Entrepreneur and Business Resources

Integral Methods and Technology

Governance and Investor Responsibility

archive

signup

credits

archive

signup

credits

Private and Confidential

October 2006

- Perspective

- Investment, finance & VC * Interest rates and currencies * Trade & FDI

- Activities and Media

The following sections are delivered through Astraea. The links below will take you to those sections.

Perspective

Things look good, don't they. Stock markets are up. Iraq is going to be OK. Other hot spots are being managed. And everyone's happy.

Yet next to this positive thread are intertwined stories of difficulty. Extended credit and stock markets being fuelled by the rising price of risk (see Investment). Iraq and the middle east needs help of a different kind. North Korea is the best reason for removal of all nuclear weapons - they set a precedent for nutters to follow and they are not a deterrent, Dr Strangelove. And some people are beginning to feel the pinch of credit costs. And while these are urgent, they are not the important challenges. The problems that critically must be remedies revolve about the destruction of earth's biosphere and poverty.

A "Stern warning" is the light of hope that humanity is changing fast enough to preserve the biosphere and live peacefully. October saw a number of reports circulating which highlight the need for change, the Stern Review being perhaps the most high level and already underpinning change in UK government policy. Our holonic perspective suggests that despite imbalances, humanity is on an enlightened trajectory, which is fast approaching the tipping point (discussed in September's issue). America is the centre of power, while China and India are the emerging centres of power, together with other emerging economies. America's cultural profile centres on competition and fear, but that is changing as people realise it and strong community values provide the framework for stable reorientation.

Change occurs, do not expect the status quo to continue. The harbinger of change is a regression to former models, which is followed by a rebound to the next level. It appears that the Iraq Occupation has been this regression to primitive values (fight, kill) but that has run a course in a short period and now the trend is to a more cooperative, multilateral cultural profile. America is peaking and will rapidly accelerate through a more integral cultural profile, built on its diverse ethnic DNA. A criticality is occurring. Because it must.

Everything seems to be balanced. Stable and positive. A change in the wrong direction can be too terrible to think about. "Will humans pull together or will we swing apart?" Certainly the choice is there. We do have the ability in body, technology and spirit - even to the extent of the Theory of Everything and the Big Picture. But doing the right thing the right way is not easy - some say more difficult than for a camel to pass through the eye of a needle. Watch the decisions "our leaders" make in the coming weeks. Our propensity to change must accelerate. A simple solution would work. The rich worl can solve the world's problems by consuming 30% less - to take pressure from the biosphere, and by meditating all the time (as people like Dalai Lama do) to bring peace.

October celebrates the birth of world renowned holonic change agents. My favourite is probably John Lennon, perhaps because he had fun as well as committing himself and resources to change the world. But Ghandi must be the role model: while changing the uniform of a lawyer for the cloth of a peasant he liberated a significant proportion of the world's population. Mohandas Karamchand Gandhi was born on 2nd October 1869. Lets remember his unique contribution to global humanity through soft-power: non-violent action, non-cooperation and civil resistance.

Albert Einstein wrote: "Mahatma Gandhi's life achievement stands unique in political history..."

"...He has invented a completely new and humane means for the liberation war of an oppressed country, and practised it with greatest energy and devotion. The moral influence he had on the consciously thinking human being of the entire civilized world will probably be much more lasting than it seems in our time with its overestimation of brutal violent forces. Because lasting will only be the work of such statesmen who wake up and strengthen the moral power of their people through their example and educational works. We may all be happy and grateful that destiny gifted us with such an enlightened contemporary, a role model for the generations to come."

In regard to Mahatma Gandhi and Philanthropy, Einstein wrote:

"I am absolutely convinced that no wealth in the world can help humanity forward, even in the hands of the most devoted worker in this cause. The example of great and pure personages is the only thing that can lead us to find ideas and noble deeds. Money only appeals to selfishness and always irresistibly tempts its owner to abuse it. Can anyone imagine Moses, Jesus or Gandhi with the moneybags of Carnegie?"

