Cover

Notice

Directory

Definitions

Glossary

Slide Show

Executive Summary:

-Overview

-Administration

-Success Factors

Market Opportunity

Change Technology

Market Dynamics

Timing

Administration

Structure

Strategy

Subscriptions

Administration

Economics

Operations

Business

model

Overview

Infrastructure

Culture

Economics

People

Investment

Process

Overview

Dealflow

Initial screen

Target research

Verification & documentation

Monitor & advice

Exit

Listed investments

Decision making process

Appendicies

Business Model

*Example

Deal Flow Reports

*Initial

Screen Template

*Environmental

And Social Guidelines

*Strategic

Review Templates

*Financial

Review Template

*Due

Diligence Checklist

*Diagnostic

Tool – Questionnaire and Illustrative Graphs

*Outline of Investment Committee

Report

*EVCA

Valuation Guidelines

*Proforma

Fund Projections

*Parallel

Analysis Decision Making Model

*Memorandum

and Articles of Association

*Securities

Law Matters

*Taxation

Market & Geopolitics

*Summary

Findings of Global Economic Outlook (UNEP)

*Conclusions

of World Resources Institute Global Resources Analysis

*The

Future of the Global Environment – Analysis by UNEP/RIVM

![]() :

Example Fund Details

:

Example Fund Details

information dated 2004

GRI Equity Investment Process

Overview

GRI Equity' builds a diversified portfolio of attractive businesses whose expected returns are improved while managing risk. The portfolio is comprised of globally diversified investments in a range of sectors from startup to expansion and development. All enterprises demonstrate a globally responsible initiative.

GRI Equity applies a diligent yet flexible selection process. Various guidelines, analysis and audit procedures, governance and environmental screens. Opportunities are subject to greater or lesser research and verification procedures depending on the amount and quality of information available; long established listed companies are likely to require a lower commitment of resources in the investment management process than emerging unlisted businesses. Experience shows that while listed companies have proven certain aptitudes it is appropriate to apply similar breadth of screening. The cost of acquiring information on listed companies is lower but the breadth of analysis is similar.

The ongoing relationship with the businesses we finance allows for changes. We expect developments to be predictable and transparent. This underlies the critical aspect of private investments - managing the investment in an environment of uncertainty and illiquidity. If negative changes appear we expect to resolve them with our partners and other stakeholders involved. We obtain formal reports from our partners and communicate with them regularly, offering advice and experience when appropriate.

The operations described below focus on the unlisted method. The listed process is a subset of the unlisted process, relying on publicly available information, and the superior return expectation is predicated on a value investment strategy combined with appropriate timing over a long investment period. (The process for selecting listed investments is summarised at the end of this section.)

Our successful investment strategy requires:

-

Successful initial selection (select for competitive strength and screen risk)

-

Appropriate timing of investment and exit, and

-

Value adding investment management (or at least no net cost to Holding).

Our guidelines help to avoid unnecessary errors in investment selection.

Private Investment Process

We provide the skills and experience to make and manage investments and business relationships and a culture compatible with the craft of direct investment management. Structuring deals and managing the investment process in venturesome environments demands a broad perspective to develop successful solutions. For example, to improve realisation prospects in developing economies investments may be structured to allow capital retrieval even if realisation through a stock market listing or trade sale is not immediately possible.

Graphic Representation of GRI Equity Management's Investment Process

Target Sourcing (Deal Flow)

Opportunities are sourced passively and actively.

Passive deal flow is expected to be 100 to 200 opportunities per year, based on industry norms and past experience. This flow is from membership of industry groups, web based and other marketing and partner networks.

Active deal flow is expected to be 10 to 20 opportunities per year per executive. These opportunities are sourced and developed by team members contacting targets and building relationships in anticipation of investment opportunities.

In total the Manager expects to receive over 100 proposals per year, of which 30 – 40 would be considered further and investment might be made in a handful of these.

On receipt opportunities are entered in to the Weekly Deal Flow Report and the Historical Deal Flow Reports.

Weekly Report covers: Company / Business / Status / Size. It provides a tool to:

-

Monitor progress

-

Discuss action

-

Update relevant executives

-

Inform committees

Historical Report covers: Company / Sector / Business / Stage / Geography / Size / Source it provides a tool to:

-

Record deal flow internally.

-

Monitor type of dealflow.

-

Reference for new deals.

-

Reapproach principals.

Please see Appendix for a draft unlisted dealflow report from 2001. A current report may be seen by contacting us directly. At any moment, 5 to 10 proposals are normally active on the Weekly Deal Flow Report (ranking: Holding, active priority A, B, C and watch).

