Entrepreneur and Business Resources

Integral Methods and Technology

Governance and Investor Responsibility

|

Private and Confidential

GRI Equity Review - December 2005

- Perspective

- Investment, finance & VC * Interest rates and currencies * Trade & FDI

- Activities, Books and Gatherings

The following sections are delivered through Astraea. The links below will take you to those sections.

Email clean up

Perspective

Lies, lies and more lies - we're just so good at it! (See Holonics for more of the science.)

A World Economic Forum/Globescan survey indicates that trust is declining globally, despite immense wealth and a reasonably fruitful year in most economies. Trust in Governments, Corporations and Global Institutions Continues to Decline. Of all the institutions examined, national governments have lost the most ground over the past two years. In twelve of the sixteen countries for which tracking data is available, public trust in the national government has declined by statistically significant margins, leaving only six of the tracking countries today with more citizens trusting their national government than distrusting them. Trust in government has fallen the most in Brazil, South Korea, Mexico, Canada and Spain, followed closely by Argentina and the United States. The case of Nigeria is also noteworthy, where trust in the national government fell by thirteen points while trust in all other institutions rose. Even in countries such as Great Britain and India, where trust remains positive, it has suffered its biggest fall since tracking began in 2001.

The institutional dishonesty that we are oblivious to was thrown in our faces in December by our global superpower on several fronts. We learned that US security institutions export prisoners to foreign locations where many believe torturing to have taken place, and we learned that probably illegal and certainly immoral surveillance is being ordered on US citizens by the President. But the most shocking fact was the admission by President Bush that he lied, in particular about weapons of mass destruction, Al Quaeda and Iraq. It seems that everyone thinks its OK for the President to lie, because if his name was Richard Nixon he wouldn't be in office today. It is unlikely that we will see a confession from Bush like that of eight-term Republican congressman Randy Cunningham charged with accepting $ 2.4 million in bribes and evading over $ 1 million in taxes: " I broke the law, concealed my conduct and disgraced my high office". Instead we heard W tell us all that he lied, but its OK because he's in charge. He again used the excuse that he would do what he thinks necessary irrespective of the law or ethics. The founding fathers must be turning in their graves.

For me however, it is not OK just to do the right thing, it must be done in the right way. ( I have been at the sharp end of bullying, as both child and adult, too often to think otherwise.) Too often privilege has been used to execute decisions, good and bad, but that is not equity or justice. The US appeared to be a strong meritocracy "anyone can make it" - and that has been attractive. But that has been lost in recent years at the highest political office. When the President stands up and says "I lied and cheated, but I did the right thing so its OK" as he did in mid-December, democracy is not in effect at all. Neither institutions, media nor people have challenged teh US's evangelical leader about this failure of ethics. I believe that responsibility is the price of power - and if ethics are absent the power is ill-deserved. (A company, like Enron, can not say we lied and cheated but we enriched our shareholders so its OK.) The US behaves as a monarchy or dictatorship, even if benevolent. One estimate is that over 25,000 civilians have been killed in Iraq in the last couple of years - even by world trade centre standards that is huge. It is be difficult for us all to balance the tension of being a loving and caring person and also loyal, yet circulating in a world where peers and friends make daily decisions that are inequitable and polluting the planet.

The New York Times reported on their survey conducted with TIAA-CREF and Harris Interactive entitled Mutual Funds Investors Rate Public Figures. The numbers are worrying - perception is often a reflection of reality and people are obviously aware of dishonesty in the corridors of power but are also seemingly unable to do much about it. You can read more analysis by Claudia Deutsch in The New York Times: "New Surveys Show That Big Business Has a P.R. Problem,"

"Who Do You Think Is Very Trustworthy?"

| President Bush |

27% |

| Supreme Court |

25% |

| Congress |

4% |

| The News Media |

4% |

| Fortune 500 CEOs |

2% |

"Who Do You Think Has Too Much Power in Washington?"

| Big Companies |

90% |

| PACs |

85% |

| Political Lobbyists |

74% |

| The News Media |

68% |

| Labor Unions |

43% |

Coincidentally newly minted Nobel Laureate Harold Pinter's Nobel Lecture delivered in early December reflects on the same subject: Art, Truth & Politics. You can read the speech here, though its title reveals the gist: most communication, including art, is not true - it is instead a reflection of reality. And the important difference is whether or not it is honest. (We have all been in professional situations where we have told the truth but created an illusion to entice others into action, usually to buy something.)

In

recognising the most significant events of 2005 people highlighted disaster

and war, rather than positive change like poverty alleviation.

The results of the worldwide BBC poll are summarised in this chart.

You can read the article

here or the poll

results here.

In

recognising the most significant events of 2005 people highlighted disaster

and war, rather than positive change like poverty alleviation.

The results of the worldwide BBC poll are summarised in this chart.

You can read the article

here or the poll

results here.

From the other side of the world, China News Weekly shared a wish list for 2006. The article in English is here. For those of us who feel fear or that they are not getting their fair share in life, it makes interesting reading. This is how it begins:

-

Facing 2006, we hope that China's reform will make critical progress in challenging areas, the country will be prosperous and people at peace; and society will be harmonious;

-

We hope that there will no longer be so many miners who die in the dark underground, and that their families will no longer be so worried when they go to work;

-

We hope that every death penalty case will be under the strictest scrutiny by the most experienced judges, excluding all doubts, and every single death penalty case will be proven over time, even if this means high operating costs for the judicial system;

-

...

Our wish is that we all have the strength to do the right thing, the right way.

Geopolitics

The rise of geopolitical dishonesty was reiterated by Transparency International in their most recent study. Corruption is on the increase in a majority of countries around the world. People in 48 of the 69 countries covered in its annual Global Corruption Barometer survey said corruption had risen over the past three years. The survey showed that taking bribes was particularly prevalent in Africa, Eastern Europe and Latin America. Political parties were the most corrupt bodies for the second year in a row. They were followed by parliaments, police and judicial systems. In central and eastern Europe, customs officials were seen as the most corrupt. TI said corruption also extended to the education system of many countries, and that this could have a detrimental effect on their future development - few are immune from this as fake degrees are widely available and screening is often modest. Its chairwoman Huguette Labelle said corruption was "a major problem of our times ... its most deadly impact is on the poor. ...The results of this survey are a call for alarm for people."

The Bush administration based a crucial prewar assertion about ties between Iraq and Al Qaeda on detailed statements made by a prisoner while in Egyptian custody who later said he had fabricated them to escape harsh treatment, according to current and former government officials. The officials said the captive, Ibn al-Shaykh al-Libi, provided his most specific and elaborate accounts about ties between Iraq and Al Qaeda only after he was secretly handed over to Egypt by the United States in January 2002, in a process known as rendition. The new disclosure provides the first public evidence that bad intelligence on Iraq may have resulted partly from the administration's heavy reliance on third countries to carry out interrogations of Qaeda members and others detained as part of American counter terrorism efforts. The Bush administration used Libi's accounts as the basis for its prewar claims, now discredited, that ties between Iraq and Al Qaeda included training in explosives and chemical weapons.

The New York Times said Mr Bush signed a secret presidential order for personal surveillance following the attacks on 11 September 2001. They allowing the National Security Agency, to track the international telephone calls and e-mails of hundreds of people without referral to the courts. Previously, surveillance on American soil was generally limited to foreign embassies. Critics have questioned whether wider surveillance in the US crosses constitutional limits on legal searches. American law usually requires a secret court, known as a Foreign Intelligence Surveillance Court, to give permission before intelligence officers can conduct surveillance on US soil."This is Big Brother run amok," was the reaction of Democratic Senator Edward Kennedy, while his colleague Russell Feingold called it a "shocking revelation" that "ought to send a chill down the spine of every senator and every American". There is intense concern about infringements of civil liberties in the name of security, but the power of the Bush gang seems unassailable. Even Republicans are not convinced that the things it does in the name of the war on terrorism are always justified.

