Entrepreneur and Business Resources

Integral Methods and Technology

Governance and Investor Responsibility

archive

signup

credits

archive

signup

credits

Private and Confidential

January 2007

- Perspective

- Investment, finance & VC * Interest rates and currencies * Trade & FDI

- Activities and Media

The following sections are delivered through Astraea. The links below will take you to those sections.

Perspective

Admit that the waters around you have grown

And accept it that soon you'll be drenched to the bone

Then you better start swimmin' or you'll sink like a stone

For the times they are a-changin'

see Dillon on video (1964) here

As humans we have to tell ourselves stories, otherwise we would go mad. Our mind must filter billions of impulses to create a sane picture of the world we live in, even if it is not always accurate. The sun doesn't rise, though we say it does, rather the earth spins. The earth is not the centre of the universe, though its difficult to think otherwise. If we did not tell ourselves stories how could we face ourselves? We could not.

Today we are faced with the fact that our behaviour (as a species) is suicidal. We have already consumed so much of nature, so quickly, that since 2 or 3 generations we now can see the dying planet and know that in 2 or 3 generations it will be dead. Whether your code of consumption is X or Y, the results are bad, for the planet. Our behaviour must change. As our truth changes, so must our stories. And our old stories must have a new meaning.

It doesn't matter who our leaders are. It doesn't matter who our bosses are. We can write or speak or shout at our politicians and managers of big business - all people that wield influence over our communities and world - but that will not change our lives, much. For that to happen, we must be the change we want to see.

But that is not a prospect we relish, oh no! The change we wish for is to keep the pleasures and privileges that we enjoy, or maybe even get a few more, but solve the problems of the world. When the problems of the world are terrorism, it's actually easy to do little more than condemn it and complain of the accidental danger to life. But when the problem is a boiling planet, which is caused directly by the consumption habits of us and those of the last few generations, it is hard to claim innocence while jetting the world, speeding in your sedan or pouring poison down the drain or on to plants. And we all do it. How else do get strawberries in winter from the tropics.? How else do we pay a dollar for a loaf of bread? Make it yourself and you'll spend an hour of labour before you grind the wheat, thanks to technology (which is free) and energy (which is not)*.

Enjoy an unspoilt countryside, beautiful views, beaches, woods and rolling hills, while you can. Check out beautiful blue from space.

And while we seek a way out of the labyrinth of challenges (climate change, biodiversity loss, slavery and terrorism, poverty ...) there is a massive premium on time - we have little time to change. Our priorities must change. We must want a world for people, instead of capital; a world for community not business. This is not utopia (yet), this is survival. And the rich (you and us!) must lead the change.

(* Technology exists outside of space-time. Energy-matter coexists with space-time.)

Investment, Finance & VC

Many of you will have seen forecasts from your favourite broker, advisor, pundit or paper. They have their uses, but the following saying reminds us to keep perspective on forecasts and remember the due diligence: In golf, you drive for show and you putt for dough. Forecasts are for show.

Sustainability was launched to the top of the agenda at the World Economic Forum currently under way in Davos, Switzerland. This shift in consciousness of the global business community has raised the relevance of the Global 100 Most Sustainable Companies, the 2007 list here, announced at the WEF for the third year. "The relationship between economics and environmental issues, particularly climate change, are hot this year in Davos," said a sponsor of the G100 list. Compared to the minimal fanfare of the G100's inaugural launch, this year's unveiling of the list was trumpeted in a BusinessWeek cover story and heralded at a launch event by speakers ranging from Nobel laureate Joseph Stiglitz to executives from Goldman Sachs and Swiss Re. The G100 includes only companies that receive "AAA" ratings (on a bond-like scale ranging from "AAA" to "C") on environmental, social, and governance (ESG) performance from Innovest. Furthermore, the G100 includes companies according to their sector weighting in the MSCI World.

SAM Group and PricewaterhouseCoopers launched the Sustainability Yearbook 2007 at the World Economic Forum.

Several months ago a professor at the University of North Carolina published research that turned beliefs about the economy upside down. Health improves, he said, as the economy shrinks. And as the economy declines, deaths, smoking, obesity, heavy drinking, heart disease and some kinds of back problems all decline as well. We have known for some time the problems of GDP and encourage the use of wider measures , like Quality of Life Indicators used by some governments. Click here to read why measuring events in terms of GDP is simply worshipping a false idol ...

The risk from demands by labour for an increasing share of output is likely to affect the global investment environment this year. The potential for labour to demand more of the pie is growing and will put pressure on capital returns. This issue, well outlined by Stephen Roach and reported last month, is now being discussed more widely. As the majority of populations in developed economies see a few super rich hoarding the majority of gains in the economy, they will demand a fairer share of the pie, and their votes will be the tool to help effect this. Investors are optimistic, but should be cautious that US housing, consumer credit and unhappy labour don't change the outlook in the coming months.

