Business and Investor Resources

Governance and Investor Responsibility

- Analysis,

Data, Tools, Links

- Analysis,

Data, Tools, Links

Private and Confidential

GRI Equity Review - May 2006

- Perspective

- Investment, finance & VC * Interest rates and currencies * Trade & FDI

- Activities, Books and Gatherings

The following sections are delivered through Astraea. The links below will take you to those sections.

Perspective

I was pulled between the extremes of

optimism and futility in May, even wondering "have I been living

under a stone?". The optimism was engendered by a host of businesses

and projects which are initiating positive change and helping turn humanity

from an exclusive beast to an inclusive part of nature. On the other

hand there were personal and global warnings that we are accelerating

down the wrong road. Could the wars in Iraq and Afghanistan, the

west's growing confrontation with Iran, and efforts to divest North Korea

of its nuclear weapons approach crucial turning points that might

combine to create a perfect storm of simultaneous international crises?

Could the economic rumblings, like the dollar decline, trade imbalances

and inequities and various asset bubbles combine to destabilise our cosy

lifestyles?

On the positive side, BeTheChange in particular introduced some powerful businesses, like Eprida, and change agents, like Stan Thakera and Tim Flannery. These businesses and people will make it possible to recreate humanity such that we see the world though a filter that is more unified and wholesome than the current belligerence in politics and economics. But at the same time it is depressing to hear of ignorance and selfishness among privileged people who imagine that traditionally derived solutions, like Halliburton's Survivaball (see Climate Change section), might work, and, even worse, that we are manipulated by rich power brokers more than we imagine (see Geopolitics).

On a personal note, my predilections to family business were greatly challenged. A number of people I respect denigrated the idea of pursuing family business, although I still maintain the view that family values are appropriate for long term stability of organisations. In one incident, I met a man with 6 siblings who chats with them all weekly, but never wanted to be involved in his father's business and does not want his children to take over his; this carries weight because he has built a billion dollar private business group in which the principals aim to share ownership with management up to 50% - he is extremely successful and fair. I reflected that Einstein, and other greats, never created family legacies. And two family enterprises with which I am in touch appear to be choosing dualistic strategies rather than unified ones. As Pratchett notes "gold and mud come out of the same hole" - that is to say there is no telling what creature your loins will create. The longevity of family businesses (they are the oldest in the world; we have a tenuous 15 generation record) suggests that families can create an environment that nurtures the right kind of guardian, but I've not seen any literature, even supported conjecture, that this might be the case. Perhaps the key is to nurture family values, but allow succeeding generations to adapt to the changing world that organisations inevitably face.

Geopolitics

Last month we reported on the crisis of confidence at the IMF/World Bank. The UN also faces a crisis when its interim budget runs out at the end of next month. The US and the other large contributors are threatening to withhold new funds unless the G77 (developing) countries agree to essential reforms of the UN secretariat. Getting the latter to sign up will probably in turn depend on progress towards revamping the Security Council. UN reform is high on many people's agenda. There are many who would scrap it and start again. More pragmatic views favour reform. And this is likely to be the right solution, but it is not clear how and it is not clear what. The UN is seen as impotent, because the US is the global superpower not the UN, and incompetent, because of waste and corruption from within. At the top of the list of needs is who is to replace Annan. Most candidates are high-profile leaders from politics or business. But that is not the kind of leader that a multilateral organisation needs. In fact, lessons can be learnt from VISA the highly successful trillion dollar credit processing company: Who is VISA CEO? Don't know? That's because the organisation is designed to cooperate internally - it is a member owned organisation (designed by Dee Hock) and it works. Multilateral organisations need similar structures and anyone at the head needs the disciplines of big company CEOs, without the ego.

Immigration was high on many agendas in May. The USA continued trying to bolster border control with Mexico. While the sentiment of wishing to preserve jobs and safety is understandable, the approach needs to be more thoughtful and less belligerent. The approach of doubling the resource allocation and applying a militant strategy is an inefficient use of resources which will not benefit America. Also Spain faced immigration issues as waves of north Africans attempt to land in the Canary Islands. Some 7,000 migrants, mostly from Africa, have reached the Canary Islands in the Atlantic Ocean this year; in May alone, about 2,000 would-be migrants reached the Canary Islands, mostly from Central and Sub-Saharan Africa, alone. Here in Ireland the state deported a few dozen Afghanistanis who have sought amnesty being afraid of torture and death on repatriation. A bigger issue in Ireland is the massive influx of people from eastern Europe which is now testing traditional Irish hospitality. While just 2.3pc of the Irish population were foreigners in 1990, the level rose to 7.1pc in 2003. This compared with just under 5% in the UK. Since then, the number of migrants has increased considerably, with more than 200,000 eastern Europeans registering for social welfare numbers since EU enlargement in 2004. We can guess that the proportion is now at least 10%. If this kind of influx occurred in the US one can imagine there might be rioting. While long term residents can be frustrated as parts of towns are taken over by immigrants and jobs are taken up, the immigrants have provided a strong foundation to the labour force and are greatly appreciated by employers.

Last month we spoke about the need for more insightful measures of prosperity, such as Index of Sustainability and Economic Welfare, the Genuine Progress Index and the Calvert-Henderson's Quality of Life Indicators. Now the call has been taken up by David Cameron the new leader of UK conservatives, as he talked about the desirability of moving from GNP to Gross National Happiness or similar. It is heartening to hear the call, it will be better to see it implemented in the coming 5 years.

Thai Prime Minister Thaksin Shinawatra chaired his first cabinet meeting since stepping aside from front-line politics at the beginning of April. He had handed power to his deputy after the election, which was later annulled. The return to political life has concerned some opponents who accuse Thaksin of abusing power and weakening democratic institutions. In the meantime, the anti-Thaksin street protests have melted away and Thailand has been calm despite extraordinary levels of political confusion. It appears that Thaksin did not want a long political vacuum, though it will take some weeks to organise new elections. Guessing who might succeed Thaksin is difficult as there are no clear leaders ready to step into the breach. Our current best guess is Surakiart Sathirathai who has a good academic pedigree, international experience and appears to be acceptable to a wide range of interests.

One of our readers in Thailand was kind enough to share with us a review from the Economist Intelligence Unit on the current political situation in Thailand. It offers a comprehensive summary by a long term resident and may be read here.

Petropolitics is getting interesting. Soon after invading Iraq, the US determined that Iraqi oil can only be bought in US$, in effect prohibiting the use of Euros and other major currencies. Now Putin has raised the stakes in the oil game during his State of the Nation to parliament address on May 10 when he announced that Russia was planning to make the rouble “internationally convertible” so that it could be used in oil and natural gas transactions. “The rouble must become a more widespread means of international transactions,” Putin said. “To this end, we need to open a stock exchange in Russia to trade in oil, gas, and other goods to be paid for in roubles." Presently, oil is denominated exclusively in dollars and sold through the New York Mercantile Exchange or the London Petroleum Exchange, both owned by American investors. Currently, the central banks around the world carry large stockpiles of dollars to use in their purchases of oil. This gives the US a virtual monopoly on oil transactions. It also forces reluctant nations to continue using the dollar even though it is currently underwritten by $8.4 trillion national debt. If Russia proceeds with its plan, the rouble will become another alternative to the the dollar on the open market, particularly attractive to its neighbours, and may help deflate demand for the dollar putting raising the pressure for devaluation.

Russia’s plan is similar to that of Iran,

which announced that it would open an oil-bourse (oil exchange) on Kish

Island in two months. The bourse would allow oil transactions to be made

in petro-euros, thus discarding the dollar. The Bush administration’s

belligerence has intensified considerably since Iran made its intentions

clear. Secretary of State Rice said that “security guarantees were not

on the table”; in other words, Washington will not provide Iran a “non-aggression

pact” whether it follows UN Security Council guidelines or not.

