Business and Investor Resources

Governance and Investor Responsibility

- Analysis,

Data, Tools, Links

- Analysis,

Data, Tools, Links

Private and Confidential

GRI Equity Review - September 2005

- Perspective

- Geopolitics * Risk and terror

- Investment, finance & VC * Interest rates and currencies * Trade & FDI

- Energy * Climate Change

- IT

- Integral systems and LOHAS

- Activities, Books and Gatherings

Ch...ch...ch...changes!

Perspective

Ray Kurzweil is a leader in articulating the increasing rate of technology change and its impacts. He himself has been part of this revolution as an inventor of speech recognition, scanners, music synthesizers and more: http://www.kurzweilai.net. Kurzweil's Law of Accelerating Returns says that in an evolutionary process, positive feedback increases order exponentially. A correlate is that the "returns" of an evolutionary process (such as the speed, cost-effectiveness, or overall "power" of a process) increase exponentially over time -- in a range of fields including biology, physics, chemistry and psychology. Technology, like any evolutionary process, builds on itself. And in his new book "The Singularity is Near" he makes a strong argument that technology will itself become intelligent within 3 to 5 decades. "The paradigm shift rate (i.e., the overall rate of technical progress) is currently doubling (approximately) every decade; that is, paradigm shift times are halving every decade (and the rate of acceleration is itself growing exponentially). So, the technological progress in the twenty-first century will be equivalent to what would require (in the linear view) on the order of two hundred centuries. In contrast, the twentieth century saw only about twenty-five years of progress (again at today's rate of progress) since we have been speeding up to current rates. So the twenty-first century will see almost a thousand times greater technological change than its predecessor." While we see some critical limitations to his extrapolative thinking (systems generally follow an S curve and we may be at the bottom curve, ie accelerating, but that will level off naturally), the sound research and experience foundation of his view underlies the fact that the "rate of change" is accelerating in a logarithmic fashion and will do so for the coming generation.

Evidence of the acceleration of change in natural phenomena is also rising. The section on climate change below alerts us to the fact that Arctic ice melt rate is accelerating and the ability of plants to be a net absorber of CO2, a greenhouse gas, is waning because climate temperatures are rising too fast.

This requires a fundamental paradigm shift in human thinking. Our way of life is built on the status quo - history is the window to the future. But this is now being undermined. At the first level of change this may simply mean new technology disrupting social and economic models, for which we will find new models. But if the change is accelerating in this logarithmic fashion, the foundation of reason may become a moveable reference because natural systems change their laws constantly. This resonates well with the biology of emerging intelligences. It is clear that humans will think differently in one or few generations.

Today, in order to succeed in this changing world, leaders must think differently: they must think about a lot more dimensions and in a shorter time frame. Resorting to institutional logic will not solve the challenges of today. The following informal opinion from a private think tank illustrates the tension in our global powerhouse America where this challenge is immediate:

Americans invented the telephone, the atomic bomb, and the silicon wafer, and they put a man on the moon, but a very simple scientific fact eludes many of them -- not for 270,000 years has there been as much carbon dioxide in the atmosphere as there is now (~380 parts per million). An atmosphere that traps more heat holds more moisture and produces more frequent extreme-weather events. A 12-year-old could understand this. ... The end run of September 11 was the Iraq war. Will the end run of Katrina be more intensive U.S. oil exploration and fossil-fuel burning? [We] may one day thank the 2005 hurricane season for thwarting the economic arguments against climate action and security. [Ignoring] global warming really is worse than trying to do something about it.

How do we begin to deal with these challenges which seem to have no solution?

Integral thinking is the leading solution to the challenge and it is therefore a prudent investment to develop this skill. Unfortunately, it is an emerging science (in whose application we specialise as you, dear reader, will know) which has yet to be adopted by most leading businesses, nations and organisations. And you have to look carefully to find academic institutions which are applying it - although a number of top executive education organisations are establishing partnerships to develop courses. A basic model of integral systems analysis is available here. The underlying approach is founded in natural science and reflects natural systems - flexibility, robustness. The principle is to analyse situations and organise solutions reflecting a whole system approach. This incorporates three main spheres physical, intellectual, ethical along a spectrum of emerging intelligence from basic needs (like shelter, or sales), through more complex needs (like organisation and communication) to whole system needs (like equity). Fortunately integral thinking is innate in all of us though generally repressed by traditional education and institutions, and can be liberated in a reasonable time frame. We are also in the age in which it is emerging. An example of integral thinking is the web: a self organising, non-hierarchical reflection of all members' (users) needs.

