Entrepreneur and Business Resources

Integral Methods and Technology

Governance and Investor Responsibility

|

Private and Confidential

GRI Equity Review - October 2005

- Perspective

- Geopolitics * Risk and terror

- Investment, finance & VC * Interest rates and currencies * Trade & FDI

- Energy * Climate Change

- IT

- Integral systems and LOHAS

- Activities, Books and Gatherings

Perspective

In October a couple of issues kept presenting themselves. Do I want truth or justice? Can you be an atheist Christian? It seems difficult to come to terms with these zen like dilemmas, and others like them, that face humanity. But they are the fulcrum upon which humanity is deciding its future. We prefer truth and justice, which usually means that results take longer. And we see many atheists who behave in a way that Jesus of Nazareth would respect. It is also painfully obvious that many people succumb to the psychology of tyranny in which they express a group value ("go to war") which is directly opposed to their personal value ("do not kill"). It is unfortunate that the hegemon USA has allowed religion (in contrast to spirituality) to enter government. The country was established by people intent on equity, but recent events have led to the breakdown of responsibility at the highest levels. Most other countries are guilty of the same complacency, but nature and public opinion will hopefully wake us up and help us be the change that we need to be.

Bush has claimed he was told by God to invade Iraq and attack Osama bin Laden's stronghold of Afghanistan. This was part of a divine mission to bring peace to the Middle East, security for Israel, and their own state for the Palestinians. The President made the assertion during his first meeting with Palestinian leaders in June 2003, according to a new BBC series aired in October. In the programme, Elusive Peace: Israel and the Arabs, the former Palestinian foreign minister Nabil Shaath says that Mr Bush told him and Mahmoud Abbas, former Prime Minister and now Palestinian President, that "I'm driven with a mission from God. God would tell me, 'George, go and fight those terrorists in Afghanistan.' And I did, and then God would tell me, 'George, go and end the tyranny in Iraq,' and I did." And "now again, I feel God's words coming to me: 'Go get the Palestinians their state and get the Israelis their security, and get peace in the Middle East.' And by God, I'm gonna do it." Mr Abbas remembers how the President told him he had a "moral and religious obligation" to act. Striking also was Mr Bush's unrelenting portrayal of radical Islam as a global menace, which only the forces of freedom, led by the US, could repel. It was delivered at a moment when the President's domestic approval ratings are at their lowest ebb, in large part because of casualties in the war in Iraq.

Geopolitics

Bush is beset on many fronts such as the disappointing and failed Miers nomination, the White house leak investigation which is probing Dick Cheney, Lewis Libby and Carl Rove, the deathtoll in Iraq passing 2,000, and economic pressure. HIs approcal rating has sunk to around 40%. So far the cracks in his administration are mainly with the conservative intelligensia, but if sentiment spreads it would cripple the administration.

From a global perspective, the behaviour of the Empire of America is causing a shift in sentiment. As one commentator says:

-

the image of the US is no longer the statue of liberty, but the prisoners of Abu Ghraib

-

a hegemon has to be perceived not just as benevolent, but competent, and the adminisatration fails catastrophically on the competence test

Francis Fukuyama says that Bush has done enormous harm to the US, though asserts that his "doctrine" will not be followed by any future administration, whether Democrat or Republican. All one can hope is that the damage will not be irreparable.

Germany is continuing its emergence as an enlightened

society and culture. Gerhard Schroder, who was seen as a breath

of fresh air when he took over from Kohl, is now stepping back as Angela

Merkel appears ready to take over a large coalition government.

The evolution of this proces has taken place in a measured and stable

way and is all good for Germany and Germans. The worst that will

happen is that the coalition will hold together but do little. The

opportunity is to introduce more variety and opportunities in Germany

for all.

A recent paper

by Philippe Aghion of Harvard and Peter Howitt of Brown has made two

exciting suggestions. They say that appropriate development strategies

are dependent on the stage of emergence of an economy,

which suggests that planners, policy makers and analysts should be more

sophistcated in determining strategy. They also say that growth

is not always good and that periods of rejuvenation and reorientation

are beneficial and should be incorporated and managed. An example might

be the development of a country's industrial profile in which old infrastructure

must be destroyed and replaced such as the replacement of Europe's textile

industry as manufacture is exported to lower wage environments and domestic

labour reorients to local specialist manufacture or services.

Risk and Terror

The

earth quake in Pakistan has devastated

communities. The earthquake is thought to have been the strongest the

region has seen in a century. In some areas a whole generation of children

has been lost. The effects of Katrina pale in comparison. Children had

been the biggest casualties, many of whom were killed when schools collapsed.

And many survivors will be orphaned. Initial estimates of the death toll

were 20,000 - the actual number of dead is closer to 60,000. Access has

been difficult, winter is setting in and conditions are attrocious. Despite

aid from the international comunity, more is needed.

The

earth quake in Pakistan has devastated

communities. The earthquake is thought to have been the strongest the

region has seen in a century. In some areas a whole generation of children

has been lost. The effects of Katrina pale in comparison. Children had

been the biggest casualties, many of whom were killed when schools collapsed.

And many survivors will be orphaned. Initial estimates of the death toll

were 20,000 - the actual number of dead is closer to 60,000. Access has

been difficult, winter is setting in and conditions are attrocious. Despite

aid from the international comunity, more is needed.

Unicef www.unicef.org Kashmir International Relief Fund www.kirf.org Red Cross/ Red Crescent www.ifrc.org

The other risk that has shouted at us through the media is avian influenza.

Bird flu fear is not appropritae, but pragmatism is.

The death rates from H5N1 are not indicative of a pandemic and there is

no reason to guess that this year will be worse than another. In

the short term normal healthy living is the best precaution - eat

properly, don't get stressed. However, the dynamics of this virus

are a symptom of the more fundamental problem of increasing volatility

of nature. The media reports lead us to believe that the virus is

being communicated from one creature to another. This may be the

case and the reason for appropriate hygiene (too many detergents weaken

our imune system so do not overdo it), but it obscures the fact that the

virus is emergent in the right conditions. Like BSE, if

the food web or habitat of the mammal are too toxic a mutant virus emerges.