If Ithe course of events in Iraq had not been so disastrous this would

suggest that America is anticipating military action in Iran.

The US has maintained strategy of protecting its dollar-monopoly

in the oil trade because it can not afford to lose the advantage

of being the world’s “reserve currency”. The massive national debt

($ 8 trillion) and trade deficit ($ 800 billion) can be inflated as long

as foreign central banks maintain dollar deposits and dollars are needed

for oil trade. As these reservoirs of cash begin to diversify to

other currencies, the dollars will come back to the US driving up inflation

and deflating the US$.

In the US Attorney General Alberto Gonzales's threatened to prosecute media stalwart the NY Times for revealing President Bush's domestic spying program. Strangely he claimed that a century-old espionage law could be used to muzzle the press and asserted that the administration cares about enforcing laws the way Congress intended. Gonzales said that a careful reading of some statutes "would seem to indicate" that it was possible to prosecute journalists for publishing classified material. He called it "a policy judgment by Congress in passing that kind of legislation," which the executive is obliged to obey. Gonzales seemed to be talking about a law that dates to World War I and bans, in some circumstances, the unauthorized possession and publication of information related to national defense. It has long been understood that this overly broad and little used law applies to government officials who swear to protect such secrets, and not to journalists. But in any case, Gonzales and Bush have not shown the slightest interest in upholding constitutional principles or following legislative guidelines that they do not find ideologically or politically expedient.

European residents may wish to vote for a unified seat of government. If you think the European government should be consolidated to one location (Brussels) by disbanding Strabourg and saving some € 200 million annully, please say so here: http://www.oneseat.eu/.

Risk and Terror

Risk profiles are rising globally. While military and political risk has been in the danger zone for some time, we feel that economic risk is now moving from yellow/orange to red. That is not to say that financial systems are not robust and flexible, but the imbalances are massive and are now being recognised by a wider proportion of the public which may in itself undermine stability.

In Iraq, neither militray nor political stability has improved. And the Haditha incident of last November is now at the forefront of minds in America's administration, population and around the world. The allegations in Newsweek magazine contribute to an ever more disturbing portrait of embattled marines under high stress, some on their third tour of duty after ferocious door-to-door fighting in the Sunni insurgent strongholds of Falluja and Haditha. The marine unit involved in the killing of Iraqi civilians in Haditha last November had suffered a "total breakdown" in discipline and had drug and alcohol problems, according to the wife of one of the battalion's staff sergeants. The wife of the unnamed staff sergeant claimed there had been a "total breakdown" in the unit's discipline after it was pulled out of Falluja in early 2005. "There were problems in Kilo company with drugs, alcohol, hazing [violent initiation games], you name it," she said. "I think it's more than possible that these guys were totally tweaked out on speed or something when they shot those civilians in Haditha." The troops in Iraq have been ordered to take refresher courses on battlefield ethics, but a growing body of evidence from Haditha suggests the strain of repeated deployments in Iraq is beginning to unravel the cohesion and discipline of the combat troops. "We are in trouble in Iraq," Barry McCaffrey, a retired army general who played a leading role in the Iraq war, told Time magazine. "Our forces can't sustain this pace, and I'm afraid the American people are walking away from this war."

Blair has met with Bush to discuss the viability of Iraq's fragile new national unity government, as British aides admit there is no short-term prospect of stopping the sectarian murders plaguing the country. They also discussed a programme of troop withdrawals from Iraq that will be much faster and more ambitious than originally planned. The US ambassador to Baghdad added to the sense of foreboding by predicting that the next six months would be "critical" for Iraq. To achieve stability, the new government must "get the security ministries to transform in such a way that they will have the confidence of the Iraqi people". Unfortunately, Iraq's prime minister, Nuri al-Maliki, speaking as his cabinet met for the first time, took a basal militaristic approach, vowing to use "maximum force against terrorism". But his government was met with a fresh wave of bombings, killing at least 19 people in Baghdad alone. The new government, due to internal sectarian disputes, has been unable to fill the key interior and defence posts .

Further calls to close Guantanamo Bay camp in Cuba and any secret "war on terror" detention facilities abroad came from a United Nations report following hearings in early May in to US conduct. The UN Committee against Torture said that detaining persons in such conditions was a violation of the UN Convention against Torture. It also urged the US to put in place "immediate measures" to eradicate torture of detainees by its troops. "The state party should cease to detain any person at Guantanamo Bay and close the detention facility," the 11-page report said. It also urged the US to "rescind any interrogation technique" that constituted torture, such as the use of dogs to scare detainees. The report was compiled by a panel of 10 experts who heard testimony in early May from a delegation of US officials into its "war on terror" conduct.

In connection with this, we saw for the first time an interview with two detainees released after proof of innocence supplied by the UK government. The two UK citizens seemed to have become more resentful and religious since their detention and, while their testimony appears tainted by hype, aspects are crdible enough to further blemish the reputation of the global superpower.

An audio recording supposedly of Osama Bin Laden denies Zacarias Moussaoui's involvement in the 9/11 attacks, for which he was convicted and jailed for life without parole. "I am the one in charge of the 19 brothers and I never assigned brother Zacarias to be with them in that mission," the voice said, in a reference to the 19 hijackers of 11 September 2001. "Since Zacarias Moussaoui was still learning how to fly, he wasn't No 20 in the group, as your government claimed," he said. Moussaoui confessed because of pressure caused by over four years in prison, he said. Whatever the aunthenticity of the tape and statement, it further detracts from the US administration's credibility.

Indonesia suffered a massive 6.3 magnitude earthquake on Saturday. The area around Bantul, a district eight miles south of Yogyakarta, was devastated where most of the deaths occurred. Unfortunately the ancient site of Prambanan was rocked and suffered damage too. The scale of mortality is similar to that of the World Trade Centre, being over 3,000. However, there is no comparison to be made between this relatively modest earthquake and far more devastating quakes in Pakistan and Pakistani-administered Kashmir in October 2005, which killed 75,000, and in Iran in 2003, which killed 31,000, let alone the tsunami, which killed 181,000 people in Southeast Asia in 2004.

Nurpashi Kulayev was convicted for crimes in connection with the Beslan massacre, in a trial that was emotionally charged and closely watched. He is a young Chechen carpenter, who was caught during a final battle at School No. 1 in Beslan, in North Ossetia, near the Chechnya border. Kulayev was charged with several crimes, including terrorism and murder. He was first shown on Russian national television two days after the battle, looking overwhelmed and afraid as masked law enforcement officers handled him. The judge, Tamurlan Aguzarov, largely sidestepped these issues in his verdict, incorporating the positions of both the prosecutor and the government into the sentence. He said Mr. Kulayev deserved to die, but "because the Russian government has introduced a moratorium on carrying out death sentences, I sentence him to life imprisonment". The history of Chechnya and that massacre suggest that he is more of a scape-goat than a criminal.

The US is beginning to debate whether to set aside a longstanding policy taboo and open direct talks with Iran, to help avert a crisis over Tehran's suspected nuclear weapons program. European officials who have been in contact with the administration in recent weeks said the discussion was heating up, as Secretary of State Rice worked with European foreign ministers to persuade Iran to suspend its efforts to enrich uranium. European leaders make no secret of their desire for the United States to join in the talks with Iran, if only to show that the Americans have gone the extra mile to avoid a confrontation that could spiral into a fight over sanctions or even military action. But since the Iranian revolution of 1979 and the crisis over the seizure of American hostages in November that year, the US has avoided direct talks with Iran. There were sporadic contacts during the war in Afghanistan, in the early stages of the Iraq war and in the days after the earthquake in Bam, Iran, at the end of 2003. Incentives and possible sanctions against Iran are the focus of negotiations between the United States and the European nations. The United States is resisting the Europeans' desire to increase economic incentives for Iran, because that would involve a lifting of American sanctions on European businesses that helped Iran. At the same time, Russia and China are resisting the idea of seeking a new resolution at the United Nations Security Council that could be seen as clearing the way for sanctions or possible military action against Iran. We do not see the Iranian nuclear threat as imminent.

