Entrepreneur and Business Resources

Integral Methods and Technology

Governance and Investor Responsibility

archive

signup

credits

archive

signup

credits

Private and Confidential

September 2006

- Perspective

- Investment, finance & VC * Interest rates and currencies * Trade & FDI

- Activities and Media

The following sections are delivered through Astraea. The links below will take you to those sections.

Perspective

September was naturally dominated by reflections on the fifth anniversary

of the destruction of the World Trade Center. Most of us who care

to think about our world are confounded by the phenomenal contrast of

our species, which can synthesise DNA and yet behaves so primitively that

violence is the first resort of diplomacy. In the name of freedom

we restrict our own freedom and blame others. In the name of democracy

we fuel sectarian violence and civil-war. In the name of God and

goodness we kill and allow innocents to die from poverty.

Humans are a problem for this planet and we will cause our own extinction

if we do not behave as if we love life more. [Editor's note: This paragraph

refers to humanity at a species level,

not a particular country or other subset. Some readers in the past have

appreciated this emphasis.]

While people generally want the same things from life - peace

and equity - there are strongly opposed views of how this may

be achieved. Readers will know that we are peace-mongers so I will

let the reported news and views in Geopolitics reflect that, and here

in Perspective will talk about two big picture reflections that have arisen

in the past weeks.

The first concerns criticality. Readers of this

review generally believe that humanity's intelligence is enlightening.

Some will point to the problems of the world and simply note that they

are big and need new thinking to resolve. Some will point to new

trends in environmental care, community engagement and governance.

Some will simply point to advanced consumer technology and the luxurious

lifestyle that so many can enjoy. Others are engaged in a community

of conscious consumers who invest in spiritual development and LOHAS.

Whichever opinion group(s) you fall into, the data shows that enlightened

systems and thinking are growing fast to replace flat world thinking.

But the debate remains: when will humanity's behaviour as a whole be dominated

by an integral or holonic perspective? Because until that change

occurs, operating to a new paradigm is hard work against the flow.

I believe that the critical mass of new thinking is near. That critical mass of people is not 50% of the population. Most people don't influence trends, they follow them. It is only 10% or so of the population that determines the trends. And the preponderance of enlightened thinkers in this group is significant. This is natural because change agents tend to come from the privileged who are better educated and therefore further along the curve of intellectual emergence. In the sphere of science, Ray Kurzweil has articulated the technological singularity or time at which scientific advances accelerate logarithmically because of cross-fertilisation - and he reckons we are at the initial cusp of that emergence. And it was in an interview with Niall Ferguson of Harvard Business School, in which he discusses the forces of globalisation as permanent and natural step in intellectual development which is now pervasive, having reached its critical mass. The signs therefore indicate that the critical mass of leaders pursuing enlightened thinking is being reached now. In the coming half decade we will live through the tipping point in global culture from feudal, hierarchical competition to enlightened, cooperative, integral living.

The second reflection concerns our approach to education and nurturing children. While it is based on personal experience I hope it will resonate with readers and that our pedigree will give the idea enough support. I believe that the single thing we can do to address human failings is spending time with our children, dare I say it, love our children. When young people are neglected by family, even if they are under the umbrella of a reliable guardian, such as a boarding school, the natural lesson learned is survival. And that lesson teaches one to suppress empathy in order to achieve personal gain. If this lesson is not supplanted by compassion, and it rarely is, the resulting adult then exists with a colder heart and a learned and practical selfishness. It is appropriate for a child to be selfish, for a period, as it learns about social interaction. Unfortunately in human world culture, this lesson is compounded rather than adapted to a lesson for interdependency, and humanity perpetuates a society built upon values of greed and selfishness. In fact, a happier world is being created by love and sharing, and these values must be put first quickly, while we still may enjoy our natural world.

Investment, Finance & VC

There have been several reports on the state of the world which bear a look for those investing internationally.

The Economist survey of the world economy in September is a useful overview of the global investment playing field. Some general conclusions are discussed including the shift of economic weight from developed to emerging economies which now provide more that 50% of global GDP (PPP - even using current exchange rates its 30%). We summarise: Emerging markets must continue to grow faster than developed one. The growth will predominate in low tech industries which drives price competition which keeps inflation modest. Growth is in labour intensive applications, which are subject to price competition, which tends to exacerbate social inequality as the rich get richer very quickly. The weight of capital is greater than the weight of people. Overall savings are higher in emerging economies, and these savings are financing rich country consumption. Our conclusions: invest in emerging economies. Medium to long term there may even be casualties among developed economies and the political landscape which both should encourage broader perspectives on income and welfare improvement.