The solution is therefore to improve the living conditions of the animals.

Unfortunately, neither global trade agreements nor local governments or

consumers have yet begun to reverse the trend of industrialisation of

food cultivation.

Another natural disaster is ongoing but virtually ignored - the food crisis in southern Africa caused by disrupted infrastructure, including water, bureaucracy, poor land management and other easily avoidable problems.

Refco, a leading commodities and futures broker, has been in crisis since it revealed it was owed $ 430 million by an unregulated subsidiary. Please read more in the investment section.

The Human Security Report is the most comprehensive annual survey of trends in warfare, genocide, and human rights abuses. The Report, which was produced by the Human Security Centre at the University of British Columbia, supported by five governments and published by Oxford University Press, shows how, after nearly five decades of inexorable increase, the number of genocides and violent conflicts dropped rapidly in the wake of the Cold War. It also reveals that wars are not only far less frequent today, but are also far less deadly. It explodes a number of widely believed myths about contemporary political violence. The latter include claims that terrorism is currently the gravest threat to international security, that 90% of those killed in today's wars are civilians and that women are disproportionately victimized by armed conflict. The number of armed conflicts has declined by more than 40% since 1992. The deadliest conflicts (those with 1000 or more battle-deaths) dropped even more dramatically-by 80%.

On the subject of terror, Scientific American Mind published analysis of the psychology of tyranny, which we recommend. A telling finding is that group behaviour requires comliance of all in the group, and while individual values may be compromised, individuals will do that in order to adhere to the group behaviour. The description of "The BBC Experiment" illustrates shifts in group dynamics and changes in authoritarianism which result in otherwise good people doing unethical things.

The publication of Transparency International's annual ranking in October is reason to reiterate the problem of corruption in Russia, which fell even further to rank among Sierra Leone and Albania. Ironically people in Russia see the worst corruption in the police force, where they may be faced with traffic violation bribes daily, but the least in banking and law, where corruption's effect in far greater and the aggregate numbers influence major cash flows. The effect of tightening central control is to raise corruption and risk. Not only can corruption cut into daily living costs, but it can wreak havoc with investment and business development, and often results in death. Chechnya is the most visible illustration of a rotten core, but it is seen throughout society - business, academia, internet, law, politics. There appears to be little energy to clean the situation up, either from within Russia or among the foreigners that invest, do business or engage politically. Caveat emptor.

Interestingly, Carlyle, the politically connected US hedge, closed its

Russia office because of, according to founder Rubenstein, unmanageable

corruption issues and Putin is not as receptive to foreign private equity

as Carlyle had expected.

US senators have voted overwhelmingly (90-9) to outlaw cruel or

degrading treatment of detainees held in US custody abroad.

Prisoner abuse scandals at Abu Ghraib jail in Iraq and concern over the

treatment of detainees at Guantanamo Bay have dogged the US since 2001.

The motion was opposed by the White House, which views it as unnecessary.

Bush administration officials say the move would be restrictive, and limit

its fight against terrorism. Republican Senator John McCain tabled

the motion as an amendment to a Pentagon funding bill. Correspondents

say the White House could veto the entire $440bn (£248bn) bill to defeat

the motion.

Investment, Finance & V. C.

The investment outlook is not buoyant, although there are no major tremors that pressage a debacle. The general economic environment is under pressure from rising interest costs and moderating demand, illustrated by falling consumer confidence (from 105 in July to below 90 now). With price benchmarks well valued there is not room either in multiple or in fundamental performance that will boost the market. We are considering strategies for investment in a modest 2006 market.

Ben Bernanke, currently head of Bush's Council of Economic Advisers and a former Fed governor, has been nominated to succeed Alan Greenspan as US Federal Reserve chairman. Bernanke has been well received as a competent, experienced Fed governor whose approach and policies are close enough to Greenspan's to expect a smooth transition. Mr Bernanke is an advocate of "inflation targeting" - an approach widely adopted in Europe - under which central banks set a target for inflation and stick to it. Greenspan believes central banks should keep markets guessing on how tough they would be on inflation. Bernanke will however have a tough job as the economy is stretched, demand is moderating. Also increasingly the gloabl economy moderates the impact of Fed actions and complicates analysis. Mr Greenspan will end his 18-year tenure January 31 2006.

Intellectual property rights are a key part of many businesses today. But they are becoming couterproductive to innovation and testing the bounds of ethics, as well as having their economics questioned. The growth of open technology in high tech spheres like computing and bioscience are the brightest illustration that the economics of intellectual property rights are questionable. The greatest danger is that nature will be compromised by hasty use of "patented" seed because moral hazard presses a company like Monsanto to spread use of their genetically engineered seeds despite evidence that they destroy productive systems (eg horseweed in California, red millet in India). Fortunately a call has been made by a group of leading scientists, legal scholars, artists and experts from around the world, who have issued the Adelphi Charter in a bid to bring intellectual property rights under control. A principal feature of the charter is a public interest test. It is a welcome step in the right direction. The unfolding story has implications for business heavily invested in technology and for portfolio planning. The Economist published a survey of patents and technology on 22 October which provides an up-to-date precis of issues.

The US budget deficit shrank to $319 billion last year as better economic conditions boosted tax revenues. Despite falling from 2004's record $412 billion figure, the federal deficit for the fiscal year ending last month was still the third highest on record. The 2005 fiscal year deficit amounted to 2.6% of GDP, below the 3.6% recorded in 2004 and the post World War Two high of 6% in 1983. This year's deficit is likely to be swelled by $ 30 billion of spending on post-Hurricane Katrina reconstruction.

A study by the Ifo Rresearch Institute found that Germany's business climate index hit a five-year high of 98.7 in October, up from 96 a month earlier, further suggesting the recovery in Europe's largest economy may be strengthening.

