Entrepreneur and Business Resources

Integral Methods and Technology

Governance and Investor Responsibility

|

Venture Capital Journal

Cover Story:

My Life as a Blogger

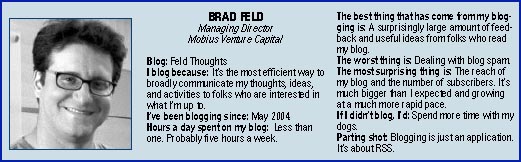

To blog or not to blog? That's the question Brad Feld, a managing director at Mobius Venture Capital, asked himself last year before launching his personal Web diary, dubbed Feld Thoughts. He wondered if anyone would be interested in his musings about bear watching in Alaska, the latest movies he's seen, and, of course, what it means to be a venture capitalist.

As an avid software investor, he was intrigued by the rise of blogs (short for "Web logs") and the new wave of blog-related technologies and startups hitting the market. He felt that the only way to understand the phenomenon was to become a blogger himself.

Since starting his blog, Feld has made some startling discoveries. On one level, his blogging activities convinced him of the worthiness of blog startups, prompting him to invest in both Technorati, a real-time search engine that keeps track of what is going on in the world of blogs, and Newsgator, a content aggregator for Microsoft Outlook that retrieves news from multiple sources, including blogs. But perhaps more importantly, Feld believes the simple act of posting his thoughts on a regular basis has made him a better venture capitalist.

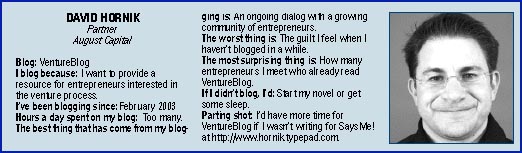

One of the very first VC blogs is the aptly named VentureBlog, which was started in February 2003 by David Hornik, a partner at August Capital in Menlo Park, Calif. He realized that blogging was becoming an important way to share information on the Web, and he wanted to play a part in the revolution.

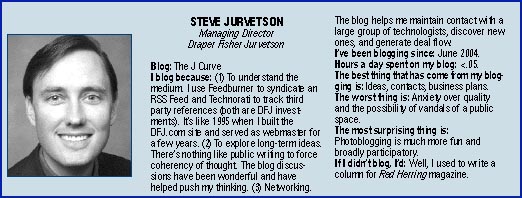

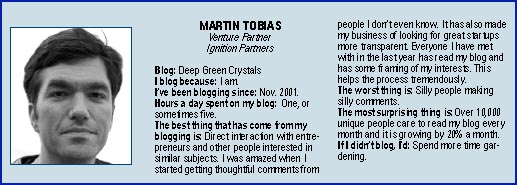

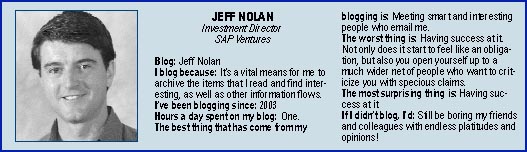

Now there are a dozen or so venture-related blogs, including those written by Steve Jurvetson of Draper Fisher Jurvetson, Jeff Nolan of SAP Ventures, Ed Sim of Dawntreader Ventures, and Martin Tobias of Ignition Partners. (See "Inside Bloggers' Brains," pages 27 & 29.)

The consensus among that group is that blogging represents a leap forward for the venture profession. They say that venture blogs help to shed light on some of the more arcane aspects of the industry, thus providing entrepreneurs and others a rare glimpse into how things really work. This, say VCs, is a very good thing because it demystifies the profession by providing insights into everything from how deals are structured, to what entrepreneurs should look for in a VC, to the finer points of "exploding term sheets" and liquidation preferences. Beyond that, VCs say posting their thoughts also helps with deal flow. That's because if you write a posting explaining what you like or don't like about, say, nanotechnology, there is a much higher likelihood of gaining the attention of serious people in the space and actually being introduced to some decent business plans.

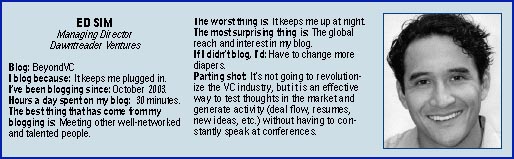

Dawntreader's Sim says that he has received a number of impressive resumes from people who have responded to his posts. He has even forwarded some of those resumes to portfolio companies if he thought there was a potential fit. He doesn't know for certain if that has resulted in someone getting hired.

But there are also a host of thorny issues that can arise from blogging. To begin with, there is the unwanted perception that VC bloggers will spill the beans about anyone who walks through the doors, even thought that is rarely the case. Still, some entrepreneurs may take to holding back details or simply avoiding certain VCs if they believe their private conversations will later be broadcast to the world in the form of negative blog postings.

The notion of publicly advertising your areas of interest-and the promising startups in those areas-can also pose serious competitive challenges. What if one of your blog postings is read by a rival VC, who then speeds ahead of you and plops down a term sheet to a company you were considering first?

