Cover

Notice

Directory

Definitions

Glossary

Slide Show

Executive Summary:

-Overview

-Administration

-Success Factors

Market Opportunity

Change Technology

Market Dynamics

Timing

Administration

Structure

Strategy

Subscriptions

Administration

Economics

Operations

Business

model

Overview

Infrastructure

Culture

Economics

People

Investment

Process

Overview

Dealflow

Initial screen

Target research

Verification & documentation

Monitor & advice

Exit

Listed investments

Decision making process

Appendicies

Business Model

*Example

Deal Flow Reports

*Initial

Screen Template

*Environmental

And Social Guidelines

*Strategic

Review Templates

*Financial

Review Template

*Due

Diligence Checklist

*Diagnostic

Tool – Questionnaire and Illustrative Graphs

*Outline of Investment Committee

Report

*EVCA

Valuation Guidelines

*Proforma

Fund Projections

*Parallel

Analysis Decision Making Model

*Memorandum

and Articles of Association

*Securities

Law Matters

*Taxation

Market & Geopolitics

*Summary

Findings of Global Economic Outlook (UNEP)

*Conclusions

of World Resources Institute Global Resources Analysis

*The

Future of the Global Environment – Analysis by UNEP/RIVM

![]() :

Example Fund Details

:

Example Fund Details

information dated 2004

GRI Equity Management Operations

The objective of the fund is to build a portfolio of small and medium businesses demonstrating sustainable economic success. The partners, both investors and holdings, will benefit from business development technology held by GRI Equity. This Technology is not protected by law other than normal copyright. The rate and quality of technology transfer is accelerated by the assistance of our managers.

Business Model

GRI Equity provides:

-

An understanding of the investment opportunity.

-

A successful investment management methodology.

-

Investment management team with skills, experience and attitude required to make and manage investments.

-

Cost effective infrastructure. Information and communication resources allowing the team to source and analyse investment information, to work interdependently, and to generate feedback and control. Administrative resources to supply and disseminate investment information.

-

An enterprise culture that reflects the values associated with globally responsible investment.

Our global network combined with our cooperative culture provides cost effective access to a financial engineers and business advisors that support the investment and management activity. Holdings and business partners are part of the web based enterprise management system so that skills and knowledge resources are extended and deepened.

PWC's 10 Critical Actions For Developing Tomorrow's Leading Investment Managers(Go here for full presentation)

PriceWaterhouseCoopers |

Operations Overview

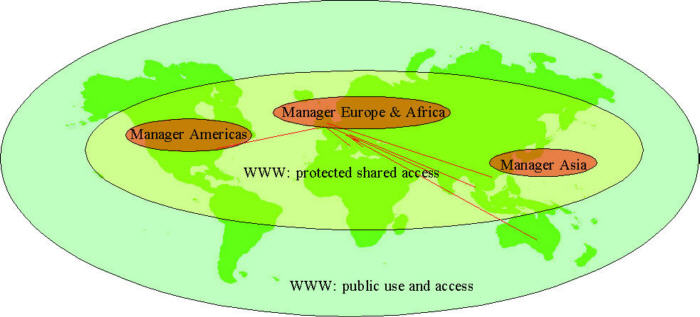

Interdependent managers operate to a prescribed process in sourcing, making, managing and exiting investments. Communication among managers occurs via telephone and internet regularly with weekly deal flow reviews formalised.

Documentation is produced on open systems and shared via the internet. Online resources are managed at varying degrees of accessibility screened at three levels: full access internally, more limited access to partners and investors, and further limited access to public.

Infrastructure

The Manager operates a web based management infrastructure leveraging knowledge resources of its team, investors, holdings, partners and others. Collaboration in easier and cheaper than in traditional systems and administration costs are reduced.

Open linux IT provides a secure, stable cost effective infrastructure. Standard screens control investment processes. Network resources accessed through the Internet.

Knowledge sharing is encouraged through:

-

cooperative compensation structures and culture,

-

data and learning capture systems (e.g. email, online forums), and

-

systematic archiving (regular reports to monitor business and market conditions).

The principle of disclosure underlying the web based system encourages continuous improvement in operations. Individuals and groups are less comfortable allowing poor performance or inattention. Inefficiencies are more visible and must be justified. Because we share responsibility, the positive environment encourages improvement (rather than creating a fear to motivate).

Improvement is modular, or parallel, rather than serial. The benefits of knowledge leverage continue to accrue and become more significant over time.

These management systems and techniques may be made available to Holdings to improve their operational performance.