The "State

of the Future 2006" by The Millennium Project has just been

published. This year, the main emphasis of the report was energy in the

future, and there was a global energy survey and four energy scenarios

for 2020. This “Report Card on the Future” distills the collective

intelligence of over 2,000 leading scientists, futurists, scholars, and

policy advisors who work for governments, corporations, non-governmental

organizations, universities, and international organizations. Summary

available at: http://www.acunu.

• 15 Global Challenges – Prospects, Strategies, Insights

• 4 Global Energy Scenarios for 2020

• 650 Annotated Scenario Sets

• Reflections on 10 years of Global Futures Research

Also the World Economic Outlook was published by the IMF.

The International Monetary Fund also focused attention on the world of money in its Global Financial Stability report. It warns that a global slowdown is looking more likely because of high oil prices and a cooler US housing market. It also notes that the US dollar may fall unless policies on savings levels and investment imbalances were changed. At the heart of many of the fears are trading imbalances, and the IMF's report came the day after China said it had posted a record of $18.8billion trade surplus with the rest of the world in August. By contrast the US, the world's largest economy, has seen its trade deficit reach over $64 billion. One explanation for this huge gap is the weakness of China's currency, which makes Chinese goods comparatively cheap, thereby boosting exports. In its report, the IMF urged Asian nations to aim for greater exchange rate flexibility, and said Europe and Japan should improve structural reform. A couple of other interesting issues addressed are The Yen Carry Trade - Does the Recent Increase in Stock Market Volatility Signal a Recession? and Corporate Earnings Growth - Global Equity Markets: Price/Earnings Ratio Indices.

Although interest rates are rising, inflation pressure, housing deflation, geopolitical risk and a number of global financial imbalances, stock markets are sizzling. The expected stock market returns are modest yet prices are rising. Investors are buying risk. This trend is also reflected in the growth of alternative investments. The next couple of months may be a good time to cash out. As Dr John Hussman, President of Hussman Investment Trust , notes:

Stock valuations remain extremely elevated on the basis of nearly every historically reliable fundamental, including normalized earnings (price/peak, price/earnings normalizing profit margins, etc). The only fundamental that suggests stocks are reasonably valued is the price/forward operating earnings ratio. While this, of course, is the only valuation measure that's widely quoted by analysts here, the price/forward operating earnings ratio has a very limited historical record, much less any proven reliability. Even here, the assertion that the current multiple is "reasonable" is based on an apples-to-oranges comparison with the historical average of 15 for price/ trailing net earnings.

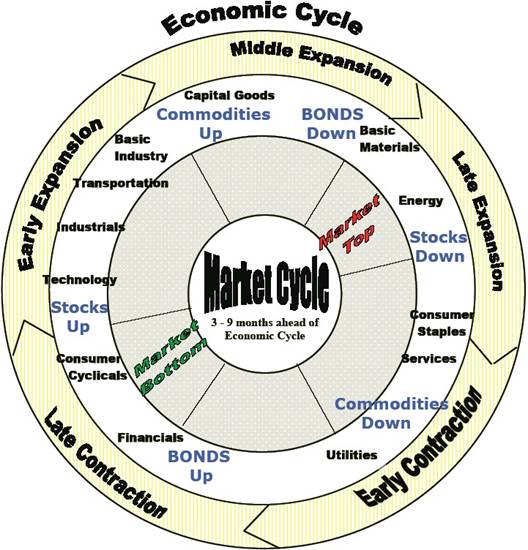

Matt Blackman, writing in the EquiTrend Weekly Market Watch, has shared

this easy graphic:

Would you not agree that we are at about 3 o'clock?

The changes in Chinese news distribution regulations referred to above in Geopolitics, are of particular interest to financial media suppliers and users. The regulations, which seek to bar financial information companies, including Reuters and Bloomberg, from selling services directly to Chinese banks and brokerages, would not hurt China's financial market reforms. Unfortunately, this may become a hindrance to information access which is so important to efficient markets. Fees, for example, are to be resolved through consultations based on "mutual respect and equal consultation and under the principle of mutual benefit". The foreign minister of Finland, which currently holds the EU presidency, has even suggested the curbs might also be aimed at securing Xinhua's position in China's multi-million-dollar financial information market.

Germany's revitalisation continues. The economy minister has given a bullish forecast for growth in Europe's biggest economy. Michael Glos said he expected to see economic growth of between 2.0% and 2.5% this year. The government's official forecast for 2006 is 1.6%, but many analysts now expect growth to top 2% this year.