Initially it appeared that some balance was returning to policy when the Republican-controlled Senate blocked the renewal of the Patriot Act, the law introduced after September 11 that gives the FBI wide-ranging powers to investigate US citizens. However, a short term extension has been agreed and it will be another six months before another chance to step back from a police state occurs.

In Bolivia, the national election was won by an indigenous candidate - the first to achieve such an office. This exercise of democracy occurred because of widening inequality. David Brooks of the New York Times highlighted the illustration given by the election: "That election illustrated many of the combustible phenomena we'll be dealing with for the rest of our lives. It demonstrated that economic modernization can inflame ethnic animosity, that democracy can be the enemy of capitalism and that globalization, far from bringing groups closer together, can send them off in wild and hostile directions."

Some of the unrest born of inequality of opportunity that we saw in France in November was reflected in Australia in December. Thousands of young, white men attacked people of Arabic and Mediterranean background in Sydney's Cronulla, Maroubra and Bondi beaches. The large-scale violence in Sydney started when white men attacked people of Arabic and Mediterranean background on Cronulla Beach - apparently in revenge for a recent attack on two lifeguards. Many of the rioters had been alerted to congregate in the area by receiving text messages. Apparently in retaliation for the violence, groups described by police as having "Middle Eastern or Mediterranean" appearance were involved in two nights of violence and vandalism. New laws to prevent civil unrest were passed in the Australian state of New South Wales - authorities can enforce strict curfews, confiscate cars and ban alcohol sales.

The outspoken economic adviser Andrei Illarionov aide to Russian President Vladimir Putin resigned in protest against what he called the end of political freedom. He said Russia was no longer politically free but run by state corporations acting in their own interests. He added that Russia's economic policy and the economic model of the state had changed. "I did not sign a contract with such a state," Mr Illarionov told reporters. "Until not long ago no-one put any limits on me expressing my point of view. Now the situation has changed." He had been one of the most vocal critic in Russia for some time.

In Hong Kong on 4 December over 250,000 people marched peacefully for democracy ... again. Unlike previous marches, no one could say people came out because they were unhappy about the economy, suffered negative equity or didn't like former chief executive CH Tung. They clearly flooded out because they wanted to tell the authorities here and in Beijing they wanted universal suffrage soon.

Thai politics became even more interesting in December. While the unrest in the south has not improved as expected under the new National Reconciliation Council and economic performance has been modest, early in the month the Prime Minister suffered a rebuke from King Bhumipol which he felt compelled to acknowledge by withdrawing lawsuits against people who had criticised him. It would be nice for Thailand if this spirit of openness could return. While it is not likely that Thaksin's modesty will be long lived - he is not Prime Minister and the richest person in Thailand for nothing - it is possible and his rural initiatives and continuing experience may signal new enlightened policies. He will make statements in early 2006 which may reveal his hand, so let us see what transpires.

There were important events related to trade (ponderous WTO round) and health (GMO liberalisation) which effect geopolitics. There is more on these in the sections on Trade and Holonics.

Risk and Terror

Fear is weighing too heavily on economic decisions as well as political ones. Our fundamentalist reaction to terrorism has been impractical censorship at home (eg patriot act and shooting the insane) and the fear of the unknown prevents us from liberalising economic policy at home (eg the stagnation of trade liberalisation despite its proven benefits). It is ironic that we fear job insecurity, among the best educated populations in the world, and food scarcity, in countries with a recognised obesity problem. As more people become aware, through education and experience, the higher intelligences that emerge are emotionally, as well as cognitively, able to manage fear, live more fully and benefit in an enlightened socio-economic dynamic. The rise in fear and anger will hopefully result in a rebound to sensibility. But the pace of change required to avoid a painful correction is much faster than ever before. As Paul Volker said of financial markets: "I don't know whether change will come with a bang or a whimper , whether sooner or later. But as things stand now, it is more likely than not that it will be a financial crisis rather than a policy foresight that will force change." This foresight is increasingly relevant for all spheres of life.

The US is particularly prone to dishonesty at the moment because nationwide dynamics, such as the Patriot Act and Presidential speeches harping on about terrorism, have exacerbated the feelings of fear. Hollywood cop movie displays are emerging ... Federal air marshals shot and killed a passenger, Rigoberto Alpizar, at Miami International Airport after the man claimed he had a bomb in his backpack and ran from an aircraft. But the man, an American citizen from Maitland, Florida, had no bomb and was mentally ill and merely off his medication. Mr. Alpizar's wife had tried to follow her husband as he ran off the plane, saying he was mentally ill and had not taken his medication. And then there was a coverup as law enforcement officials refused to answer questions about Mr. Alpizar's mental state or his wife. Under the circumstances we can understand why this happened and feel for the officials who murdered this person. But it would not have happened if fear did not rule America today.

An example of the other end of the spectrum is the Dalai Lama, spiritual leader of Tibetan Buddhism. In December a man burned himself to death in protest at Chinese repression in Tibet, yet the Dalai Lama advocated a non-violent approach to him on his death bed. How can one respect the feelings of anger and hatred when inequity strikes from your home to your heart? Is the Dalai Lama right to advocate total peace in seeking liberation, even at the bedside of a self-immolated man who was desperate in the face of Chinese repression of Tibet? This is certainly the policy that enlightened people should be adopting - and most certainly one that Christians, even in America, should hold dear. While it is difficult and possibly impractical in certain situations - it is the only honest way for the rich and powerful to engender change.

After months of resistance by Mr Bush and Vice-President Dick Cheney, the White House was forced to retreat after proposals to ban torture were overwhelmingly backed by the Senate and House of Representatives. The ban was proposed by the Republican senator John McCain, a former Navy pilot who was held and tortured for five years during the Vietnam War. He introduced legislation that would prohibit "cruel, inhuman or degrading treatment or punishment" of any prisoner in US custody, regardless of where in the world they are held. Last month, the Senate backed Mr McCain's amendment by ninety votes to nine, one of the sharpest legislative rebukes to the White House since Mr Bush took office. The House overwhelmingly endorsed Mr McCain's position by 308 to 122. Although the House vote was non-binding and did not turn Mr McCain's amendment into law, it specifically instructed House negotiators to include the McCain language, word for word, in next year's $453bn (€378bn) Pentagon budget Bill.

I was sent the following view on the developments in Iraq which gives positive news (verifiable on Department of Defense web sites). The news is worthy, especially because many people must be feeling bad, even guilty, about the continuing unexpected course of events in Iraq out of their control. Good people deserve to hear good news. And the Iraqi election happening now may hopefully provide some more of that. (But please remember these numbers are delivered out of context and are not balanced by the continuing tapestry of lies and death surrounding Iraq and America.)

Did you know that 47 countries have reestablished

their embassies in Iraq?

Did you know that the Iraqi government currently employs 1.2 million Iraqi

people?

Did you know that 3100 schools have been renovated, 364 schools are under

rehabilitation, 263 schools are now under construction and 38 new schools

have been built in Iraq?

Did you know that Iraq's higher educational structure consists of 20 Universities,

46 Institutes or colleges and 4 research centers, all currently operating?

Did you know that 25 Iraq students departed for the United States in January

2005 for the re-established Fulbright program?

Did you know that the Iraqi Navy is operational?! They have 5- 100-foot

patrol craft, 34 smaller vessels and a naval infantry regiment.

Did you know that Iraq's Air Force consists of three operational squadrons,

which includes 9 reconnaissance and 3 US C-130 transport aircraft (under

Iraqi operational control) which operate day and night, and will soon

add 16 UH-1 helicopters and 4 Bell Jet Rangers?

Did you know that Iraq has a counter-terrorist unit and a Commando Battalion?

Did you know that the Iraqi Police Service has over 55,000 fully trained

and equipped police officers?