Geopolitics

Today 20,000 people will die from poverty related problems in the world's poorest countries. This shocking statistic is at the heart of this year's global anti-poverty campaign. Its simple message is that continuing poverty and death on this scale is no longer morally or politically acceptable. The September UN summit in New York evaluated progress made in working towards the Millennium Development Goals agreed by world leaders in 2000. Many countries, particularly in sub-Saharan Africa, will not meet the goals - to halve poverty and hunger, to achieve universal primary education, and to halt the spread of Aids - by the target date of 2015. What is certain is that new thinking is required. How can we learn from development work and avoid the mistakes of the past? What innovations, good science and new resources can be used to defeat poverty? What networks and partnerships can be created to tap into the concern shown by ordinary citizens, business and professionals after the Asian tsunami and during the Live 8 campaign? New models of partnership are emerging between official government aid programmes, business and non-governmental aid agencies. Micro finance (2005 is the year of) is a fast growing financial sector and offers both attractive investment metrics and poverty alleviation. So progress is being made. But changes in behaviour will only be effective at the personal level where action makes the difference.

This year’s Human Development Report (6.4 mb pdf) by the UNDP takes stock of human development, including progress towards the MDGs. Looking beyond statistics, it highlights the human costs of missed targets and broken promises. Extreme inequality between countries and within countries is identified as one of the main barriers to human development—and as a powerful brake on accelerated progress towards the MDGs.

Faced with the biggest crisis of his political life, President Bush has hit the bottle again. A Washington source said: "The sad fact is that he has been sneaking drinks for weeks now. Laura may have only just caught him, but the word is his drinking has been going on for a while in the capital. He's been in a pressure cooker for months. I think it's a concern that Bush disappears during times of stress. He spends so much time on his ranch. It's very frightening."

German election result is seen by many to be problematic in that no clear winner arose. However, this may suit the revitalisation of the German economy and is certainly reflective of the cultural changes occurring. The required coalition will have representation from the business community as the FDP (business orientation, reduce taxes, reduce contributions to state pension) had its strongest showing ever. The uncertainty is not a bad thing because it encourages critical thinking and change which is what Germany needs.

Koizumi’s Liberal Democratic Party won an outright parliamentary majority in the Japanese election. He also succeeded in crushing many of the dissidents who had defied him over his insistence on privatising the postal savings system. A great vote of confidence and well deserved. Japan's economic revitalisation will continue.

The first multiparty presidential elections were held in Egypt. They were not as open as that sounds but this is a significant milestone in the development of Egypt and the Middle East.

I don't believe it - North Korea will provide food and fuel in exchange for giving up nuclear ambitions. But in fact, that agreement only lasted a day and North Korea retracted their acquiescence, saying it will not give up its nuclear programmes until the United States provides it with reactors, thus reinforcing the fact that dealing with that regime will be as tricky as ever.

Iran stated that it is an inalienable right to develop nuclear weapons. This is certainly ethical as long as others have them and do not share them. There is a nuclear apartheid until the technology is possessed by all. The reality is that discussion has been provoked but little change will occur because America is intractable.

Congratulations to Israel for their Gaza pull-out. Progress towards cohabitation and peace was rocked in late September by missiles after Hamas said they would cease fire! But cooperation continues to improve.

Similarly in Northern Ireland after the IRA confirmed weapons' decommissioning, violence erupted as the Orange order, feeling disenfranchised, started a spate of coordinated mob-violence. This appears to be instigated by a few incumbents but is reviled by others including the Irish government and Sinn Fein.