Responsible Investing

The risks of investing in pollution has been highlighted by an unprecedented lawsuit against carmakers in California, that reflects tobacco lawsuits of the past decade. The state of California has accused Ford, General Motors, Toyota, Honda, Chrysler and Nissan of creating a "public nuisance" and costing it millions of dollars. Environmental campaigners hailed the lawsuit as a landmark event in the effort to deal with global warming.The suit alleges that vehicle emissions have contributed significantly to global warming, and argues that the car manufacturers should be held responsible for the past and future cost of combating this crisis. "Global warming is causing significant harm to California's environment, economy, agriculture and public health," said the state's attorney general, Bill Lockyer, who filed the complaint. "The impacts are costing millions of dollars and the price tag is increasing ... It is time to hold these companies responsible for their contribution to this crisis." California is the largest car market in the US, with more than 2 million new vehicles registered every year. Car sales in the state totalled $ 83 billion in 2005 according to the Automobile Alliance, an industry group representing carmakers. The 29 million registered vehicles in the state drive a total of 500 billion kilometres in the year. While the case has not been tried, it is an inevitable progression from tobacco litigation and will not be quietly ignored. The next line of fire may be aimed at oil companies.

Socially responsible investment assets grew faster than the universe of managed assets in the United States during the last 10 years, according to the Social Investment Forum's fifth biennial report on SRI trends. Total socially responsible investment assets rose more than 258% from $ 639 billion in 1995 to $ 2.29 trillion in 2005, while the broader universe of assets under professional management increased less than 249% from $7 trillion to $ 24.4 trillion over the same period.The $2.29 trillion in total assets under management using one or more of the three core socially responsible investing strategies - screening, shareholder advocacy, and community investing - is up from a total of $2.16 trillion in 2003. Among the signs of an ongoing growth from 2003 to 2005 in socially responsible investing are the following: an 18.5 % increase in assets invested in SRI mutual funds; a 16 % jump in social and corporate governance shareholder resolutions (and significantly higher levels of support for such proxy measures); and a 40 % boost in funds invested in community investing. Highlights of the report included the following:

-

Nearly one out of every ten dollars under professional management in the United States today is involved in socially responsible investing. The $2.29 trillion in SRI identified in 2005 reflects 9.4 % of the $24.4 trillion in total assets under professional management tracked in Nelson Information's Directory of Investment Managers.

-

Assets in socially screened mutual funds and other pooled products rose to $179 billion in 2005, an 18.5% increase over the $151 billion tracked in 2003. Over the same period, the number of mutual funds and pooled products tracked edged up from 200 to 201. In 1995, $12 billion in assets were found in socially screened funds.

-

Socially and environmentally screened mutual funds have experienced substantial growth in the number and diversity of products and screens offered.

-

With more than $1.5 trillion in assets, socially screened separate accounts managed for individual and institutional clients constituted the bulk of SRI assets tracked in 2005, including $17.3 billion managed for individual clients and another $1.49 trillion under management in institutional client accounts. SRI separate account assets have increased 10-fold from the $150 billion identified in 1995.

-

Mainstream money managers are increasingly incorporating social and environmental factors into their investing.

-

Shareholder resolutions on social and environmental issues increased more than 16 percent from 299 proposals in 2003 to 348 in 2005. Social resolutions reaching a vote rose more than 22 percent, from 145 in 2003 to 177 in 2005. Institutional investors that filed or co-filed resolutions on social or environmental issues controlled $703 billion in assets in 2005, a 57-percent rise over the $448 billion in assets counted in 2003.

-

Assets in community investing institutions rose 40 percent from $14 billion in 2003 to $20 billion in 2005. Community investing assets have nearly quintupled from the $4 billion identified a decade ago

On the other hand a UN report suggest that ESG reporting is not being adopted widely as hoped. The internal 101-page United Nations-commissioned study, focusing on the Global Reporting Initiative, a non-profit agency whose measurement indicators have become standard setters,argues that moves by companies to report on their labour standards and environmental footprints will remain a “niche practice” limited to transnational companies based in industrialised countries. Few small and medium sized enterprises, or companies in emerging markets, are set to join the “sustainability reporting” club, according to the study. The findings may raise questions for companies on the value of such reporting, depicted by corporate social responsibility advocates as central to boosting the accountability and social image of companies. The trend towards nonfinancial reporting for investors and customers has been particularly strong in UK, where 70 of the top 100 companies produce such documents, according to the study. It predicts that by 2020 only 11 % of transnational companies – let alone other businesses – will provide social and environmental data.