Two important questions have been regularly addressed by ourselves and other analysts during the past year: Is the global economy dependent on the US economy? Is the US economy dependent on a low impact from housing market depression? While the US economy inevitably affects the world, the global economy is not dependent on the US in the same way that China and India are driving growth and change. (This does not exclude the dire consequences of a collapse in financial systems whose risk is raised by imbalances and inequity in global markets.) As to the US market itself, the impact of housing may be stretched out, but there are a number of fundamentally extreme balances which are potential catalysts themselves. And while US markets have been buoyant and a number of respected pundits are talking them up, a small article on inside selling caught our eye. Market Profile Theorum believes that there has been significantly more selling than usual by insiders of businesses exposed to credit markets. It would support the general concerns about consumer credit and suggests reviewing exposure to this risk.

Sam Zell offered a big picture review via a brilliant online video Capital Keeps Falling on My Head to the tune of Raindrops Keeps Falling on My Head. As you might guess he supports the thesis that excess liquidity must put pressure on asset prices which will put pressure on markets. Enjoy!

And John Hussman also gives a warning in his article Hazardous Ovoboby, in which he reckons the US market is overvalued, overbought and overbullish and notes that historically when this happens the stock market declines, usually quite quickly. Quoting: "Reviewing the foregoing instances carefully, one of the striking features that emerges is the abruptness of the declines. -10.5% in 30 days, -12.3% in 50 days, -36.1% in 38 days, and so forth. The first several days of decline from a market peak has often erased weeks and sometimes months of prior net gains. It's that tendency for abrupt declines from overvalued, overbought, overbullish conditions that has held us to a defensive position despite market action that otherwise looks "good" and has repeatedly produced marginal new highs."

And if you're still over-optimistic here are a couple of Foolish articles: Get Ready for a 25% Drop and Is Your Portfolio Ready for a 50% Loss?

China announced at the beginning of the year that it requires 1,200 companies listed on Shanghai and Shenzhen exchanges to adopt accounting standards similar to IFRS. While this will be difficult and time consuming, and will need to be partially fudged initially, it is a signal that the development of market infrastructure and modern standards is at a point that the government can make such a demand, knowing that it will reveal scary skeletons in the closet.

Similarly on the tech industry front, while we are used to eye popping market statistics in more basic industries like the number of mobile phone users (440 million) or the proportion of world cement it consumes (40%), now it seems China will change in to high gear on tech development. This is to be expected and China has been preparing for it for over a decade and can use Hong Kong as its role model. In 1992 I helped start Hong Kong's first technology incubator (HKITC) to nurture local high tech and we immediately had ties to the sister infrastructure in China - government, industrial and academic. You can be sure that their efforts to nurture innovation will succeed. While a report by McKinsey estimates that only 10% of the engineering graduates of Chinese universities have the practical and language skills needed to work for a multinational company, the rest being “stuffed ducks” who are good at memorising facts and passing exams but have little initiative, one-quarter of foreign PhD candidates in the US are Chinese and a growing number of them are heading back home: Beijing says 170,000 Chinese who studied abroad have returned, 30,000 of them last year.

In India recent data shows that industrial production grew at its fastest annual rate in more than a decade in November, spurred by capital goods (25.3% yoy) and consumer goods. Including output from factories and mines, it rose 14.4% year-on-year. The strong performance creates pressure for an interest rate increase.

The 2007 Index of Economic Freedom measures and ranks 161 countries across 10 specific freedoms, things like tax rates and property rights. View scores and rankings for any country, along with detailed data and background analysis. Visit the countries or see top 10.

The following reports on investment psychology all tie together coincidentally.

Dr Jim Montier, has a great article (kindly reproduced by John Mauldin) summarising the problems with the foundation of all professional investment analysis: CAPM is CRAP, or, The Dead Parrot lives!

And neuroscience research supports similar observations about distorted consumer behaviour and the role of credit in biasing purchase decisions. Neoclassical economics assumes that the process of decision-making is rational. But that contradicts growing evidence that decision-making draws on the emotions - even when reason is clearly involved. The role of emotions in decisions makes perfect sense. But modern shopping has subverted the decision-making machinery in a way that encourages people to run up debt. Researchers found that different parts of the brain are involved at different stages of the test. The nucleus accumbens, known from previous experiments to be involved in processing rewarding stimuli such as food, recreational drugs and monetary gain, as well as in the anticipation of those rewards, is the most active part when a product was being displayed. Price information activated the medial prefrontal cortex, the part of the brain involved in rational calculation, and the insular cortex, a brain region linked to expectations of pain. People's shopping behaviour therefore seems to have piggy-backed on old neural circuits evolved for anticipation of reward and the avoidance of hazards. The abstract nature of credit cards, coupled with the deferment of payment that they promise, may modulate the “con” side of the calculation in favour of the “pro”. Credit cards clinically now join the list of things such as fatty and sugary foods, and recreational drugs, that subvert human instincts in ways that seem pleasurable at the time but can have a long and malign aftertaste. Caveat emptor!