Thailand's Thaksin Shinawatra opened the new $ 4 billion Bangkok airport terminal. Unfortunately the infrastructure is only half finished and won't be completed till at least next June. He insists the airport will beat its rivals in the region to become East Asia's dominant transport hub - a goal his critics say is within reach, but only if the government acknowledges its past mistakes. Though he managed to fill the airport with dignitaries to fake the opening because he had promised it, this event is another indicator of limited transparency in Thai business and the evident crony capitalism.

An estimated 1,247 donkeys, 306 horses and 24 camels, not to mention helicopters and hundreds of trucks, were used to carry ballot papers to the remotest corners of Afghanistan for its elections. Such heart-warming statistics show the importance the world attaches to the first parliamentary elections in Afghanistan in more than 30 years; the $159million (€130million) cost of the United Nations-organised election was borne by foreign governments. This may be a bit of overkill and reflective of the Bangkok airport approach above - show not substance. Many voters are illiterate and will have been baffled by newspaper-sized ballots displaying hundreds of names. Women were in many cases prevented from voting. It appears turnout was lower than for the presidential poll that confirmed the US-backed Hamid Karzai as head of state last year.

Risk and Terror

The EC decision to legalise the importation of Monsanto’s patented GT73 oilseed rape is self-inflicted bio-terrorism. It is the first live GMO seed to be authorised for use as animal feed in the EU, even though the spilled seeds inevitably produce a crop. GT73 can now be freely imported. The decision was taken against the wishes of the majority of EU member states. If a single shipment of these GMO seeds is unloaded, contamination will be inevitable and irreversible. This means that in a few years time, it may be impossible for farmers to grow GM-free Brassica crops including broccoli, brussel sprouts, cabbage, cauliflower, collards, kale, kohlrabi, mustard, oilseed rape and turnips because of cross-contamination by seed dispersal and wind-borne pollen. All these contaminated crops will belong to Monsanto; contaminated farmers will have to pay royalties or face patent infringement lawsuits; they will have to put GM labels on their produce, and may no longer be able to sell it in most EU countries. Many organic farmers will lose their constitutional right to earn a livelihood. This policy will have longer lasting and more pernicious affects than the war in Iraq, especially if other GMO's like Monsanto's Terminator are allowed to be propagated.

In Iraq, a woman walked up to the gate of a new army

and police recruitment centrer in Tal Afar, a northern city, last week

and blew herself up, killing 8 people in addition to herself and wounding

57. In the same week, armed men dressed as police officers burst

into a primary school in a town south of Baghdad, rounded up five Shiite

teachers and their driver, marched them to an empty classroom and killed

them. The war in Iraq remains

bloody and inhumane. Is there a solution?

Andy Krepinevich appears to have some sound ideas. NY

Times' David Brooks' Winning in Iraq describes Andrew Krepinevich

as a careful, scholarly man. A graduate of West Point and a retired

lieutenant colonel, his book, "The Army and Vietnam," is a classic on

how to fight counterinsurgency warfare. His friends and colleagues

in the army have no clear strategy or metrics for managing this war.

Krepinevich has now published an essay in the new issue of Foreign Affairs,

"How to Win in Iraq," in which he proposes a strategy. The article is

already a phenomenon among the people running this war, generating discussion

in the Pentagon, the C.I.A., the American Embassy in Baghdad and the

office of the vice president. Krepinevich's proposal is hardly new.

He's merely describing a classic counterinsurgency strategy, which was

used, among other places, in Malaya by the British in the 1950's. The

same approach was pushed by Tom Donnelly and Gary Schmitt in a Washington

Post essay back on Oct. 26, 2003; by Kenneth Pollack in Senate testimony

this July 18; and by dozens of mid level Army and Marine Corps officers

in Iraq.Krepinevich calls the approach the oil-spot strategy. The core

insight is that you can't win a war like this by going off on search

and destroy missions trying to kill insurgents. There are always more

enemy fighters waiting. You end up going back to the same towns again

and again, because the insurgents just pop up after you've left and

kill anybody who helped you. You alienate civilians, who are the key

to success, with your heavy-handed raids. Instead of trying to kill

insurgents, Krepinevich argues, it's more important to protect

civilians. You set up safe havens where you can establish good

security. Because you don't have enough manpower to do this everywhere

at once, you select a few key cities and take control. Then you slowly

expand the size of your safe havens, like an oil spot spreading across

the pavement. Once you've secured a town or city, you throw in all the

economic and political resources you have to make that place grow. The

locals see the benefits of working with you. Your own troops and the

folks back home watching on TV can see concrete signs of progress in

these newly regenerated neighbourhoods. You mix your troops in with

indigenous security forces, and through intimate contact with the locals

you begin to even out the intelligence advantage that otherwise goes

to the insurgents.