SAM Group has completed its annual review of the Dow Jones Sustainability Indexes. The DJSI World Index, which tracks the most sustainable 10% of the 2,500 biggest companies in the world, saw 46 companies added and 36 removed. Meanwhile, 26 firms were added and 16 dropped from the European benchmark index, the 162-member DJSI STOXX. A further 17 companies have been added and 13 removed from the 112-member DJSI North America. Notable companies that have been cut from the DJSI World include Colgate-Palmolive, Motorola and Hitachi. Alexander Barkawi, managing director of SAM Indexes, said "Most of the deletions fell out because their peers have progressed faster than they did."

Governance Matters 2006: Release of Worldwide Governance Indicators reports on the latest update of the worldwide governance indicators, covering 213 countries and territories and measuring six dimensions of governance: voice and accountability political stability and absence of violence, government effectiveness, regulatory quality, rule of law, and control of corruption. The full report and appendices, as well as a booklet, and the user-friendly interactive access to the updated data and graphics is available at: http://www.govindicators.org or, visit directly: http://www.worldbank.org/wbi/governance/govmatters5/.

And

a survey by EIU and KPMG summarises who they believe will be winners and

losers from the introduction of the Markets in Financial Instruments

Directive. This EU legislation championed by McCreevy will

require compliance by November 2007, though states are expected to have

implemented national changes in law by January 2007. The rules aim

to increase cross border competition, increase competition for exchange

business removing national monopolies, and they will raise transparency.

MiFID may miff some suppliers who must reengineer business, but others,

the bigger players, will take advantage to get more market share, and

consumers should benefit.

And

a survey by EIU and KPMG summarises who they believe will be winners and

losers from the introduction of the Markets in Financial Instruments

Directive. This EU legislation championed by McCreevy will

require compliance by November 2007, though states are expected to have

implemented national changes in law by January 2007. The rules aim

to increase cross border competition, increase competition for exchange

business removing national monopolies, and they will raise transparency.

MiFID may miff some suppliers who must reengineer business, but others,

the bigger players, will take advantage to get more market share, and

consumers should benefit.

We were disappointed to hear that four major European banks continue to invest in cluster munitions despite pledging to withdraw, according to a report by Belgium-based nongovernmental organization (NGO) Netwerk Vlaanderen. These banks include AXA, Dexia, Fortis and ING.

Focussing on Asia, ASrIA's latest research includes "ESG Disclosure : A Cat and Mouse Game for Investors". In early 2006, ASrIA undertook a review of IPO documents as a means of assessing critical disclosure and operational trends on ESG issues from a representative cross section of supply chain companies operating in China and listing on the HK stock exchange. The findings indicate that whilst the environment in which these companies operate in is rapidly changing, disclosure is generally at a standstill, both in terms of coverage and content.

Another new report discusses Corporate Governance and Risk Management in Asia. You can find Asian Perspectives on Corporate Governance here. The following story illustrates the life-cycle of corporate governance in Asia's, and now the world's according to purchasing power parity, largest economy.

The Communist Party secretary of Shanghai, Chen Liangyu,

has been dismissed for corruption in an investigation

in China's commercial hub, started to come loose last month as more than

100 investigators arrived from Beijing to probe a government pension funds

scandal. In recent years he has been linked to corruption, but avoided

removal because of protection by political allies. Chen was allied

with former President Jiang Zemin, who still wields residual influence

through political allies in the party's senior nine-member Politburo Standing

Committee, and a political thorn for incumbent Hu Jintao. Before

Chen was sacked for misuse of pension funds, he was also linked to a major

property development corruption case and was often mentioned as a potential

casualty of leadership battles. Having fought off political challenges

for several years, Chen's downfall was fast. Two days after his

last public appearance, Chen's dismissal was widely announced by state

media. His picture, job description and introduction were purged from

the city government Web site. A contrast with how events might transpire

in US or EU.

Shareholder activists have questioned Google's charitable commitment,

Google.org (discussed in Holonics - Living).

They question whether this is an appropriate use of company cash or whether

company founders Sergey Brin and Larry Page ought to make donations to

their favorite causes personally.