Did you know that there are 5 Police Academies in Iraq that produce over

3500 new officers each 8 weeks?

Did you know there are more than 1100 building projects going on in Iraq?

They include 364 schools, 67 public clinics, 15 hospitals, 83 railroad

stations, 22 oil facilities, 93 water facilities and 69 electrical facilities.

Did you know that 96% of Iraqi children under the age of 5 have received

the first 2 series of polio vaccinations?

Did you know that 4.3 million Iraqi children were enrolled in primary

school by mid October?

Did you know that there are 1,192,000 cell phone subscribers in Iraq and

phone use has gone up 158%?

Did you know that Iraq has an independent media that consists of 75 radio

stations, 180 newspapers and 10 television stations?

Did you know that the Baghdad Stock Exchange opened in June of 2004?

Did you know that 2 candidates in the Iraqi presidential election had

a televised debate recently?

But please remember the body count. Iraqbodycount.net estimates between 27,736 and 31,263 civilians have been killed because of the war. (View Database ... Get the dossier).

Investment, Finance & V. C.

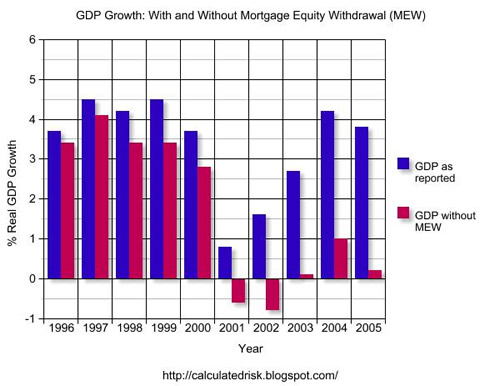

Figures released by the Department of Commerce show that the US

economy grew at an annualised rate of 4.3% in the third quarter,

revised upward from a preliminary estimate of 3.8% issued in November.

The Department of Labour reported that over the same period, productivity

had grown by 4.7%. And jobs are being created as quickly as interest

rates rise. It is a conundrum that fundamentals are shaky but performance

is good. In another part of the world we would assume numbers had

been fudged. But the reality is that size, complexity and integration

of social and economic dynamics globally is changing the rules and more

chaordic analysis is needed.The most positive ingredient in America's

performance is its culture of change and adaptability. If intellectual

stagnation does not take hold, innovation could provide the energy for

continued wealth creation and its more equitable distribution. Nevertheless,

we do not expect strong performance in 2006, though sharp downturns are

unlikely too.

US consumer spending has been higher than expected for some years now, but there are signs that the inevitable swing may occur in 2006. It will change when there is a change in consumer sentiment - when people start to feel that they have enough stuff. But it will also be catalysed by economic balances. At the moment spending has been fuelled in particular by monetising home values. These charts shared by Paul McCulley, Managing Director of PIMCO and John Mauldin, the increasingly famous macroeconomist and hedge fund consultant, show how extended the pendulum is.

To reiterate the quote above in Risk and Terror by Paul Volker speaking of financial markets: "I don't know whether change will come with a bang or a whimper, whether sooner or later. But as things stand now, it is more likely than not that it will be a financial crisis rather than a policy foresight that will force change."

While markets appear exuberant it is prudent to have a strategy planned

should a slowdown occur in 2006. Holiday season sales were below

expectations and may be an early harbinger of 2006 performance.

According to the Ifo research institute, Germany's GDP is estimated to have improved in 2005 hitting a higher-than-expected 0.9% will expand by 1.7% next year, compared with an earlier forecast of 1.2%. Growth in the German economy, Europe's largest, is expected to be lifted by exports and stronger investment. The report is another suggesting the recovery is becoming more sustainable. Concerns still exist, however, and producer prices surged to a 23-year high in November - driven by oil prices and energy costs - climbing in November from the same month a year earlier. The monthly rate was less worrying, declining by 0.1% in November from October.

Inflation remains a worry in major economies: in the US it is inflation that may push the Federal Reserve to raise rates beyond 4.5%, in Europe the European Central Bank is expected to raise interest rates unless inflationary pressures diminish in coming months, and in Japan inflation has been seen for the first time in a decade as that economy's restructuring begins to take hold and rejuvenation accelerates.

The Japanese market was up over 35% in 2005. While we are still positive about the fundamental changes occurring in Japan, including cultural, social and political, the risk/return profile is now more balanced and selection more important.

Continuing modernisations promoted by Japanese Prime Minister Junichuro Koizumi are liberating more of Japan's potential. The cabinet has approved a gender equality plan that aims to put more women in leadership positions. It gave the green light to a series of measures to improve employment conditions for women and encourage their return to work after maternity. The changes, known as the female re-challenge plan, are in response to Japan's plunging birth rate. Japan's population contracted in 2005 for the first time since records began more than a century ago, and politicians are alarmed by the absence of women from the shrinking workforce. Over two-thirds of Japanese women do not return to work after childbirth. Only 11% of management positions nationwide were held by women as of 2004 - but that is up from 8.3% in 2001. The plan aims to redress the perceived failures of an equal opportunities law enacted 20 years ago. New measures include granting flexible hours and training programmes to women who return to work after maternity, using vacant retail space for childcare centres and providing financial support for women entrepreneurs. The plan aims to push girls towards science and technology studies from an earlier stage, and the cabinet has set itself the target of filling a third of all leadership positions with female managers by the year 2020.

Goldman Sachs followed in the footsteps of global financial institutions Citigroup, Bank of America, and JP Morgan Chase in adopting a comprehensive environmental policy. The policy combines important philosophical statements, for example acknowledging the reality of human-induced climate change, with practical commitments, such as the goal of reducing indirect greenhouse gas (GHG) emissions from leased and owned offices by seven percent by 2012. Setting the GS policy apart from other banks' policies is its commitment to the United Nations Millennium Ecosystem Assessment (MA), as well as its $5 million donation to establish the Center for Environmental Markets to study how the free-market system can solve environmental problems. What mostly sets the GS policy apart, though, is the type of bank it is - an investment bank. "This policy does not break new ground when it comes to substantive environmental issues," said Michelle Chan-Fishel, head of the green investments program for Friends of the Earth (FoE), which has engaged with GS for a number of years on environmental issues. "However, it's significant because Goldman Sachs is the first 'pure' investment bank to develop such a detailed environmental policy." As reported last month, the United Nations Environment Programme Financial Initiative (UNEP FI) commissioned GS to conduct research on the materiality of environmental, social, and governance (ESG) issues in the oil and gas sector that resulted in a well-regarded report that served as an impetus for creating the policy. "The report found that indeed 'environmental and social issues count,'" Ms. Chan-Fishel points out. "After producing that report, a light bulb went off at Goldman Sachs, and it realized that ESG issues could be material for other sectors as well."

A consortium led by Citigroup has made a successful bid of 24.1 billion yuan ($ 3 billion) for a controlling stake in Guangdong Development Bank. The deal is for 85% of the state-owned bank, with Citibank keeping a 50% stake and the remaining shares split among several Chinese partners. It will make Citigroup the first overseas company to buy a controlling stake in a state-run Chinese bank. However, such a deal would need to be approved by the government, which has set a 20% limit on foreign investment in Chinese banks.

Australia & New Zealand Banking Group Ltd. agreed to buy a 19.9% stake in China’s Tianjin City Commercial Bank for about US$120 million. The deal is ANZ’s first direct investment in a Chinese lender and continues a push by Australian banks to secure a foothold in the world’s fastest-growing major economy. Tianjin is China’s third-largest city and part of the Bohai Bay development region that includes nearby Beijing.