China Construction Bank, known by locals as "China Corruption

Bank" in honour of its jailed former Chairman Wang Xuebing (who's offences

were actually committed at Bank of China), had its $ 8 billion IPO at

the end of October indicating the bubbly nature of the quest for Chinese

bank stocks. The market cap is around $ 66 billion making it more valuable

than American Express, Barclays, or Deutsche Bank! Technically insolvent

a few years ago, bad loans may have been taken out but, even if so, there

is little evidence that practices have changed. We continue to urge caution

in the headlong rush to buy Chinese banks, especially since foreigners

have been promised full market access from 2007 under China's WTO commitments.

The next mega-sale is Bank of China expected to have a foreign listing

in early 2006.

Another bank deal is the proposed purchase by Deutsche Bank AG and Sal. Oppenheim jr. & Cie. of a combined 14% stake in China’s Hua Xia Bank for € 272 million. This is the first major purchase of a stake in a Chinese bank by a German financial institution and further extends foreign participation in China’s financial system beyond the country’s top tier banks. The two German lenders will buy a total of 587.2 million shares from 18 Hua Xia shareholders; the deal will give Deutsche Bank a 9.9% stake in Hua Xia, while Sal. Oppenheim, Europe’s largest independent private bank, will have 4.1%. Fitch Ratings estimates that Deutsche Bank and Sal. Oppenheim paid 2.1 times book value for Hua Xia, higher than the 1.2 times book value that foreign investors have paid for minority stakes in Bank of China and CCB.

So far this year, foreign banks have spent $ 10.3 billion to acquire shares in Chinese banks, according to Dealogic. The major deals have swirled around China’s big four banks: Industrial & Commercial Bank of China, Bank of China, China Construction Bank and Agricultural Bank of China.

As these charts from the Economist show, a fundamental view of the banking

system is not reassuring. While business is good, consumer loans have increased by about 6x in 6

years, the bank system foundation appears shaky. If this is a bubble pumped

up by foreign banks and investors, the Chinese won't mind. Foreign money

will pay for the learning curve of the Chinese banking system when conditions

deteriorate. Caveat emptor.

While business is good, consumer loans have increased by about 6x in 6

years, the bank system foundation appears shaky. If this is a bubble pumped

up by foreign banks and investors, the Chinese won't mind. Foreign money

will pay for the learning curve of the Chinese banking system when conditions

deteriorate. Caveat emptor.

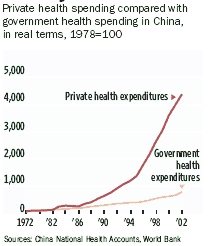

The

health sector may be more interesting to pursue. This chart shows how

spending on private health care is skyrocketing.

The

health sector may be more interesting to pursue. This chart shows how

spending on private health care is skyrocketing.

A host of reports emerged that suggested that India is becoming a more attractive investment destination than China.

In China, a widening income gap between town and country is worrying officials and will have implications for market analysis and development. But in India, the gap is narrowing and this is a virtuous circle which stimulates opportunities. A WBCSD reports that in 1990, for every $100 earned by an Indian villager, an urbanite made $82 more. Today, the difference has dropped to $56. Though in India, 390 million people still live on $1 a day or less. What is changing is the nature of the rich-poor divide. That divide was once synonymous with the urban-rural split. The only way to get rich was to live in town, and to reside in the country was to be bound to interminable poverty. But increasingly, the rural economy is a microcosm of the national economy, with its own rich and poor. The rural rich are 1,000 times as likely as the rural poor to own a motorcycle, 100 times as likely to own a color television and 25 times as likely to own a pressure cooker, according to a survey of 96,000 rural households by the research council. That distribution of wealth may or may not be equitable. But in creating the possibility of making it in rural India itself, the new rural prosperity is transforming rural India's image from economic nonentity to emerging market within the emerging market. India's 700 million villagers now account for the majority of consumer spending in the country, more than $100 billion a year. Millions step into consumerism each year, graduating from the economics of necessity to the economics of gratification, buying themselves motorcycles, televisions, transistor radios and pressure cookers. Diverse forces are fueling the trend. The government has invested billions of dollars in development, including road building and rural electrification, and has forced banks to lend to farmers. Good monsoons have helped farmers' profits. Widening educational access has helped farmers' children to get city jobs and send money home. With the private sector booming, industry and services have overtaken farming to account for 54 percent of rural income.

Also in India, Sanjiv Gupta, former Coca-Cola India CEO, and Kishore Biyani, founder of Indian retailer Pantaloon, reportedly are forming a private equity firm focused on the retail space suggesting that they see booming opportunities in this space. This contrasts with a deteriorating retail environment in Europe and the US.

Microfinance is an emerging niche which we believe exhibits an attractive risk/return profile. A well attended gathering, including Stanley Fischer and Kofi Annan, was sponsored by Cassin in October. Papers are available online here.

Responsible Investing

Enron Risk hit the headlines in October. Another telling tale of woe is the story of Refco, a New York-based independent futures brokerage, which typically posts over $1 billion in annual revenue and around $20 billion in managed assets, imploded in October. Refco chairman and CEO Phillip Bennett admitted to having hidden $430 million in debt owed to the company. The scam involved a holding company controlled by Bennett, and apparently had been going on since he took the reigns in 1998. Bennett has been arrested and charged with securities fraud. It is a sorry story because bad apples at the top of the barrel have caused distress for everyone in the group, as well as other stakeholders. (More from a VC perspective below.)

Another hedge fund debacle also hit the news in October with the SEC probe of Wood River Capital Mabagement. Caveat emptor.

Whole Foods has said it will open its first lifestyle store in late October on Santa Monica Boulevard, West Hollywood. The new store is likely to be smaller than its food stores (typically around 50,000 sq ft) and will offer products such as organic blue jeans, recycled handbags and environment-friendly paints and household products. The clothing offer is expected to include the Edun line by U2’s Bono. A selection of world music, sustainable living books and magazines will also be available. Neil Currie, a retail analyst with investment bank USB commented: "The opening of this store is interesting. It is showing that Whole Foods is thinking of ways it can build strong brand equity. It's a sensible approach and a low-risk way of the company testing out a new concept to move into new product categories.”