Wall Street analysts beware: Your jobs could soon be outsourced. That’s the message coming from Adventity, an India-based company that announced $ 20 million in VC funding led by Norwest Venture Partners. It’s hard to miss the implications of its sales pitch to corporation, I-banks and asset managers like private equity firms and hedge funds: Get high-quality research and analytics at a far lower cost than what you are accustomed to paying. This is known as “knowledge process outsourcing”. The business opportunity partially relates to the cost arbitrage, but also to the availability of talent: “What you find in the high-end research and analytics space is that many of the skill sets used are by folks with engineering degrees and MBAs – and that talent is more readily available in India than in the United States” says Adventity.

JWT, the largest advertising agency in the U.S. and the fourth-largest in the world, has released 70 "in" products, services and trends that will help to define 2007. They are listed here.

Responsible Investing

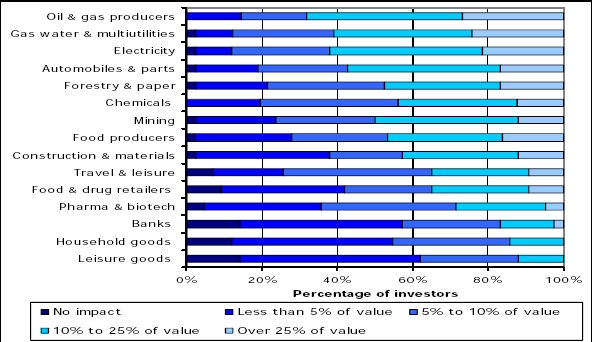

Concerns

over climate change, the environment, and corporate responsibility

are in the forefront of investors' minds reports a new

survey conducted by Ethical

Investment Research Services. Investors strongly feel that environmental,

social and governance issues affect market value in over 50% of companies

included in the FTSE

All World Developed Index. Energy and utility companies were ranked

first by investors as the sectors most affected by ESG issues. Conducted

in late 2006, the on-line survey asked 40 socially responsible asset managers

and mainstream managers which ESG issues investors considered the most

important to investment performance. 90% of investors said

that ESG issues would have some impact in the top ten sectors' value over

the short to medium term. EIRIS identified the top ten sectors as oil

and gas producers, gas, water and multi-utilities, electricity, automobiles

and parts, forestry and paper, chemicals, mining, food producers, construction

and materials, and travel and leisure.

Concerns

over climate change, the environment, and corporate responsibility

are in the forefront of investors' minds reports a new

survey conducted by Ethical

Investment Research Services. Investors strongly feel that environmental,

social and governance issues affect market value in over 50% of companies

included in the FTSE

All World Developed Index. Energy and utility companies were ranked

first by investors as the sectors most affected by ESG issues. Conducted

in late 2006, the on-line survey asked 40 socially responsible asset managers

and mainstream managers which ESG issues investors considered the most

important to investment performance. 90% of investors said

that ESG issues would have some impact in the top ten sectors' value over

the short to medium term. EIRIS identified the top ten sectors as oil

and gas producers, gas, water and multi-utilities, electricity, automobiles

and parts, forestry and paper, chemicals, mining, food producers, construction

and materials, and travel and leisure.

Social funds noted their key SRI stories of 2006: Green investing booms, microfinance pioneer wins Nobel Peace Prize, shareowner democracy increases, resolutions receive record votes, and UN launches Principles of Responsible Investment.

The world of business and philanthropy come closer together as scrutiny of the Gates foundation portfolio raised the issue of GRI investing by philanthropic funds. The Los Angeles Times published a two-part investigative report: Dark cloud over good works of Gates Foundation and Money clashes with mission. The articles discussed the contradiction of the Bill & Melinda Gates Foundation - the world's largest charitable organisation, in which the foundation, for all the immense good that it does, has invested nearly half of its $ 35 billion endowment in companies that cause many of the problems it tries to alleviate through its philanthropic grants. The revelation was rather awkward and prompted a statement to be issued by The Bill & Melinda Gates Foundation. Notwithstanding Bill Gates's initial public comments essentially dismissing " SRI" as inimical to financial returns, the mere fact that the world's largest foundation has (involuntarily, perhaps) placed these critical issues squarely on the social change agenda cannot but enliven, expand, and enrich the global dialogue. This was particularly true coming on the eve of the WEF. Unfortunately the views expressed so far by Gates and Foundation CEO Stonesifer reflect a rather disappointing lack of leading thinking and action in the field. But expect this now to change.

Is 2007 the

End for Voluntary Standards? So asks the provocatively titled

essay by Arvind Ganesan of Human Rights

Watch that was published in December 2006 by Business

for Social Responsibility . Another report Beyond

Compliance: Business Decision Making and the US EPA's Performance Track

Program, unfortunately finds little distinction between the environmental

performance of participants and non-participants, and also that participants'

performance may be no better than it would be in the absence of the program.

Looking

more broadly, voluntary initiatives in general are often held up as

preferable to regulation for promoting social and environmental improvement.

However, voluntary initiatives do not necessarily promote social and environmental

progress, and in fact, it is the threat of regulation that pushes participation.