New research by McKinsey indicates that Chinese consumers lack confidence in their financial future and are saving a quarter of their income to cover health care and retirement. This is as much traditional Chinese culture as prudent wealth creation (and a trend that the US and Europe would like). Nonetheless, shopping lists for the next 12 months include big-ticket items such as flat-screen TVs, automobiles, and new homes. Consumers in towns and smaller cities - now a key battlefield for multinationals and domestic companies alike - are intensely interested in big-ticket consumer goods. While branded fast moving consumer goods are a sign of wealth and a contributor to obesity among molly-coddled children, conspicuous over-consumption is not widespread as it is in the US and Europe.

For its 10th-anniversary issue, Strategy & Business magazine asked itself: Of all the Big Ideas we have covered over the past decade, which are most likely to endure for (at least) another 10 years? Here's their answer:

1. Execution

2. The Learning Organization

3. Corporate Values

Its is encouraging to see ethics and education in the top three. (See the rest of the list, as well as great references for each Big Idea here.)

Responsible Investing

GE has proclaimed its "greenness" and will start measuring performance by a set of non-financial parameters, including CO2 production. That will be a difficult change of culture. But one which will keep the high calibre people at GE interested. And, being led from the top by Jeff Immelt, has some chance of success. It remains to be seen how much is greenwash. A strong indicator of culture change will be liquidations of irresponsible assets in 2006. And Immelt will find quickly that critical thinking is required to change in tune with the emerging enlightenment of the marketplace.

Unilever which has pioneered change from within for over half a decade shows how challenging it can be to reengineer culture. Unilever has completed a groundbreaking project with Oxfam that sets out to explore the fraught question: does international business investment help or hinder the fight against poverty? Opening its internal documents to scrutiny by campaigners for fairer globalisation is a truly bold move for a multinational company operating in impoverished parts of the world. For nearly two years, the consumer goods company has allowed Oxfam to probe and analyse its socio- economic impact in one very large country, Indonesia, where it sells soap, soy sauce, ice cream and mosquito coils to consumers, more than half of whom live on less than $2 a day. Oxfam says the research, which concentrated on Unilever’s operations in 2003/4, challenged its view that expansion by a multinational squeezed domestic companies. Although the findings were not conclusive, “it appears that during the period under review, competing domestic industries had expanded rather than contracted”. The charity is open about the risk that its collaboration with Unilever will attract criticism from partner organisations and colleagues skeptical about the potential of multinationals to benefit poor people. But it says there are lessons for other NGOs in what it discovered about Unilever. A surprising finding is that more people are employed, and more value is generated, in the distribution and sale of goods than in the supply chain. Unilever, which has been active in Indonesia since 1933, calculates that 90 per cent of poor consumers buy its products in the course of a year.The jointly funded report, which is available on the Oxfam UK and Unilever websites, estimates that the company indirectly provides the equivalent of 300,000 full-time jobs, in addition to its 5,000 direct employees. More than half of this indirect employment is in distribution and retail, including up to 1.8m small shops, street hawkers, kiosks and warung, outlets that operate from family homes.

The Operating and Financial Review (OFR), the UK Department of Trade & Industry (DTI) regulation that came into force in March 2005 mandating annual corporate disclosure of non-financial environmental, social, and governance (ESG) information, was shot dead last week. In a speech before the Confederation of British Industry (CBI--the voice of business interests in the UK), Chancellor of the Exchequer Gordon Brown killed the initiative, citing concern over "goldplating"- or blind adoption of European Union regulations. The move came as a surprise as the creation of the OFR, which dates back before 2002, resulted from a comprehensive consultation process coordinated by a working group assembled by DTI representing a broad spectrum of affected parties, including SRI practitioners. Indeed, while considerable consultation went into the creation of the OFR, it seems precious little went into its scuttling. We have to agree with environmentalist organization Friends of the Earth (FoE) in the UK which sent a letter to Mr. Brown claiming his decision was "procedurally unfair, irrational, perverse, a breach of legitimate expectation, and based upon material errors of fact." FoE's letter claims that the Chancellor's failure to consult before making the decision was in breach of the UK government's Code of Practice on Consultation. "We have written to Mr. Brown today to warn him that unless he can satisfy us that his decision was lawfully made we intend to seek a judicial review," said FoE legal advisor Phil Michaels. "The decision was a breach of fundamental public law principles of fairness and due process." More than that it is likely to be to the detriment of UK competitiveness because it has been proven that a triple bottom line business culture creates more value.

‘Rewarding Virtue – effective board action on corporate responsibility’ by Insight Investments here and executive summary here.

The Co-operative Bank, which has just carried out a survey into ethical consumerism, found that the value of ethical consumption increased by 15% in 2004 to a staggering £ 25.8 billion. The reason for this huge figure is that it includes categories such as ethically invested funds (valued at over £10 billion) and products and services bought because they offset climate change (£3.4 billion). Spending ethically on food — including organic food and free-range eggs — surpassed £4 billion for the first time, whilst spending on ethical fashion reached £680 million. These markets are reaching critical mass and have strong growth potential too, unlike other sectors.

The newest in the Megatrends series advances a framework for conscious capitalism that highlights socially responsible investing. The chapter on socially responsible investing in Megatrends 2010 (Hampton Roads), which seeks to harness the popularity of best-sellers Megatrends (Warner BooksMegatrends 2000 (William Morrow 1990), will likely drive greater interest in SRI. The Megatrends books have become a kind of self-fulfilling prophecy: they not only identify significant trends, but also spur them. Author Patricia Aburdene frames SRI as one of seven "megatrends" ushering in "conscious capitalism," which fuses free market economics with social responsibility and spiritualism. (See book review here.) "SRI is becoming a megatrend for two reasons, one 'top-down,' the other 'bottom-up," writes Ms. Aburdene. "At the grass roots level, people insist on 'investing with their values,' as [GreenMoney Journal founder] Cliff Feigenbaum and the Brills [Investing with Your Values (Bloomberg Press 1999) authors Hal and Jack] would put it." "At the macro level, after Enron et al., even Wall Street's institutional investors got the message: Corporate ethics--or, rather, their lack--can nuke your portfolio".

A current summary of SRI and why it is growing came from finance-magazine.com: Socially responsible investment – the future of investment? Editor Ellen Bailey is senior investment consultant with Mercer Investment Consulting and notes that education remains a key issue for the SRI industry. "For many, socially responsible investment still conjures up visions of negatively screened funds with a particular ‘agenda’ to pursue. In fact, this approach is only adopted by a comparatively small amount of assets under management in SRI funds. The combination of increasing interest in SRI, coupled with new, more acceptable mainstream approaches for its implementation, appears likely to result in the rapid growth of SRI assets under management over the coming years. Increasing awareness of the impact of ESG issues on company performance is also likely to encourage the further integration of SRI teams and their mainstream investment colleagues and confirm SRI’s place in the wider investment process."

The Financial Times has created a global awards programme recognising banks that have actively integrated social and environmental objectives into their operations. Banks from both developed and emerging markets will be invited to enter for awards in five different categories. The deadline for initial entries is 1 March 2006.For further information, please write to: sustainablebanking@ft.com

And to round out this section on Responsible Investing lets have some food for thought from Adam Smith:

Every individual necessarily labours to render the annual revenue of the society as great as he can. He generally neither intends to promote the public interest, nor knows how much he is promoting it. By preferring the support of domestic to that of foreign industry, he intends only his own security; and by directing that industry in such a manner as its produce may be of the greatest value, he intends only his own gain, and he is in this, as in many other cases, led by an invisible hand to promote an end which was no part of his intention. Nor is it always the worse for society that it was no part of his intention. By pursuing his own interest he frequently promotes that of the society more effectually than when he really intends to promote it. I have never known much good done by those who affected to trade for the public good.