Wal-Mart CEO Lee Scott surprised company observers by embracing sustainability in a speech announcing ambitious initiatives on "all the issues that we've been dealing with historically from a defensive posture." The very fact Wal-Mart is addressing the issues it has so long avoided or short-shrifted - such as greenhouse gas emissions, waste reduction, product sourcing, healthcare, wages, and diversity - sends a loud signal to the market from one of the world's largest companies. Observers in the socially responsible investing (SRI) community welcome the potential changes while maintaining skepticism. "Wal-Mart's environmental goals - 100 percent renewable energy, zero waste, and sustainable products - are extremely ambitious but also very promising; merely aspiring toward the first two will have enormous ripple effects throughout their supply chain and reduce the strains that the company places on the public sector," said Shelley Alpern, director of social research and advocacy at Trillium Asset Management. "Obviously, what kinds of products constitute the third goal will be open to great debate, but the package-reduction goals will go a long way toward greening many product lines." Wal-Mart, the largest U.S. retailer, is joining the largest manufacturer, General Electric, in setting specific environmental goals while advertising those goals to shareholders, customers and the public as strategic business decisions. Goals include to invest $500 million in technologies that would reduce greenhouse gases from stores and distribution centers by 20 percent over the next seven years, increase the fuel efficiency of the truck fleet by 25 percent over the next three years and double it within a decade and design a new store that was at least 25 percent more energy-efficient within four years.

Socially responsible investing is showing signs of being memetic - in other words, spreading like a cultural virus. Specifically, traditional "mainstream" investors are starting to integrate social and environmental considerations into fundamental analysis of companies. Goldman Sachs for example, self-described as "one of the oldest and largest investment banking firms", recently issued a report to its clients entitled Global Energy: Sustainable Investing in the Energy Sector. GS inaugurated its own assessment of issues typically associated with SRI with its February 2004 launch of the Goldman Sachs Energy Environment and Social Index, assessing 30 social and environmental criteria in the global energy sector. It subsequently expanded coverage with its Environment, Social and Governance Index, increasing the number of criteria to 42 while adding a corporate governance category. "We believe that this template will be applicable across most industries because it captures the full spectrum of a company's interaction with the four key pillars: the economy; the industry in which it operates; society, from employees to partners, consumers, and counterparties; and the environment, in terms of resources consumed, emitted, and produced," states the report. "We believe excellence is a habit and that companies with superior environmental and social management are likely to be more successful in operating projects in the new world." The 164-page report demonstrates how GS applies its sustainable investing strategies to the global energy sector. The report finds GSEES leaders financially outperforming their peers by 12 percent since the index launch. It also finds strong financial performance by energy companies exposed to so-called "new legacy assets"--the largest oil and gas fields as defined by reserves that will drive the future of the industry over the next 20 years. Significantly, the report finds a strong correlation between strong ESG performance, exposure to new legacy assets (GS identified the top 50 such projects in June 2003 and the top 100 in January 2005), and financial performance. What distinguishes GS's methodology in this report from typical SRI approaches is the additional consideration of exposure to new legacy assets, while the ESG Index covers similar if not identical territory to most SRI research. The ESG Index ranks companies (based on information from their own disclosures) in five categories: environment, environmental and social management, social, corporate governance, and investment for the future. Interestingly, new legacy assets are not completely divorced from but rather intersect with ESG considerations. For example, the investment for the future category assesses community investment.

Venture Capital

Venture capital fund-raising slipped in Q3 2005. 714 companies raised $ 5.26 billion in the third quarter of 2005, according to the MoneyTree Survey by PricewaterhouseCoopers, Thomson Venture Economics and the National Venture Capital Association. Venture investment decreased from Q2 2005 of $ 6.07 billion, but surpassed Q1 2005 of $ 5.0 billion and Q3 2004 of $4.66 billion. For the first nine months of 2005, investing totaled $16.3 billion compared to $15.9 billion for the first nine months of 2004. Total venture capital investing in calendar 2005 could meet or exceed 2002's $21.7 billion which is the highest level in the prior three years. Over the past three years, investing has ranged from $4-$6 billion per quarter.

On the fund capital raising side, 45 U.S.-based VC firms closed on approximately $5.39 billion in fund capital during Q3 2005, which is the lowest tally since 54 such firms raised around $4.8 billion in Q3 2004. Second quarter 2005 numbers had been $6.49 billion for 53 firms, while year-to-date VC fund-raising stands at $17.37 billion for 130 funds. This last figure actually tops the entire 2004 total, which may discount a bit of prudence and discipline, given that this may be the richest VC fund-raising year since 2001.

The Refco debacle has hit major private equity firm

Thomas H. Lee Partners. In August 2004, TH Lee Partners

led a $2.25 billion leveraged buyout of Refco. The deal included just

over $500 million from TH Lee at around $8 per share. The IPO priced

at $22 per share in August 2005 (just above its $19-$21 offering range),

for a take of $583 million. TH Lee recouped around $170 million by selling

shares in the IPO, but remained Refco’s second-largest shareholder (behind

company management). Thomas H. Lee Partners is

losing around $1 billion in just three days. It may affect their current

fund raising as their due diligence was obviously weak in this case

(there may even be litigation), though their performance in general

is fine.

China is expected to relax capital-control

rules implemented earlier this year, in a move that could make it easier

for venture capitalists to invest in Chinese companies. The rule adjustment

is “to help domestic companies to make full use of the international

capital market, support the growth of the domestic high-technology industry

and venture-capital industry,” according to a draft of the new regulations.

The expected policy change comes amid a renewed push by Chinese leaders

to develop a domestic high-tech industry and amid a flood of new interest

by venture-capital firms in investing in Chinese technology and other

companies.

