Entrepreneur and Business Resources

Integral Methods and Technology

Governance and Investor Responsibility

archive

signup

credits

archive

signup

credits

Private and Confidential

July 2007

- Perspective

- Investment, finance & VC * Interest rates and currencies * Trade & FDI

- Activities and Media

The following sections are delivered through Astraea. The links below will take you to those sections.

Perspective

Beware the deadly donkey

falling from the sky

You may choose the way you live, my friend

But not the way you die

A little humour to introduce a serious issue. The deadly donkey is like the Black Swan that has been referenced in much media over the recent months. And the little ditty offers the way to deal with it. Whether the externality is a flood, a heat wave, a crop failure, a drop in financial markets or a heart attack, you can not prepare for it, because it is unexpected. But you can be comfortable in the way you live your life. And that makes all the difference.

An unusual clutch of reports on happiness appeared in July (see them referenced in the Living section of Holonics) and their conclusions all point in a similar direction - your attitude in life is as much a key to happiness as anything else, and, above a minimum level, much more important than wealth. Unfortunately most of us, and certainly at a macro-level nation-states, continue adolescent posturing and comparison and find it difficult to grow up and face the facts of life and nature. We spend more time with our computers outside work hours than we do with our families. As Ricardo Semler questions in his recent book, if we can find time to do emails on a Sunday night, why can't we find time to play football with our children on a Monday evening?

And the signs that we should change are all around us from volatile weather patterns to volatile capital markets. The massive growth in human population, infrastructure and technology over the past 100 years has moved in lock-step with the consumption of fossil fuels. What has not grown is our philosophy of life. We continue to behave as if with impunity, like a know-it-all teenager. The gentle prodding from mother nature is resulting in little real response and certainly no system change. Unfortunately, like the egomaniacal teenager, we leave the problems for others to sort out, little realising that those other are ourselves, and we fob off our responsibilities with a spiel.

Many of us are on holiday now, having flown to some exotic climate, to stay in a hotel and relax. Now is the time to think about a lifestyle change, not how to climb the corporate ladder. Start small and take the guide from our own humility - sell the vulture portfolio and invest in green assets, stop drinking pre-packaged drinks, shop locally, turn-off the lights, walk or cycle. And give people less fortunate than ourselves a bit more, and take a bit less. Otherwise when that heart- attack comes (or some other deadly donkey) options for a real life will not be there.

Investment, Finance & VC

As many analysts noted in July, perceptions about market risk have clearly shifted. Investors of are now less willing to accept risk, and the cost of assets is consequently increasing. The uncertainty in the market now contributes to volatility, which has been expected anyway because of summer holidays. In this kind of turbulent market you just have to make a decision and stick with it. When its rough, you're either in or out. If you try to change, you loose. At the moment we're out (thankfully) and are now analysing where and when bottom will occur. This is made difficult by the volatility and currently expect that no window of opportunity will become apparent till September.

Credit has started to tighten rapidly as spreads between different classes of risk ballooned at the end of July. Declines in house values and sales have hit consumer spending. Debt costs are slowing M&A, even halting some deals. There is a flight to quality, though even that is less easy to determine. But is it US treasuries or is it foreign bonds? Or is it selection of stable earners with low leverage? Debt or equity is a choice of legal security and terms. Operations is a selection for individual operating dynamics. I recommend benchmarking relative price, leverage and cash flow as a first step in reviewing investment portfolios.

Where in the cycle might markets be? Housing can fall 30% to correct, but has only come off by less than 10%. Perhaps 30% is too much, but not according to the long term trend in price/quality. Similar numbers can be benchmarked for equities; they have simply shaved a bit of their unusual appreciation over the past months on the back of steady bull market, but are not at levels that long term trends would suggest are reasonable.

And at the end of July there is still optimism in the markets. (Obviously there are not enough readers of this newsletter! :-) ) Some analysts have earning estimates that are not aggressive and give reasonable pricing. But, if earnings are over estimated, PEs are underestimated. Earnings growth are generally expected to be 10%. So the issue is what is going to drive earnings by 10% to underpin current expectations? Consumer spending, with consumption slowing and mortgage equity withdrawal having a questionable future? Corporate spending when finance costs are already being increased by rising base rates, that are reflecting a riskier investment environment anyway? Government spending by governments already indebted and facing bailout calls? The virtual reality of optimism has been pushing the market higher for a couple of years, but the reality of economics is beginning to change the perception of risk which hits all assets.

For governments and regulators the challenge for policy will be to accept lower growth and keep inflation down. This is all about expectations. Unfortunately across the world people want more now than ever before and have less appreciation of what it takes to deliver these expectations - financial credit, massive natural resource consumption and economic transfers from poor to rich. The IMF made a recent presentation which makes sober reading: The Global Economy and Financial Markets: Where Next?

It is true that the greater complexity of our world means that the outlook is not clear cut. It is also true that history may not repeat itself. The question that many will ask themselves is, can we afford to loose? Perhaps the house is on the line. Maybe its control of the business, or the business itself. Perhaps its an upcoming election. We were lucky to liquidate equities before the recent plunge - we're still cautious about how soon to reinvest especially with the (expected) high volatility. So as we mentioned above, check leverage and cash flow, not just earnings.

The US Dow Jones Index and S&P 500 both reached record highs, trading over 14,000 and 1550 respectively, rises of over 12% and nearly 10% for the year so far. And they also fell sharply because of worries about slowing domestic growth and tighter borrowing conditions. American stock markets saw index drops of 3 - 5%. That's volatility!

Credit rating firm Standard & Poor's finally addressed its mortgage ratings saying it would tighten standards it uses to rate bonds backed by subprime mortgages, tacit acknowledgment that it might have been too optimistic about the housing market. Moody's Investors Service followed suit. Both however, started with modest expectations targeting about $ 15 billion and $ 5 billion of bonds only, though analysts have been saying that $ 100 - 250 billion of subprime assets are questionable. There is now more attention being paid to the role of credit agencies in the market for mortgage securities, which helped fuel the housing boom by extending credit to people who may not have otherwise qualified for loans and by making securitised portfolios of lower risk bonds seem more secure than they were.