Examples of Unlisted Investment Targets:These investments are all at the source stage of investment selection. The list is offered to exemplify the type of investments available. No commitment is given that any of them will be concluded for The Fund 0 = identified, 1 = seen, 2 = first screen, 3 = opportunity research, 4 = verification, 5 = invest Startup waste and fertiliser business established by related industry players. 2 Established jam, preserve and condiment developer and producer seeking expansion capital and structuring flexibility. Ireland.1 Organic cosmetics line with international franchise. Australia. 0 A start-up hemp processor with proprietary technology and a well experienced textile production and marketing team. Ireland. 1 An established non-CFC aerosol manufacturer with proprietary manufacturing process seeking development capital. Switzerland 1 An established manufacturer of ecologically friendly detergents seeking expansion capital. Germany. 0 A manufacturer of biomass burners for small scale agricultural and industrial applications seeking expansion capital. UK 0 An established manufacturer of toys made from sustainable forest sourced timber seeking expansion capital. Thailand. 0 A start-up designer of low cost, low emission motor scooters targeted to low income mass market consumers. Thailand. 0 A provider of proprietary plastic sorting technology (for recycling) seeking expansion capital. USA 0 A provider of mobile phone services to rural areas seeking expansion capital. Bangladesh 0 0 = identified, 1 = seen, 2 = first screen, 3 = opportunity research, 4 = verification, 5 = invest |

Screening and Analysis

Summary of Screens and Guidelines Used

investment policy * Initial/Summary Screen (see appendix) * Environmental and Social Guidelines * Strategic Summary * Financial Summary * Due Diligence Checklist *Diagnostic Tool * Investment Committee Report

Initial Screen

We first screens all investment opportunities to ensure that they fall within the investment policy of The Fund. The Manager refers to the Fund’s Environmental and Social Guidelines (see appendix) at this and later stages of screening as appropriate.

If the opportunity is worthy of consideration an Initial/Summary Screen is circulated internally and management responsibility is agreed.

The Initial/Summary Screen (see appendix) provides the following:

-

background on target,

-

globally responsible initiative,

-

summary financial review.

If prima facie evidence of the globally responsible initiative (e.g. the business is an organic food production or processing business) is not apparent, this section would be more comprehensive.

At this point the target should at least be within the investment policy of the Fund.

If the investment team considers that an attractive investment opportunity may be generated within a matter of months, target research may proceed. Otherwise contact with the business may be maintained.

Target Research

The Manager researches the company in as much detail as is required to develop a good understanding of the opportunities and risks of the business.

Investment Committee Report

The analysis and assessment is described in an Investment Committee Report which describes the business: general company information, management, market and product, production, marketing, finance, investment sought. A brief of the contents of the investment committee report is here.

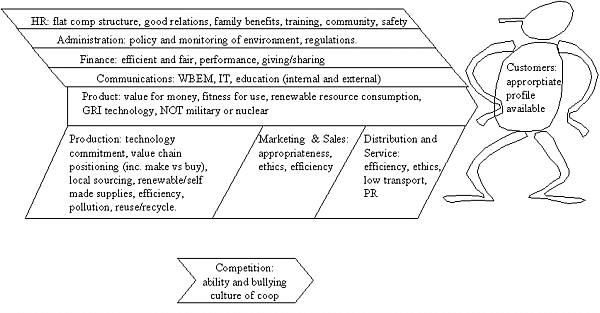

The value chain graphic summarises the strategic analysis perspective.

As part of the investment opportunity research, the manager will circulate summaries of the strategic and financial characteristics of the target. Templates of Strategic Summary and Financial Summary are available in the appendix.

A Due Diligence Checklist is used to control and standardise the review process. In addition, GRI Equity Management has a Diagnostic Tool applied in the evaluation of unlisted investments. (This diagnostic tool was developed from the Bell-Mason diagnostic process.) The tool is used to benchmark competitive strengths and investment risks.

Neither the Due Diligence Checklist nor the Diagnostic Tool are intended to give an "answer" but they provide a framework for systematically evaluating opportunities. The Fund’s Environmental and Social Guidelines are also referenced again and the Environmental Review is used. Other tools may also be used. Third party due diligence services may be engaged.

An Investment Committee Report is completed which reports the target research (see below) and identifies particular issues to be addressed in the Verification stage.

The Due Diligence Checklist, Diagnostic Review, Social and Environmental Review and the Investment Committee Report are signed by the responsible manager when the target is submitted for internal review.

Verification and Documentation

The Investment Committee Report that:

-

describes the target company, including its globally responsible initiative,

-

the deal structure and investment opportunity presented, and

-

makes a recommendation on action.

The Investment Committee Report is circulated to the Investment Committee for review and a decision is taken by the Investment Committee whether or not to pursue independent verification, noting any conditions.

If approved, preparation of documentation and legal and financial verification by independent professionals is undertaken. If necessary market or operations reviews may be contracted as agreed between the Manager and the Target.

If this due diligence process is satisfactory, the Manager recommends the investment, taking into account verification findings. If the Investment Committee approves the final recommendation, the investment is made.

Monitoring and Advice

Regular contact and quarterly review meetings are held with management of Holdings to enable the Manager to monitor progress and to support the development of the business and its financial strategy.

Quarterly reports are produced discussing operational and financial performance, including comparison to expectations. If Holdings do not perform in line with expectations, the operating strategy of the Holding is reviewed and the investment strategy of the Company may be reconsidered.