Think it can't happen? Just ask Tobias, a venture partner at Ignition Partners in Bellevue, Wash. "I heard about an interesting company up in Canada and wrote a post explaining why I thought it was so neat," he says, declining to name the actual company (though you can check out his blog and see for yourself). "I soon discovered that another VC who read my blog had phoned up the company and put down a term sheet. That's the most disadvantageous part about putting your good ideas out there for the world to see-you invite competition." Tobias says from now on he will think long and hard before writing about a company he hasn't ruled out as a possible investment opportunity.

Still, Tobias insists that plenty of good has come out of his daily postings on his blog, called Deep Green Crystals. He estimates some 10,000 people visit it each month. Earlier this year, he noticed he was receiving very targeted pitches from entrepreneurs who were actually reading his blog and were surprisingly attuned to his way of thinking. "This was incredibly helpful because these entrepreneurs were doing their research and knew what I liked," he says. "This makes the entire venture process much more efficient and eliminates a bunch of preliminary BS you usually have to go through."

Recently, Tobias added a new category to his blog called "My Bets," where he writes specifically about technologies he is championing-and those he is avoiding. For instance, he expresses a clear disdain for Java, so it's almost certain he will receive no more Java-related business plans going forward. Conversely, he is a fan of BioIT and has written a number of posts about what he's looking for in a potential investment and where he thinks the sector is headed. "One firm contacted me six months ago after reading one of my posts, but I didn't do the deal," he says. "However this same firm has been following my musings on BioIT and now is very current with my way of thinking. When we spoke again very recently, they were much better able to address my issues." Tobias says he is seriously considering an investment in the company.

In another instance, Tobias was contacted by a company that makes a software application that runs on a USB device. He asked the team to send him a product before they formally pitched him. He also told them he would write a review on his blog, which would give the company a good idea how he felt. He was less than gushing, and a follow-on conversation was unnecessary. "This kind of product review exercise makes me more prepared before I even hear the pitch," he says. "It also lets companies know exactly where I stand, which really helps elevate the conversation when we do speak."

VCs agree that anything that makes their jobs easier-anything that matches their interests with those of an entrepreneur-is a very good thing indeed. They are also in agreement that the VC industry is not as transparent as it could be, and that it has operated within a black box for too many years. "There is no book called VC for Dummies," quips Jeff Nolan, investment director for SAP Ventures, the venture arm of enterprise software developer SAP.

What he means by that is most entrepreneurs do not know why VCs demand preferred stock over common stock. They do not understand what constitutes a good liquidation preference-and whether a 4x preference is actually too high or too low. They do not think about the kinds of intangibles VCs look for in a partnership. They don't even know what to look for when searching out an appropriate VC partner. And they don't understand why VCs ask such confrontational questions and perform what can often appear to be overzealous due diligence.

By addressing these very subjects, venture blogs in a small but important way are opening up the industry and ushering in a new era. "The more information that is out there is better for both VCs and entrepreneurs," says Feld of Mobius. "There are a lot of entrepreneurs who think they got screwed by VCs because they didn't understand the terms of the deal they were signing." Feld is tackling this problem by writing a series of blog entries on venture capital math. So far, he's covered the ins and outs of pre- and post-money valuations, preferred preference, and deal algebra. He says that after each post he's received a number of comments and private emails echoing the same theme: "Tell me more about how VC investments work."

Hornik of August Capital covers even more basic issues on his popular VentureBlog site. Issues like how to pitch a VC. One of his very first posts was entitled, "I'm a VC. Who the hell are you?" The post was inspired by the fact that even smart entrepreneurs can get 30 minutes into a pitch without introducing themselves or their team. "Even my waiter at Denny's starts off with Hi. I'm Dawn and I'll be your server,'" says Hornik. "It's not a bad model. Hi, I'm Dawn and I'm a serial entrepreneur.'"

He has also tackled such topics as "Putting the Power in PowerPoint," which spells out in detail the kinds of things VCs look for in a presentation. He even reveals some pet peeves on his blog: "I hate it when entrepreneurs use the word conservative' to describe their financials," he fumes. "I much prefer realistic,' because I would rather know what the company really thinks it is going to be able to achieve."

Nolan, for his part, recently wrote a provocative post on how to pick a VC. In the posting, he outlined the different types of VCs and their motivations for investing. Somewhat controversially, he also warned entrepreneurs not to get caught up in brand names. "Startup execs who are inclined to take an investment from an A-list fund but don't like the partner are setting themselves up for conflict that will result in long-term harm," he writes. He also advises entrepreneurs to conduct the same kind of due diligence on VCs as VCs do on them. "I'm always surprised that maybe 1 in 10 deals I look at seriously will call my references," he observes. "We make a big deal about calling the company's references and, indeed, the personal references of the executives. Why not for the investors as well?" Nolan says he was particularly proud of this post because it was widely read and linked to extensively from other blogs.