Investment, Finance & VC

Discussion of a world slowdown has become louder. Most drastically, though medium term, the Stern Review, issued in October estimates a slowdown of 20% if climate change is not tackled (see Climate Change). While we have raised the spectre of global risks, whether economic, social or natural, it is less and less likely that a breakdown will occur because of the interdependence of our globalised humanity. Emerging economies, especially China, India and Asia, even eastern Europe, are currently supporting the global economy, by producing and consuming much of global growth. The Economist highlights the importance of US financial infrastructure to global trade and wealth (in the article the Alternative Engine) which is true, and America likes it that way, but the influence of the US$ is declining as the Euro and Yuan become more important and oil trade diversifies to non-US$ currencies. The general integration of humanity gives stability, but the excesses must be counted. Measures of wealth are being refined to measures of well-being. Fundamental changes in culture are ongoing which will help stabilise economic volatility.

Some have suggested that the market might correct, that current exuberance is a sucker's rally. And if the market does correct, 30% down would be a fair bet. But I don't think that is how the market should be approached, even if that is the best bet. It seems that while the risk of down is higher than the chance of up, selection can help preserve value. While the market is buying risk (and it seems to be), you buy value. Look to Asia too where fundamentals are sound. And if currency exposure is an issue for your portfolio, hedge because the pressures on currency volatility are high.

There has been growing evidence of a shift in global business power, with foreign investment from developing countries now a major factor in the world economy. In its latest report, the United Nations Conference on Trade and Development has confirmed the trend that has prompted speculation of billion dollar takeovers in Europe by firms including Indian steelmaker Tata. According to Unctad, foreign direct investment from developing countries and transition economies, such as Russia and the former Soviet Union, rose 5% to $ 133 billion in 2005 - with more and more firms in developing nations investing overseas. Foreign investment is also flowing into developing countries, with $335 billion - about one-third of the total - moving into poorer nations, far more than is provided by official aid flows. Unctad estimates that investment to developing countries has nearly doubled in two years, from $ 175 billion in 2003. The boom is being fed by rapid economic growth, especially in China and India, high prices for raw materials, and the increasing liberalisation of the economy in many developing countries, which has made investment easier, it said. These assets are highly concentrated, with just a few third world countries and a few companies owning a large percentage of these assets. China accounts for one-third of the total. Off-shore financial centres like the British Virgin Islands and Singapore are also important investors. And there has been a sharp rise in overseas investment by countries rich in natural resources, such as Russia and South Africa. The overall pattern over the past decade has been the rise of Asia as a source of investment, overtaking Latin America, which has suffered a series of economic crises, and Africa is growing in importance. In terms of proportion of investment, 28% of its FDI comes from developing countries, twice the world average. Africa still represented only 3% of the world total of foreign direct investment. This uneven development of the world's economies is destabilising, so the new trends are encouraging as rich countries face a shrinking share of global growth, trade and investment, while the rising economic power of Asia is now the central fact in the world economy.

China's soaring economic growth rate slowed slightly to 10.4% in the three months to September, as government attempts to cool the boom took effect. The year-on-year growth rate fell back from the record 11.3% growth seen from April to June. The government has raised interest rates twice this year and cut approvals for new business investment as it tries to prevent the economy overheating. The economy is generally robust as the latest data put inflation at 1.3% and showed industrial output slowing.

The Industrial and Commercial Bank of China held its long-awaited initial public offering, which was the largest one ever, raising $ 19 billion. The shares are listed separately in Hong Kong and China and can not be arbitraged because of differing ownership requirements. The sale was heavily oversubscribed as investors tried to tap into one of the world's fastest growing economies. The IPO followed period of restructuring and recapitalisation during which non-performing loans were reduced from around 20% to around 5% and Goldman Sachs and others injected new capital. China has been overhauling its banking system, toughening up regulation in an effort to cut corruption and bad loans, including the government buying back billions of dollars of bad loans to help banks clean up their balance sheets and make them more attractive to investors.Analysts said the potential for growth of consumer and corporate lending in China was massive as wage levels increase and company profits rise. Industrial and Commercial Bank of China was set up by the Chinese government in 1984 and has 21,000 branches, 360,000 staff and 150 million customers. ICBC said it expected to earn a net profit of $6billion this year, compared with $4.3billion in 2005. Its shares rose more than 17% in Hong Kong, but only a few % in Shanghai. It remains to be seen whether the assets of ICBC are fairly valued.