BusinessWeek ended January with a special report on the Green Business Revolution which was prefaced with the delightfully positive vision: Imagine a world in which eco-friendly and socially responsible practices actually help a company's bottom line. It's closer than you think. The report is worth a browse. Within it, the global green 100 is a good place to start thinking about green/ethical/social responsible investing. And a nice cheat sheet "who's doing well by doing good" is offered with a little more of the story behind a few companies. Once you've explored these businesses, you can move on to more focussed businesses which target the inevitably fast growing market for planet saving solutions. Dotcom? Think eco/green ...?

As well as the special report by BusinessWeek in January, both BusinessWeek and the Economist also highlighted the booming wellness industry. BW reported on an ashtanga yoga ("the yoga for investment bankers and soldiers"!) ashram, Ashtanga Yoga Research Institute, in Mysore, India to which people flock from around the world. And The Economist reports on the exploding business of wellness products and services which regular readers will know is a buoyant market.

The 2007 Global 100 Most Sustainable Corporations in the World:

| ABN Amro Holding NV |

Diageo PLC |

Investa Property Group |

Royal Bank Of Canada |

| Accor |

East Japan Railway Company |

Johnson Matthey Group |

Royal Dutch Shell PLC |

| Adecco SA |

Eastman Kodak Company |

JP Morgan Chase & Company |

Sainsbury (J) PLC |

| Adidas Salomon Agency |

Electrocomponents PLC |

Kesko Corp. |

SAP AG |

| Advanced Micro Devices |

Enbridge Inc |

Kingfisher PLC |

SCA AB |

| Agilent Technologies Inc |

FPL Group Inc |

Kuraray Company Limited |

Scania AB |

| Air France-KLM |

Fresenius Medical Care AG |

Lafarge |

Schlumberger Limited |

| Alcan Inc |

Gamesa Corp. Technologica |

Land Securities PLC |

Scottish & Southern Energy PLC |

| Alcoa Inc |

General Electric Company |

Marks & Spencer Group PLC |

Severn Trent PLC |

| American International Group Inc |

Genzyme Corp. |

Mayr-Melnhof Karton AG PLC |

Smith & Nephew PLC |

| Atlas Copco AB |

Goldman Sachs Group Inc |

Mitsubishi Heavy Industries Limited |

Storebrand ASA |

| BASF AG |

Google Inc |

Land Securities PLC |

Sun Life Financial Inc |

| Baxter International Inc |

Groupe Danone |

Nike Inc |

Swiss Reinsurance Company |

| Benesse Corporation |

Grupo Ferrovial SA |

Nippon Yusen KK |

Toppan Printing Company Limited |

| British Airways PLC |

Hbos PLC |

Nokia Corporation |

Toyota Motor Corp. |

| British Land Company PLC |

Henkel AG |

Nomura Holdings Inc |

Transcanada Corp. |

| British Sky Broadcasting Group PLC |

Hewlett-Packard Company |

Novo Nordisk A/S |

Unibail Holding SA |

| BT Group PLC |

Holmen AB |

Novozymes A/S |

Unilever PLC |

| Cable & Wireless PLC |

HSBC Holdings PLC |

NTT Docomo Inc |

United Technologies Corp. |

| Centrica PLC |

Iberdrola SA |

Pagesjaunes |

Vestas Windsystems A/S |

| Coca Cola Company |

Inditex SA |

Pearson PLC |

Walt Disney Company |

| Daikin Industries Limited |

Indra Sistemas SA |

Philips Electronics KON |

Westpac Banking Corp. |

| Daiwa Securities Group Inc |

ING Groep NV |

Pinnacle West Capital Corp. |

Whitbread PLC |

| Denso Corp. |

Insurance Australia Group |

Ricoh Company Limited |

Wimpey (George) PLC |

| Dexia |

Intel Corp. |

Roche Holdings Limited |

Yell Group PLC |

And again, for those of you who still wonder (or need to convince others) whether environmental performance and financial performance can go together, take a look at the top performers for 2006 in Portfolio 21:

-

Portfolio 21's 2006 return was 24.38%.

-

Vestas Wind Systems (VWS.CO; VWSYF.PK): the world's largest wind turbine manufacturer, based in Denmark. 2006 performance: 131%

-

Fuel Systems Solutions (Nasdaq: FSYS): formerly called IMPCO Technologies, this California-based company designs and manufactures systems that enable internal combustion engines to run on clean burning gaseous fuels, such as natural gas, propane, and biogas. 2006 performance: 114%

-

JM (JM.ST): This Swedish construction and real estate company uses tools such as The Natural Step and the Precautionary Principle, and is a leader in green building practices. 2006 performance: 89%

-

Interface (Nasdaq: IFSIA): the company that spearheaded sustainable practices in the carpet industry, Interface developed the first "climate neutral" carpeting and is designing carpet made from renewable materials that can be composted or recycled back into the same product. Its goal is to attain zero waste and closed loop production. 2006 performance: 76%

The current media hubbub over options back-dating at companies like Apple

has again raised the issue of directors responsibilities.

