The minimum initial subscription is € 50,000.

Please contact Tom Butler to subscribe to our venture capital investment services or for more information.

Home * Business Advice and Coaching * Investor Services * Resources *About * Contact