It is not just the stock market. Retail sales in June in the US decline by the most in 2 years, falling 0.9%. Demand for cars, furniture and building supplies all plunged. Sales were down 0.4% even without the effect of a slump in the car market, the cause of much of the fall. The problems in the housing market were reflected by a 3% fall in furniture sales and a 2.3% fall in sales of building materials and garden supplies. The drop was much bigger than the flat expectations of economists. In May, while optimism still remained, retail sales had risen by a revised figure of 1.5%. The June decline raises new worries about consumer spending, which accounts for two-thirds of total economic activity.

Sales of existing homes in the US during June fell 3.8% to a seasonally adjusted annual rate of 5.75 million homes, the slowest pace since November 2002, giving no sign of an end to the housing slump. Though figures from the National Association of Realtors showed that the median price paid for a home rose 0.3% compared with June 2006 to $230,100 - the first such increase in average prices for 11 months.

Although the US economy grew faster than expected in the second quarter at 3.4% on an annual basis, recording its best quarterly performance since early 2006 and bouncing back from a dismal first quarter where it grew just 0.6%, this data should be read with caution given the decline in consumer sales and the reverberations of the sub-prime lending crisis.

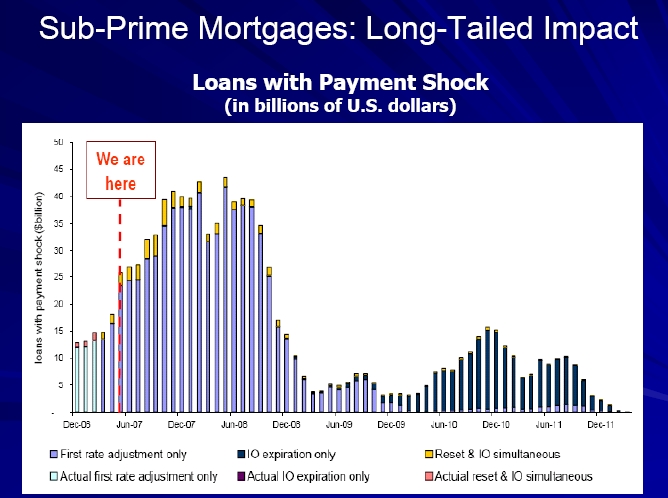

The

credit crunch in the US is not over ... A recent research

piece by Bank of America estimates that approximately $ 500 billion of

adjustable rate mortgages are scheduled to reset upward in 2007 by an

average of over 2%. 2008 holds even more surprises with nearly $700 billion

ARMS subject to reset, nearly ¾ of which are subprimes. This chart

from the IMF paints the picture.

The

credit crunch in the US is not over ... A recent research

piece by Bank of America estimates that approximately $ 500 billion of

adjustable rate mortgages are scheduled to reset upward in 2007 by an

average of over 2%. 2008 holds even more surprises with nearly $700 billion

ARMS subject to reset, nearly ¾ of which are subprimes. This chart

from the IMF paints the picture.

And John Mauldin shares another uneasy insight:

let's look at the investment banks. Creating and selling CDOs was a particularly juicy business. I have heard, but not verified, that sales commissions were running 5%. You can bet the banks were making at least as much. Put together a $250 million CDO and sell it to institutions, pension funds, insurance companies, and hedge funds, put some of the equity portion into your own portfolio, and you could generate substantial profits and commissions. Rinse. Lather. Repeat.

In an attempt to get a feel for where markets might go, I've cobbled together a few statistics which give a frame of reference for the market turbulence.

-

The United States accounts for just over 30% of world GDP, Europe is around 25%, Japan nearly 15% and China and SEAsia 10%. Global financial stock (including equities, government and corporate debt securities, and bank deposits) was $140 trillion in 2005 and growing by about $ 7 trillion a year. We can estimate it to be over $ 150 trillion now.

-

Eurozone is emerging as a greater force in the global financial landscape. That region added $3.3 trillion of assets in 2005, boosting financial depth to more than three times the eurozone’s combined GDP and reflecting a 6% annual growth rate over the last ten years – nearly twice the pace of Anglo–Saxon rivals.

-

The depth of world financial markets rose to an all–time high of 316% of world GDP. With few exceptions, deeper financial markets create better access to funding for companies, a theme confirmed by our survey of business executives.

-

Equities are the top source of recent growth, increasing by $7.1 trillion and accounting for nearly half of growth in global financial assets in 2005. The vast majority of equity market increases worldwide were due to increased earnings and new issuance rather than increases in P/E ratios.

-

Global cross–border capital flows topped $6 trillion in 2005, a new record and more than double their level in 2002. Our data shows that foreign investors hold one in four debt securities and one in five equities, suggesting that national financial markets are increasingly integrating into a single global market for capital.

-

80% of capital flows are between the US, UK, and euro area. Although global capital flows to emerging markets are growing rapidly, they still account for just 10% of global capital flows.

The main conclusion to be drawn is that the pain of a downturn will be borne globally, but predominantly in richer economies.

The China Development Bank and Temasek, the investment arm of the Singaporean government, invested £ 2.4 billion (€ 3.6 billion) in Barclays. This is a second strategic investment by the Chinese government in the financial services sector, following its stake in Blackstone in May. The significant investment may help the UK bank to raise its offer for the Dutch bank ABN Amro. CDB and Temasek will invest a further £ 6.5 billion (€ 9.8 billion) if the ABN takeover goes through. If Barclays acquires ABN, the Chinese state would emerge with a shareholding of 7.7% in the enlarged group, though has pledged not to raise its stake to more than 9.9% for three years.Temasek would own 3%. (Barclays raised its offer to € 67.5 billion (£45.4 billion) in cash and shares for ABN Amro. The offer by the group led by Royal Bank of Scotland, also vying for ABN, is higher.) CDB is under direct control of the Chinese State Council and its governor has the rank of a government minister. At the same time analysts see the CDB as one of the country's most commercial institutions, financing industries including petrochemicals and railways. This investment is part of the $1.2 trillion of foreign exchange reserves China has to invest, much of which has been placed in US Treasuries or government bonds.