The study, Climate Change and Insurance: An Agenda for Action in the United States, was issued by Allianz Group, one of the largest insurance providers in the world with operations throughout the U.S., and World Wildlife Fund (WWF), a leading conservation organization. The report, the first of its kind in the US but not elsewhere, examines the latest scientific findings about climate change, specifically on forest fires, storms and floods, and the potential impact on the insurance industry and its customers. It concludes that the insurance industry should do more to address the growing impact of climate change-induced damages. The report notes that climate change has the potential to significantly alter and intensify destructive weather patterns in the US, leading to increased flooding, forest fires, and storm damage. The most direct risk to the US will likely come from hurricanes, which are expected to become more frequent and powerful. The report makes a number of recommondations, including for both governments and insurance companies to help correct market distortions, for US insurers to begin incorporating future potential climate change impacts such as continued sea level rise and longer fire seasons into planning (rather than relying only on historical data of past weather events), and for insurers to influence land use development and planning in high risk areas.

France is becoming an interesting investment target for us. Its unfamiliar mix of engineering excellence and traditional communities has not seemed to produce the same wealth effect that other EU economies have enjoyed. But that may be changing. Certainly a shake up in politics is beckoning change. The Economist survey of France in October also paints a more positive picture. While the track record has not been great we are begining to look at France more carefully and wonder if it might be time for it to shine in a "kinder, gentler" world.

Morgan Stanley says it plans to invest in approximately $3 billion of carbon/emissions credits, projects and other initiatives related to greenhouse gas emissions reduction over the next five years.

During US election season, Blue Funds is launching two funds to invest in companies that support Democrats. The two new funds seek to capitalize on research that finds that Democrat-supporting companies significantly outperform Republican-supporting companies.

Responsible Investing

Research from Flag - a communications consultancy – showed a growing proportion of investors now base their decision to buy on a corporation's "green strategies". Share buyers are increasingly concerned that the companies they invest in are pursuing sound environmental policies. In a telephone poll 36% of investors answered yes to the question “Do a company’s environmental policies have any effect on your decision to buy its shares?” The ethical investment market has flourished in recent years but the poll suggests that mainstream investors now demand environmental awareness from all companies. Rob Cameron, Director of Flag, said: “This research shows there is increasing awareness among investors, and society in general, of the importance of corporate environmental policies and actions. Only eight years ago investors’ awareness of these issues was very limited and had little effect on stock purchase decisions."51% of investors replied that it had no effect on their share purchase decision and the remaining 14 % gave no indication either way. There is still time to place green bets as the wave of eco-awareness rises.

The 2006 European SRI Study shows an SRI market that has considerably changed since 2003 - the European Broad SRI market is now valued at over €1 trillion. Across Europe, are signs of robust SRI strategies, increased mandates from institutional players and the growing involvement of more traditional financial services. SRI has been actively promoted in European countries and the latest survey released by the European Social Investment Forum says SRI is up 71% since 2002 and possibly represents as much as 10-15% of the total European funds under management.

Although up to 70%of people surveyed by fund managers say they would invest all or part of their superannuation in SRI if they had the option and if they knew more about it, less than 1% of global funds under management are directed towards SRI or ethical funds. According to the latest benchmarking study commissioned by the Australian-based Ethical Investment Association, the SRI funds' market share in Australia is about 1.54 percent, up from about 1.34 per cent a year earlier. The study estimated the SRI mutual funds market in United States to be about 2%, and in Canada, about 3.5% of the total.

Mercer Investment Consulting last year released a global study on the speed with which SRI and ethical investment was becoming mainstream. The results varied from region to region but among Australian and Asian managers, 85% predicted that all three SRI related practices would become mainstream within 10 years. Mercer asked 195 investment managers worldwide, representing more than $30 trillion in assets, whether SRI practices would become common components of mainstream investment processes in the short and long term. The three SRI related practices are: active shareholding which includes share voting and engagement; positive and negative screening; and, the incorporation of social and environmental factors into corporate performance, usually known as triple bottom line accounting.