Investors in China are putting money into first-time

firms, first-time teams, and, in several cases, first-time VCs. Not

only are these VC firms abandoning the 30-minute rule (“We don't invest

in a company if we can't drive there in 30 minutes”), they're moving

into the risky territory of emerging managers. That should make the

next several years quite interesting.

India is overtaking China as the new hot spot for private equity investing. China is still expected to continue to absorb the lion’s share of Asian PE, but the benefits of India - including a robust stock market, an English legal system, English as the language of business and entrepreneurs with a lot of U.S. connections - are shifting at least some of the attention away from China.

A Financial Times story about IP theft in China in the semiconductor sector is an important reminder that the risk of illegal copying really has not changed since General Motors, Volkswagen, Cisco and others found parts they had designed in competing products from their Chinese sub-contractors. The fact that this story focuses on semiconductors should serve as a cautionary tale to VCs rushing to China.

At the recent LBO Symposium in Boston, Carlyle founder David Rubenstein made

the striking assertion that private equity capital has become

the

As a specialist in family business we were especially taken by the following editorial by Private Equity Week ...

FAMILY MATTERS by Adam Reinebach |

Expansion

Capital Partners has acquired an additional 20,000 common

shares of Biorem Inc., an

Bessemer Ventures has listed on its site some of the deals that it missed. Congratulations on their humanity.

Interest Rates and Currencies

We expect the federal funds rate to continue to rise to at least 5% within the next 6 months. US GDP and consumer spending both rose in the three months to 30 September, despite the hurricanes. The GDP rose by an annual rate of 3.8% during the quarter, and consumer spending increased by 3.9%.

In the US there has been much talk of inflation, however the general conclusion is that inflation is under control, but deflationary pressures may instead rise in the first half of next year. Prices are being pushed up, by interest rate rises, energy price rises and buoyancy in the housing market. But the underlying demand is not burgeoning and is under pressure. We expect stability in inflation and interest rates, but recognise that volatility risk is high. The spike in US house prices seems to be slowing but is well off historical trends which suggests a slowdown in demand is imminent. The weather and energy problems in the US may have curtailed short term enthusiasm. Hoisington Investment Management Company illustrate the tension with these two charts below. The first shows the spike in real house prices. The second shows the reliance on imported oil, which transaltes in to higher energy costs and lower demand for domestic production.

And inflationary pressures are global. This chart shows the massive spike that has been fuelled by war and weather change. This makes planning more challenging.

Trade and FDI

In an effort to revive stalled World Trade Organization talks, the EU and US have said they will cut controversial agricultural subsidies and tariffs. The US has said its reductions are dependent on similar action from the EU and Japan. The statements were made at a WTO meeting in Zurich which is leading to meetings in Hong Kong in December which aim to bring about a trade treaty by year-end. These proposals could see the key agricultural subsidies cut by 60% before 2010, with trade tariffs slashed by up to 90%. Trade tariffs would eventually be phased out completely, except on a limited number of "sensitive" products. Agricultural subsidies within the EU are on their way out. There is resistance, especially in areas like sugar, but they are uncomeptitive. "The abolition of the CAP is the only proper objective. There are no valid efficiency, security or fairness arguments for the continued protection and subsidisation of the agricultural sector." says Willem H. Buiter, Professor of European Political Economy, London School of Economics. If agreement on subsidy reduction is made, the Doha round of trade talks will be revived.

On the other hand, in related developments, the US has said it may retaliate against Brazil if it imposes sanctions in a cotton trade dispute. Brazil, which is at the forefront of efforts by the G20 group of developing nations to win more access to foreign market, had asked the World Trade Organization (WTO) for permission to impose $1 billion in penalties because the US has failed to meet a deadline for cutting its aid to US cotton farmers. In particular US cotton subsidies distort prices and harm competition by lowering export prices. The US could remove trade preferences which are worth more than $2 billion to Brazil. But even in the US Agriculture Secretary Mike Johanns has called for an overhaul of its system of subsidies for farming, saying that without such measures, the US would be unable to set out its own terms for access to world market.

Energy

US oil giant Exxon Mobil has posted a quarterly profit of $ 9.9 billion, the largest in US corporate history, on the back of record oil and gas prices. Profit was up 75% and revenue rose 32% to more than $ 100 billion.

The French government has cancelled plans to part-privatise nuclear power group Areva, claiming strategic and safety concerns for its U-turn.

Climate Change and Environment

The weather is still volatile and seemingly topsy-turvy.

Wilma followed Katrina through Florida and floods have disrupted life

in Pakistan,  on

top of the earthquake. These warnings seem to be coming thick and fast,

but we need to do much more to rejuvenate the world environment.

on

top of the earthquake. These warnings seem to be coming thick and fast,

but we need to do much more to rejuvenate the world environment.

Many insurance and reinsurance firms have begun to quantify the financial damage caused by the hurricane and the extent of likely claims. Munich Re, the world’s largest re-insurer, has estimated that the total insured loss could be $15 billion - $ 30 billion and expects a significant hardening of prices and conditions in natural catastrophe and marine reinsurance, with more people likely to realise the importance of such insurance. Insurers began to study possible links between climate change and catastrophic losses in the early 1990s; the devastation and cost of Hurricane Katrina has now provided a new impulse to insurers trying to raise public awareness and push the topic onto the political agenda. Nevertheless, two reports, published by Ceres and Friends of the Earth (FOE), both conclude that climate change is catching insurance companies unawares. The Ceres report points out that “insured and total property losses ($45 billion and $107 billion in 2004, respectively) are rising faster than premiums, population, or economic growth both globally and in the US”.