Venture Capital

Indian VC seems to be growing significantly with reports of large funds being launched: ICICI Ventures, the Hyderabad, India-based venture capital arm of India’s second largest Bank, ICICI Bank, is nearing a close on its $750 million India Advantage Fund III. It is considered the largest single VC fund in India’s history and is almost triple the size of the group’s previous VC fund, which was $250 million. The group held a first close of $250 million in November and hopes for a final close in January. LPs in the first closing are primarily Indian institutional investors with the exception of Swiss Re, the multi-billion Swiss re-insurance firm. Sudhir N. Nariyar, the director of investments at ICICI Ventures, says that the firm is already looking at investments for the fund. The San Francisco Employees’ Retirement System, which manages more than $12 billion of assets, plans to invest in India. The pension fund’s entry follows that of the California Public Employees’ Retirement System, which went into India in January 2005. E David Ellington, a trustee of the San Francisco retirement board, says that the fund is evaluating investments in infrastructure and real estate. Mumbai India-based Housing Development and Finance Corp. HDFC announced that it would launch a new global realty fund in the first quarter of 2007. The fund will enable non-resident Indians and foreign institutional investors to invest in real estate projects in India. The fund is being launched in association with State Bank of India. The fund will be managed by HDFC Venture Capital Ltd. HDFC hopes to raise about $400 million from the foreign market and a spokesperson from HDFC says that the company will seek significant institutional funding from its offices across the middle east.

A useful introduction to family business dynamics by Joachim Schwass of IMD is here.

Interest Rates and Currencies

China has approved 13 domestic and foreign banks to act as market-makers for yuan trading, in another move towards a more flexible currency. China plans to bring in a market-making trading system for the yuan early in 2006, letting it float more freely against foreign currencies. According to reports, the 13 banks include foreign lenders Citigroup, HSBC, ABN Amro and Standard Chartered. As China's currency becomes more freely traded it will play a bigger part in global financial flows and remove some incentive to hold US$ as a single reserve currency.

US rates rose to 4.25% and are expected to rise again in January - Greenspan's last - to 4.5%. While this had been the expected point of flattening, it is now more likely that rates will rise another 0.5% in the first six months of 2006. US rates are under scrutiny because there is an inversion in the yield curve (scroll down linked page) which may become more accentuated when short term rates rise again, if long term rates do not follow. The inversion of the yield curve (short term rates are higher than long term rates) especially between the 3 month and 10 year tenors, have historically been very reliable indicators of an impending recession in 6 to 18 months. While nothing can be predicted with certainty, the inverting yield curve is a red flag and its impact should be considered in portfolio and strategic planning.

US consumer prices fell 0.6% in November, marking the sharpest slide in 56 years. The fall was driven by a record 8% drop in energy costs in the month, following a previous surge in oil prices in the wake of Hurricane Katrina. Analysts had been expecting a 0.4% fall in US consumer prices. The larger decline will come as some relief to the US Federal Reserve, which has been raising interest rates in a bid to dampen inflationary pressures. Excluding food and energy costs, the so-called 'core' measure of US inflation rose in-line with forecasts by 0.2% in November. Over the past year, US consumer prices have climbed by 3.5%.

The appetite of UK consumers for new debt has fallen to its lowest level for 11 years. Bank of England figures show that in November, the growth rate of consumer credit - such as credit cards and bank loans - fell to just 9.8% a year. That was the slowest growth recorded since September 1994 and a fall from the recent peak of 16.1% in 2002. Unsecured borrowing rose in November by its smallest amount for nearly five years, at just £900 million. The Bank of England said this was mainly due to a drop in credit card spending, which it said was £0.3 billion lower in November than in October - people are tending to use debit cards instead, which is a much more prudent tool for managing current consumption.

Trade and FDI

The WTO ministerial meeting in Hong Kong was not as disastrous as expected, but was still embarrassingly pathetic. A limited trade deal has been reached in Hong Kong after developing countries approved a European Union offer to end farm export subsidies by 2013. It is hoped that it will pave the way for a global free trade treaty in 2006. Yet only modest progress was made in other key areas, and officials admitted much more work needed to be done. "This is a profoundly disappointing text and a betrayal of development promises by rich countries whose interests have prevailed yet again," said Oxfam's Phil Bloomer.

The main points are:

-

Agricultural subsidies: Farm export subsidies will progressively be phased out by 2013. However, there has been no agreement on import tariffs.

-

Cotton: Rich countries will phase out export subsidies for cotton, but there is no agreement on a date for reducing domestic subsidies for US farmers. (The US is resisting pressure to rapidly reduce the subsidies it gives to domestic cotton farmers, a source of great concern for African countries.)

-

Development Aid: The poorest countries will get quota-free and duty-free access to global markets for 97% of their goods.

For further detail see a Q&A on the Trade deal here. And in pictures: WTO protests.

The tragedy of GM contamination of nature continues to strangle earth's potential. To force genetically modified products into global markets, the US has filed a legal dispute at the WTO, accusing the European Union of blocking trade by restricting GMOs. The US argues that Europe's position on GMOs violates WTO rules and is a barrier to trade. In particular, it claims that US farmers have lost exports because they grow GM crops not approved in Europe, which is presumably their choice to do so. President Bush later added that the EU's moratorium was impeding efforts to feed the world, which is another myth since in fact results prove the opposite. The US argued heavily for science to be kept out of the dispute, stating that it was a trade complaint and the safety of GM foods was not at stake! This is ironic since GMOs are tantamount to chemical weapons of mass destruction which have already devastated farmland in California and India.

Unfortunately GM products take away consumer choice, make farmers dependent on big business and undermine food security in developing countries. Furthermore, nobody knows what risks they pose to people's health and the environment. Since the launch of the dispute, the European Commission has already kowtowed to US pressure and approved five GM crops despite scientific uncertainty and potential environmental and health problems. The European Commission also attempted unsuccessfully to overturn bans on GM food and crops that Austria, France, Greece, Germany and Luxembourg put in place to protect its citizens and the environment. On 24 June 2005, Environment Ministers from across Europe voted to allow countries to keep their safety bans on genetically modified food. On 29 November 2004 the Commission had already tried (and failed!) to end those bans. The rejection to lift the national safety bans by the member states showed that the countries want to keep their sovereign right to ban GM food and crops despite WTO pressure. (For more info see here and here.) Indian Ecologist Vandana Shiva said: "The transatlantic trade dispute shows the worst face of the WTO. Despite the fact that the UN Biosafety Protocol allows countries to use the precautionary principle to ban the import of GMOs, the WTO may force feed us GMOs".

Energy

The year ended with the oil price still hovering around $ 60. There is no reason to expect it to decline, particularly as winter continues in north America and Europe. The risk remains on the upside.

The fire at a UK oil depot was newsworthy, not because of the importance of that depot and the large amount of fuel lost, but because of the evacuation of 2,000 people and the visible pollution - a cloud of toxic smoke that stretched for several kilometers and is visible from space - see here.

Jerry Taylor and Peter Van Doren, senior fellows at the Cato Institute a highly regarded think-tank, have proposed eliminating the US oil reserve.The rise in fuel prices that followed Hurricanes Katrina and Rita has prompted many members of Congress to call for new and expanded federal reserves of crude oil, diesel fuel, home heating oil, jet fuel and propane. Proponents of stockpiling claim that if the government were to hoard those commodities when prices were low, it could unleash them on the market when supplies are tight, thus dampening price increases and stabilizing the market. But the US experience with the strategic petroleum reserve strongly suggests that such government-managed stockpiles are a waste of taxpayers' money. Rather than increasing the stockpile, the reserve should be emptied and closed. Public stockpiles are far more expensive to maintain than many analysts realize. For example, after adjusting for inflation, the petroleum reserve has cost federal taxpayers as much as $51 billion since it was created in 1975. If you divide that sum by the amount of oil in the reserve, that's $80 per barrel by the end of 2003. In its 30-year history, the 700-million-barrel reserve, which was recently authorized by Congress to expand to 1 billion barrels, has been tapped only three major times: 21 million barrels were released at the onset of the Persian Gulf war in the early 1990's, 30 million barrels in September 2000 and 24 million barrels last year after Hurricane Katrina struck. Those releases were so small considering the size of the reserve that one wonders why politicians are so keen on having a billion barrels.