Presenting a report entitled The Military Balance, Dr Chipman warned

of a rising Taliban insurgency in Afghanistan aimed at British and Nato

troops who are replacing some US forces. "This year will be crucial for

Afghanistan as well as for Nato as it expands its mission into the south,"

he said. "The Taliban are likely to increase their operational tempo -

not least because they know that casualties among European Nato states

may mobilise domestic opinion against the war." British-led efforts

to eradicate Afghanistan's heroin production also "carry high risks to

international forces as they will come into direct confrontation with

the local population and the Taliban".

The IISS said North Korea had

obtained enough plutonium to

build between 5 and 11 nuclear weapons and long-running talks to induce

Pyongyang to disarm were at an impasse. In an implicit criticism

of Washington's policy of ostracism and financial sanctions, Dr Chipman

said North Korea had concluded that "the Bush administration is not

serious about negotiations and [has] hostile intent". The US approach

had also caused splits with its partners in the six-party talks. Meanwhile,

Pyongyang continued to move towards additional nuclear weapons capabilities.

The report also highlighted growing US concerns about China's military

build-up and intentions, quoting the findings of the recent US Quadrennial

Defence Review. It said China was "a power at a strategic crossroads

that is still pointing largely in the wrong direction and which has

the greatest potential to emerge as a military rival to the US".

Our views of risks to global stability were coloured by an unusual stream of referneces to consipracy theories which sound all too plausible and were prompted by the release by the US government of the 9/11 Pentagon video (which appeared to have the wrong time-stamp: September 12, 2001 17:37:22!). The US justice department has released the first video of the plane crashing into the Pentagon on 11 September 2001. The release of the video, taken from a Pentagon security camera, comes after a Freedom of Information Act request by legal watchdog Judicial Watch. For a more entertaining "movie" of the lead-up to the destruction of the Pentagon see this video (3 MB).

Coincident with receiving the two video links above in mid-May, a participant in a discussion on global finance raised the issue of dollar support by oil, miltary and drug interventions by the US government; supporting conjecture with various evidence but most interestingly recognition of the fact that the US government has plotted against its citizens before - as a matter of governemnt record: Operation Northwoods was signed off by all five Joint Chiefs of Staff under the Kennedy administration as a way to foment public support for a war against Cuba, who would be blamed for the terrorist acts.

| Northwoods: Title: Justification

for US Military Intervention in Cuba (proposal to stage terrorist

attacks) |

Rejected sternly by President Kennedy, which may have contributed to reasons behind his assassination, this approach to political gain may have been the model for September 11, shifting the blame this time to the Taliban homeland. What would make a more irresistible excuse for war?

And then, perhaps because of heightened scrutiny fuelled by the Pentagon video, the question over the source of the World Trade Center collapse was brought to our attention: Dr. Robert M. Bowman, the former head of the Star Wars missile defense program under Presidents Ford and Carter has gone public to say that the official version of 9/11 is a screen and his main suspect for the architect of the attack is Vice President Dick Cheney. There appears to be evidence that the buildings were professionally demolished using themolite. (See: 9/11 Conspiracy: Controlled Demolition Dropped WTC and Miracles of 9/11: 'Surely the Hand of Allah' ) Bowman outlined how the drills on the morning of 9/11 that simulated planes crashing into buildings on the east coast were used as a cover to dupe unwitting air defense personnel into not responding quickly enough to stop the attack. Bowman agreed that the US was in danger of slipping into a dictatorship and stated, "I think there's been nothing closer to fascism than what we've seen lately from this government." Over the past two years, scores of highly regarded individuals have gone public to express their serious doubts about 9/11. These include former presidential advisor and CIA analyst Ray McGovern, the father of Reaganomics and former Assistant Secretary of the US Treasury Paul Craig Roberts, BYU physics Professor Steven Jones, former German defense minister Andreas von Buelow, former MI5 officer David Shayler, former Blair cabinet member Michael Meacher, former Chief Economist for the Department of Labor during President George W. Bush's first term Morgan Reynolds and many more. It certainly strains the credibility of the stories told so far by the US administration.

Other related developments include the increase by a factor of some 8x in heroin production in Afghanistan since the US military was mobilised there in 2002. And if you are looking for a connection to "loose-cannon" Cheney and gang, enjoy the chart of Halliburton's recent fortunes.

Investment, Finance & V. C.

The big news in May was that markets started to rumble. This would not have been surprising to readers of this newsletter, although timing is always difficult to predict. There seemed to be no particular event that catalysed the sell off in stockmarkets and the dollar, but the weight of imbalances had to be recognised soon. Perhaps it was the classic motto "sell in May and go away" that appealled to investors who have seen attractive gains in portfolios. Perhaps it is the growing realisation that theyre is alot oif liquidity fuelling inflation, and not finding useful investment. Perhaps it was the exhaustion of war. Or the realisation that oil prices are going to remain high and we are passing Hubbert's Peak. What is important is that investors avoid hype and seek value while they can.

China and India are quickly becoming the focii of the global economy depreciating the importance of the US and Europe. The news in the paragraphs below add to this. While it is certain that growth and opportunities are abundant in these Asian economies the outlook is beginning to mature. The May FEER led with an article on China's capital market by a McKinsey director and senior fellow. It is useful in highlighting some of the concerns with which you may be familiar and one statistic that stands out is the decline in investment efficiency: In the early 1990s $ 1 of GDP growth was achieved with $ 3.30 of capital, but since 2001 $1 of growth required $ 4.90 of new investment, which is 40% more than South Korea or Japan during their high growth periods. The deterioration of this relationship is a powerful indicator of what it will take to make investments work in China. With 70% of China's capital stock coming from the banking system and only 15% from equity, there is little flexibility in the system and banking problems will increasingly make planning difficult. Even India has 35% of capital provided by equity, a similar proportion to the US. The pressure for rejuvenation of financial infrastructure in China is high and changes must occur in the next five years if gross imbalances are to be lessened.

This restructuring is already under way. China's state banks face a huge increase in competition from December, when the government will open the retail banking market to overseas lenders who will be able to open their own branches in the country. In anticipation of this the top Chinese banks are raising new capital and taking on partners.

May saw the largest IPO since 2000, and it was in China. The Bank of China raised about $ 9.7 billion, selling nearly 26 billion shares at 38 cents each on the Hong Kong Stock Exchange. The bank had received private equity investments of $ 3 billion for a 10% stake prior to the IPO from The Royal Bank of Scotland, Merrill Lynch, Singapore's Temasek and several high net-worth private investors, including Li-Ka Shing. BoC is the country's second largest lender and has one of the most international outlooks of all China's banks, with offices around the world and a listed subsidiary in Hong Kong. Its position as China's principal foreign exchange bank has also enhanced its profile in the eyes of would-be investors. But some analysts have warned off investors, pointing out the bank's problems with bad loans, fraud investigations and antiquated computer systems. Demand was strong and the sale was oversubscribed as investors placed orders worth $152bn for Bank of China shares, with the retail side at least 70 times over-subscribed. The company priced its shares at 2.95 Hong Kong dollars ($0.38) each, 5 cents below the top of its pricing range. Trading of Bank of China shares starts on 1 June.

The country's largest lender, Industrial & Commercial Bank of China, is planning a $ 10 billion share flotation for later this year.