The increasing scrutiny over director's behaviour is entirely appropriate

as the short tip-sheet from BusinessWeek illustrates. It is plain

that even without SarbOx directors should be following the policies proposed

"under the emerging regime". The level of commitment to the well-being

of the company and to the fiduciary responsibilities to shareholders which

are a foundation of the corporate model, with or without SarbOx, has been

very poor. It has been this way because those in power make the

rules. Now that information and communication technologies allow

fast access to relevant information and the general level of sophistication

of all stakeholders has increased, the power is shifting to a

more open system. Currently, additional regulations are

increasing transaction costs. But these will reduce as the integrity

of boards grows to match their responsibilities.

| PAY |

KNOW THE MATH |

| STRATEGY |

MAKE IT A PRIORITY |

| FINANCIALS |

PUT IN THE TIME |

| CRISIS MANAGEMENT |

DIG IN |

American readers in particular might be interested in a great initiative: "A Financial Literacy Life Raft for Generation of Youth Drowning in Debt" by the US Hip Hop Action Summit Network: 2007 National Tour on Financial Empowerment: "Get Your Money Right".

Venture Capital

China National Offshore Oil Corporation agreed to invest $ 5.5 billion in an Indonesian biofuels project.

Segway Inc., a maker of two-wheeled, self-balancing vehicles, has secured $10.12 million of a $20 million Series C round, according to a regulatory filing. More info at peHUB.com.

Bus Radio Inc., a Needham, Mass.-based provider of a US radio show for broadcast on school buses, has secured $10 million of an $18 million Series B round, according to a regulatory filing. Charles River Ventures is leading the deal, with Series A backer Sigma Partners also participating. www.busradio.com

Boston-Power Inc., a Westborough, Mass.-based developer of lithium-ion batteries, has raised $15.56 million in Series B funding, according to a regulatory filing. Granite Global Ventures was joined by return backers Venrock Associates and Gabriel Venture Partners co-led the deal. www.boston-power.com

North Castle Partners has completed its previously-announced sale of portfolio company Avalon Natural Products Inc. to The Hain Celestial Group Inc. for $120 million. Avalon is a provider of natural products in the areas of skin care, hair care, bath and body and sun care.www.hain-celestial.com

HeyLetsGo Inc., a Boston-based social networking startup, has raised $3.5 million in Series A funding from General Catalyst Partners and Highland Capital Partners, according to a regulatory filing. www.heyletsgo.com

Honest Tea, a maker of organic bottled tea, has raised $12 million in private equity funding from Inventages Venture Capital and distributor Stonyfield Farm Inc. www.honesttea.com

LinkedIn Corp., a Mountain View, Calif.-based social networking company for businesspeople, has raised $12.8 million in Series C funding from Bessemer Venture Partners and European Founders Fund. Existing backers Sequoia Capital and Greylock did not participate in the deal, which reportedly came with a $250 million post-money valuation. LinkedIn previously had raised $15 million over two rounds of funding in 2004 and 2004. www.linkedin.com

Educate Inc., a provider of supplemental education products and services to the pre-K-12 market, has agreed to be acquired for $8 per share by Sterling Capital Partners, Citigroup Private Equity and members of company management. The total deal is valued at approximately $535 million, including assumed debt. Selling shareholders will include Apollo Management, which holds a majority stake in Educate via its position in Sylvan Learning. www.educate-inc.com

US venture capitalists invested more money into more companies last year than in any other year since 2001, according to MoneyTree Survey data released today by PwC, the NVCA and Thomson Financial. Go here for dozens of pages worth of data.

The latest set of US private equity performance data looks a lot like the previous set. The only real changes come in one-year returns for both venture and buyouts, with the former dropping from 13.7% to 10.8%, and the latter dropping from 26.2% to 23.6 percent. Thomson Financials' US Private Equity Performance Index (PEPI) Investment Horizon Performance through 09/30/2006

| Fund Type |

1 Yr |

3 Yr |

5 Yr |

10 Yr |

20 Yr |

| Early/Seed VC |

2.90 |

5.50 |

-5.40 |

38.30 |

20.50 |

| Balanced VC |

10.70 |

12.80 |

1.80 |

16.80 |

14.60 |

| Later Stage VC |

27.80 |

10.50 |

2.70 |

9.40 |

13.90 |

| All Venture |

10.80 |

9.40 |

-1.00 |

20.50 |

16.50 |

| Small Buyouts |

11.30 |

9.40 |

5.00 |

6.00 |

25.20 |

| Med Buyouts |

37.20 |

12.30 |

6.10 |

10.90 |

15.30 |

| Large Buyouts |

23.10 |

16.40 |

8.30 |

8.30 |

12.40 |

| Mega Buyouts |

23.40 |

16.20 |

10.10 |

8.90 |

11.60 |

| All Buyouts |

23.60 |

15.60 |

9.20 |

8.80 |

13.20 |

| Mezzanine |

-8.10 |

4.70 |

2.90 |

5.90 |

8.40 |

| All Private Equity |

19.00 |

13.20 |

5.90 |

11.20 |

14.00 |

| NASDAQ |

5.50 |

7.80 |

8.70 |

7.10 |

11.40 |

| S & P 500 |

9.70 |

9.90 |

5.20 |

7.50 |

9.70 |

The FEER offers a new recipe for success in Asian private equity investing. The various lessons, illustrated with case studies, are valuable in global VC not just Asia and across the spectrum of PE investments.