Shares in Blackstone, the private-equity firm that China invested in just prior to its IPO in June, are 17% below their offer price. Blackstone arranged the Barclays deal for CDB. I wonder if CDB got a good deal from Blackstone on arranging the Barclays deal. It would be appropriate.

A few months ago I raised the risk that problems in Ireland's and Spain's housing markets to start affecting other markets. Now that other markets have started to roil, this concern has passed. But the problems in Ireland will certainly contribute to a tightening. In July for the first time, the Irish government admitted that tens of thousands of young people are in serious trouble with their mortgages. Yet a government report reveals that one-third of all new home buyers are signing 35-year 100% mortgages - some for as much as €500,000. Belatedly, the Government is now issuing a "health warning" on mortgages as borrowers are warned that they should bear in mind long-term costs and the fact that interest rates can change significantly. House prices might be coming down but new buyers, with an average age of around 30, are still being locked into mortgages of more than €500,000. The report on house prices published by the Department of the Environment reveals:

-

More than 47% of all new house mortgages were taken out by first-time buyers aged 30.

-

One-third of them are taking 100% mortgages.

-

The typical loan is now over 31-35 years.

-

The average price of a new house at the start of the year was €314,087, and €375,577 for a second-hand property.

-

The average price of a new house in Dublin was €419,330 (+16.1%) and for a second-hand house was €517,865 (+8.9%). Prices have since fallen back.

-

A national inventory of residential-zoned serviced land at June 30 shows that there are more than 15,900 hectares of residentially zoned serviced land with an estimated yield of 492,000 housing units.

-

Despite the predicted "soft landing" for the property market, the report reveals that the value of mortgages for 2006 was 50% higher than in 2004.

Also worrying and a sad mirror of overconsumption across the Atlantic, Ireland's recently released Central Statistics Office Household Budget Survey 2004-2005 reveals that most Irish people are living beyond their means, with many households spending far more than they earn each week. 70% of all households cannot cover their weekly expenditure from their regular income, with only the richest families bucking the trend. These findings of the come as the Central Bank warned that economic growth will decline to 4% next year, as the jobs and spending boom ease back which means people can no longer rely on a sharply rising tide to lift them out of difficulties. The poorest households in the country have a shortfall of almost €60 a week - or over €3,000 a year - meaning they spend 27% more than they earn. Boosted by the high earnings of a few, overall disposable income across the country now exceeds average spending, reversing the trend of the previous two decades. However, the CSO notes that "a different picture emerges" when you look at income and spending in the poorest 20% of society - who spend between 20 and 27% more than they earn. Even well-to-do middle class households cannot quite make ends meet from their earnings. The crunch could be very painful in the Green Isle.

Responsible Investing

The UN Global Compact Leaders Summit in Geneva, Switzerland, brought together some of the world's biggest companies committed to corporate social responsibility. Sustainability is gaining momentum as more shareholders, stakeholders, and businesses are creating policies to protect the environment, empower people, and create transparent business practices. If the current drive toward sustainability is enough or too little, too late is for younger generations to debate, but it is for the future generations that many are working.

New studies from the Principles for Responsible Investment and Goldman Sachs point to both sides of the supply and demand chain asking for more corporate responsibility, and in many cases, getting it. The "PRI Report on Progress 2007" notes that 88% of investment manager signatories and 82% of asset managers are involved with shareholder engagement on ESG issues. More than four-fifths of investment manager signatories have staff dedicated to ESG investment concerns.

A report released at the summit by Goldman Sachs showed that among six sectors covered - energy, mining, steel, food, beverages, and media - companies that are considered leaders in implementing environmental, social and governance policies to create sustained competitive advantage have outperformed the general stock market by 25% since August 2005 and that 72% of the companies with ESG policies outperformed competitors.

However, a third survey of chief executives that have signed onto Global Compact shows that the implementation of ESG principles into practice at companies still needs work. The survey, conducted by McKinsey, was conceived of to complement the PRI survey of investment and asset managers. The executive survey reports on a positive note that more than 90% of CEOs are doing more than they did five years ago to include ESG issues into companies' operations. Yet although 72% of CEOs said corporate responsibility should be part of daily operations, only 50% think that their companies are actually practicing it. 27% of CEOs think that the corporate responsibility is embedded into the global supply chain.

Also at that event, a group of chief executive officers representing some of the world's largest corporations issued The CEO Water Mandate, urging their business peers to take immediate action to address the emerging global water crisis. Meanwhile, the chief executives of 153 companies worldwide committed to speeding up action on climate change and called on governments to agree as soon as possible on measures to secure workable and inclusive climate market mechanisms post 2012, when the Kyoto Protocol expires.

The gathering also delivered a new online tool aimed at helping companies "embed responsible business practices as a driver of long term, sustainable competitive performance."

There are a number of relevant reports downloadable here.

Although UK business is spending millions of pounds to invest in becoming greener, responding to a sea change in attitude from shoppers, a recent survey shows that consumers are generally unwilling to pay more for becoming greener. Out of 2,610 people interviewed by YouGov on behalf of unbiased.co.uk, half said they were not prepared to pay higher taxes to help sustain the environment and 7% said they didn't care about the environment at all! Perhaps this is simply a sign that most people haven't yet attained the standard of living and education that allows them to think of others and their environment, though ironically it is usually the richest among us that are least philanthropic.

Other indicators from the survey are: Only a minority said they would be willing to pay higher taxes in specific areas. Only one fifth said they would be happy to pay 'green taxes' on flights. A quarter would agree to pay higher car taxes despite one in 10 claiming this to be their most resented tax.A further 17% said they'd be happy to pay to combat problems closer to home, such as littering. The survey also confirmed that younger people are more in tune to the need to change the way we live - while 50% overall were against increased environmental taxes, 63% of those aged between 45 and 54 took this position.