China drew attention to the issue of bad loans after it forced Ernst & Young to withdraw a report just published which estimated the total exposure of China's financial system to bad loans to be $911bn. That included $358bn - nearly three times the official figure - at the big four state banks. Nine days after it was issued, E&Y withdrew the whole report, saying the $358bn figure was "factually erroneous" and lamenting the absence of the "normal internal review and approval process" before publication, which is probably an exageration at least. The withdrawal was more likely done to protect its China business and mollify the People's Bank of China, the central bank, which had publicly called the report"ridiculous and barely understandable" hours before E&Y backed down.

A general survey on international banking was published by the Economist in May. It discusses the massive size of global banks and the pros and cons of such mega-bank strategies. The report covers both India and China offering a useful summary of issues.

The economy of China continues to be resilient. Chinese retail sales have jumped 13.6% during April, a sign that domestic demand is starting to catch up with the nation's red-hot export sales. There have been concerns that China's boom was too reliant on investment and trade, with consumer spending too weak for it to weather a global slowdown. However, analysts said that retail sales are now likely to keep improving. April's data from the National Bureau of Statistics topped market forecasts, and was up from 13.5% in March.

Anecodtally, a total of 41% of respondents in the BBC World Poll, powered by GMI, had China's economy in top spot by 2026, 35% plumped for the US, 10% chose Japan, and 6% favoured India. The findings contradict a Goldman Sachs projection of the world's economies which had the US in top place in 2026.

Media in India report that Goldman Sachs Group will establish a $1 billion property investment fund for India, becoming the fifth or sixth new real estate fund to be announced for India over the last month. RE Venture Fund Advisors of Mumbai and New Delhi, India, is raising two real estate investment funds for India. RE Capital India Fund I is raising $25 million and RE Capital FDI Fund is raising $100 million to $250 million. The Reserve Bank of India continues to withhold approval of about four dozen foreign private equity real estate investment fund filings due to fears of hyperinflation in India's real estate market.

In India, the stock market dropped significantly in May forcing the Bombay Stock Exchange to halt trading. The previous crash of the BSE, another black Monday in India in 2004, saw a loss of about 450 points. This time one single, intraday drop of over 1,100 points, or almost 10%, followed the previous week's 7% drop.

Bush signed into law a $ 70 billion tax cut which he says will boost the US economy. But analysts say it is a tactical move to help Republicans keep control of Congress in November's mid-terms elections. The cut comes as a poll indicates public confidence in the Republican Party has reached a new low. Bush says his "pro-growth economic policies are working for all Americans". Democrats say the cuts are irresponsible and favour the wealthy. Its provisions include a two-year extension of reduced tax rates for capital gains and dividends, which were set to expire at the end of 2008.

The US economy doesn't seem to need help. It registered 5.3% growth in GDP in the first quarter of 2006, its fastest growth rate in two-and-a-half years, revised official data has shown. The new figure for the first quarter is more than triple the 1.7% growth rate recorded in the last quarter of 2005. The upward revision, from the initial 4.8%, came as growth was led by exports and firms increasing inventories, said the Commerce Department.

America could be better served by an overhaul of the tax system, which was mooted but now seems to be on hold. As far back as1984, The Grace commission encapsulated their findings which, among the shocking things revealed the following: Resistance to additional income taxes would be even more widespread if people were aware that:

-

One-third of all their taxes is consumed by waste and inefficiency in the Federal Government as identified in the survey.

-

Another one-third of all their taxes escapes collection from others as the underground economy blossoms in direct proportion to tax increases and places even more pressure on law abiding taxpayers, promoting still more underground economy - a vicious cycle that must be broken.

-

With two-thirds of everyone's personal income taxes wasted or not collected, 100 percent of what is collected is absorbed solely by interest on the Federal debt and by Federal Government contributions to transfer payments. In other words, all individual income tax revenues are gone before one nickel is spent on the services which taxpayers expect from their Government.

Reflecting the theme of predatory lending covered a couple of months ago, Bernanke tried ot focus the administration of the value of a well educated population, saying that: Financial literacy leads to better decision-making among consumers and to improvement in the financial markets. This was not indicative rhetoric that might be expected in connection with predictions about interest rate movements. Bernanke said clearly that while technology has transformed the ability of the financial services industry to provide a greater range of products to a larger audience, the public still needs the financial knowledge to make informed decisions. He believes that a better-informed public will also promote lower-cost financial products.

Henry "Hank" Paulson, the chairman of investment bank Goldman Sachs, has been nominated as the US treasury secretary. He will take over the role from John Snow, who is resigning after three years in the job. Paulson has been chairman and chief executive of Goldman Sachs since May 1999, when the bank went public. He worked for the White House in a previous life: he was a member of the domestic council as staff assistant to President Nixon in 1972. Is this good news? Despite being an appointee of Bush, it may be: Goldman Sachs has recently promoted its publications on the importance of analysing ESG risks (as reported in the Review of December 2005) and Paulson is reputed to be an avid nature-lover, being chairman of the board of The Nature Conservancy in the US. Paulson also spent most of the most recent Goldman AGM defending their environment policy - well done Hank.

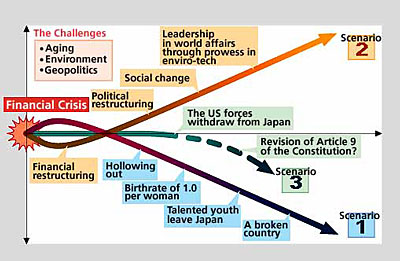

Japan's

performance continues to be better. It appears to be joing the

global habit of inflation. Japanese consumer prices were higher

in April than a year ago, the sixth month in a row they have risen,

lifting hopes that deflation has been shaken off. Japan watchers

will be interested in the scenario

forecasting of Nakamae International Economic Research on possible

courses that Japan could take during the period up to 2010 - 2020. The

scenarios are built around the four key challenges facing Japan: the

financial crisis, the aging of Japan's population, local and global

environmental problems, and changes in existing geopolitical relationships.

Japan's

performance continues to be better. It appears to be joing the

global habit of inflation. Japanese consumer prices were higher

in April than a year ago, the sixth month in a row they have risen,

lifting hopes that deflation has been shaken off. Japan watchers

will be interested in the scenario

forecasting of Nakamae International Economic Research on possible

courses that Japan could take during the period up to 2010 - 2020. The

scenarios are built around the four key challenges facing Japan: the

financial crisis, the aging of Japan's population, local and global

environmental problems, and changes in existing geopolitical relationships.

A new Ceres report, Climate Risk and Energy in the Auto Sector -- Guidance for Investors and Analysts on Key Off-balance Sheet Drivers, finds that the uncertainty in the U.S. regarding the future course of energy and climate change policy is a major problem for investors and Wall Street analysts in assessing the value of auto companies, and that analysts need better disclosure from auto companies about their strategies for managing the risks and capturing the opportunities posed by new energy and climate change policies taking effect worldwide. The Ceres report analyzes several key trends that could affect the valuation of auto companies' securities, which are already subject to critical scrutiny. Three conclusions were widely agreed upon by the analysts at the meeting:

-

Regulatory uncertainty on climate change is a major problem for the auto sector;

-

Flexibility in manufacturing is a key factor for future profitability;

-

Investors need improved disclosure on the risks and opportunities posed by fuel prices, climate change, and other factors.

Six key factors have combined to send a strong signal to automobile companies that they must shift production to new technologies that enable them to produce vehicles that are more fuel-efficient and emit less pollution. Those six factors are:

-

Volatile gas prices. High and volatile gas prices as a result of Hurricane Katrina coupled with limited supply and rapidly rising worldwide demand.

-

Energy Security. Dramatic revisions to both the IEA’s and the EIA’s oil price forecasts, predicting rising oil prices and increasing dependence on five or six middle eastern countries.