But how far can VC bloggers really open the kimono? Paul Kedrosky, academic director of the Von Liebig Center of Entrepreneurism and Technology Advancement at the University of California, San Diego, says VCs can get into trouble if they write specifically about companies that come through the door or if they broach sensitive topics, like raising money from limited partners. "It's a tricky issue because you don't want to jot down some opinion or belief that will come back and haunt you six months down the road," he says. "Once you commit your thoughts to a blog, they can't be erased, largely thanks to the way Google caches Web pages. This means VCs have to impose a great deal of self-censorship."

There is also the notion that blogs can be either a marketing bonus for a VC-or a marketing liability. On the one hand, a good blog can attract deal flow and impress potential investors in a fund. On the other hand, a poorly executed blog can alienate good companies and potentially turn off limited partners. The idea that LPs can conduct a Google search and instantly scrutinize the activities and thought patterns of a particular VC is anathema to many in the industry.

Hornik, for one, believes it is possible to write about the industry in an open and honest way without limiting the possibilities. But he says he tries to address topics that are useful without exposing the family jewels. Yet, on one occasion, he recalls how an entrepreneur approached him at a conference and assailed him for using his blog to badmouth certain companies. "I have never done that," he says. "But it worries me that some entrepreneurs may have the perception I'll write something negative after they pitch me."

All VC bloggers insist they have a high regard for confidentiality. Nolan says he won't write about his personal reactions to a pitch meeting, and that if he doesn't like a company he simply won't mention them in his blog. "In this business you are only as good as your reputation," he says. "If people think I'll spread whatever I hear or feel, they will be more cautious with me and I won't have access to the kind of information I need to do my job." Still, Nolan says he won't hold back when writing about a particular market sector, especially if it has some glaring holes. For instance, when writing about open source software, he wonders aloud whether "any software package or tool that is brought into the mainstream by a community of dedicated users can ever evolve to a traditional pay-me kind of software license model without alienating the very user base that brought you to the party?"

Indeed, the essence of any good blog is the author's ability to convey opinions and passion in a forceful, engaging manner. That's hard to do if you're overly sensitive to the concerns of others. "It's really important to keep my edge and write what I think," insists Ed Sim, managing director at Dawntreader Ventures in New York City. Sim's blog is called BeyondVC and gets about 500 page views each day. "I like it when other people disagree with me and write back to let me know." Sim says he struggles to write in general terms and avoid naming names, while still getting a strong point across.

One of his recent blog entries, for instance, chastises young companies that blindly add new features and functions to their products in a futile attempt to be all things to all people. "In the long run, having too many of the wrong customers can kill your business," he writes. Sim explains that it is not his goal to piss off anyone in his portfolio, but if there's a point to be made, they shouldn't be surprised to read about it in his blog. "In any case, it's more than likely they've already heard from me in the board meeting," he says.

Ultimately, Sim and his brethren believe blogging makes them better VCs, otherwise they wouldn't do it. Feld, for instances, laments that VCs often become nothing more than professional emailers and meeting takers who approach industry issues in a superficial manner. "By contrast, blogging forces me to be more thoughtful and really think deeply about the issues and trends I write about," he says.

Nolan says he's hopelessly disorganized and his blog acts as a personal archive, allowing him to bring greater order to his professional life. "I've written about 800 posts that I can search by keyword," he says. "I recently met with one company, and I remembered writing about something similar eight months before. I was able to go into the meeting with a better understanding. My blog has been incredibly valuable simply from a knowledge management perspective."

Most VC bloggers are also voracious readers of other people's blogs. Nolan says he can skim through as many as 100 a day, including other VC blogs as well as those targeted at particular industry segments, such as consumer devices or broadband technology. He says this is actually a very efficient way to stay abreast of trends and gain insightful viewpoints he would not normally find in an average newspaper or trade magazine.

Clearly, blogging is not for everyone. It requires a significant time commitment. Some, like SAP's Nolan, like to spend an hour each day no matter what. Others may spend only five or 10 minutes each day, and some may post every day for a month, and then not make a single entry the following month.

Of course, some may just get bored with the entire exercise and only post sporadically or when inspiration strikes. The problem with that is visitors will lose interest if they don't see fresh posts at least once a week. The repercussion is that no one will come to your blog after a while.

It also requires a love of writing and the ability to express one's self in print-a skill that eludes many intelligent people. But as the art of blogging catches on with more VCs, it is sure to have a profound and lasting impact on the entire industry.

Tom Stein is a freelance writer who specializes in venture capital. He can be reached at tom_stein25@yahoo.com.

Pick Your Blog

A VC: Musings of a VC in NYC.

BeyondVC

Ed Sim's blog on venture capital,

technology, the markets, and life in a

connected world.

Deep Green Crystals

Martin Tobias musings.

http://www.martinandalex.com/blog

Due Diligence

Tim Oren's notes and opinions on

technology, venture investing, Silicon Valley, life, the universe and everything.

http://due-diligence.typepad.com

Feld Thoughts

The J Curve

Jeff Nolan

All the news that I see fit to print.

http://sapventures.typepad.com

NorthWest VC

Steve Hall's "notes to self" and anyone else who happens to read this page.

http://nwvc.blogs.com/northwest_vc

VentureBlog

A random walk down Sand Hill Road.

VentureWiki