Also in the UK a survey finds green business attitudes on the slide. UK business attitudes towards the environment are polarizing, with a small group of green pioneers in danger of leaving the bulk of their contemporaries behind, according to a new survey from printer giant Kyocera released in July. The survey of 340 employees at UK organizations with over 1,000 staff also found that adoption of some environmental policies had actually deteriorated when compared to a similar survey carried out by Kyocera back in 1993. The survey questioned C-level executives, IT chiefs and general office staff and found that the proportion of businesses that have a green office policy had fallen from 54% in 1993 to 41% this year. Furthermore, less than a quarter claimed their firm used "environmentally conscious" suppliers, while just 31% said they were willing to pay a modest premium for green products, down from 60% in 1993.

On the other side of the Atlantic however, Americans' expectations

of businesses are at an all-time high, with more than two-thirds

of Americans saying they take a company's business practices into account

when they consider their purchases, according to the latest Cause Evolution

Survey from marketing and public relationships company Cone. The study

also found a substantial increase in the number of American workers who

want their employers to support a social cause or issue. Cone's researchers

said the results suggest that the country has undergone an evolution in

consumer thinking about the ways businesses interact with society.

About one-third of American shoppers responding to the survey said that,

across a range of industries, business practices are now an additional

purchasing influence, and another third of consumers consider both social

issues and business practices when deciding what to buy. The overwhelming

majority of Americans, 85%, say they would switch to another company's

products or services if a problem with business practices was uncovered.

The survey found that Americans are more likely than ever before to reward

companies for their support of social issues. 87% are likely to switch

from one brand to another (price and quality being about equal) if the

other brand is associated with a good cause, an increase of more than

31% when the question was asked in 1993. Attitudes in the workplace have

undergone a similar revolution, the survey found. 72% of employees said

they wished their employers would do more to support a social issue, an

increase of 38% since Cone's 2004 survey on the subject.

Many companies are choosing which issues to support based on where they can deliver the most meaningful business and social results to their stakeholders. 9 in 10 Americans say companies should support causes that are consistent with their responsible business practices. 87% say they want a company to support issues based on where its business can have the most social and/or environmental impacts. The top issues that survey respondents want companies to address are health, at 80%, and education, environment and economic development following closely at 77%.

This data supports the contention that America can change fast and for the better. It is a key strength of the culture. The challenge will be to maintain the pace and direction of enlightened consumption in the face of a slowing economy.

Environmental research group Trucost released its annual ranking of UK investment funds based on their overall carbon emissions. "Carbon Counts 2007" compares 185 funds in four categories on their environmental impact and notes which investments are at greatest risk from climate change. Overall, the top three funds in the study, Prudential Ethical Trust, AXA Ethical, and Sovereign Ethical, are all socially responsible funds. The report's authors found that three-quarters of SRI funds have smaller-than-average carbon footprints. But the low end of the carbon scale and the high end is dramatic: The Invesco Perpetual High Income fund, which ranked as the most carbon-intensive fund, has a carbon footprint nearly ten times larger than the most carbon-efficient fund, Prudential Ethical Trust. Interesting and relevant is their calculation that the impact of moving a £7,000 investment from the least carbon efficient fund to the most carbon efficient fund is 10 tonnes per annum. The average UK household emits 10 tonnes of CO2 per year.

According to the latest Banking Industry report from research group Covalence, competition for eco-minded customers has helped improve how banks' services affect the environment. The study looked at the EthicalQuote Reputation Index for nine industries from June 2006 to June 2007 and found that the banking sector was ranked second highest in its overall reputation, following the food & beverage sector and just ahead of technology companies in score. Covalence found that both market-side demand and international standards were responsible for the green boom in banking. On the market side, there has been an increase in demand from consumers for socially responsible investment options, including microfinance, and the market for investments in renewable energy is also increasingly attractive to investors.

Eurosif released their Forestry & Paper and Real Estate Sector reports. This series of publications is aimed at raising awareness on the nature and understanding of social and environmental issues, as well as related business opportunities potentially affecting long-term returns and productivity within these sectors. The Eurosif Sector Report focusing on real estate considers current trends in the European real estate market and analyses social & environmental challenges, risks and opportunities for the sector. A complimentary survey, also released in July by the University of Arizona is Responsible Property Investing: A survey of American Executives.

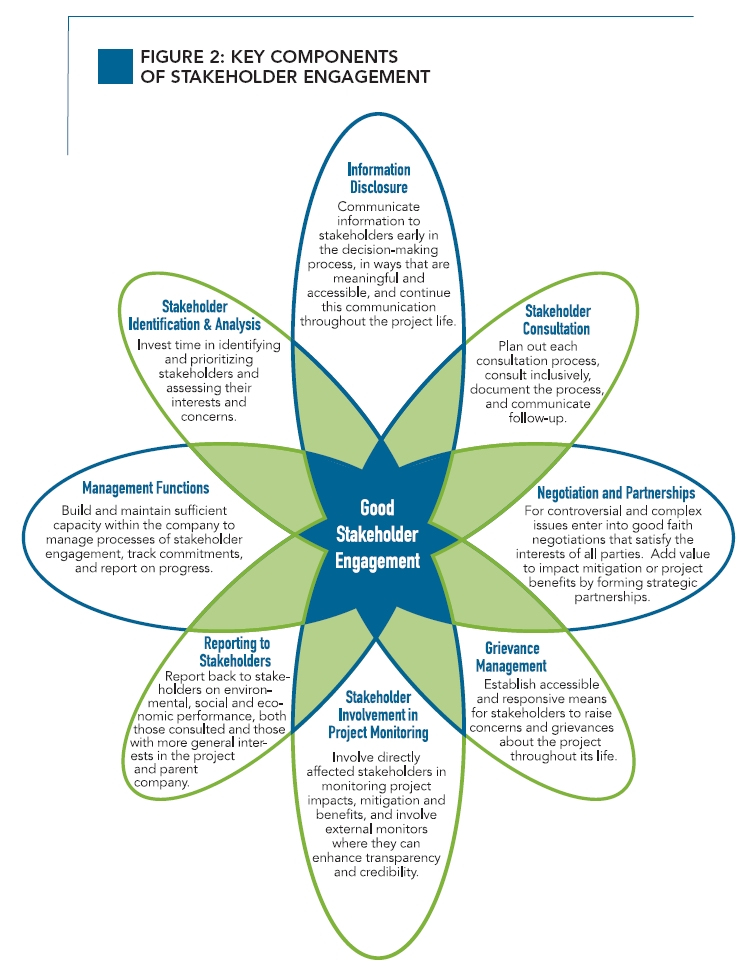

Stakeholder

Engagement: A Good Practice Handbook for Companies Doing Business

in Emerging Markets from the International

Finance Corporation draws on the current thinking and best practices

of a range of companies and other institutions to provide the good practice

"essentials" for building and sustaining constructive relationships over

time as a means of risk mitigation, new business identification, and enhancing

development outcomes. The Handbook offers new and detailed guidance in

a number of areas, including gender, indigenous peoples, grievance mechanisms,

sustainability reporting, management functions, and the integration of

stakeholder engagement activities with core business processes.