-

Energy Independence. New calls for energy independence and ending the “addiction” to foreign oil, including the enactment of the 2005 U.S. Energy Bill to accelerate adoption of fuel efficient technologies and biofuels.

-

New Standards. New policies globally and domestically ensure that the world’s major auto markets are covered by carbon reduction or fuel economy standards.

-

Alternative Technologies. The clear emergence of hybrids as an important mid-term auto technology to produce cleaner, more fuel-efficient vehicles.

-

New Fuels. The emergence of biofuels as the alternative fuel of choice.

The findings of this paper indicate that oil prices, regulation, and new technologies, and specifically the six factors above, are pushing auto manufacturers in one direction: toward the production of cleaner, more fuel-efficient vehicles.

Jeremy Siegel (author of Stocks for the Long Run) is now lending further support that the US is in for a long term bear run. In a book to be published next year he explains that he expects baby boomers, now hitting retirement age, will start liquidating savings in the stock market to finance retirement spending. Because of the demographic bulge they represent this will put a damper of capital flows to the stock market (as well as putting strain on social security and medicare). While there is unlikely to be a great sell-off we can expect this factor to add to the downward pressure on stocks over the coming years.

Responsible Investing

All sorts of financial entities are now participating in the reinsurance market, most notably hedge funds. However one has to ask how resilient these investors will be, should there be a repeat of the 2005 hurricane season. This is the critical question and, unfortunately, the preconditions for increased hurricane activity seem to be embedded in the current cycle of increased sea temperatures. See the box at right.

| Dr Robert Muir-Wood, a Lead Author for the forthcoming 4th IPCC (Intergovernmental Panel on Climate Change) Assessment Report, writes: An important milestone was reached at the end of last week in regard to the interface between the Climate System and Financial Markets. With the release of RMS's latest US and Caribbean Hurricane Catastrophe Loss models, we have confirmed that the hurricane activity measured for all forward-looking risk management applications is now higher than the long term historical average previously employed for quantifying risk. Atlantic Hurricanes generate the largest natural catastrophe insurance loss, and US & Caribbean hurricane is the most traded risk among international reinsurers and in catastrophe risk securitizations. Since our models are the most widely used in the market for setting insurance and reinsurance rates, this re-evaluation of risk -- within the insurance economy -- is the equivalent of a major dollar devaluation. The re-evaluation of risk also includes contributions from revised building vulnerabilities and the inclusion of new models of loss amplification effects -- systemic processes that expand losses for the largest catastrophes. The combination of changes in the new model has raised the annual expected loss for US insurance industry hurricane risk from USD 7 billion per year to more than USD 10 billion per year, while the 100 year loss increases from USD 70 billion to more than USD 100 billion. In effect, the former 100 year return period loss has now become the 50 year return period loss. While the 2005 season broke a number of records -- most named storms, most hurricanes, most Category (Cat) 5 hurricanes in a single season and most intense (Cat 3-5) US land-falling storms, as well as the record insurance loss -- it built on a rising baseline. Seven intense (Cat 3-5) hurricanes have made landfall in the US over the past two years -- four standard deviations higher than the long term mean. However, there has been increased hurricane activity in the Atlantic basin (including the Caribbean) since 1995, and the past two years are notable principally because high activity has now broken through to US landfall. The increase is highest for the most intense Category 3-5 hurricanes, which since 1995 have been running at more than 200% of the activity that prevailed in the 1970s and 1980s. This increase in activity and severity shows a strong correlation with raised sea surface temperatures in the main development region of the equatorial Atlantic, which themselves appear to shadow northern hemisphere temperatures, implying that there is a significant contribution from global warming. The uptick in risk in the our models means that arguably some of the costs of climate change are connecting through the economy. While reinsurers' rates are set in an open market, US insurers must deal with the rigid state-level insurance regulatory system, with elected or politically appointed officials unwilling to accept the evidence that risk has increased, or that these costs should be passed onto their electorate. It would be better if these same citizens were made better informed as to the potential link that exists between necessary increases in insurance costs and climate change. We are already seeing dislocations in the market in states such as Florida as private insurers attempt to withdraw from situations where they are unable to charge the technical rate for the risk. In surfacing issues related to rebuilding New Orleans, US government agencies have so far failed to acknowledge that the risk of storm surges from Cat 4 hurricanes with the power to overwhelm the current flood defences has significantly increased. More fundamentally, a set of international private companies, including ours, with a business model predicated on neutrality and independence may be better positioned to provide dispassionate information on risk rather than governments concerned with which interest group -- from real estate boards to consumer groups -- they are seeking not to offend. |

Investors in paper pulp producers should take note of a new report by the Centre for International Forestry Research in Indonesia. A significant number of projects financed in the last decade had no environmental assessment and may now fall foul of regulation and tougher scrutiny. A number of projects, including those of Asia Pulp and Paper and Asia Pacific Resources International came to market on the basis that they would be able to source affordable raw materials. In fact they are a long way from securing sustainable sources and their viability is thus questionable. The concerns over increasing requirements of environmental stewardship and materials availability will increase, not lessen, and investors should consider how much downside risk they have taken on.

The US organic sector grew impressively between 2000-05 with total sales topping $15bn last year, according to a new report from the Hartman Group. According to the report around 3/4 of the US population now buy organic products at least occasionally and 23% of US consumers buy organic on a regular (at least weekly) basis. Organic now commands around 2.5 % of total food sales in the US. Presenting key findings from the report at the All Things Organic summit in Chicago, Harvey Hartman noted that organic was “taking over from ‘natural’ in the US”. This was partly due to growing consumer recognition of the USDA organic seal (“while many consumers don’t know what it means they feel reassured by it”), but also because consumers had grown wary about the term ‘natural’, increasingly seeing it as a marketing tool. While "organic" will have its share of cynicism, in light of some questionable or disallowed pratices by some producers, it will continue to have significant credibility and value as a differentiator to consumers.

US Congress has passed an amendment to the Agricultural Appropriations

Bill that will increase federal funding for organic agriculture research

from $1.8 million per year to $5 million (as a reference point, eight

times that amount was spent on Bush's last inaugural party). Although

this allocation is better than nothing, organic subsidies and program

funds are ridiculously small, given the USDA's annual $90 billion budget

and the $25 billion in annual crop subsidies allocated to chemical intensive

farms and genetically engineered crops. According to the Organic

Consumers Association's National Director, Ronnie Cummins, "Since

organics represent 2.5% of all grocery sales, $15 billion in annual sales,

we deserve at least

2.5% of all USDA program monies."

In the UK, supermarket convenience stores, such as Tesco Express, are to come under the full scrutiny of the Competition Commission as it carries out its third investigation of the £5 billion-a-year grocery industry. Previous inquiries into suspected anti-competitive behaviour by the four big UK supermarket chains - Tesco, Asda, Sainbury’s and Morrison’s - have been criticised for failing to investigate the rapid growth of the supermarket C-stores. Small business groups argue that the spread of C-stores has allowed the major grocery retailers to shoe-horn themselves into the high street, where they have used supermarket tactics such as below-cost selling to draw consumers out of independents. The Office of Fair Trading, which has recommended the inquiry, says that as well as below-cost selling, the latest review will also look at the abuse of buying power and the land banks that have been built up by the big retailers. A spokesperson for Friends of the Earth, called on the Commission to: “find tough remedies that will help small shops flourish and protect farmers from bullying behaviour.”

The International Finance Corporation allocated some 11% of its total investments in fiscal 2005 to projects with a sustainable energy component, according to its latest sustainability report, Choices Matter. Read more here. The IFC - the private sector arm of the World Bank Group - has identified projects within its mainstream portfolio that have a sustainable energy component: it found 21 projects, representing $705 million of IFC investment. Of this, $221 million went directly to sustainable energy. During 2005, the IFC committed a total of $6.45 billion to 236 projects. The full report can be downloaded here.