In October, the news of a deteriorating biosphere was not good, especially with the Stern Review and Up in Smoke 2 (see Climate Change). BusinessWeek underlined the risk we highlighted last month that litigation against polluters, as being pursued by California against carmakers, is becoming a significant force for change among car, oil and utility companies.

The United Nations Global Compact woke members up by announcing that it de-listed 335 companies for failing to issue a Communication on Progress (COP) report. The Global Compact is a voluntary initiative whereby businesses pledge to uphold ten principles in the areas of human rights, labor, the environment, and anti-corruption. Companies failing to issue COPs are first listed as " non-communicating" upon missing the first annual deadline for releasing COPs, then as " inactive" when they miss the second consecutive annual deadline, resulting in the de-listing. The main reasons for not reporting are: small company size makes it difficult to administer, and a company's quick sign-up discounted requirement to actually do something later. In the wake of announcing the de-listing of 335 companies, the Global Compact also announced new alliances to facilitate Communication on Progress (COP) reporting. At the unveiling of the third generation sustainable reporting guidelines (dubbed G3) by the Global Reporting Initiative, the Global Compact announced its alliance with GRI by releasing a guide on how to use G3 in preparing a COP. The Global Compact has also allied with SRI World Group to launch the OneReport COP Publisher, a free web-based tool for generating COPs.

Also, FTSE4Good announced the addition of 24 companies and the deletion of 9from its global socially responsible investing index series resulting from its semi-annual review. Deletions included Enel for acquiring a nuclear power producer, Hasbro for falling short on supply chain labor standards, and Harley-Davidson and six others for failing to meet environmental criteria.

A coalition of 14 major institutional investors and other organizations that represent trillions of dollars in combined assets published a climate risk-disclosure framework to help companies determine what information they should provide to investors on the financial risks posed by global warming. The so-called Global Framework for Climate Risk Disclosure framework is divided into four key areas: measurement of current and projected greenhouse gas emissions from operations and products; strategic analysis of climate risk and carbon emissions management; assessment of the physical risks of climate change; and risk analysis related to emerging greenhouse gas regulations in the United States and other countries. Among the groups that created the framework are the Carbon Disclosure Project, Investor Network on Climate Risk, Ceres and Global Reporting Initiative. Institutional investors that have endorsed the framework, including CalPERS and California State Teachers' Retirement System, say they will use the document to press companies to use existing sustainability reporting mechanisms, such the Carbon Disclosure Project, a greenhouse gas emissions questionnaire sent to more than 2,100 global companies this year. The investors said they also plan to distribute the framework to securities regulators and investors, as well as companies that have not responded to past investor requests for environmental information.

Among ethical investors, conscious consumers and the "enlightened", there is much misunderstanding about capitalism. One of the main areas of contention, though not as misunderstood, is the "company". The legal entity "company" does have some inhuman characteristics which may need to be addressed, such as its ability to be undying. However, the idea that a company is inherently evil is misconstrued - a company is only as good or evil as the people who run it. Collective organisations, whether family, partnership, tribe or comapny, are in fact a very beneficial concept because they allow for the more efficient use of resources in achieving a given output (at the simplest level economies of scale and scope). Our readers generally agree with this perspective, but linked here is an enlightening article on companies from The Ecologist. A history of the Company: Licensed to Loot concludes that making companies responsible for their actions is essential to prevent them exploiting both people and the planet. The only refinement we would make is that it is the people behind the companies that must take responsibility - it is futile and foolish to blame wrong on metaphysical ideas (like company and money) rather than the people that wield them. It is like blaming death on the gun rather than the shooter.

Without wishing to cut-off my own hand, the following comment on financial advisors is worth reading:

| "But My Financial Advisor..." would not be working for a living if he were so great at investing his own money. His objective is to

If you have any delusions that your best interests are being protected by any organization, please jump to the Shareholder Activism page now and check out the reality. The professional bodies governing the advisors were also contacted (but not on the list). They also refused to advise their members of the initiative. |

Surf here to see/hear one of our heroes, Iqbal Quadir, explain the triple impact of bringing cell phone service to rural areas.