European regulators are serious about curbing greenhouse-gas emissions, at least relative to the laissez-faire Americans, and new models from teh auto industry illustrate the changes. A walk around the Messe Frankfurt complex, home of the city's biennial international motor show, reveals how far European car makers have to go. There is doubt about how enormous cars, like Mercedes-Benz's eighth-generation S-Class sedan and Audi's enormous Q7 luxury SUV, which seem a part of some previous modus vivendi, fit into Europe's changing regulatory landscape. For example, the European Union has targeted that by 2009, the European new-car fleet will have to average something like 40 miles per U.S. gallon (about 5.9 L/100 km). It's virtually climate martial law. All other things being equal, European manufacturers - particularly global giants such as the VW Group and DaimlerChrysler - would rely on their historic advantages in diesel technology to meet these goals (diesel engines get anywhere from 25 per cent to 40 per cent better fuel economy than gasoline engines). But the EU has ruled out easy answers. Other European requirements in 2010 will force huge cuts in diesel particulate and nitrides of oxygen (NOx) emissions. Meeting those provisions may all but eliminate the economy advantages of diesel powertrains. About the same time, new standards for occupant and pedestrian safety will add more weight to cars and proscribe more aerodynamically efficient designs. This is herding European manufacturers toward the one propulsion technology that they have most disdained: hybrids. It's with no small sense of exasperation that the Europeans are conceding on this technological point, where they have been outflanked by Japanese manufacturers, particularly Toyota and Honda. Read more here.

Asian Environment Outlook (AEO) 2005, estimates the global market in 2005 for environmental goods and services to be about $600 billion, and projects this market will expand to more than $800 billion by 2015. Out of this burgeoning market, Asia and the Pacific accounts for $37 billion. With a growth rate of 8%-12% -- the fastest in the world -- the regional market is expected to triple to $100 billion by 2015. AEO 2005 argues that there is a critical missing ingredient in the pursuit of a sustainable future for Asia and the Pacific -- that of a fully engaged private sector. While governments determine the rules under which businesses act, the firms themselves use natural resources, make products, and generate pollution. A sustainable future for the region - and the rest of the planet -- is not possible without greater corporate engagement and environmental responsibility.

Climate change could lead to the extinction of many animals including migratory birds, says a report commissioned by the UK government. Melting ice, spreading deserts and the impact of warm seas on the sex of turtles are among threats identified. The report says that warming has already changed the migration routes of some birds and other animals. The UK's Department of Environment, Food and Rural Affairs (Defra) commissioned the research, which was led by the British Trust for Ornithology.

IT

Currently, the nearest thing to an internet ruling body is a California-based group called the Internet Corporation for Assigned Names and Numbers (ICANN). The private company was set up by the US Department of Commerce to oversee the domain name and addressing systems, such as country domain suffixes. It manages how net browsers and e-mail programs direct traffic. ICANN was to gain its independence from the Department of Commerce by September 2006. But in July the US said it would "maintain its historic role in authorising changes or modifications to the authoritative root zone file". America's determination to remain the ultimate purveyor of the internet has angered other countries which believe it is time to come up with a new way of regulating the digital traffic of the 21st century. In the face of opposition from countries such as China, Iran and Brazil, and several African nations, the US is now isolated ahead of November's UN summit. The row threatens to overshadow talks on other issues such as bringing more people online and tackling spam e-mail. The stakes are high, with the European Commissioner responsible for the net, Viviane Reding, warning of a potential web meltdown. "The US is absolutely isolated and that is dangerous," she said during a briefing with journalists in London. "Imagine the Brazilians or the Chinese doing their own internet. That would be the end of the story. I am very much afraid of a fragmented internet if there is no agreement." For this reason and the increasing type of equipment that uses internet addresses, a resolution is likely and will include the UN.

China said Sunday it is imposing new regulations

to control content on its news Web sites and will allow the posting

of only "healthy and civilized" news. The move is part of China's ongoing

efforts to police the country's

100-million Internet population. Only the United States, with 135 million

users, has more. As part of the wider effort to curb potential dissent,

the government has also closed thousands of cybercafes — the main entry

to the Web for many Chinese unable to afford a computer at home. Authorities

in Shanghai have installed surveillance cameras and begun requiring

visitors to Internet cafes to register with their official identity

cards. The government also recently threatened to shut down unregistered

Web sites and blogs, the online diaries in which users post their thoughts

for others to read. China also shut down three intellectual forums in

October.

It appeared last month that Toshiba's HD DVD format would be adopted over Sony's BluRay because of the commitment of Microsoft to HD DVD. However, this was premature. The tide has shifted to BluRay because it holds more data, has a number of film studios in its camp and now has teh backing of Dell. Some analysts reckon Microsoft's move was a desperate attempt to preempt BluRay and thereby harm one of the key players in the entertainment market where Microsoft's strategy is leading it.

Novell released SuSE 10.0 in October. The desktop Linux distribution has the power of the previous professional version but is designed for first time users too. We upgraded/installed it with no problem. It is quick, functional and nice to look at - a good buy.

A quick note on blogs, a fast emerging source of intelligence and analysis. A blog (weblog) is a website of editorial postings that is updated in real time by users. (The web is normally compared with a library - each site is a book, but blogs are more like coffee shops - each site is a table of chatter.) Often they are the daily journal of an individual who may get a following because of her position or expertise in an area. The blog search site www.technorati.com is a useful site to browse as you explore this arena - link there now and you will see top blog searches at this moment.

Holonics and LOHAS

Holonics * Health * Environment * Education * Living

Holonics

We taken ths bold step of using the professional, but commonly unfamiliar, term "holonics" to describe our approach, replacing terms based on "integral" technology. The reasons for this are that holonics is more accurate and we have observed a number of references to holonic methods, including in the fields of management and mechanical design, suggesting it is entering mainstream use. For those unfamiliar, we have an introduction here. Simply, a holonic system is built of modules which are whole in themselves and also fit together with others (similar and different) to form a bigger, different system. For example cells (which are individually independent and perform functions within themsleves) are incorporated together to form a body of interdependent cells (which body itself is independent and functions independently) and these people are incorporated to form larger systems like a society or business. This section will tend to focus on holonics as it is reflected in personal or business management.