Stakeholder

Engagement: A Good Practice Handbook for Companies Doing Business

in Emerging Markets from the International

Finance Corporation draws on the current thinking and best practices

of a range of companies and other institutions to provide the good practice

"essentials" for building and sustaining constructive relationships over

time as a means of risk mitigation, new business identification, and enhancing

development outcomes. The Handbook offers new and detailed guidance in

a number of areas, including gender, indigenous peoples, grievance mechanisms,

sustainability reporting, management functions, and the integration of

stakeholder engagement activities with core business processes.

A new report from Business for Social Responsibility proposes shifting supply chain management from a surveillance model to a comprehensive, proactive solution. In the globalisation explosion of the late 20th Century, corporate pursuit of cheaper labour stretched supply chains like rubber bands encircling the world to reach regions where supplier labour rights, human rights, and environmental standards typically matched pay. Since before the turn of the century, NGOs and CSR practitioners have attempted to pull standards up through factory monitoring and auditing, achieving some success. Beyond Monitoring: A New Vision for Sustainable Supply Chains maps a new supply chain landscape, shifting from periodic surveillance to “catch” negative practices to comprehensive, systemic change toward positive practices. The report proposes a four-pronged approach:

-

First, buyer internal alignment to address the “unresolved tension” (to quote a World Bank report) between buyers’ commercial objectives and their desire to ensure fair working conditions.

-

Second, supplier ownership of good working and environmental conditions in their workplaces in exchange for buyers securing long-term relationships.

-

Third, empowerment of workers, who take a stronger role in asserting and protecting their own rights.

-

Fourth, public policy frameworks in recognition of the limits of voluntary initiatives and the value of setting level playing fields.

The report breaks new ground with the final two pillars, which have largely been neglected until now. The first model encompassing all four Beyond Monitoring pillars is the International Labour Organization Better Work initiative, which grew out of its Better Factories Cambodia program. The second is a collaborative program in the information and communication technology industry in China that partners BSR with FIAS, EICC, and GeSI, which is described in depth in a July 12 report.

The US National Wildlife Federation released ratings on progress by companies using sustainable wood products. Ratings are based on the amount and visibility of their FSC-certified products. Crate & Barrel in particular was noted for giving preference to vendors that use recycled or sustainably managed wood. The Forest Stewardship Council's certification is used because FSC certified product helps support sustainable forest management, which reduces the emission of greenhouse gases and protects wildlife habitat. The NWF says it plans annual surveys of retailers. The full scorecard is available for download from the National Wildlife Federation's website.

The SEJs' Guide to Climate Change Information and Disinformation released in July is an extensive resource list from the Society of Environmental Journalists. It is aimed at reporters, but provides a wealth of tips, facts and experts to help anyone sort out fact from fiction in the climate change discussion.

UNEPFI Human Rights Toolkit provides a framework for lending managers to:

-

identify potential human rights risk in lending/investing

-

assess the materiality of the risk

-

identify possible risk mitigants

Financial institutions may want to use the tool to assess the human rights issues in their own business and its supply chain.

Venture Capital

The European leveraged finance market is an "unsustainable bubble", according to 60% of respondents to a survey conducted by law firm White & Case and almost 80% expected the bubble to burst in 6-12 months’ time. Ironically, the vast majority of banks, private equity firms and turnaround specialists surveyed expected the growth in LBOs, lending and in debt multiples to continue over the next six months. Given the current volatility in markets it is prudent to walk the talk, ie don't get in to deals that would be compromised by rising capital costs.

Summit Partners has agreed to acquire to online post secondaryeducation division of Touro College. No financial terms were disclosed.

K12 Inc., a Herndon, Va.-based provider of online education curricula and learning programs, has filed for a $172.5 million IPO. It plans to trade on the NYSE under ticker symbol LRN, with Morgan Stanley and Credit Suisse serving as co-lead underwriters. K12 has raised around $45 million in VC funding, from firms like Constellation Ventures.

Achive3000, a Lakewood, N.J.-based provider of online reading, vocabulary and writing instruction, has raised $9 million in funding from Insight Venture Partners.

Irish software entrepreneur Barry O'Callaghan has pulled off his second mega-deal in less than a year, with his Houghton Mifflin Riverdeep set to buy the US education provider Harcourt for $4 billion.

Hercules Technology Growth Capital has provided $3 million of venture debt funding to Prism Education Group, a Philadelphia-based provider of associate degree and diploma -level career training programs.

Think Global AS, a Norwegian electric car maker, has raised $60 million in second-round funding. DFJ Element and Rockport Capital Partners co-led the deal, and were joined by UK Hazel Capital and CG Capital. Think Global raised a $25 million first round earlier this year.

SoloPower, a California developer of thin-film photovoltaics, has raised $30 million in Series B funding. Convexa Capital of Norway led the deal, and was joined by return backers Crosslink Capital and Firsthand Capital Management.

SkyFuel Inc. a developer of utility-scale solar thermal projects raised $1.6 million in a seed round of funding, according to a filing with the Securities and Exchange Commission. The filing indicated that the financing was raised from angel investors.

Sierra Solar Inc., a developer of “affordable” thin-film photovoltaics, has raised $6.86 million in Series A funding led by GSR Ventures, according to a regulatory filing.

MWOE Solar, a maker of thin-film solar panels, has raised $7 million in a Series A round from Emerald Technology Ventures and NGP Energy Technology Partners.