Venture Capital

Deftly linking from responsible investing to private investing the late September disintegration of hedge fund Amaranth was precipitated by other players who, aware of Amaranth's big bets, invested to benefit from their positions and forced trading position. Talk about barbarians at the gate. But a colourful story for hedge investors. Fortunately, while it's no solace to Amaranth investors, the fallout of this fund, unlike the 1998 Long-Term Capital Management debacle, has been fairly well contained. Even though Amaranth was bigger in dollar terms, banks' exposures to LTCM were more concentrated and faster liquidation was allowed.

The topic of VC returns started to be scrutiniesed in October as both VCs and LPs start to mine the data on performance over the recent few years. The conclusion that is drawn by those brave enough to state it is that the 10 year rolling returns have declined. Some commentators suggest that they are at modest levels (10-15%). And more worrying is the expected trajectory of returns: there is downward pressure because of the overhang, which was prominently discussed a year ago and continues. While there is no doubt in our minds that the best returns are to be found in VC, the lessons from the dot com boom still apply: choose carfeully, don't overpay, or underestimate risk.

Reflecting on this, Sevin Rosen Funds has indefinitely postponed fundraising for its tenth fund. SRF argued that the exit environment for VC-backed companies has fundamentally changed for the worse. Part of the blame is that VC-backed IPOs have been hindered by SOX-required separations between investment bankers and analysts and impatient hedge funds becoming larger IPO buyers than more patient mutual funds. Head of SRF, Steve Dow, also does not believe that the M&A market can adequately make up for IPO market failures, because VCs have created a buyer’s market by over-funding just about every sector. Of course there are homeruns, but a surprisingly high number of M&A deals actually are $1 dispositions that don’t get included in the quarterly “disclosed value” data. And, without a viable exit market, VCs are setting themselves up for a second-straight decade of cash-on-cash losses (which could begin in 2008). SRF doesn’t want to be a party to that.

Hedge funds as expected are looking less attractive as the rush of cash-in has forced an evaporation of alpha. Returns for many hedge funds, which are supposed to be market beaters, have paled in comparison with stocks. Hedge Fund Research's weighted composite index is up 7.23% through September, compared with Standard & Poor's 500-stock index, which, with dividends, has total total return of 8.5% over same period; many of big-name debuts of 2004, 2005 and even 2006 have produced lackluster results.

Also, the scrutiny of fiduciaries continues as the US Justice Department has launched an inquiry into anticompetitive practices among private equity firms. WSJ says that firms like KKR and Silver Lake Partners have received letters that “asked for a range of information and documents related to deals and business practices.” The DOJ investigation so far looks like a fishing expedition, as the letters do not allege any wrongdoing ror do they even disclose the probe's subject (if any). But somethhing will turn up. Even BusinessWeek covered the private equity industry, accusing it of flipping deals and raising fees to line the pockets of advisors and GPs. Its worth a browse to help raise awareness. The picture painted suggests that the demand for regulation may increase if the trend continues.

A report, commissioned by the European Energy Venture Fair, looked at a sample of 57 companies, who have attracted funding from 19 VC investors since 1999. VCs investing in clean technology firms in Europe have made an average annual return of 86.7% on their investments since 1999. The companies received €130.8 million in funding from venture capitalists and a further €449 million in follow-on funding from public stock markets. So far, five of the 57 companies have completed an initial public offering, and three have been sold to a trade buyer, with these deals making an average annualised return of 476% for their investors. Nine more of the companies included in the study had undergone a second round of VC investment, generating an average annual return of 14.9% on paper. Of the rest of the sample, six firms had been liquidated, losing most of the money invested, and 34 had not undergone any significant further rounds of investment. These were valued by New Energy Finance, the London-based information provider which carried out the study, at the same level as at the initial investment.

Cleantech investing in North America hit a record $933 million in Q3 2006 investment, according to the Cleantech Venture Network. It was the 9 th consecutive quarter of growth. Clean energy investments were the favorite among investors, raking in $837 million in investments in Q3, a 41% increase over Q2.