Venture Capital

Hedge

funds have become a significant force in the world of finance

and have been the incentive for a number of asset allocators to raise

the portion of alternative investments. What everyone is looking

for is outperformance, beating the market, alpha. Unfortunately

reality dictates that not everyone can win this game, not everyone can

beat the market - only half will. And as every financial advisor

will tell you (in very small words) a manager's past performance

doesn't predict future performance, which is true. Hedge funds are

expensive vehicles, all shooting for the same alpha. The risks are

up, the expected returns have been shaved. Investors often rely

on their gut to invest which tends to underperform tested models, rather

than analysis and formula which works. The market is loosely regulated.

Amaranth (below) illustrates vulnerability to market shocks. AA

Capital (below) illustrates moral hazard and due diligence failures.

Let us hope that there is enough sensitivity built into the big funds'

spreadsheets.

Hedge

funds have become a significant force in the world of finance

and have been the incentive for a number of asset allocators to raise

the portion of alternative investments. What everyone is looking

for is outperformance, beating the market, alpha. Unfortunately

reality dictates that not everyone can win this game, not everyone can

beat the market - only half will. And as every financial advisor

will tell you (in very small words) a manager's past performance

doesn't predict future performance, which is true. Hedge funds are

expensive vehicles, all shooting for the same alpha. The risks are

up, the expected returns have been shaved. Investors often rely

on their gut to invest which tends to underperform tested models, rather

than analysis and formula which works. The market is loosely regulated.

Amaranth (below) illustrates vulnerability to market shocks. AA

Capital (below) illustrates moral hazard and due diligence failures.

Let us hope that there is enough sensitivity built into the big funds'

spreadsheets.

The hedge fund, Amaranth Advisors, made an estimated $1 billion on rising energy prices last year. In September the fund told its investors that it had lost more than $3 billion in the recent downturn in natural gas and that it was working with its lenders and selling its holdings “to protect our investors.” Amaranth’s investors include pension funds, endowments and large financial firms like banks, insurance companies and brokerage firms. The turnabout in the fortunes of the $9.25 billion fund reflects the decline in energy prices recently; natural gas prices fell 12 % in just one week. Amaranth is not the first hedge fund to experience problems in energy markets. MotherRock Energy Fund, a $ 400 million portfolio, shut down last month after losing money on its bets that natural gas prices would fall. Summer heat sent prices soaring and the fund lost 24.6 % in June and 25.5 % in July, according to one investor. The natural gas market is exceptionally volatile, making it an ideal playground for hedge funds that thrive on wide price movements in securities. Natural gas prices are subject to more severe swings than oil, in part because gas cannot be stored easily.

Another failure occurred at AA Capital Partners. Which is alleged had misappropriated at least $10.7 million from its six union pension fund clients. More specifically, the SEC charges that AA Capital used the fraudulent guise of capital call-downs to cover such expenses as private jet rentals, Super Bowl tickets, donations to political candidates and the operations of a Detroit strip club! The sheer extravagance of CEO Orecchio’s Travel & Entertainment expenses is staggering: he spent more than $175,000 on private jets in May 2006, over $67,000 at the Tryst Nightclub in Vegas on February 4, 2006 and more than $75,000 at the Temple at Tao nightclub in Vegas this past New Year’s Eve - that is just the beginning. There is a question as to how a firm of this size had so few financial controls that Orecchio was so easily allowed to divert cash into inappropriate accounts. Signs of irrational exuberance?

Göran Persson, Sweden's prime minister, thrust the role of private equity into the political spotlight when he attacked moves by activist investment funds to force Volvo, the truck maker, to restructure its operations. Cevian Capital, a Swedish fund, and Parvus Asset Management, a UK fund, have acquired 5 % of Volvo and are demanding it pay shareholders billions of dollars in excess cash. "In the long-term, I see Volvo as a large Swedish creator of both economic growth and jobs," Mr Persson said. "These venture capitalists will break the national capital structures into pieces." His comments echo recent criticism by Dutch and German politicians. Franz Munterfering, a leading German Social Democrat, accused private equity funds of behaving like "locusts" in devouring local companies. These attacks are not new and may be defensible, but the industry is going to come under scrutiny as it grows in size and influence and especially if it is seen to cause popular problems.

Ethanol producer Cilion raised $200 million in startup capital (broken into $40m and $160m tranches). The company originally announced its formation as a partnership between Western Milling and Khosla Ventures, and now says that additional backers include Virgin Fuels, Yucaipa Cos. and Advanced Equities.