Qlusters Inc., a provider of open-source systems management solutions for software provisioning and managing virtual environments, has raised around $10.36 million in Series C funding, according to a regulatory filing. Network Appliance Inc. was joined by return backers Benchmark Capital, Charles River Ventures, DAG Ventures and Israel Seed Partners. Qlusters has raised around $23 million in total VC funding since 2001.

Gevo Inc., a developer of advanced biofuels like butanol, has raised an undisclosed amount of Series B funding from Virgin Fuels and return backer Khosla Ventures. VentureWire pegs the round amount at $10 million.

SNTech Inc, a Seoul-based cleantech company, has received a $1.2 million investment from SAIL Venture Partners, which takes a 25% stake in the business.

TSG Consumer Partners has sold its stake in Alexia Foods Inc., a Long Island City, N.Y.-based natural foods company, to ConAgra Foods Inc. No financial terms were disclosed. Alexia was founded in 2002, and generates around $35 million in annual sales.

Sun Capital Partners completed its acquisition of the fabrics division of Interface Inc. (Nasdaq: IFSIA). The transaction was valued at up to $70 million, including a $63.5 million up-front cash payment. The fabrics division makes interior fabrics and upholstery products for automobiles, and markets under the Guilford of Maine, Chatham and Terratex brands, and provides specialized automotive textile solutions.

TPG Capital’s Aleris International, a maker of aluminium sheets, is to acquire Wabash Alloys of Indiana, a recycler of scrap metal into aluminium alloys, for $194 million.

Thomson Financial and the National Venture Capital Association released US 2Q fund-raising data. Overall 68 funds raised $7.1 billion. There was high growth of expansion stage and late stage funds that were raised. Although 39 early stage funds, led by Draper Fisher Jurvetson and Emergence Capital Partners, raised about $2 billion during the quarter, 10 expansion focused funds raised $2.8 billion in the second quarter of 2007, shattering the previous record from the first quarter of 2000 when three funds raised $1 billion. Among the funds active in Q2 ’07 were Insight Venture Partners VI, which raised more than $900 million, Institutional Venture Partners XII, $600 million and Sequoia Capital China Growth Fund, about $430 million. In addition, 10 balanced stage funds and seven later stage funds, including the third largest fund of the quarter, North Bridge Growth Equity I at $545 million, accounted for more than $2.4 billion during the quarter.

UK stock markets experienced a second quarter surge in the number of IPOs with a 129% increase on the same period last year according to the latest PricewaterhouseCoopers quarterly IPO Watch Europe survey. London was the largest market in terms of offering value and volume in the quarter, with 102 IPOs raising € 14,808 million compared with 108 IPOs raising € 6,454 million in 2006.

On the other hand, data released by Library House, a UK research house specializing in early-stage European tech companies, showed the amount of venture capital invested in Europe contracted during the second quarter of 2007. In Q2 2007, under €1.4 billion of venture capital was invested in Europe down slightly from Q1 and substantially down from the €1.7 billion invested in the second quarter of 2006.

But do not write off European VC. As Amanda Palmer editor of EVCJ comments: For some time now European venture capital has been the “ginger step child” of the private equity industry – everyone knows it’s there but no one really pays it any mind. But with10 European countries including Lithuania, Ireland, Belgium and Switzerland producing more science and technology graduates per head of population than the US and Russian and Polish coders beating US-based ones in competitions on sites like topcoder, the next generation web-based businesses is likely to end in .co.eu rather than .com.

And overall the European venture capital funding scene has improved immensely over the last five years. According to a recent European Venture Capital report released by Ernst & Young, IT had the most significant upturn in investments of any industry in the first quarter of this year totaling €505.2 million, an increase of over €30 million, in capital investment. Library House also conducted some interesting research which breaks down venture capital investment into geographic clusters which analyses the US market beyond the national level. In this view, California and Boston are way out ahead but the UK is third in terms of the amount of venture capital investment. Five years ago it would have been virtually impossible to consider building a global technology business outside the US. But times are changing. Against measures such as broadband penetration, percentage of online advertising spends and mobile phone adoption – the US is no longer the world’s most important market.

And according to the 2006 Global Venture Capital Survey sponsored by Deloitte & Touche in cooperation with the National Venture Capital Association, 54% of US venture capitalists are not investing outside the US and 73% of those are not planning to. Of the 46% who do invest globally, they invest so little in global deals that it makes up less than 5% of their capital. As with geopolitics it has been difficult for America to look beyond her own back yard, but in an increasingly interconnected world, where growth is coming from Asia and Central Europe, this must change to be successful.

According to a report from Cleantech Network, venture capitalists invested $420 million in Chinese clean technology companies in 2006, more than double the previous year's $170 million. The network predicted the trend would continue, with clean-tech venture capital investment reaching $580 million this year, and surpassing $720 million in 2008. "Policy drives much of the interest in China's clean-tech industries. The enforcement of China's renewable energy law attracted a flood of VC investment into energy-related fields in 2006," the report said. Some 70% of the $420 million total was invested in the solar sector, including 2006's largest VC deal – the $53 million first-stage investment by CVC International and Good Energies in SolarFun, a manufacturer of photovoltaic cells. SolarFun was subsequently floated on US exchange Nasdaq, a trend that is also set to continue with at least four solar companies expected to go public this year. Energy generation will continue to take the lion's share of VC investment in coming years, but water and wastewater will be the next emerging segment. Of the 26 deals struck in 2006, six were in the water sector, for a total of $90 million. However, the report predicts water technology investment will only reach $100 million by 2008. Overall VC investment in China reached $2.2 billion in 2006, and the report said veteran investors see opportunity in clean-tech that is akin to IT, which today is the dominant investment segment in China.

A great initiative has been launched by some of European venture capital’s bigger players, including 3i, The Accelerator Group, Accel Partners, Highland Capital, Wellington Partners, Advent Ventures, Atlas Ventures and Baulderton Capital, have launched Seedcamp. 20 teams selected from online applicants will be invited to London for “a week of intensive mentoring and networking” with industry experts in fields like HR, law, marketing and product development. At the end of that week scheduled for September 3rd through the 7th the top five teams will be announced and they’ll receive €50,000 in funding and an additional three months of mentorship. This camp is groundbreaking in Europe as it is one of the first times that the industry has reached out to entrepreneurs in this way.