It is normal for markets to change during the tenor of holding an investment and thus challenges will arise and the strategy will be adapted to new opportunities. We are committed to participating in the development of our partners' opportunities and make our experience and knowledge resources available. It is important that we can participate in this process and prior to investment we evaluate the likelihood of a productive relationship.

Realisation of investments (exit)

Realisation of investments is expected to be by business sale or public listing. In unusual cases, realisation through distributions by a Holding may be pursued.

Many Holdings will seek liquidity through listing on a recognised stock exchange followed by sale of listed shares. Many companies continue to have superior growth prospects after listing, and that retaining the Holding would maintain a high return to investors over time. Thus, Holdings may be retained after listing and would be subject of the normal quarterly review process of listed investments. Furthermore, because of stock exchange regulations and the substantial holding which The Fund may have in each company, The Fund may be restricted from selling some or all of its holding on listing. This "silent period" is usually imposed by stock exchanges as part of the listing arrangements.

Listed Investment Process

Private investments in listed companies may be made or the Fund may hold a portfolio of listed stocks for cash management purposes.

Private investment in listed companies generally follows the normal private investment process described above, but, we rely on publicly available information. A superior return expectation is predicated on a value investment strategy combined with appropriate investment and exit timing over a long investment period.

GRI Equity's sponsor, Astraea, advises on the management of other portfolios of listed shares with similar investment objectives.

The portfolio of listed companies is intended to be held for long term investment. It is not intended to buy and sell stocks over a time horizon of less than three months, however, liquidity events may be influenced by the cash flow dynamics of the unlisted portfolio.

The initial investment portfolio is selected from the core portfolio. New investments are likely to come from the database of suitable listed target investments.

Opportunities are screened by the following criteria, of which targets should have at least three including demonstrable globally responsible initiative:

-

Activity must demonstrate globally responsible initiative.

-

Geography, sector, stage to reflect Investment Policy. Size: over US$ 1 million in sales.

-

Management team complete and competent.

-

Management systems and culture reflective of cooperative approach.

-

Pricing: PEG less than 1.

If a target is selected for potential investment a Recommendation is made together with a Strategic Review and Financial Review following the format indicated in Appendix Strategic and Financial Review. We source information from media, investment and industry analysts and the company themselves. We prepare an internal valuation model which may be derived from third party reports. We would expect to watch a listed company for three months before buying shares. An investment recommendation would include benchmarks referring to investment price and timing as part of an investment strategy underpinned by valuation comparison. The recommendation will also include an evaluation of globally responsible initiative.

If investment is approved, the investment is made having due regard for price and timing. If it is intended to acquire more than 5% of the company, the Unlisted Investment Process described above should be adopted.

Listed Holdings are reviewed quarterly. A quarterly review of Listed investments is circulated recommending to hold or sell the Holding.

The Manager invests in listed companies normally for a minimum of six months, one aspect of the investment strategy being to acquire investments when valuations are depressed by short/medium term market conditions.

Listed investments would not be sold for 6 months notwithstanding extreme market volatility (>10% change in a relevant index within 1 week). It is intended that listed investments are to be held for a minimum of three years.

The system used to manage the listed investments process includes:

-

Listed investment global database

-

Initial Screen (as for unlisted)

-

Deal Flow Report.

-

Recommendation including Strategic Review and Financial Review

-

Quarterly review (as for unlisted)

Pre-listing and IPO Investments

Companies preparing for listing or IPO are reviewed by a financial adviser (a sponsor) which prepares the company for listing. The advisor will have undertaken certain steps (e.g. to appoint suitable auditors) required to meet stock exchange listing requirements. The due diligence process undertaken by the Manager does not duplicate this work, and the focus of the Manager is on assessing the company’s prospects. The Manager also assesses the credibility, reputation and quality of work of the sponsor. A Recommendation similar to that for making listed investments is circulated to the Investment Committee.

Decision Making Process

Investment Activity Roles

The initial screen is carried out by the staff in the office where the deal is sourced.

Target research is carried out by the investment executives. Product, market, operations research may be sub-contracted if appropriate.

Evaluation and structuring of the investment is performed by the executives performing the target research.

Verification is performed by third party professionals.

The final review is carried out by the investment team and the Investment Committee.

Monitoring and exit is carried out by the investment team that reviewed the investment.

Information is available to all executives via the web.

Investment Committee

The Investment Committee is an internal committee of the Manager with responsibility for approving investments for The Fund.

The investment committee is an internal committee of the Manager. It is comprised of:

Investment proposals are circulated to the investment committee at all stages of selection. The investment committee members are individually invited to comment on the proposals. Investments will be declined if any member of the committee feels strongly that investment should not be pursued.

After investment, the Investment Committee is consulted on shareholder actions, strategic review of Holdings and liquidation strategies.

Investment Decision Making

Internal decision making is consensual rather than by majority. Decisions are made by consensus rather than formal vote, so that, for instance, if one member is strongly opposed to an investment, that view is usually respected.

The decision making style adopts not only a normal conflict/resolution model, but also a parallel analysis model (see Appendix Parallel Decision Making Process). This accelerates and improves decisions.

Home * About * Resources * Investors * Businesses * Members * Admin