Interest in African VC is rising. CDC, of the UK, says it is the biggest private equity investor in Africa and the following paragraph outlines some of its characteristics as a role model for African investing.It will put at least $ 100 million into a new fund launched by Citigroup, the nineteenth new Africa vehicle in which CDC will be invested. The capital it has invested in or committed to the region exceeds of $ 1 billion. CDC is active in Asia and Latin America as well, and in 2005 reported a worldwide total return of £ 426 million, a return on net assets of 35%. The group invests funds from its own near-$3billion balance sheet and recycles all profits back into fresh opportunities. But almost half of its portfolio is in Africa, with most investments concentrated in South Africa, Egypt and Nigeria. CDC's sector exposure is weighted heavily towards energy – it makes up about 40% of the mix – and the rest is spread across industries including agribusiness and microfinance. Aureos Capital, another experienced private equity group in Africa that spun out from CDC, is aiming to raise $ 400 million for a ground-breaking bet on the potential of smaller companies to build businesses spanning the continent. Citigroup also has a dedicated fund to invest at least $ 200 million in the continent. Other key players include Kingdom Zephyr, EMP Africa and Actis. The big names such as Blackstone, Texas Pacific and Kohlberg Kravis Roberts are absent.

Interest Rates and Currencies

Interest rates in the US are expected to remain at 5.25% for the time being. This is a modest level, especially in real terms, and is not enough to cause a recession. It may continue to be a damper on business enthusiasm, but only for risk averse investors. The Federal Reserve has kept interest rates at 5.25% for several months, but has expressed concerns about inflation and a slowdown in the housing market.

US retail sales picked up in December as shoppers continued spending in the holiday season despite a slowing economy. Commerce Department figures showed takings were 0.9% greater than the same month in 2005 - higher than most analysts were expecting and the biggest since July. The biggest increase came in electronic shops (3%), with demand too for furniture. Motor vehicle sales were up 0.3% after remaining flat in November, however the impact of increased sales at petrol stations - up 3.8% - meant that the overall figure was "flattered".

December's labour market grew by 167,000, putting more money into the pockets of consumers. Job growth was brisk as businesses added to their payrolls with surprising confidence, further evidence that the economy is not likely to slip into a recession. See this NYT Graphic:The Labor Picture in December. This growth helped both the employed and the unemployed. The prospects strengthened as wages for most workers climbed at a steady clip. Those looking for a job last month found a more welcoming job market, and the amount of time they spent out of work dropped considerably. The US unemployment rate held steady at a low 4.5%. These numbers came as a surprise to many economists, who expected the slowing economy to pressure employers to rein in hiring. They support the contention that the cost of labour will increase faster than the cost of capital in the short to medium term, which will impact asset returns, as discussed above in Investment.

US producer price growth slowed to 0.9% in December, half its November increase, as oil prices fell, while industrial output rose 0.4%, faster than expected.

The Bank of England raised UK interest rates to 5.25% from 5% in an effort to curb inflation. UK inflation jumped to an 11-year high of 3% in December the highest level since 1991. The Retail Prices Index, which includes mortgage interest payments, rose to 4.4% in December from 3.9%. The rise is the third in five months, as part of an effort by policymakers to stem inflationary pressures. The UK economy grew at its fastest pace in two-and-a-half years during the last three months of 2006, boosted by demand for services. GDP rose 0.8% in Q406 over Q306. On an annual basis, GDP increased by 3% from the same quarter in 2005. The quicker-than-expected growth has raised worries over inflation and the threat of more interest rates rises.

The European Central Bank held its main eurozone base rate at 3.5%. Despite the ECB's latest decision, many analysts believe the central bank will raise the cost of borrowing across the eurozone as early as next month. Inflation remains a concern for the ECB as the eurozone economy expands. Last month's 0.25% rise was the sixth such increase made by the ECB since December 2005. An improving European economic environment is likely to increase the pressure on the central bank to raise rates and rein in inflation. The European Commission raised its forecast for growth in the 13-member eurozone to between 0.4% and 0.8% in Q107, and between 0.4% and 0.9% in Q207. Separate figures from Germany, showed that the eurozone's biggest economy had expanded at its fastest pace in six years during 2006.

The Bank of Japan has kept interest rates at 0.25%, confounding many analysts who believed a rise was likely given the strengthening economy. Japan's economy has been performing strongly although domestic consumption is still seen as being fragile. The level of borrowing is the lowest of all the major industrialised economies. Some analysts speculated that the Bank may have come under political pressure not to lift rates at a time when ministers are worried about choking the economic recovery. The rate freeze was seen as good news for exporters since it would likely depress the value of the yen. Economic prospects have improved in the past year with unemployment falling and business confidence rising.