BusinessWeek offers a small taste of the interest some managers now have in microfinance here and a small study of micro-VC here.

Interest Rates and Currencies

In July US futures markets started pricing in a 100% chance of the Federal Reserve cutting short-term interest rates by December. While inflation will be as much of an influence on this as economic prospects, it is a guide to market sentiment, particularly about risk. The rise in interest rates has already affected M&A and private equity. Until recently, issuers of high-yield bonds and loans, the portion of the capital structure that allows the deal to go ahead, were able to borrow at thin spreads over the base rate. That relationship has now been broken and high risk debt is being more appropriately priced. As a result, more than 40 companies, many the targets of leveraged buyouts, have had to cancel, postpone or sweeten bond or loan offerings in July.

Bulls point out that share prices are not, on average, particularly high as a multiple of profits. The economy is reasonably strong. Plenty of companies are still racking up good profits. But it is not these corporate fundamentals that are driving the markets right now. Instead, it is subprime woes and the awful possibility of a full-blown credit crunch.

America would be helped by a stronger currency, but there is nothing attractive about it at the moment - a wrecked balance sheet and low yield. It seems hard to believe, but perhaps numbers have been inflated by a massive spend on the Iraq war ($ 100 billion a year) which does not add to US productivity and a wasting of the administrative, transport, health and energy infrastructure of the nation.

Falling food and energy prices helped US wholesale prices rise slower in June, its first fall since January. Its the harvest season and less energy is needed for heating. This trend will not last. Producer price inflation fell 0.2% last month, but the core number, which excludes volatile food and energy prices, rose 0.3%, mainly as a result of rising car and light truck sales (- how many financed on credit that is getting more expensive?).

The US Federal Reserve has kept rates steady at 5.25%, saying it had concerns that inflation might fail to "moderate". We don't expect them to come down soon, painful as that might be.

In the UK, GDP rose by 0.8% in 2Q. It was the sixth consecutive quarter of above-average growth, ahead of analysts' predictions of 0.7%. Annual growth came in at 3.0%, ahead of the 2.9% forecast.

The Bank of England raised interest rates to 5.75% in July. The Monetary Policy Committee said there were no major signs of a slowdown in consumer spending or the housing market despite previous rate rises. Rates have risen five times in the past year as policymakers have tried to contain inflationary pressures. Inflation weakened last month to 2.4% but the fall was smaller than expected. The optimism has been driven by a boisterous London property market and active financial services sector. If the UK was in the Euro zone it might stabilise the frothy market as transparency would rise. And with Europe's stable performance being more attractive than US volatility, the unthinkable might be discussed. In the meantime, perhaps Prime Minister,and erstwhile Chancellor, Brown has other plans. Perhaps tax will change. The private equity industry is already being investigated. September will be an important time to gauge direction.

The pound marked a 26-year high against the US dollar, exceeding $2 / £, amid contrasting prospects for interest rates in the two countries.

It is not just the pound, the euro also rose to new highs against the dollar, amid worries about the US economy.

The People's Bank of China (PBC) ordered an increase of 0.27% in commercial banks' benchmark one-year deposit and lending rates. The one-year benchmark deposit rate will move to 3.33% from 3.06%, while the one-year lending rate will rise to 6.84% from 6.57%. The move comes a day after data showing that China's economy outstripped analysts expectations during the second quarter, growing by 11.9% from a year before.

The government has said it would "improve macro controls" to rein in the economy, whose rapid growth has pushed inflation to a 33-month high of 4.4% for the year to June.

China's yuan also recorded a new high against the dollar, over 7.28% higher than its value in July 2005 when the government ended its fixed exchange rate policy. It has traded above 7.55 per USD. Maybe simply depositing Yuan would be a long term, safe, attractive investment.

A critical fact of China's size and growth now is that its capital flows are increasingly affecting global balances. It is now accumulating dollars at about $ 500 billion and the amount of accumulation is nearly doubling every year. Still smaller than the amount of US GDP annual growth, but its in range now and at these rates would match the US in a few years.

This rapid growth leads to a nice problem to have for the China - how to invest this accumulation of foreign reserves. Blackstone and Barclays are part of that, but that can only be the start.Maybe they'll buy some US property portfolios at knock down prices.

Total world foreign exchange reserves are $5.3 trillion. The dollar share is $3.4 trillion, or 64.2% of the total, which is at its lowest share level since 1996. Rising are the euro, pound sterling, and "others." China owns about $1.2 trillion of those dollars. Russia and India own another $0.8 trillion. Add to these three Korea, Japan, and Taiwan and those 6 Asian nations have $3.1 trillion, or 93% of all dollar reserves. Maybe the idea that they will diversify to Euro and other currencies and away from government bonds should be taken more seriously by US policy makers.

But, as Pakpoom Vallisuta shared with me, Stephen Jen of Morgan Stanley raises another spectre - that the $ 20 trillion managed by US real money managers (a lot more than dollar foreign exchange or even world foreign exchange reserves) will be diversified away from $ and US assets, and that this has begun to happen.

Trade and FDI

After the list of problems with Chinese goods exported to the USA, China closed down three companies and arrested several people involved in food and drug scandals. Two of the firms exported contaminated wheat protein to the US that eventually led to the deaths of cats and dogs. Another firm was shut down after being linked to the deaths of a number of people in Panama. Also as expected, the former head of China's State Food and Drug Administration, Zheng Xiaoyu, was executed for corruption, after being convicted of taking 6.5 million yuan ($850,000) in bribes linked to sub-standard medicines and of dereliction of duty at a trial in May. Newly appointed to be in charge of food and drug safety,Minister Li Changjiang, has promised China would improve its standards and personally oversaw the company closures. Li said two other suspected cases of sub-standard products turned out to be untrue and blamed the foreign media for not waiting until the full facts were known before reporting these incidents.