In May Novethic presented the results of their annual study on assets under management in the French SRI market. They reported an increase of 27% in 2006, compared to 2005, with a total of 8.8 billion euros, of which 58% are for institutional investors. The report is here.

IFC's Capturing Value program invites research houses, rating firms, index providers, and similar organizations to compete for grants to encourage high-quality, long-term investment in emerging markets from pension funds and other investors worldwide.

New briefings covering SRI topics have been published by Insight Investment. The topics include corporate governance and financial performance, health and safety, the role of the board in governing corporate responsibility, climate change, voting disclosure, obesity, pesticides and environmental technology. They are available here.

MicroRate is the first rating agency specializing in the evaluation of microfinance institutions (MFIs). Its objective is to link MFIs with funding sources and in particular with international capital markets. MicroRate’s comparison tables are an useful tool for measuring the performance of MFIs. The data are verified in the field and they can be adjusted to neutralize the effect of differing accounting practices and subsidy levels.

WWF launched an umbrella fund with PhiTrust Finance, investing in companies that have a proactive commitment to environmental and social issues. Living Planet Fund - Equity is the first mutual umbrella fund invested on the international share market.

More than 25.8% percent of ConocoPhillips shareowners voted in favour of a resolution filed by Green Century Capital Management asking the company to recognize and eventually stay out of sensitive areas within the National Petroleum Reserve Alaska, particularly areas near Teshekpuk Lake. This represents the highest vote ever given by shareowners on a question of wilderness preservation.

It was disappointing to hear that Consumers International, a world collection of consumer organisations, has attacked the International Organisation for Standardisation for what it described as blocking press access to the debates at its social responsibility summit in Lisbon. The group said that it believed the action was the result of the business lobby that was 'forcing ISO' to ban the press. Richard Lloyd, Director General of Consumers International, said: "Big businesses love to tell anyone who'll listen just how socially responsible they are. Yet when it comes to media access to discussions on a global guideline for Social Responsibility, they slam the doors shut. By restricting media access to decision-making, the ISO sends a message to everybody that transparency is not an issue that needs to be taken seriously. This is an irony that won't be lost on consumers."

Venture Capital

China's government again signalled that foreign buyouts involving majority control will not be allowed in China. It announced that it will not allow a consortium investors led by Citigroup to acquire a majority stake in Guangdong Development Bank. Instead, it will require any investments to fall within the current foreign ownership limit of 19.9%. Much as they did with the recently denied or deferred Carlyle, Caterpillar and Harbin buyout deals, government regulators have informed provincial authorities who approved of the Citigroup buyout that Chinese national authorities would not approve any acquisition that gives foreign buyers majority control of a domestic Chinese company.

Global VC Insight by Ernst and Young (1.6 MB) is naturally a bit self-serving but offers some useful case studies, data and global perspective.

We'd like to draw your attention to a couple of novel sites. Ecostructure is innovating in the delivery of entrepreneurial VC services. It aims to

-

Collect cool ecological businesses and projects via their Eco-preneur Portal

-

Work with eco-preneurs to improve their presentations and business models

-

Provide financing for rapid expansion ecological business strategies via a percentage of the revenues generated from Individual and Eco-Preneur subscriptions to their website, and via their associated company, Ecostructure Capital LLC

And www.prosper.com is an online marketplace for people-to-people lending, demonstrating the jump in scope and efficency that the web can bring.

The Case for Categorizing Community Development Venture Capital as a New Asset Class by Bill Baue is a white paper by Pacific Community Ventures laying out the argument and identifying steps to promote growth in community development venture capital, such as standardizing social return metrics.

Galveston Bay Biodiesel LP, a 20+ million gallon per year biodiesel facility on Galveston Island, Texas, has raised an undisclosed amount of Series B funding from Contango Capital Management and Chevron Technology Ventures.

SolarCentury, a UK-based provider of solar energy solutions, has raised £5.5 million in new VC funding. VantagePoint Venture Partners led the deal, and was joined by return backer Scottish and Southern Energy PLC.

Last.fm Ltd, a London-based provider of an online social music network, has raised an undisclosed amount of first-round funding. Index Ventures led the deal, and was joined by angels Joi Ito, Reid Hoffman and Stegan Glaenzer.

Interest Rates and Currencies

As expected the US Fed raised base rates again at their May meeting from 4.75% to 5%. We continue to expect the rate to rise to 5.75% before year end, and if inflation becomes more pronounced in the coming quarters it may be even higher. It will be interesting to see how the higher cost of fuel will drive though to basic food prices in the US as most of US agriculture is oil based from fuelling tractors and distribution to herbicide and pesticide to fertiliser. This will become apparent in autumn and may cause a more popular reaction as consumers see price rises in daily consumption other than fuel.

The dollar slipped a bit trggered by concerns about rising inflation around the world, and because there are significant global imbalances weighing on the currency. A declining dollar appears inevitable, though it has been propped up by foreign central banks treating it as a reserve currency, and liberalisation of the rouble and yuan as well as increasing trade in Euros may lubricate its adjustment.

Commodity prices are at bubble-like levels and are due a significant correction. This seemed to be beginning with single day drops of 9% for copper and 12% for zinc. Silver and gold also came under pressure. Is it time to sell commodities?

Inflation is rising around the world. The US is obviously concerned as data showing US headline inflation rising at 5.2% annual rate. Japan seems to have turned from a deflationary environment to an inflationary one and Europe is feeling the pressure. Germany registered a leap of 6.1% in producer prices in the year to end April, the worst in almost a quarter of a century. The German statistics office cited rises of 37% in non-ferrous metals, 26% in natural gas, 7.2% in tobacco and 6.4% in meat, a breadth of range suggesting systemic pressures.

The Bank of Japan has provided liquidity to financial market players (in particular via hedge funds through the "carry trade") because of the low interest rates and the policy of maintaining stability between Yen and US dollar, the BoJ has been buying and hoarding dollars. The zero-interest policy of the BoJ may come to an end soon which will help drain liquidity from the global system.

Markets across the world are begin to face the possibility that a four-year boom may end painfully because of a seemingly abrupt growth in prices that forces central banks to jam on the breaks. It is Bernanke's misfortune in particular that he is starting his job with the global credit cycle at a peak. But all central bankers are being challenged by massive global liquidity and relatively loose money. Those economies with bubbles in the system which may burst are exposed to the most volatility - managing expectations is very difficult with inflation pushing up and the risk of certain asset classes, like housing, at risk of bursting. A broad decline in the US housing market in particular would be bad for the global economy: last year Americans fuelled demand to the tune of € 900 billion in equity withdrawals from their inflated home prices; estate agents alone made up a full 20% of the 2 million jobs created by the US economy in the past 5 years.

And if you enjoy a bit of humour, see the Borowitz report for 31 May: China Calls US Loans; Demand California as Repayment: Golden State to Become China’s East Coast

And a friend pointed out that the Columbia University Follies video "Every Breath You Take" mentioned last month has become a Cult Hit with financial media ... view the video.

Trade and FDI

The OECD warned that the global imbalances in world trade are unsustainable and must be tackled. Opening the global think tank's annual forum, Greek finance minister George Alogoskoufis said the situation posed major risks to global economic stability. Some imbalances "are clearly not sustainable and will have to be addressed in an effective manner as soon as possible," he said. His comments were echoed by the president of the European Central Bank, Jean Claude Trichet, who also addressed the OECD meeting. Unfortunately, the possibility of a productive Doha round of trade talks has all but evaporated.