The Harvard Business Review published in October a study of seven organization types. The authors - Gary Neilson, Bruce Pasternack, and Karen Van Nuys - discover that the most common type is of the far-from-healthy passive-aggressive variety, in which lines of authority are unclear, merit is not rewarded, and people have learned to smile, nod, and do just enough to get by. Passive-aggressive organizations are friendly places to work: People are congenial, conflict is rare, and consensus is easy to reach. But, at the end of the day, even the best proposals fail to gain traction, and a company can go nowhere so imperturbably that it's easy to pretend everything is fine. Such companies are not necessarily saddled with mulishly passive-aggressive employees. Rather, they are filled with mostly well-intentioned people who are the victims of flawed processes and policies. (See Psychology of Tyranny in Risk section.) Commonly, a growing company's halfhearted or poorly thought-out attempts to decentralize give rise to multiple layers of managers, whose authority for making decisions becomes increasingly unclear. Some managers, as a result, hang back, while others won't own up to the calls they've made, inviting colleagues to second-guess or overturn the decisions. In such organizations, information does not circulate freely, and that makes it difficult for workers to understand the impact of their actions on company performance and for managers to appraise employees' value to the organization correctly. A failure to match incentives to performance accurately stifles initiative, and people do just enough to get by. Breaking free from this pattern is hard; a long history of seeing corporate initiatives ignored and then fade away tends to make people cynical. Often it's best to bring in an outsider to signal that this time things will be different. He or she will need to address every obstacle all at once: clarify decision rights; see to it that decisions stick; and reward people for sharing information and adding value, not for successfully negotiating corporate politics. If those steps are not taken, it's only a matter of time before the diseased elements of a passive-aggressive organization overwhelm the remaining healthy ones and drive the company into financial distress. Here are the category types and the results of how workers identify their own companies:

Healthy Organizations:

| 17% |

Resilient - Highly adaptable to external market shifts, yet focused on and aligned behind a coherent business strategy. |

| 10% |

Just-in-Time - Inconsistently prepared for change but can rise to an unanticipated challenge without losing sight of the big picture. |

| 4% |

Military Precision - Dominated by a small, involved senior team; succeeds through superior execution and the efficiency of its operation. |

Unhealthy Organizations

| 27% |

Passive-Aggressive - Congenial and seemingly conflict free, achieves consensus easily, but struggles to implement agreed-upon plans. |

| 10% |

Too large and complex to be effectively controlled by a small team, but has yet to democratize decision-making authority. |

| 9% |

Overmanaged - Its multiple layers of management create analysis paralysis and also politicize decision-making. |

| 8% |

Fits-and-Starts - Contains scores of smart, motivated, and talented people who rarely pull in the same direction at the same time. |

| 15% |

Inconclusive organization type |

Health

Eat your brussels sprouts! Scientists assert that eating vegetables from the cabbage family can reduce the risk of lung cancer for people with a certain genetic make-up. Such cruciferous vegetables had already been linked to reduced rates of lung cancer, but it had not been clear why. The study found eating the vegetables at least once a week cut cancer risk for people with inactive versions of two genes, carried by 70% of people. The Lancet study was by International Agency for Cancer Research scientists. The two genes which were studied are the GSTM1 and GSTT1, which normally protect the body against certain toxins. Vegetables such as cabbage, broccoli and sprouts are rich in chemicals called isothiocyanates, which strongly protect against lung cancer. Normally, isothiocyanates are eliminated from the body by "clean-up" enzymes produced by the genes GSTM1 and GSTT1. But eating the vegetables at least once a week was found to have a 33% protective effect against lung cancer in people who just had an inactive form of the GSTM1 gene. Around 50% of people have this form of this gene. In those with an inactive form of the GSTT1 gene, there was a 37% protective effect. Around 20% have this form. But individuals who had inactive versions of both genes - which applies to 10% of the population - were 72% protected.

More general studies presented to the annual meeting of the American Association for Cancer Research add to the evidence that changing your diet may be among the most effective ways of prolonging your life. Up to a third of cancers are thought to be associated with diet. Experts say eating more fruit and vegetables is the second most effective way to reduce the risk of cancer, after not smoking. Vegetables, fruit, nuts, oily fish and whole grains stand out in the nutritional crowd for their cancer preventing qualities. Brassicas contain glucosinolates, which are broken down by chewing or cutting into sulphoraphane which has been shown to have anti-cancer properties. In another study, researchers found that using garlic to flavour meat could help counteract the carcinogenic substances produced in cooking protein.

National Geographic covered longevity in their latest issue. Included in their review were several case studies of very old people, including a number over 100 years old. The two main recommendations for long life are lifestyle choices: be vegetarian and be active. Longue vie!

The Ecologist September issue has a comprehensive review of aspartame, a chemical sweetener. The findings are worrying and if you use it we recommend reconsidering.

New research has revealed that men who smoke are damaging their fertility as well as their general health. Two-thirds of male smokers were found to have sperm that did not have the normal ability to fertilise an egg. And heavier smokers were more likely to fail the test. Those who failed the test were, on average, 75pc less fertile than non-smokers. The findings are revealed in a study funded by the American cigarette giant Philip Morris - which manufactures a number of leading brands, including Marlboro which had its 50th birthday in October. Researchers from the University of Buffalo studied 18 men who had smoked at least four cigarettes a day for more than two years and then compared their sperm function with that of non-smokers.

McDonalds will put nutritional information on food packaging from next February, including details of fat and salt. They are also giving Ronald a sporty makeover. And Fair Trade Certified organic coffee will now be served in 658 McDonald's restaurants in New England and Albany, New York. The coffee brand is Newman's Own Organics, roasted by Green Mountain Coffee Roasters. These initiatives demonstrate responsible business practices and bode well for the stability and growth of that business.

The corporate takeover of the global food chain is now the world’s biggest public health hazard, experts warned at a major conference in London last month. The conference — If Food Could Talk: Hidden Stories from the Food Chain — was hosted by the Mayor of London and was staged to mark World Food Day (16 October). It brought together leading figures from the world of food policy, fair trade, health and sustainable development. With just four companies responsible for 13% of total food sales in the world — and global food brands was taking a huge toll on public health, particularly in developing countries.