Climate Change and Environment

A deal to tackle global warming was secured after marathon international talks in Canada. However, the US will not sign the treaty because President Bush says it will hamper its economy. The US which had earlier walked out of the summit, has agreed to take part in non-binding talks on long-term measures to tackle global warming. Countries which have signed up to the Kyoto Protocol on greenhouse gas emissions have agreed to set new targets when the treaty expires in 2012. Delegates at the UN climate change conference in Montreal also agreed to adopt a draft rule book detailing the operation of the Kyoto Protocol, making it operational after years of negotiation. And they have agreed to get the compliance mechanism for the treaty up and running. The deal came on the final day of the two-week summit.

The Kyoto Protocol is an international agreement setting targets for industrialised countries to cut their greenhouse gas emissions. Signatories of the Kyoto Protocol have agreed to cut their combined emissions to 5 per cent below 1990 levels by 2012. The US appears to have been stung by negative coverage in the US media after it walked out in protest at Canadian attempts to get it to accept mandatory targets, as well as by Bill Clinton's strong comments at the event: "There is no longer any serious doubt that climate change is real, accelerating and caused by human activities."Jennifer Morgan, climate-change expert for environmental group WWF, said US negotiator Harlan Watson's decision to leave the talks overnight showed "just how willing the US administration is to walk away from a healthy planet and its responsibilities".

But let's hear from US media. The NYTimes editorial reads:

At least the Americans' shameful foot-dragging did not bring the entire process to a complete halt, and for this the other industrialized countries, chiefly Britain and Canada, deserve considerable praise. It cannot be easy for America's competitors to move forward with costly steps to reduce greenhouse gas emissions while the United States refuses to carry its share of the load. Nevertheless, the Europeans and other signatories to the 1997 treaty limiting greenhouse gas emissions - a treaty the Bush administration has rejected - promised to work toward new and more ambitious targets and timetables when the agreement lapses in 2012.

For its part, the Bush administration deserves only censure. No one expected a miraculous conversion. But given the steadily mounting evidence of the present and potential consequences of climate change - disappearing glaciers, melting Arctic ice caps, dying coral reefs, threatened coastlines, increasingly violent hurricanes - one would surely have expected America's negotiators to arrive in Montreal willing to discuss alternatives.

They did not. Instead, the principal negotiators, Paula Dobriansky and Harlan Watson, continued to tout the benefits of an approach that combines voluntary reductions by individual companies with further research into "breakthrough" technologies.

That will not work. While a few companies may decide to proceed on their own, the private sector as a whole will neither create new technologies nor broadly deploy them unless all countries are required to do their share under a regime that combines agreed-upon targets with strong financial incentives for reaching them. To believe that companies will spend heavily to reduce emissions while their competitors are not doing the same is to believe in the tooth fairy.

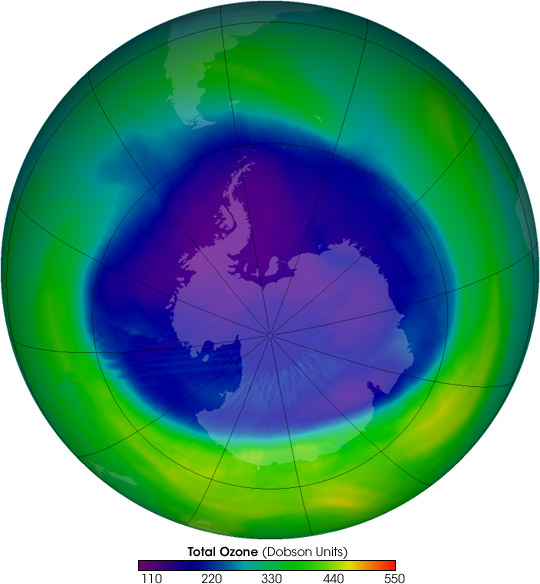

2005

marks the twentieth anniversary of the discovery of the ozone hole and

the first full year that NASA’s Aura satellite has provided detailed

images of the hole. Aura was launched in 2004 to monitor the Earth’s

atmosphere, including the health of the delicate ozone layer. The Ozone

Monitoring Instrument on Aura collected the data used to create this

image on September 11, 2005, when the ozone hole covered 27 million

square kilometers—its peak size for the season. Deep blue shows where

ozone levels were low enough to be considered part of the ozone hole.

New research shows that the ozone layer may be slower in recovering

than previously thought.

2005

marks the twentieth anniversary of the discovery of the ozone hole and

the first full year that NASA’s Aura satellite has provided detailed

images of the hole. Aura was launched in 2004 to monitor the Earth’s

atmosphere, including the health of the delicate ozone layer. The Ozone

Monitoring Instrument on Aura collected the data used to create this

image on September 11, 2005, when the ozone hole covered 27 million

square kilometers—its peak size for the season. Deep blue shows where

ozone levels were low enough to be considered part of the ozone hole.

New research shows that the ozone layer may be slower in recovering

than previously thought.

The fiduciaries who control the world’s financial assets – on our behalf – have long argued that their sole concern is to maximise financial returns. Michael Northrop, of Rockefeller Brothers Fund in New York, and David Sassoon, founder of Science First Communications, New York say it is also their duty to act to minimise climate change.

The world has suffered more than $ 200 billion in

economic losses as a result of weather-related natural disasters

over the past year, making 2005 the costliest year on record, according

to preliminary estimates released by the Munich Re Foundation at the

international climate conference in Montreal.

Citing the enormous risks that insurance companies face from escalating

losses caused by extreme weather events and the financial risks and

opportunities associated with climate change, 20 leading U.S. investors

urged 30 of the largest publicly-held insurance companies in North

America to disclose

their financial exposure from climate change and steps

they are taking to reduce those financial impacts. The investors, who

collectively control more than $800 billion in assets, co-signed letters

sent today requesting that the climate risk reports be completed and

shared with investors by August 2006. The reports should address the

multiple types of risk and opportunity that insurers face in regard

to climate change, including physical loss, legal and investment risks,

as well as opportunities for new markets and products in a changing

economic environment. The group included state treasurers and

controllers from California, Connecticut, Kentucky, Maryland,

New York, North Carolina, Oregon, and Vermont, as well as two of nation's

largest public pension funds, CalPERS and CalSTRS. the New York

City Comptroller, the Illinois State Board of Investment, socially responsible

investment funds, faith-based investors, labor pension funds, and a

leading foundation.

A special investigation by the New York Times reveals the extent of criminal activity by Freeport in Indonesia. Freeport has sent almost one billion tons of mine waste down the river from their copper and gold mine. The investigation revealed a level of contacts and financial support to the military not fully disclosed by Freeport, despite years of requests by shareholders concerned about potential violations of American laws and the company's relations with a military whose human rights record is so blighted that the United States severed ties for a dozen years until November. Company records show that from 1998 through 2004, Freeport gave military and police generals, colonels, majors and captains, and military units, nearly $20 million. Individual commanders received tens of thousands of dollars, in one case up to $150,000. Letters and other documents showed that the Environment Ministry repeatedly warned the company since 1997 that Freeport was breaching environmental laws. They also reveal the ministry's deep frustration. At one point last year, a ministry scientist wrote that the mine's production was so huge, and regulatory tools so weak, that it was like "painting on clouds" to persuade Freeport to comply with the ministry's requests to reduce environmental damage. That frustration stems from an operation that, by Freeport's own estimates, will generate an estimated six billion tons of waste before it is through - more than twice as much earth as was excavated for the Panama Canal. Much of that waste has already been dumped in the mountains surrounding the mine or down a system of rivers that descends steeply onto the island's low-lying wetlands, close to Lorentz National Park, a pristine rain forest that has been granted special status by the United Nations. A multimillion-dollar 2002 study by an American consulting company, Parametrix, paid for by Freeport and its joint venture partner, Rio Tinto, and not previously made public, noted that the rivers upstream and the wetlands inundated with waste were now "unsuitable for aquatic life."