Morgan Stanley's Stephen Roach comments on the massive imbalances:

By our reckoning, the disparity between the world's current account surpluses and deficits will hit an astonishing 6% of world GDP in 2006. Moreover, the deterioration is occurring at unprecedented speed. If our forecast comes to pass, this year's divergence between surpluses and deficits will be fully 50% higher than the 4% gap of 2003. And the asymmetry of the world's imbalances remains one of its most problematic characteristics: The surpluses are broadly diffused, whereas the deficits are highly concentrated; last year, the US accounted for about 70% of all the current account deficits in the world. This asymmetry underscores the precarious nature of the global disequilibrium. With the three largest surplus nations -- Japan, China, and Germany -- all hard at work in stimulating internal demand, there is a growing likelihood that their surplus saving will decline. That will put even more pressure on the funding of the largest external deficit in recorded history.

Energy

The

world consumes oil at more than two times the rate of discovery of new

supply. No wonder traditionalists like Blair are embracing nuclear.

It is certainly a drastic measure and probably a poor investment of

resources. Blair upset many people, including some within his

own cabinet, by endorsing a new generation of nuclear power stations.

Using easy arguments such as protecting UK energy security he failed

to diligently understand the problems of nuclear or seek more effective

and efficient alternatives. He also effectively pre-empted the

outcome of the government's energy review due to be published in July,

saying, in a speech to the CBI, the issue of a new generation of stations

was back on the agenda with a vengeance. He did mention a big

push on renewables and a step change in energy efficiency and it will

be telling to see if anything happens in these areas.

The

world consumes oil at more than two times the rate of discovery of new

supply. No wonder traditionalists like Blair are embracing nuclear.

It is certainly a drastic measure and probably a poor investment of

resources. Blair upset many people, including some within his

own cabinet, by endorsing a new generation of nuclear power stations.

Using easy arguments such as protecting UK energy security he failed

to diligently understand the problems of nuclear or seek more effective

and efficient alternatives. He also effectively pre-empted the

outcome of the government's energy review due to be published in July,

saying, in a speech to the CBI, the issue of a new generation of stations

was back on the agenda with a vengeance. He did mention a big

push on renewables and a step change in energy efficiency and it will

be telling to see if anything happens in these areas.

In the meantime, Africa and the Middle East, including places like Libya, Nigeria and Saudi Arabia, supply 60% of global oil reserves and are increasingly seeing this as their bargaining chip at the table of global resource allocation and wealth.

The US energy secretary announced that the US does not think countries

such as Venezuela and Iran

would cut off oil supplies, despite

fraying relations. Sam Bodman believed the nations were so dependent

on oil export revenues that the drastic action was unlikely. He

added that while high oil prices may damage the US's economic growth little

could be done to bring down costs and attempted to blame traders for the

price of oil rather than OPEC, which sounds more like propaganda to benefit

the US administration's friend Saudi Arabia.

Bodman presumably aimed to bring some pressure to bear on South American

countries that have nationalised energy assets recently - he told the

Reuters Global Energy Summit in New York that the tactic of changing contracts

or expropriating oil fields - as seen in Venezuela, Bolivia and most recently

Ecuador - would discourage foreign investment and hit those countries

in the long term.

Ford is trying to temper US motorists'

worries about soaring fuel prices by giving

away at least $1,000 of petrol

with new vehicles. The move came a week after General

Motors offered to subsidise petrol

prices for drivers of its new vehicles.

In the wake of ever-escalating gasoline prices, an ethanol craze has officially taken hold. US Congress has approved $ 5.7 billion in federal tax credits to support the ethanol market, in addition to the $10 billion U.S. corn farmers annually receive in subsidies. While the corn-industry-lobbying-machine has President Bush predicting ethanol will replace gasoline, the science behind corn-based ethanol seems to suggest this alternative fuel may be more about politics than an actual solution. According to the U.S. Department of Energy, it takes the equivalent of three barrels of oil to create four barrels of corn-based ethanol. Couple that with the fact that ethanol gets lower miles per gallon than gasoline, and the corn-based solution begins to show its true colours. But other nations are demonstrating that plant-based ethanol fuels can help meet our energy needs. Brazil makes ethanol from sugar-cane, which is almost 8x more energy efficient to produce than the US corn-based fuel. Crops with high cellulose or sugar content that can be easily grown in the U.S., such as sugar beets, hemp or switch grass, make much more efficient fuels. But, in the U.S., where special interests, not the public seem to govern federal policy, it appears the immediate future of U.S. automotive fuel is going to the highest bidder: genetically engineered corn - scary!

BusinessWeek reported on developments in bio-energy. Exciting bio-mimicry technology is being developed which offer clean, localised energy. Simply put, bacteria digest organic matter and produce electricity which can be captured and transferred. To quote the article: "microbes in a septic tank could power a house"! Now that sounds like a solution. While the technology is some years from commercialisation, it has been proven to work and it is a good example of how the solutions to today's problems may well come from unexpected sources.

Anyone got a good idea on how to jump start hydrogen energy? The H Prize (expected to be passed in to US law) will award alternating prizes of $ 1 million and $ 4 million for advances and a grand prize of $ 100 million for paradigm shifting technology.

Climate Change and Environment

"An Inconvenient Truth," Al Gore's film about the climate change, opened in New York and California. It promises to be provocative, as its website quotes: "It is difficult to get a man to understand something when his salary depends on not understanding it". Much of the advocacy agenda stemming from the movie and its companion Web site, climatecrisis.net, is aimed a modest provisions, such as forest conservation, adoption of energy-efficient appliances, expansion of the hybrid car market and purchases of "green power" from electric utilities.

The US National Association of Insurance Commissioners (NAIC) made a recent unanimous decision to establish a task force on climate change. And one sceptic has been converted by the weight of science. NY Times journalist Easterbrook says: Has anything happened in recent years that should cause a reasonable person to switch sides in the global-warming debate? Yes: the science has changed from ambiguous to near-unanimous. As an environmental commentator, I have a long record of opposing alarmism. But based on the data I'm now switching sides regarding global warming, from skeptic to convert.

More of this kind of media is needed because many seemingly well informed and powerful people remain oblivious to the problem let alone its massive scale.

Unfortunately, Canada will to try to block efforts to set stricter emissions targets in the Kyoto Protocol's second phase starting in 2012 and wants the climate-change accord scrapped in favour of a separate, voluntary deal. Canada wishes to join the Asia-Pacific Partnership on climate change, a non-binding pact criticized by environmentalists and an alternative to the Kyoto Protocol. This is driven by the fact that Canada's emissions are now 35 percent above its 1990 base levels whereas its protocol target is six percent below 1990 levels by 2012. This is particularly a shame because Canada makes a weighty contribution to alternative fuels.

In a new report, the World Bank noted that the global market for carbon dioxide emissions, an innovative offshoot of the Kyoto pact on global warming, has shown explosive growth, though recent events in the European Union's Emissions Trading System underscored how deeply volatile the market remains. The study said the worldwide market in CO2 trading was worth more than $ 10 billion in 2005, 10 times the value of 2004 and more than the entire $ 7 billion US wheat crop. "The data makes it clear that carbon is now a financial commodity. Carbon is now priced and business managers take the carbon price into consideration along with other factors in making business decisions," said Karan Capoor, senior financial specialist at the World Bank and the report's main author.

The volatility in the ETS came about on the release of reports that six EU countries had emitted far less CO2 than anticipated. Carbon prices dropped by more than 50% upon reports that the Czech Republic, Estonia, France, the Netherlands and the Walloon region emitted far less CO2 last year than initially anticipated by the market. The news took the market by surprise because of the magnitude in the discrepancy between the caps placed on countries' emissions and the amount of CO2 actually emitted. The shortfall was as much as 25% in Estonia with other countries reporting between 8 and 15% fewer emissions than anticipated. In France, this amounted to 19 million tonnes surplus allocations. However, the reported CO2 emissions represent only about 15% of the total emitted in the EU with reports for the biggest emitters like Germany, Italy, Poland and the UK still pending. And the drop also has positive effects, sending electricity prices down as CO2 market valuation is integrated into power prices. Electricity prices already fell by 5 to 10 euros in Europe in general on hearing the news. It was hardly a "crash" anyway - "the market started at € 6 and nobody then thought it would go above €10", said EU environment spokesperson Barbara Helfferich. Attention now turns to the EU's next round of emission allocation plans due on 30 June.