Thailand cut its key interest rate to 4.75% to boost economic growth and confidence in the country. The decision by the Bank of Thailand to lower the rate from 4.94% is the first cut in six months, and comes amid lower domestic demand and falling inflation. However, investor confidence in Thailand has been undermined since a military coup last September, December bombings, and more worryingly changes in capital controls and foreign investment rules. The rate cut will not remedy these problems.

Trade and FDI

Trade ministers at the World Economic Forum had a side gathering to try to restart the Doha WTO talks. There were some positive reactions and at least representatives are still talking, but the likelihood of a turnaround in the talks is small. Until soft issues like climate change and ethics become priorities, whose solutions encompass open trade, it is unlikely that there will be enough goodwill for rich countries to compromise on important but sensitive issues like food trade and IP and technology transfer. A current example of where compromise should occur is the US corn subsidy. While the EU and Canada have just lodged formal complaints, far worse is the influence of US corn subsidies and agribusiness on Mexico, where the price of corn has skyrocketed, poor people can barely afford a tortilla and local strains of corn have been destroyed by GM contamination. Until the US demonstrates ethical leadership on trade, there is little hope for compromise.

As noted, the Doha Round of negotiations at the WTO has reached a stalemate, with most countries blaming the deadlock on a US agricultural trade proposal they see as offering little or no actual policy change by the US while requiring maximum concessions by farmers elsewhere. However, only 4.5% of US exports are agricultural while the overwhelming majority are services and manufactured goods. The deadlock means that the interests of most US exporters are being held hostage to the interests of a small group of agricultural exporters; breaking the stalemate would be beneficial for the US economy as a whole. The US proposal may even be counter-productive to the interests of US farmers. Future growth in world food demand will come primarily from rising incomes in rapidly growing economies like China and India. Those countries claim that the US agricultural proposal could reduce incomes for their already poor farmers, which in turn would reduce demand for food imports, including from the US. In a new Carnegie Policy Outlook, Breaking the Doha Deadlock, Sandra Polaski argues that the new Congress should reexamine the skewed U.S. proposal. She demonstrates that the claim that developing country agricultural markets are closed to U.S. exports and must be prized open during the Doha Round is not supported by the facts. Polaski maintains that a favourable deal is available if the US can find its way out of the corner it has backed in to. Congress can and should help, in order to achieve benefits for the U.S. economy as a whole and the wider US interests of global growth, stability and poverty alleviation.

It seems that a token effort to reform agricultural subsidies has been made. US Department of Agriculture has released its new proposal for a farm bill to replace the "Freedom to Farm Act of 2002", which expires September 2007. The Department of Agriculture announced its proposal for a new agricultural policy, seeking to reduce spending by about $ 10 billion and to limit subsidy payments to the wealthiest farmers. The administration's proposal would cost about $87.3 billion while the 2002 farm bill cost about $97 billion. But, at $17.5 billion a year, remains well above the G20 proposals of $ 12 billion a year.

China's President Hu Jintao visited Africa again (3rd trip) on a 12-day tour aimed at strengthening economic and political ties. Hu met Cameroonian counterpart Paul Biya and signed a series of bilateral co-operation agreements. Trade has expanded dramatically between Africa and China in recent years as China seeks resources to feed its economy and markets for its exports. Trade between the two countries doubled in 2006 from the previous year, reaching $ 338 million, according to China's ambassador to Yaounde.

Activities and Media

January was a productive start to the year as we took on some extra help and initiated a couple of infrastructure projects, planted 50 yew trees and plan for more, and recovered another submerged drainage system supplying the garden stream. This was in addition to the seasonal startup of the horticultural cycle of preparing beds, sowing some crops, clearing stores and so on. The winter group yoga lessons started too. On the desk we initiated some new media projects which I hope will find their way online as well as revising listed portfolios in light of accelerating change in market sentiment. We hope you are also enjoying a varied and interesting year too.

BallinTemple is very fortunate to find itself listed in Alistair Sawday's first edition of worldwide Green Places to Stay - one of only 3 places in the whole of Ireland. Many thanks to Emily Bunbury, who first sponsored us in ASP, and Ann Cooke-Yarborough who nominated us for a position in the green guide.

Happily PestalozziWorld has taken on an executive director who has great experience in Africa, where PestalozziWorld is growing fast, and will be able to share the burden of administration with trustees. PestalozziWorld educates underprivileged children in emerging economies. All donations go to children's support - administration is sponsored by trustees. (Please consider donating. Thank you.)

On a recent trip, when booking the travel we were asked if we wanted to rent a car. While we would not normally, the car offered was a Toyota Prius, so we decided to invest in some R&D. It was great. It took us 5 minutes and reading the manual (in French) to work out how to start it, but once done, it was a dream. Super quiet, comfortable, auto-everything, GPS etc and it hardly used any fuel. It is not a sports car, but for anything else (especially family or touring) you should definitely check it out.