Venture capitalists invested $6.2 billion in 797 deals in Q3 of 2006, a decrease of 8% from Q2, according to the MoneyTree Report by PricewaterhouseCoopers and the National Venture Capital Association, based on data by Thomson Financial. The quarter saw increased investment in seed and early stage deals as well as sectors such as telecom, media and entertainment and industrial and energy. First time financings were also strong. The same target survey by VentureOne and Ernst & Young is in line with MoneyTree, saying that VCs disbursed $6.36 billion into 611 deals in Q3 2006. Fundraising also declined according to the survey.

Thomson Financial and the NVCA also released their latest private equity performance numbers available at the NVCA website. Thomson Financials' US Private Equity Performance Index (PEPI) Investment Horizon Performance through 06/30/2006:

| FundType |

1Yr |

3Yr |

5Yr |

10Yr |

20Yr |

| Early/SeedVC |

11.20 |

5.40 |

-7.60 |

36.90 |

20.50 |

| BalancedVC |

20.50 |

12.50 |

-0.20 |

17.00 |

14.50 |

| LaterStageVC |

16.40 |

9.40 |

-1.10 |

9.50 |

13.70 |

| AllVenture |

16.20 |

9.00 |

-3.50 |

20.80 |

16.50 |

| SmallBuyouts |

12.10 |

9.60 |

3.70 |

7.10 |

25.90 |

| MedBuyouts |

21.50 |

11.80 |

5.00 |

11.10 |

16.10 |

| LargeBuyouts |

26.80 |

15.80 |

6.30 |

8.60 |

12.50 |

| MegaBuyouts |

28.50 |

17.50 |

7.20 |

8.90 |

11.60 |

| AllBuyouts |

27.30 |

16.30 |

6.60 |

8.90 |

13.40 |

| Mezzanine |

9.70 |

5.30 |

2.60 |

6.20 |

8.70 |

| AllPrivateEquity |

22.50 |

13.40 |

3.60 |

11.40 |

14.20 |

| NASDAQ |

5.6 |

10.2 |

0.0 |

6.2 |

11.7 |

| S&P500 |

6.6 |

9.2 |

0.7 |

6.6 |

9.79 |

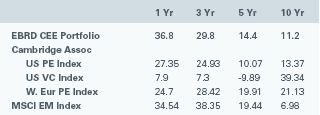

Another comparison of PE Returns by Cambridge, Associates LLC Proprietary Database, EBRD Proprietary Database, Morgan Stanley Capital International also shows unexciting long term performance, generally less attractive than emerging market listed investment returns. (Calculated for returns in US$)

The buyouts market is expected to record its third-straight year of record-breaking deal volume, according to Q3 numbers released this week by Buyouts Magazine. The first three quarters of 2006 saw U.S. firms participate in a total of 770 control-stake deals valued at $181 billion in disclosed value (including leverage), compared to $198 billion for 840 such deals in all of 2005. In addition, Buyouts reports that there is approximately $150 billion worth of agreed-upon deals that will close either this quarter or in Q1 2007.

CalPERS has updated its private equity fund performance data, which now goes through June 30, 2006.

Primafuel Inc., a Long Beach, Calif.-based developer of alternative energy sources, has raised nearly $6 million in Series A funding, according to a regulatory filing.

EnerWorks Inc., an Ontario-based provider of solar-powered hot water appliances, has raised Cnd$3.65 million in VC funding from Chrysalix Energy Management and Investco Capital.

China Venture Capital Yearbook 2006 Order Sheet (Download here or here)

Paul Graham offers a thought provoking primer on the 18 Mistakes That Kill Startups.

Interest Rates and Currencies

The US economy grew only 1.6% in the third quarter,

the lowest since early 2003. Growth slowed from a 5.6% pace in the first

quarter and 2.6% in the second. However, vigorous consumer spending

continues, even as the housing market continues to falter. Consumer

spending grew 3.1% in the third quarter - nearly twice as fast

as overall economic growth. In line with this, US consumer prices fell 0.5% last month, their

sharpest decline in nearly a year, in an apparent signal that inflationary

pressures are easing. The decline, due mainly to a sharp fall in

gasoline prices, was the first since December and was larger than expected.