IT

Several reports from North America and Europe show that internet commerce took a huge leap of around 30% in the holiday spending season. While bricks and mortar store sales did not achieve expectations, online shopping took up more of the slack than expected. It also seems that the standard shopping process includes both the hard and soft retail experience - consumers like to know there's a shop in the high street and will go there occasionally, but will tend to make the purchase online where they can do it at a time convenient to them and often compare prices with other shops at the same time. A few shops have been successful without the solid store front, like Amazon, but they have built loyalty through advertising, performance and the passage of time.

Sony BMG is rethinking its anti-piracy policy following weeks of criticism over the copy protection used on CDs. The head of Sony BMG's global digital business, Thomas Hesse, told the BBC that the company was "re-evaluating" its current methods. It follows widespread condemnation of the way anti-piracy software on some Sony CDs installs itself on computers. The admission came as Sony faced more censure over the security failings of one of its copy protection programs. The row began in November when software developer Mark Russinovich discovered that Sony BMG's XCP anti-piracy programs used virus-like techniques to hide itself on a PC. The row ended with Sony recalling all the CDs that use XCP and offering to swap customers' existing discs for ones that do not use the much-criticised software.

Mozilla, the home of the fastest growing browser Firefox has launched a sister site, Mozilla.com. It offers simplified navigation focusing on Firefox the #1 rated browser, and Thunderbird, the "best thing to happen to e-mail in a long time". Both are free.

Microsoft has advised Mac users of Internet Explorer to switch to rival browsers such as Apple's Safari. The advice came as the software giant formally announced the end of IE for Apple Macs. Microsoft initially said it had stopped work on the browser in June. No more security updates will be provided as from the New Year. The browser itself will be removed from Microsoft's Mactopia site and no longer be available for download.

The merger of Adobe and Macromedia is interesting in that it may lead to the next generation of web software with the merger of pdf and flash.

The internet is providing more insight to communications and marketing. According to a recent report from Pew Internet and American Life: Men are from Google, women are from Yahoo. "On the Internet, as in life, men and women have different motivations for doing what they do. Women view the Internet as a place to extend, support, and nurture relationships and communities. Men tend to see it as an office, a library, or a playground--screw the community, this is about function not family."

Here are some stats for the number crunchers:

• 67% of the adult American population goes online, including 68% of men and 66% of women

• 86% of women ages 18-29 are online, compared with 80% of men that age.

• 34% of men 65 and older use the Internet, compared with 21% of women that age.

• 62% of unmarried men compared with 56% of unmarried women go online

• 75% of married women and 72% of married men go online

• 61% of childless men compared with 57% of childless women go online

• 81% of men with children and 80% of women with children go online.

• 52% of men and 48% of women have high-speed connections at home

• 94% of online women and 88% of online men use email

And a great example of how the internet can reduce transaction costs and improve decisions is the owner listings real estate site FsboMadison.com (pronounced FIZZ-boh) which holds a nearly 20 percent share of the Dane County market for residential real estate listings. The site, which charges just $ 150 to list a home and throws in a teal blue yard sign, draws more Internet traffic than the traditional multiple listing service controlled by real estate agents across the country, the National Association of Realtors and the 6 percent commission that most of its members charge to sell a house are under assault by government officials, consumer advocates, lawyers and ambitious entrepreneurs. But the most effective challenge so far emanates from a spare bedroom in the modest home of Christie, a former social worker who favors fuzzy slippers, and her cousin, Mary Clare Murphy, 51. They operate what real estate professionals believe to be the largest for-sale-by-owner Web site in the country. The price competition is startling. FsboMadison listed about 2,000 homes in 2005 and said that about 72 percent of its listings sell. If those 1,440 houses averaged $200,000 per sale, the real estate commissions under the 6 percent system would have been about $17.3 million. Ms. Miller and Ms. Murphy collected about $300,000.

The ICANN debate continues. Who should have control of the internet, or is control even desirable or possible? Is it to be viewed as a human construct, owned by its many creators, or is it more like a global public utility, or a natural resource? You can see here a transcript of a debate by Michael Barone of US News & World Report, Perry De Havilland of Samzdata, Franklin Cudjoe of Imani Ghana and Peng Hwa Ang of the UN’s Working Group on Internet Governance. They debate the question of whether or not the internet should or can be controlled, and if so, who should do the controlling.

Holonics and LOHAS

Holonics * Health * Environment * Education * Living

Holonics

Another indication that Germany is an enlightenment pioneer: German rail commuters are being taught yoga and relaxation techniques on their journeys to and from work in a campaign to reduce stress. Teams of yoga instructors and physiotherapists have been placed on so-called "wellness" trains in southern Germany. They are laying their hands on workers with cricked necks and backaches, giving hand and shoulder massages and teaching relaxation methods that can be used at home or work. Deutsche Bahn - Germany's state-owned railway - decided to offer the relaxation techniques as part of a widespread drive to calm an anxious workforce and get commuters off the roads.

Health

Bird flu may be spread by using chicken dung as feed in fish farms, a practice now routine in Asia, according to BirdLife International, the world's leading bird conservation organisation. Fertilising fish ponds with poultry faeces, which can dramatically improve fish growth, may in fact set up major new reservoirs of avian influenza infection if the chickens are infected themselves. The suggestion puts a serious question mark over a technique firmly backed by the UN's Food and Agriculture Organisation as a primary means of providing protein for mushrooming populations in the developing countries. Known as integrated livestock-fish farming, the technique involves transferring the wastes from raising pigs, ducks or chickens directly to fish farms, with chicken or duck sheds sometimes sited directly over the fish ponds themselves. BirdLife International is now calling for an investigation into the possibility that these thousands of manure-fed ponds across Asia may be the means by which the new, potentially deadly strain H5N1, is being spread. BirdLife points out that outbreaks of H5N1 have occurred this year at locations in China, Romania and Croatia where there are fish farms. This supports our contention that avian flu is emerging because of unsanitary production rather than simply "a new disease". (The Ecologist covers this in depth in their December issue.)

Also in December, an AC Nielsen study on consumer habits in the UK suggest that people say that they eat healthier than they really do. This is reflective of people wanting to be seen to be educated and sensible responsible consumers but having difficulty breaking old habits of sugar, fat and packaging. However, the report also reveals the intelligence of the consumer who is showing strong resistance to fortified breads and milk - we prefer natural ingredients in food rather than chemical additives to create "nutraceuticals".The new study was designed to discover which foods that actively promote a health benefit were popular with consumers and why. Of the main categories listed in the survey whole grain products were regularly bought by most consumers (48%), cholesterol reducing products by 28%, fortified fruit juices by 16%, and probiotic yoghurts by 18%. When ACNielsen compared this latest online consumer survey with data from its Homescan project - which records actual purchases - it found significant differences. For example, whilst 65% of people in the online survey said they 'regularly or sometimes' bought cholesterol-reducing products, the Homescan data reveals that less than 20% of households purchased these products last year. Commenting on this phenomenon, Jonathan Bank, business insight director at ACNielsen said: "There is a lot of pressure to eat well and so consumers may be deluding themselves into believing they have a better diet than they have." Banks also said that sceptical British consumers were not always taken in by the health claims made for particular foods and that they were suspicious in particular about fortified foods which they did not regard as 'natural'.

The Natural and Organic trade show scheduled for April in London already has the highest interest since it was launched. This certainly underpins the rapidly expanding demand for good food, against the institutional backdrop of GM contamination.