By coincidence I saw K. Clarke series "Civilisation" (from 1970s) and read the new Suicide of the West which focussed attention on the role of "the west" in today's world. Civilisation is top class. Lord Clarke presents a compelling story of the emergence of civilisation seen through art and rightly puts ethics and integrity at the top of the list of values of civilisation. The series offers a overview of more than 1,000 years of recent development clearly showing the gradual reorganisation of society from dispersed pockets of excellence to a hierarchy of wealth that can develop massive structures to today in which something else is needed - perhaps coownership of all. Suicide of the West offers some valuable insights and information, but is undermined by a foundation on a weak premise - that the west has a distinctive makeup, tantamount to westerners being a different creature, which is plainly wrong since the west is made up of immigrants from all over the world. Some will buy the books self-serving logic, though it often seems to me to be false and unnecessary. The authors can make valuable observations without resorting to traditional perspectives which are plainly passée. There is no Suicide of the West of collapse of the west - however, there is the rise of Asia, Africa and South America. And within a generation there must be the fall of hierarchy and the rise of holonics.

Here

to the right is a fun look back at 2006 from BusinessWeek ...

Here

to the right is a fun look back at 2006 from BusinessWeek ...

And Big Picture TV now has video of Takashi Kiuchi, one of Japan's most iconoclastic business executives. As Chairman and CEO of Mitsubishi Electric America he broke with corporate norms to champion a systems approach to business advocating a rapid transition to environmental sustainability and social responsibility. He is currently Chair of the Future 500, an international organization that provides tools and services to deliver improved corporate social responsibility.

Climateprediction.net is the largest experiment to try and produce a forecast of the climate in the 21st century. To do this, it needs people around the world to give time on their computers - time when they have their computers switched on, but are not using them to their full capacity. If you can help, go to the website.

Ecologist Online readers are encouraged to take photos of the changes in their local environment, and email them to photos@theecologist.org. The photos can be accompanied by a comment, and should supply both your details and the location and time of the photo. All photos and comments will be published under the 'Where has winter gone?' icon on their homepage, and a winner will be drawn when spring (or will it be summer?) arrives...

Also The Ecologist Online has launched a news service, bringing you daily updates on the most important environmental and health stories.

The Campaign for Fighting Diseases has excellent information resources on the main issues impeding the progress of disease control: Neglected diseases, Access to medicines, Intellectual property (IP), Malnutrition, Chronic Disease.

For economists and investors you can see a great video from Sam Zell with a song called Capital Keeps Falling on My Head to the tune of Raindrops Keeps Falling on My Head.

Ugly Betty hit TV screens recently and has already scooped 2 Golden Globe awards: Best Television Series and Best Performance by an Actress. The story is of a modest person trying to succeed in the world of fashion media. An ugly duckling type story set in modern context with some good lines and twists. The show's overtly perky and uplifting premise that Betty brings beauty to a beastly world is no longer considered wacky. Ugly Betty, in Hollywood circles, is being tagged as marking the start of an anti-Sex and the City trend. And it made waves at the Golden Globes where the un-liposuctioned, un-Botoxed actress America Ferrera got more attention on the red carpet than the entire picture-perfect cast of Grey's Anatomy. Ferrera patiently explained to the puzzled print-media in a packed press-room how: "It is very clear from the start that Betty is the hero. She's the one you're supposed to love and who is probably the most beautiful on the inside of everyone in the show." Its also a good story for children, who are otherwise brainwashed into stereotypes.

Please forward this publication to family and friends, print it, and

share it.

This is a publication of: Astraea, Ireland + 353 59 9155037 Subscribe

and Unsubscribe

This report has been prepared for information purposes and is not an offer, or an invitation or solicitation to make an offer to buy or sell any securities. This report has not been made with regard to the specific investment objectives, financial situation or the particular needs of any specific persons who may receive this report. It does not purport to be a complete description of the securities, markets or developments or any other material referred to herein. The information on which this report is based, has been obtained from publicly available sources and private sources which may have vested interests in the material referred to herein. Although GRI Equity and the distributors have no specific reasons for believing such information to be false, neither GRI Equity nor the distributors have independently verified such information and no representation or warranty is given that it is up-to-date, accurate and complete. GRI Equity, associates of GRI Equity, the distributors, and/or their affiliates and/or their directors, officers and employees may from time to time have a position in the securities mentioned in this report and may buy or sell securities described or recommended in this report. GRI Equity, associates of GRI Equity, the distributors, and/or their affiliates may provide investment banking services, or other services, for any company and/or affiliates or subsidiaries of such company whose securities are described or recommended in this report. Neither GRI Equity nor the distributors nor any of their affiliates and/or directors, officers and employees shall in any way be responsible or liable for any losses or damages whatsoever which any person may suffer or incur as a result of acting or otherwise relying upon anything stated or inferred in or omitted from this report.