Excluding food and energy costs, core prices rose 0.2%, the third month

in a row of moderate increases. Against this background, base

rates were maintained by the 11-member interest rate setting body

with only one person voting instead for a quarter point rise. Rates

may have peaked, however, the signs are still ambiguous - in October five

Fed rate setters have stated that further rate increases might be necessary.

This

essay by Jeffrey Lacker the Fed member who voted for a rise in rates

is worth reading.

The US economy grew only 1.6% in the third quarter,

the lowest since early 2003. Growth slowed from a 5.6% pace in the first

quarter and 2.6% in the second. However, vigorous consumer spending

continues, even as the housing market continues to falter. Consumer

spending grew 3.1% in the third quarter - nearly twice as fast

as overall economic growth. In line with this, US consumer prices fell 0.5% last month, their

sharpest decline in nearly a year, in an apparent signal that inflationary

pressures are easing. The decline, due mainly to a sharp fall in

gasoline prices, was the first since December and was larger than expected.

Excluding food and energy costs, core prices rose 0.2%, the third month

in a row of moderate increases. Against this background, base

rates were maintained by the 11-member interest rate setting body

with only one person voting instead for a quarter point rise. Rates

may have peaked, however, the signs are still ambiguous - in October five

Fed rate setters have stated that further rate increases might be necessary.

This

essay by Jeffrey Lacker the Fed member who voted for a rise in rates

is worth reading.

EU rates rose a quarter point to 3.25% in early October, as zone performance improves. Further increases may be expected, although as US performance deteriorates enough to affect EU, that might change.

UK retail sales posted a surprise drop in September, with experts blaming an increase in utility prices, less discounting and higher interest rates. The Office for National Statistics said sales fell 0.4% from the previous month, though many analysts had expected that sales would increase. September's figures bring the annual rate of increase to 3.2%. The ONS said the biggest cause of the slowdown was weaker demand at household goods stores and non-store retailers, where sales fell by 2.3% and 4.7%. Sales at non-specialised stores and clothing stores also fell. One bright spot was an increase in demand at food stores, where sales increased by 0.8%.

In fact, food futures are

spiking and our conjecture that food prices will rise in the last quarter 2006

seems to be occurring, albeit from supply problems rather than energy

costs. Wheat prices continued to rise as a drought in Australia,

the third-biggest producer of the grain, showed little sign of easing.

With low stockpiles in America, analysts are expecting an upward tick

in the price of foods such as bread, breakfast cereals and pasta.

In fact, food futures are

spiking and our conjecture that food prices will rise in the last quarter 2006

seems to be occurring, albeit from supply problems rather than energy

costs. Wheat prices continued to rise as a drought in Australia,

the third-biggest producer of the grain, showed little sign of easing.

With low stockpiles in America, analysts are expecting an upward tick

in the price of foods such as bread, breakfast cereals and pasta.

Trade and FDI

Unfortunately, but as expected, the WTO ruled against the EU protecting its markets from GMO on biological saftey grounds. This is very sad. If you disagree, please watch the Future of Food now.

Friends of the Earth called for alternative ways to deal with environmental trade disputes as the World Trade Organisation published its final ruling on the transatlantic trade dispute on genetically modified foods (the longest in WTO history). The WTO ruling will be substantially the same as the 'draft ruling', which we reported in February. The draft ruling rejected most of the US-led complaints: It refused to rule against strict EU regulations to control the use of GM food and crops; it refused to rule on whether GM foods are safe or different to conventional foods; and it rejected US claims that moratoria are illegal and did not question the right of countries to ban GM foods or crops. Sonja Meister, Trade Campaigner at Friends of the Earth Europe said, "This ruling shows that the WTO is the wrong forum to deal with environmental trade disputes and the international community must find an alternative before another case occurs. The WTO ignored international environmental laws, met in secret behind closed doors and barred any public involvement, even though we have a strong public resistance against GMOs in Europe." The Biosafety Protocol is one international agreement that was ignored by the WTO in the biotechnology trade dispute. It allows nations to use a precautionary approach, giving them the right to ban GMOs if there are concerns about their impacts on health and the environment. The resistance to GM food in Europe is greater than ever. The number of European regions and provinces now declaring themselves GM Free zones, or publicly wishing to restrict GM crops, has climbed to 174 in the EU alone. Over 4,500 local governments and smaller areas in Europe are similarly calling for restrictions to commercial growing. There are GM-free initiatives virtually in every European country.