Web Based Systems

Executives and advisors have proprietary records in hard files and locally held e-files. They also access resources on the protected areas of the website or on public areas of the web. Investors, holdings and partners have access to real time information and business review. Professional agents may be engaged in real time but from disperse locations. Normal business travel is used for face to face meetings and due diligence reviews.

GRI Equity open source technology and the internet to provide

-

Lower overheads

-

Improved communication

-

Internal expertise that is multi-disciplined and multinational.

-

Advisory network: Links to advisors, holdings and agents offers a pre-screened network of experts for consultation

-

Access to market information

Team

The Manager of The Fund employs professionals who collectively possess resources that are relevant to the analysis, implementation and monitoring of investments. Additional skills are sourced from our global network as needed by projects. We have the following general profile:

-

general and specific investment expertise in unlisted and listed investment management,

-

local knowledge in North American, European, Asian, African and South American markets,

-

and contacts in these markets

While individuals are responsible for managing the whole investment process: sourcing, screening, due diligence, deal structuring, investment, monitoring and exit, team members are encouraged to share results with colleagues. This is facilitated by intranet offering shared access to operating documents and by weekly reviews.

The executive director is introduced here.

Culture

The culture of the business emanates from an intellectual understanding of the broad aims of globally responsible management. These include mutual respect, cooperating, preservation of natural resources and access to information and technology.

The management style reflects the following values: apolitical, interdependent, self-auditing, patient, persistent, resilient and resourceful. People management systems include tools for selection, monitoring and reward.

While it is appropriate to incur ultimate responsibility for certain decisions, the style of operating is to accept individual responsibility for delegated tasks but to share responsibility for the overall objectives of the business. The hierarchy of management is low.

The Manager aims to reflect the working population of the markets in which it operates where possible.

The business operates to a policy of inclusion. This is facilitated by the web based management systems allowing people access to decisions that affect their responsibilities.

Economics

The Fund is not expected to generate a significant stream of income. While some investments may yield current income, capital appreciation is the source of expected return.

The Manager is paid a fee from the assets of The Fund to cover all operating costs of the Manager.

Compensation is competitive. The business operates on the principal that reward for work is based on time committed, skills required and responsibility assumed. Executive compensation is partly paid in shares of the company (options will not be issued) providing an incentive structure reflecting investors needs.

All executives are encouraged to acquire shares of The Fund and all staff are offered the opportunity to acquire shares in the Company.

Performance Incentives

It is expected that people employed in the business are committed to the global management objective of equality. The business adopts a cooperative approach to management and compensation.

The incentives of the management are closely tied to the objectives of investors. To this end, executives are partially compensated in shares of The Fund – this portion comprises all incentive and performance bonus. All employees are offered the option of acquiring shares in The Fund.

The maximum spread of current compensation is intended to be less than 5 times. Compensation is intended to reflect the difficulty and importance of the work. However, responsibilities are expected to be shared so that people have ample opportunity and comfort in spending time on outside activities. It is not intended to vest excessive responsibility with few executives, who are then unable to participate in other commitments.

Additional benefits may be shared among staff if cash flow in the Manager allows and performance justifies this.

The fees and fund economics are discussed in the section Company; Economics.

Investment Process

GRI Equity' builds a diversified portfolio of attractive businesses whose expected returns are improved while managing risk. Our investment management process is summarised below and elaborated upon here.

Success of any investment strategy requires:

-

Successful initial selection (select for competitive strength and screen risk)

-

Appropriate timing of investment and exit, and

-

Value adding management (or at least no net cost to Holding).

These are provided by The Manager through an adaptable, rigorous and efficient investment management process, a team with the skills and experience to make and manage investments and business relationships and a culture compatible with the craft of direct investment management.

The Manager operates a successful investment process which is continually refined. The investment methodology is necessarily flexible to accommodate the variety of opportunities with which the Manager is presented. Nevertheless, the Manager’s guidelines help to avoid unnecessary errors in investment selection.

Successful implementation of the investment strategy relies upon appropriately skilled and resourced management team. The Manager's executives provide directly relevant experience in structuring deals and managing the investment process in a range of environments including developing as well as developed economies. For example, to improve realisation prospects in developing economies investments may be structured to allow capital retrieval even if realisation through a stock market listing or trade sale is not immediately possible.

Graphic Representation of GRI Equity Management’s Investment Process

Go to detailed discussion of investment process here.

Back to The Company * Forward to Risks

Home * About * Resources * Investors * Businesses * Members * Admin