Environment

Coca-Cola is increasingly in the sights of Corporate Accountability International. Coke's business policy and practice have a powerful affect on water supplies in communities. Now the company is building a bottled water business CAI is concerned about their misleading marketing that undermines confidence in tap water. Especially unethical in countries where there are limited water resources and a population that ought to spend on education and other more pressing needs. Whether or not Coke is improving its practice and policy, the company will be affected by the deterioration of global water systems and supplies. They may engage in greenwash today but will have to face the reality of water scarcity within five years because of the natural priorities of water supply and safety. If you want to help, don't buy/drink coke/soft drinks or bottled water.

Sweden has launched a commuter train running on biogas. Its top speed is 130 kmh and emits lower pollution than fossil fuels.

Education

A study by the World Resources Institute and the Aspen Institute, "Beyond Grey Pinstripes," found that 54% of the 91 business schools surveyed required a course in ethics, corporate social responsibility, sustainability, or business and society. This is up from just 34% in 2001. The report also noted new, innovative courses on such topics as private-sector approaches for solving problems in low-income markets. The courses are part of a wider effort in business education to prepare tomorrow's leaders for the new realities of a global economy.

The Third World Environemntal Eductaion Congress took place in October. Papers are listed online.

Living

In Brazil, a referendum backed by the Catholic church, Government and UN to ban the sale of guns was defeated by a 64% majority, although restricting availability of firearms has been proven to reduce crime. In Diadema and Sao Paolo making illegal possession a felony or banning possession has reduced the number of deaths caused by angry neighbours shooting each other. It is now up to local governments to follow the lead of Diadema and ban guns to reduce crime and death. Guns kill one person in Brazil every 15 minutes, giving it the world's highest death toll from firearms. The immediate consequence of the referendum is that gun shops will remain

In the US, laws were passed resticting the prosecution of gun makers for liability when their guns are used in shootings. This pleases gun makers but does not help to reduce violent crime or accidental deaths.

We now have an excuse for my lazy teen days, and know what to expect from our children. Scientists have found that a person's "sleep pressure" rate - the biological trigger that causes sleepiness - slows down in adolescence, explaining the reluctance of teenagers to sleep until later at night.The study, published in the journal 'Sleep', suggests that as children mature, their internal, chemically-driven pressure to sleep builds up more slowly. Mary Carskadon, professor of psychiatry and human behaviour at Brown Medical School in Providence, Rhode Island, said: "The results show that the adage 'Early to bed, early to rise' presents a real challenge for adolescents."

Rosa Parks, the black woman whose 1955 protest action in Alabama marked the start of the modern US civil rights movement, has died at the age of 92. Mrs Parks' refusal to give up her seat to a white man on a bus prompted a mass black boycott of buses, organised by Baptist minister Martin Luther King Jr., whose protest movement brought about the 1964 Civil Rights Act, which outlawed racial discrimination in the US. On 1 December 1955, she was sitting on a bus in Montgomery when a white man demanded her seat. Mrs Parks refused, defying the rules which required blacks to give up their seats to whites. She was arrested and fined $14. Her arrest triggered a 381-day boycott of the bus system organised by the then little-known Rev Luther King Jr. The protest led to the desegregation of the transport system. Mrs Parks and her husband, Raymond, moved to Detroit in 1957, after she lost her job and received numerous death threats in Alabama.

Activities, Books and Gatherings

While making some minor website changes, I was delighted to find out that if you do a Yahoo search for "holonics" Astraea comes up on the second page, and if you do a search for "integral investing" GRI Equity is top of the list!

We put our first music video "Prince of Peace" by Galliano online. And hope more will follow.

The film version of Hitchhiker's Guide to the Galaxy is a brilliant story with many enlighted philosophies woven in. Worth viewing.

See the website http://www.northsoutheastwest.org/ for a dynamic look at climate change.

Pet lovers may enjoy http://www.canineportraits.org which is contributing funds to train a teacher in the US. Teach for America is the national organization of recent college graduates who commit to teach in public schools serving low-income rural and urban communities.

The International Spirit At Work highlights companies that have implemented explicit spiritual practices, policies or programs inside their organizations. For the past four years, ISAW has recognized 23 distinguished companies ranging from The Body Shop, to Times of India, and to the Australia and New Zealand Banking Group Ltd. The 2005 ceremony honours the nine new recipients of the award. The event showcases a number of inventive frameworks that the honorees used in implementing their spiritual value system into a results-oriented environment of business.

On November 7th, 9-10 PM Eastern there will be

a teleconference with Dee Hock, founder of VISA and author of One

from Many: VISA and the Rise of Chaordic Organizations. His work

is highly recommended. See details

of the conference here, or see the latest book

One from Many: VISA and the Rise of Chaordic Organizations

here.

This report has been prepared for information purposes and is not an offer, or an invitation or solicitation to make an offer to buy or sell any securities. This report has not been made with regard to the specific investment objectives, financial situation or the particular needs of any specific persons who may receive this report. It does not purport to be a complete description of the securities, markets or developments or any other material referred to herein. The information on which this report is based, has been obtained from publicly available sources and private sources which may have vested interests in the material referred to herein. Although GRI Equity and the distributors have no specific reasons for believing such information to be false, neither GRI Equity nor the distributors have independently verified such information and no representation or warranty is given that it is up-to-date, accurate and complete. GRI Equity, associates of GRI Equity, the distributors, and/or their affiliates and/or their directors, officers and employees may from time to time have a position in the securities mentioned in this report and may buy or sell securities described or recommended in this report. GRI Equity, associates of GRI Equity, the distributors, and/or their affiliates may provide investment banking services, or other services, for any company and/or affiliates or subsidiaries of such company whose securities are described or recommended in this report. Neither GRI Equity nor the distributors nor any of their affiliates and/or directors, officers and employees shall in any way be responsible or liable for any losses or damages whatsoever which any person may suffer or incur as a result of acting or otherwise relying upon anything stated or inferred in or omitted from this report.