Environment

The European Commission has authorised genetic contamination in organic agriculture, clearly putting the biotech industry before organic farmers and consumers, as well as nature. In a draft Regulation on Organic Production, adopted by the Commission on 21 December products containing up to 0.9% GMOs can be labeled as organic. This is a step backwards compared to existing EU legislation. Independent legal advice obtained by Friends of the Earth and other NGOs concludes that the Organic Regulation currently in force does not allow an organic product to contain GMOs or GM derivatives in any quantity. The organic sector in the EU must be given the means to develop and ensure its economic growth without any risk of genetic contamination. The European Commission continues to refuse to consider strict EU-wide legislation on the coexistence of genetically modified crops with conventional and organic farming. The Commission is also refusing to take environmental and health issues into account when considering coexistence, insisting that it is a purely economic concern. Independent legal advice has found that the Commission's Recommendations on coexistence are "fundamentally flawed" and that Member States must have regard to the aims of protection of human health and the environment. Helen Holder, GMO campaign coordinator at Friends of the Earth Europe, said: "Genetic contamination of organic food is completely unacceptable to consumers throughout the EU. The European Commission should be protecting organic farmers and consumers with laws that prevent organic farming from being contaminated by GM. If the biotech industry can't prevent contamination, then GM crops should not be grown in the EU."

Deep sea fish species in the northern Atlantic are on the brink of extinction, according to Canadian scientists writing in the journal Nature. They studied five deep water species including hake and eel and say that some populations have plummeted by 98% in a generation, meeting the definition of 'critically endangered'. Populations of roundnose grenadier, onion-eye grenadier, blue hake, spiny eel and spinytail skate all declined spectacularly over the period. Populations fell by between 87% and 98%; projections show that some would be completely eliminated within three generations. These statistics would place the five fish within the category of "critically endangered", as defined by IUCN, the World Conservation Union, which publishes the Red List of threatened species. "Conservation measures are necessary and lack of knowledge must not delay appropriate initiatives, including the establishment of deep sea protected areas," the researchers conclude. Scientists and conservation bodies are pressing for a global moratorium on deep-sea fishing which they regard as particularly destructive.

Education

I find this particularly revealing because it lends credence to the idea that people behave like sheep, following the few leaders in our midst. It also supports the behaviour of markets, in which consumers tend to buy/do what others are buying/doing. We have not been adept at questioning our immediate environment and more often than not just want a solution irrespective of other considerations. Examples range from the mundane: buying fashion brand because we can't choose for ourselves, to the complex: we don't care how the computer software works, even if it is overpriced and buggy, so long as everyone else is using it. Although pragmatism demands that we recognise this dynamic, it is also clear that greater education and complexity are encouraging more people to move beyond programmed "knee-jerk" behaviour to critical thinking and enlightened behaviour.

As a committed proponent of "walking the talk" we were attracted to The Economist's article the importance of actions not words which reports on "mirror neurons". This reflects the research of Derek Lyons monkey study related above providing the rationale for humans' tendency to imitate, at least until their mental sophistication allows them to engage in critical thinking. New experiments show that when we see someone carry out certain actions, the same parts of our brain are activated “as if” we were doing it ourselves. In essence: we don’t need to think and analyse, we know immediately what other people mean and feel by replicating what they do within the same areas of our own brains. As leading researcher Rizzolatti puts it, “the fundamental mechanism that allows us a direct grasp of the mind of others is not conceptual reasoning but direct simulation of the observed events through the mirror mechanism.” In the unusual properties of mirror neurons scientists may have stumbled upon the brain mechanisms that give us the power to feel what others feel, to read others’ intentions as though they were our own, and even to get deeply involved in the activity of others during a game of football or a dance performance. Yet more surprising, the properties of these mirror neurons suggest that human language began in gesture and mime, not in speech. Also new research links defects in these nerve cells to autism and suggests novel methods for treatment. The number of scientific papers mentioning mirror neurons has risen 800% in the past two years. Psychologists, linguists, biologists, robot builders (who think mirror-neuron-like properties might help their robots be a bit more human) and philosophers are all taking on board the new view that “cognition is embodied in action” or the old aphorism "learning by doing".

But the insights go further and reveal more about our absurd propensity to lie and accept others lying. That “direct grasp of the mind of others” is an ability that sets humans apart from almost all other animals, except the monkeys and apes, which have only the first rudiments of this skill. Understanding what others intend makes possible those unique human skills of deliberate lying, cheating and manipulating, as well as imitation of others. Imitation is another skill that is almost uniquely human and permits learning to be passed on and culture to develop. It is time for humanity to recognise this characteristic and move on to a more sophisticated use of our mental capacities.

Thankfully US District Judge John Jones, a federal judge in Philadelphia, banned the teaching of intelligent design as an alternative to evolution, by Pennsylvania's Dover Area School District, saying the practice violated the constitutional ban on teaching religion in public schools. In a fierce attack on the Dover school board, all but one of whom have now been ousted by the area's voters - the judge condemned the "breathtaking inanity" of its policy." Jones defended the students and teachers of Dover High School whom he said "deserved better than to be dragged into this legal maelstrom with its resulting utter waste of monetary and personal resources." The ruling for the Pennsylvania's Dover Area School District dealt a blow to US Christian conservatives who have been pressing for the teaching of creationism in schools and who played a significant role in the re-election of President Bust. "Our conclusion today is that it is unconstitutional to teach intelligent design as an alternative to evolution in a public school classroom," Jones wrote in a 139-page opinion. The school district was sued by a group of 11 parents who claimed teaching intelligent design was unconstitutional and unscientific and had no place whatsoever in high-school biology classrooms.

Living

Some of America's most prominent megachurches decided not to hold worship services on the Sunday that coincides with Christmas Day, a move that generated controversy among evangelical Christians at a time when many conservative groups are battling to "put the Christ back in Christmas." Megachurch leaders said that the decision is in keeping with their innovative and "family friendly" approach and that they are compensating in other ways. Willow Creek Community Church in South Barrington, Illinois, always a pacesetter among megachurches, is handing out a DVD it produced for the occasion that features a heartwarming contemporary Christmas tale. "What we're encouraging people to do is take that DVD and in the comfort of their living room, with friends and family, pop it into the player and hopefully hear a different and more personal and maybe more intimate Christmas message, that God is with us wherever we are," said Cally Parkinson, communications director at Willow Creek, which draws 20,000 people on a typical Sunday. Megachurches have long been criticized for offering "theology lite," but some critics say that this time the churches have gone too far in the quest to make Christianity accessible to spiritual seekers. Although an atheist, I have to agree with Ben Witherington III, professor of New Testament interpretation at Asbury Theological Seminary in Wilmore, Kentucky: "I see this in many ways as a capitulation to narcissism, the self-centered, me-first, I'm going to put me and my immediate family first agenda of the larger culture." It certainly neglects the traditional role of the church to provide a community especially for the people in society without strong family connections like the elderly, single people a long distance from family, or people who are simply lonely and for whom church and prayers would be a significant part of their day. Like the religious rationale for the war in Iraq this policy seems more hedonistic than honest.

I'd like to mention John Lennon tributes that occurred in December because he was ahead of his time and lived for enlightenment of humanity - just listen to Imagine. His former wife Yoko Ono and the musician's many fans have mingled in Strawberry Fields, New York, to mark the 25th anniversary of his death. In his home city of Liverpool devotees released hundreds of white balloons bearing messages into the sky. The former Beatle was shot in Manhattan on 8 December 1980 by Mark Chapman, who is now in a New York prison.

Activities, Books and Gatherings

I had a new experience in December - single parenthood! Well, not really new but being the single parent of four children for nearly three weeks was a great experience. Because I decided (based on past experience) that when they are about (eg not at school or asleep) I must focus on them, it allowed me to develop a better feel for what they are up to and what is going on in their minds. It was a very positive therapy for all of us and I recommend fathers make an opportunity to do the same - make sure you're actually involved rather than treating it as a holiday. I would do it again and would have continued if they were not so fond of their mother.

Work on a couple of exciting transactions proved interesting and we hope to help develop a couple of new businesses in 2006.