Carlyle/Riverstone Renewable Energy Infrastructure Fund and Bunge North America have agreed to jointly build ethanol plants that will result in production capacity of several hundred million gallons-per-year by the end of 2008. The plants will be adjacent to U.S. grain facilities controlled by Bunge, while CRREIF will be majority owner of the facilities. No financial terms were disclosed. www.carlyle.com www.riverstonellc.com www.bungenorthamerica.com

Hawkeye Holdings, Iowa-based ethanol producer, has set its proposed IPO terms to around 15.91 million common shares being offered at between $21 and $23 per share. It plans to trade on the NYSE under ticker symbol HWY, with Credit Suisse, Morgan Stanley and Bank of America serving as co-lead underwriters. Thomas H. Lee Partners holds a 79% pre-IPO position. www.hawkrenew.com

Q3 PE-backed IPO activity data are coming in. Buyout-backed offerings bested VC-backed offerings in terms of both volume and total raised (see chart below), but LBO-backed companies were not so fortunate in the aftermarket. The average aftermarket performance for VC-backed IPOs was 22.73%, with all but one company trading above its IPO offering price. This compares to only 1.07% for the buyout-backed group, which had only two companies above IPO offering price (plus one at break-even).

Quarter |

VC-Backed IPOs |

Total Raised |

Q3 2005 |

19 |

$1.46 billion |

Q4 2005 |

17 |

$1.57 billion |

Q1 2006 |

10 |

$540.82 million |

Q2 2006 |

19 |

$2.01 billion |

Q3 2006 |

8 |

$934 million |

|

|

|

Quarter |

Buyout-Backed IPOs |

Total Raised |

Q3 2005 |

23 |

$4.7 billion |

Q4 2005 |

10 |

$1.38 billion |

Q1 2006 |

17 |

$4.37 billion |

Q2 2006 |

17 |

$4.37 billion |

Q3 2006 |

9 |

$2.5 billion |

Interest Rates and Currencies

The US Federal Reserve has kept its key interest rate on hold at 5.25% for the second successive month. Only one member of its committee dissented, voting for a quarter point rate rise. The futures market is pricing in a 30% chance of a rate cut at the January meeting. That means the futures market thinks the economy will be visibly slower in the not too distant future. That contradicts the signal of high stock markets.

The yield on 10 year US treasuries has dropped from 5.24% in June to 4.5% at the end of September resulting in a significant yield curve inversion, which might be a sure harbinger of an economic slowdown. However, with interest rates plateauing and oil price dipping, the stockmarkets are reaching new highs.

We have not discussed money supply, but the signs here are also indicating a slowdown. John Mauldin's newsletter here offers a useful discussion of US and Japanese money supply and the effect it has on economic and stock market levels. John shows why liquidity is tightening and why it will dampen markets.

The downturn in housing may also precipitate a broad asset deflation. And there is always China and other emerging markets which are an increasingly significant global players. If China, and even India or Brazil, suffer badly, even the US will not be insulated.

US economic growth slowed more than expected in the second quarter of 2006, according to the latest revised data from the Commerce department. GDP rose at an annual rate of 2.6% between April and June. The figure is below the 2.9% estimated a month ago and well short of the 5.6% growth reported in the first quarter. Many market watchers expect US growth to hold steady between 2.5% and 3% during the rest of 2006, helping to reduce the upward pressure on prices.

The Fed is also keeping a close eye on inflation, which the Commerce Department's revised figures said had risen at a 2.7% annual rate in the second quarter, down from the original estimate of 2.8%.This core figure, which excludes food and energy costs, is still well above both the central bank's unofficial 2% target and the 2.1% inflation figure recorded for the first three months of 2006. US producer prices rose by just 0.1% in August as the amount spent by businesses on energy moderated after recent sharp price rises. Wholesale energy prices rose just 0.3% in August, following July's 1.3% jump, while gasoline prices fell 2.2%. Separate data published on Tuesday showed a 6% fall in house construction.

Record oil import costs have pushed the US current account deficit to $ 218.4 billion in the second quarter, a 2.4% increase on the previous period. The deficit is the broadest measure of US global trade, including investment flows and trade in goods and services. With world oil prices above $70 a barrel for much of this year, the cost of buying oil pushed import values up 2% to $463.4 billion between April and June. The deficit is equivalent to 6% of total US economic output.

Commodities, both metals and oil, are off peaks and there is serious commentary that they may not return till the cycle completes (see graphic above). Some see a transformation from an oil based economy to an electricity based economy occurring. Others note that commodities are now subject to market whim as well as fundamentals and this has contributed to a rapid rise over the past couple of years.