The Emissions Trading Scheme is the EU's flagship instrument to fight climate change and meet its Kyoto pledge to reduce emissions of global warming gases by 8% by 2012. Under the ETS, 11,500 firms that are big users of fossil fuels have to meet a target of CO2 emissions or else pay a penalty of € 40 a tonne for 2006 and 2007, a punishment that will rise from 2008 to € 100 a tonne. Energy-hungry industrial installations have been able, since 1 January 2005, to buy and sell permits to emit carbon dioxide, covering about 40% of the EU's total CO2 emissions. A CO2 cap is set for each plant covered by the scheme in order to create a shortage and keep prices high, thereby encouraging companies to emit less than what they have been allowed. Those that are below their quota can sell their surplus on the ETS to companies that are over, thus providing a financial carrot to everyone to clean up his act. Pollution credits can be exchanged on an EU-wide carbon market, favouring greener utilities that can make a profit from selling their excess credits.

This was the first time that governments have reported their actual level of emissions. The quotas established for the firms taking part in the ETS were based on estimates. The Financial Times commented "there is a strong suspicion that EU governments, of which at least 15 are on track to exceed their eventual Kyoto targets, are being too generous in awarding permits to their industries rather than the latter being unexpectedly successful in cutting pollution." In a recent study, WWF estimated that German power utility Vattenfall Europe received 99 % of its certificates for free. It said other German utilities such as E.ON and RWE had to pay for presumably only 7 % of their emission certificates. WWF calculated that German utilities were set to make windfall profits of between to €31 and €64 billion until end 2012 due to the free carbon allocations.

The Commission's reports showed a 2.5% surplus for 2005, with the 21 states granting 44.2 million metric tons more carbon dioxide permits than needed. Five companies in Britain produce more carbon dioxide pollution together than all the motorists on UK roads combined, according to new figures which reveal heavy industry's contribution to climate change. A league table compiled by the Guardian identifies EON UK, the electricity generator that owns Powergen, as Britain's biggest corporate emitter of greenhouse gases. It produced 26.4 million tonnes of carbon dioxide last year - slightly more than Croatia did. The figures, which have prompted new calls for tighter restrictions on corporate pollution, show that efforts by individuals and households to cut their carbon footprints will make little difference unless accompanied by greater action by industry. A 1% increase in the efficiency of the giant Drax power station in North Yorkshire - the largest in Europe and the single biggest polluting site in the UK - would save the typical carbon emissions of 21,000 households. Drax alone produced 20.8 million tonnes of carbon dioxide last year. The top five companies (EON UK, RWE Npower, Drax, Corus, and EDF) produced between them more than 100 million tonnes of carbon dioxide in 2005. On average, the country's 26 million private cars produce 91 million tonnes each year.

Britain's participating companies, which had lobbied for laxer targets,

produced together more than 242 million tonnes of carbon dioxide - they

had permits to emit only 209 million. Germany negotiated to produce

495 million tonnes of carbon dioxide, but its companies emitted only

474 million. France produced 131 million tonnes, but had permits for

151 million. British sites operated by Tesco, Walkers, Ford, Unilever,

Kellogg's, Allied Bakeries, Nestle and Cadbury Trebor Bassett are among

those that emitted more than 100,000 tonnes of CO2 in 2004 - more than

that of Vanuatu, the Pacific state where 100 people became the first

official climate refugees when they were moved from their coastal village

in December.

Fortunately Halliburton has "solved global warming". Their new SurvivaBalls save managers from abrupt climate change. An advanced new technology will keep corporate managers safe even when climate change makes life as we know it impossible. At least Halliburton realises climate change is a problem, but their solution is medieval! See, and click, the picture at right. (This is not supposed to be a joke.)

In mid-May Chinese news media reported that engineers were pouring the last of the concrete to finish the construction of the massive Three Gorges Dam on the Yangtze River in central China. The dam spans the entire river, and a large reservoir had filled behind it, to the northwest. The new reservoir is more than 3 kilometers (more than 2 miles) across just upstream of the dam. The dam is intended to provide flood control and hydroelectric power. When all the generators are operational (projected for 2009), Three Gorges will become the largest hydroelectric project in the world. While hydro-electric power is relatively clean, the construction of this project has devastated human and natural habitats and will continue to do so as it fills.

IT

EBay and Yahoo announced that they have agreed to combine their efforts on a number of projects. By 2007, expect an increase in eBay search results on Yahoo!, an increase of contextual text and graphical ads on eBay, PayPal to power Yahoo! Wallet, a co-branded eBay Toolbar, and click-to-call advertising using Yahoo! Messenger with Voice and Skype. This could all be good news, especially if the projects treat user data more ethically than Google does.

Dell, however, will place Google browser toolbars and other free Google software applications on freshly shipped Dell computers. Google will also be powering Dell's start page. Google will be paying an undisclosed amount for that right, though it's probably well worth it. This kind of deal is clearly an affront to Microsoft and its knack of packing as many proprietary applications as possible into their pre-installed operating systems. Wouldn't it be great if Dell shipped with Mozilla or Firefox and Thunderbird?!

The shift away from advertising on TV is likely to accelerate in the coming year as data from Nielsen Media Research suggests that already 5% of viewers are recording top shows to watch later when they skip the ads. This number could rise to 20% by the end of 2007 given the growth in DVR sales. This is probably good news for everyone because TV ads are designed to appeal to basal needs and instincts and are funneled into passive minds, ie brainwashing effect. No doubt advertisers will devlop sophisticated solutions, perhaps using other media, but it is a sign that consumers are increasingly seeking information more intelligently. The trend of consumer enlightenment is reflected in web advertising where placed ads on internet searches are also far less likely (1/5th) to recieve a click than normal search results, thus depreciating the benefit of paying for this type of placement.

Security software maker Symantec is taking legal action against Microsoft, accusing it of misusing its technology, alleging that Microsoft improperly used Symantec's data storage techniques in its own software. Symantec wants compensation, saying the alleged infringement amounts to misappropriation of its trade secrets. Microsoft describes the accusation as unfounded and says it has tried unsuccessfully to resolve the issue. The disagreement is based on Symantec's Volume Manager software, which allows operating systems to store and handle large amounts of data. Symantec believes Microsoft has "deliberately and surreptitiously misappropriated" the technology "and thereby convinced the US government to issue patents to Microsoft based on technologies invented by Symantec". Microsoft says it licensed the technology from Veritas Software, a company that Symantec acquired last year in a $ 13.5billion deal.

Holonics and LOHAS

Holonics * Health * Environment * Education * Living

Holonics

In

May we came across some excellent work on the power

of consciousness - Princeton University sponsors a study that

examines subtle correlations that appear to reflect the presence and

activity of consciousness in the world. The scientific work is careful,

though it is at the margins of our understanding. And the results are

certainly interesting, and to some, persuasive. The website,

appropriately

called "noosphere.princeton"

presents various aspects of the project, including some insight into

its scientific and philosophical implications.

In

May we came across some excellent work on the power

of consciousness - Princeton University sponsors a study that

examines subtle correlations that appear to reflect the presence and

activity of consciousness in the world. The scientific work is careful,

though it is at the margins of our understanding. And the results are

certainly interesting, and to some, persuasive. The website,

appropriately

called "noosphere.princeton"