Thailand, as the world's leading rice-exporter, has reaped a windfall as orders for non-GM rice have kept rising over the past several months. "We've got more orders from Europe to replace those which would otherwise have gone to the US," said Wanlop Pitchyapongsa of Capital Rice, a major exporter. He also said that this shows that Thailand's strength lies in non-GM rice, which should be maintained as the chief selling point. Thanakorn Jitratangbunya of Chia Meng Group, another big player, said the risk of experimenting with GM rice was high and it should not be allowed in Thailand.

As Africa's profile rises - see ADI by World Bank mentioned in Geopolitics and note the Africa-China summit coming in early November - following here are links to recent interviews by Big Picture TV with Mohau Pheko, Coordinator of the African Gender and Trade Network. Based in South Africa, GENTA delivers economic and social research to parliamentarians, women's organizations and civil servants. The short clips cover Trade Distortion (agricultural subsidies encouraging dumping in world markets which puts African farmers out of business), Food Security (the role of women in preserving seed technology and biodiversity), and Trade and Development (on why Doha failed), and Trade Injustice (subsidies supporting big business at the expense of communities and local farming - as seen in the EU subsidy review in our November 2005 issue).

Activities and Media

The gathering on executive philanthropy held on 10 October brought a valuable connection between business and philanthropy, relevant both to organisations' CSR and individuals wanting to build philanthropic enterprise. For inspiration read Handy's The New Philanthropists which he presented.

Carpet company Interface, Inc. has launched InterfaceRAISE, a corporate consulting resource that will amplify Interface's efforts to educate others seeking to implement the necessary steps for becoming sustainable.

Changemakers.org has quite an extensive library on many development subjects from microenterprise to equality.

“When the Levees Broke: A Requiem in Four Acts” the powerful HBO documentary about the federally bungled disaster in the Gulf states in August and September 2005 is now on DVD and an extended 6 hours version .

We heard about the following award whose subject we applaud. The Prize,

for USD 20,000 will be awarded for a written paper on the subject of "Innovative

Ideas for Ethics in Finance". All the details are on the website - please

take a look at it: http://www.robincosgroveprize.org

Please forward this publication to family and friends, print it, and

share it.

This is a publication of: Astraea, Ireland + 353 59 9155037 Subscribe

and Unsubscribe

This report has been prepared for information purposes and is not an offer, or an invitation or solicitation to make an offer to buy or sell any securities. This report has not been made with regard to the specific investment objectives, financial situation or the particular needs of any specific persons who may receive this report. It does not purport to be a complete description of the securities, markets or developments or any other material referred to herein. The information on which this report is based, has been obtained from publicly available sources and private sources which may have vested interests in the material referred to herein. Although GRI Equity and the distributors have no specific reasons for believing such information to be false, neither GRI Equity nor the distributors have independently verified such information and no representation or warranty is given that it is up-to-date, accurate and complete. GRI Equity, associates of GRI Equity, the distributors, and/or their affiliates and/or their directors, officers and employees may from time to time have a position in the securities mentioned in this report and may buy or sell securities described or recommended in this report. GRI Equity, associates of GRI Equity, the distributors, and/or their affiliates may provide investment banking services, or other services, for any company and/or affiliates or subsidiaries of such company whose securities are described or recommended in this report. Neither GRI Equity nor the distributors nor any of their affiliates and/or directors, officers and employees shall in any way be responsible or liable for any losses or damages whatsoever which any person may suffer or incur as a result of acting or otherwise relying upon anything stated or inferred in or omitted from this report.