The Dow touched its highs and is continuing to benefit from falling oil prices and signs that US interest rates may have peaked. Economists are hopeful that consumer spending will remain resilient in the face of a cooling economy. Consumer confidence rose unexpectedly in September, helped by falling petrol prices and more confidence in the job sector. The improvement in sentiment came despite continuing weakness in the housing market, with prices down on last year, and retail sales remaining subdued. This could be another sign of us believing in "the emperor's new clothes" - a slowing economy, but rising stock markets.

So is this the apex of US base rates? It might seem so. In any case our expectation of 5.75% by year end must be reconsidered. Whether or not US rates stay at this level or rise another quarter point or more in the coming 6 months, the global economic picture seems to be leveling off and thus the likelihood of a slowdown looms. This should not be considered to be bad, but simply an environment which needs to be managed. In the coming six months, we expect a peak of markets followed by a tail off to current levels. Economic vitality will be maintained by more stable, albeit modest expectations.

Looking further out, we hope to see a fundamental enhancement of economic data mining to move beyond current measures of activity to include measures of the quality of activity (eg quality of life indicators, social and environment measures. This must happen for two reasons: firstly qualitative indicators deliver more efficient and effective policy decisions encompassing dimensions that people care about, such as community and environmental excellence. Secondly, qualitative measures can be used to serve political incumbents by demonstrating advances in social dimensions that are appreciated by voters, even when GDP measures are flat.

It is not just a deflating housing housing market in the US that is putting pressure on markets. The stock market itself is well leveraged. Private equity activity has fuelled buyouts and buybacks. In the first half of 2006 PE bought $ 300 billion of businesses, much financed with "high-yield debt" costing under 6%. If they do the same in the second half, that total for the year would equate to about 20% of Nasdaq companies or a quarter of those in the FTSE 100. Liquidity has allowed the buying spree. But if liquidity slows or the economy stutters, the repercussions will be uncomfortable. PE managers prepare your portfolios if sensitivity analysis of cash-flow indicates your assets will be squeezed.

The Japanese Yen is at its lowest level (real trade weighted exchange rate) for 20 years and grossly undervalued by important measures. There is little demand for it. But that may change. Although the Japanese carry-trade (borrowing Yen to lend dollars) stopped in March when it looked as though Japanese assets would hold their own, it has started again in the last couple of months because it is expected that Japanese rates will not rise again. Another reason may be that Asian businesses invest profits in European and American assets. Whatever the reason for the Yen's weakness, the likelihood of the Yen revaluing upwards is growing.

UK inflation accelerated to 2.5% in August, the fourth month in a row it has topped the government's 2% target. August's 2.5% CPI figure from the Office for National Statistics was a slight increase on July's 2.4% level. Meanwhile, the headline RPI rate - which includes mortgage interest payments - rose to 3.4% from 3.3%. The latest figures will renew pressure on the Bank of England to raise interest rates. The Bank of England last increased interest rates by a quarter of a percentage point to 4.75% in August. With the Bank's Monetary Policy Committee voting 6-1 to keep rates on hold in August, some analysts now expect a further rise in November.

Trade and FDI

The new head of the US Treasury, Hank Paulson, has taken a more constructive line of negotiation with China, which is likely to be productive. Paulson painted a long-term vision of a mutually beneficial economic and political relationship between the US and China. In calling China a "co-operative partner" in trade talks, for example, he struck a sweeter note than Bush's old label of "strategic competitor". More importantly, it sets the stage for much more constructive dialogue during Paulson's visit to China now.

A World Bank report has said that China and India's growing trade and investment in Africa holds great potential for African economic growth. The study found that, led by China and India, Asia now gets 27% of Africa's exports, triple the amount in 1990. At the same time, Asian exports to Africa are now growing 18% per year, faster than any other global region. The study says both China, India and African nations must improve their trade reforms to help boost this trend. Entitled Africa's Silk Road: China and India's New Economic Front, the report recommends the elimination of China's and India's tariffs on African exports. Written by World Bank Africa Region Economic Advisor Harry Broadman, the study further calls for Africa to reform its economies to better "unleash competitive market forces, strengthen its basic market institutions, and improve governance". It also wants to see African countries improve their infrastructure and customs arrangements. Taken together it said such changes were "not only in the best interests of Africa's economic development, but in China's and India's own economic fortunes". We can expect these trends to continue as China especially, and India, forge relationships with other emerging economies.