Ironically, while China suffers media condemnation, a new US study in July from a network of nine state environmental agencies reveals that over 60% of PVC packaging tested contains toxic heavy metals that violate laws in 19 states. Due to compounding evidence of PVC's toxicity, particularly its release of dioxin (the most potent carcinogen on the planet), a growing list of manufacturers and retailers have publicly committed to phase out this toxic plastic in their packaging. Unfortunately, PVC is as equally ubiquitous in the products themselves. Consumers can avoid PVC products by looking for the number "3", "PVC" or the letter "V" inside the recycling symbol. Not all PVC products are labeled as such, but soft flexible PVC products (common in baby toys) often have an odour similar to vinyl shower curtains.

World trade has expanded dramatically since the end of World War II from $ 80 billion in 1953 to more than $8 trillion now, but Africa's share of world trade has been steadily declining. Africa mainly exports commodities like coffee, copper and diamonds which have fallen in value relative to manufactured exports like clothing and computers, which many Asian countries have specialised in. Their share of world trade has risen dramatically. At the Gleneagles G8 summit, rich countries pledged to open their markets to the poor, but progress has been painfully slow in the world trade talks. Doha is dead. Much more needs to be done to improve Africa's ports, roads and airports, and to increase manufacturing exports. See here how Africa has fared one year after the G8 promises

Activities and Media

While the weather has been boringly grey and wet, there was some sporting relief through Wimbledon (it was nice to see gentleman Federer win in front of Borg) and the Tour de France (or chaotic drug soap opera - though refreshing to see self-policing and Rabobank firing the team leader for lying) which provides some motivation for getting on my own bike.We were also afforded some welcome diversion by visitors from around the world - Hong Kong, London/Brussels, and Stockholm/Montreal - who brought us stories of what's really happening beyond the farm gate.

Although the weather has been a nuisance in the garden, we have started harvesting which means some of the best food on the table we get all year. I had to harvest potatoes early, because the humid weather encourages blight, but the fruit harvest has been fantastic. And Pam's gooseberry jam is delicious, even when I turn it in to homemade gooseberry ice cream ... mmmmm!

And we did get a few days of dry weather so I was able to finish our roof extension, including 2 hand-made skylights - amazingly it doesn't leak!

Having school holidays also means a bit more time entertaining the children, which I love to do even if it means compromising on some of the things I "should" be doing. One of which was making sure clients' equity portfolios didn't get wiped out (readers of the Investment section will be familiar with my caution). Fortunately timing was opportune and gains were preserved ... phew!

By strange coincidence in July I happened to notice two important legal milestones in the area of education which were engineered by (unrelated?) Butlers. The first rather shameful, the second positive. (I mention these simply as a kind of humorous pedigree.) July saw the anniversary of the decision of the Scopes Trial which upheld the so-called Butler Act (1925) in the US. John Washington Butler, a farmer, wrote a 2 page anti-evolution law which came to prohibit the teaching of evolution and require the teaching of creationism which stayed on the books till 1967! (Not quite as bad as Pierce Butler's role in creation of the Electoral College system, infamous for its role in the 2004 US election). More positively, RA Butler underwrote the UK's Education Act of 1944 which revolutionised education in the UK providing better access and raising its profile.

A couple of the websites that I came across during research and browsing that you might enjoy include the following.

Live Science, a fun place to explore science fact and fiction with easy reading and good pictures. Worth a browse for all age groups.

A new interactive map allows users to find green businesses and activists around the globe, or find regions that have received or desperately need some "green action."

The World Future Society had their annual meeting at the end of July: Fostering Hope and Vision for the 21st Century. You can find papers from it here. As always there are provocative and interesting perspectives to stimulate strategy, like The Death of Evolution: Long Live Creation.

I'm dipping into Winds of Change by Harold Macmillan. Its the first part of his autobiography and not my usual reading preference. But it offers some interesting reference points. It starts before World War One when horse transport dominated and moves through to World War Two when automotive vehicles had taken over. It describes his brief experience of war and fighting in the trenches in a personal manner that helps one realise how naive belligerence is. It is worth a browse if you have access to a copy.

A new book The World Without Us by Alan Weisman takes the reader on an interesting journey to consider how nature would recover if suddenly humanity was wiped out. While a morbid scenario, the good thing is that his conjecture is that nature would soon enough erode the edifice of humanity and return nature to its natural balance. Unfortunately, there is one bleak spot - climate change. He posits that it would take 100,000 years to return to pre-human levels of CO2. This long lasting legacy would therefore continue to fuel climate change and that in itself has the potential to destroy nature's balance and with it, nature.

Hazel Henderson's new book Ethical Markets: Growing the Green Economy is receiving good reviews. It is an exhaustive survey of the sustainable business landscape, serves as a perfect primer on green economics and tracks lesser-known trends and developments.

Please forward this publication to associates, family and friends, print

it, and share it.

This is a publication of: Astraea, Ireland + 353 59 9155037 Subscribe

and Unsubscribe

This report has been prepared for information purposes and is not an offer, or an invitation or solicitation to make an offer to buy or sell any securities. This report has not been made with regard to the specific investment objectives, financial situation or the particular needs of any specific persons who may receive this report. It does not purport to be a complete description of the securities, markets or developments or any other material referred to herein. The information on which this report is based, has been obtained from publicly available sources and private sources which may have vested interests in the material referred to herein. Although GRI Equity and the distributors have no specific reasons for believing such information to be false, neither GRI Equity nor the distributors have independently verified such information and no representation or warranty is given that it is up-to-date, accurate and complete. GRI Equity, associates of GRI Equity, the distributors, and/or their affiliates and/or their directors, officers and employees may from time to time have a position in the securities mentioned in this report and may buy or sell securities described or recommended in this report. GRI Equity, associates of GRI Equity, the distributors, and/or their affiliates may provide investment banking services, or other services, for any company and/or affiliates or subsidiaries of such company whose securities are described or recommended in this report. Neither GRI Equity nor the distributors nor any of their affiliates and/or directors, officers and employees shall in any way be responsible or liable for any losses or damages whatsoever which any person may suffer or incur as a result of acting or otherwise relying upon anything stated or inferred in or omitted from this report.