The EU's highest court ruled that the European Union's cotton aid regime, drawn up after difficult negotiations in 2004, must be scrapped. The Luxembourg-based European Court of Justice said in a statement that the current cotton subsidy regime could remain in place until a new system is drawn up "within a reasonable delay". Round-the-clock talks at a WTO conference in Hong Kong last December yielded a deal in which the United States and other rich countries agreed to progressively remove subsidies to their cotton producers. A key plank of the deal was that export subsidies for rich countries' cotton industries would be phased out by the end of this year. The accord was part of the WTO's wider Doha Round negotiations which aim to give developing countries a much-needed economic boost by cutting global barriers to commerce. Following the collapse at the end of July of wider WTO talks on reforming global commerce, West African countries that are heavily reliant on the crop for their export earnings warned they may launch their own legal challenge over US cotton subsidies. Brazil on Friday accused the United States of failing to fall fully into line with a World Trade Organisation ruling ordering Washington to remove its contested subsidies for cotton producers. This ruling is a significant setback to the EU's rather limited CAP reform programme and is yet another victory for the protectionist minded southern member states. It is a particularly ironic judgment given that the EU criticised the US for offering too few concessions on its cotton subsidies in the Doha round talks, whilst dismissing criticisms of its own intransigence by insisting that it had already put in place major CAP reforms.

Activities and Media

Autumnal Equinox marked the acceleration of seasonal change. September is busy in the garden for us because many crops are ready to harvest, and the cooler, but humid weather, encourages rot, so we must work hard to harvest and preserve produce. But its tasty work!

September was made interesting by two world class events taking place close to our home base. The K Club hosted the Ryder cup - the golf competition between America and Europe. And in our home town of Tullow the International Ploughing Championships followed the National Championships. We had some interest in the Ploughing because of our commitments in horticulture and land management, and we were lucky to benefit from hospitality business because of the demand for accommodation.

September has also focussed attention on investment strategy and portfolio structure, as you may gather from the relevant sections Investment and Interest Rates. And we think the next two months will be important for the timing of asset allocations.

We will participate in a gathering on Executive Philanthropy in early October and look forward to interesting discussion since the large Buffett allocation. The very interesting Charles Handy, who has studied this area, will lead key discussions. One case study will be the story of PestalozziWorld, with which we have connections.

Pratchett continues to give satisfaction. Maurice and His Educated Rodents is another worthy read showing the double standards that we adopt in order to maintain sanity in our crazy world. And Monstrous Regiment is a layered story of war. It is a natural mirror for current events in the middle east, but also addresses wider human moralities. While I would love to expound on Pratchett's excellence, I'll instead recommend a quick look at the Wikipedia entries for Pratchett and Discworld - both are extensive, detailed and complimentary.

Another biography of Adam Smith has hit the stands.

It is interesting that this is another recent biography of Smith to reveal

that he was driven by ethics not capitalism which was merely a tool of

morality, in contrast to today's propaganda that business and values do

not mix. The Authentic Adam Smith by James Buchanan helps rewrite

modern management. He recommended a market system of industry, as

a democratisation of economy, on the premise that humans live by the golden

rule - "do to others as you want them to do to you". Society would

be good because the millions of choices made by the population would be

guided by "sympathy or fellow-feeling". How far we have strayed

from Smith's ideal.

Please forward this publication to family and friends, print it, and

share it.

This is a publication of: Astraea, Ireland + 353 59 9155037 Subscribe

and Unsubscribe

This report has been prepared for information purposes and is not an offer, or an invitation or solicitation to make an offer to buy or sell any securities. This report has not been made with regard to the specific investment objectives, financial situation or the particular needs of any specific persons who may receive this report. It does not purport to be a complete description of the securities, markets or developments or any other material referred to herein. The information on which this report is based, has been obtained from publicly available sources and private sources which may have vested interests in the material referred to herein. Although GRI Equity and the distributors have no specific reasons for believing such information to be false, neither GRI Equity nor the distributors have independently verified such information and no representation or warranty is given that it is up-to-date, accurate and complete. GRI Equity, associates of GRI Equity, the distributors, and/or their affiliates and/or their directors, officers and employees may from time to time have a position in the securities mentioned in this report and may buy or sell securities described or recommended in this report. GRI Equity, associates of GRI Equity, the distributors, and/or their affiliates may provide investment banking services, or other services, for any company and/or affiliates or subsidiaries of such company whose securities are described or recommended in this report. Neither GRI Equity nor the distributors nor any of their affiliates and/or directors, officers and employees shall in any way be responsible or liable for any losses or damages whatsoever which any person may suffer or incur as a result of acting or otherwise relying upon anything stated or inferred in or omitted from this report.