A new book, Night Draws Near: Iraq's People in the Shadow of America's War by Anthony Shadid is a favourably reviewed book that brings insight and colour to this ongoing dilemma.

The natural disasters in America have had an impact on America's conscience,

though it is too early to know how large or long lasting. I know

that the initial chaos was embarrassing and painful. New Orleans

looked like Iraq.  The

photo linked

here, showing the difference between finding and looting, illustrates

the tension caused by the loss of resources in New Orleans, but it is

not printed in this note because its too inflammatory. But on

the ground Americans have pulled together. Thousands of people

have worked long hours in foul conditions to resuscitate local communities.

International aid has been offered from all quarters (even Venezuela).

Many Americans, including soldiers returning from Iraq, have leapt in

to action to help. In Houston for example a friend of mine, whose

own house was boarded up, has since collaborated with friends and associates

and opened an old unused school to provide facilities to immigrants

from Louisiana. Once the dust has settled, perhaps by the year

end, everyone will have had a chance to reflect on how their lifestyle

may change to benefit the community.

The

photo linked

here, showing the difference between finding and looting, illustrates

the tension caused by the loss of resources in New Orleans, but it is

not printed in this note because its too inflammatory. But on

the ground Americans have pulled together. Thousands of people

have worked long hours in foul conditions to resuscitate local communities.

International aid has been offered from all quarters (even Venezuela).

Many Americans, including soldiers returning from Iraq, have leapt in

to action to help. In Houston for example a friend of mine, whose

own house was boarded up, has since collaborated with friends and associates

and opened an old unused school to provide facilities to immigrants

from Louisiana. Once the dust has settled, perhaps by the year

end, everyone will have had a chance to reflect on how their lifestyle

may change to benefit the community.

Investment, Finance & V. C.

The global financial climate has not improved. The shift of savings from Asia to US has continued. American savings rate remains in a trough. Asian saving rates are high and these savings are backing the purchase of dollars. But the imbalance will not continue for long. Greenspan gives us the big picture: "History has not dealt kindly with the aftermath of protracted periods of low risk premiums". While interest rates remain modest we must be in one of the most volatile periods of economic history. Risk levels have been raised by the Iraq war (in an age when military action is generally declining), climate change now causes unforeseen risks like Katrina, fires in Portugal and floods in central Europe and China, industrial business cycles have been shortened by the pace of technological change, and consumer behaviour has become sophisticated and flexible because of internet information flows and transaction processing. Assets and people exposed to risk are also greater than ever before. There are a number of pressure valves which can release tension, but all are dependent on multilateral agreement and action, which requires compromise even from America. Sentiment will keep the market buoyant till January, but strategic planning for 2006 should consider that global economic imbalances will seek equilibrium soon.

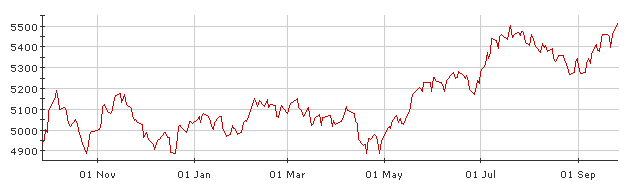

Stock

market performance has been good over the past year as the BBC

global 30 indicates. But successful portfolios are more likely

to have picked low risk stocks as unexpected developments across sectors

occur, from insurance to commodities to pharma.

Stock

market performance has been good over the past year as the BBC

global 30 indicates. But successful portfolios are more likely

to have picked low risk stocks as unexpected developments across sectors

occur, from insurance to commodities to pharma.

Weather-related insured losses have grown 15 times larger over the last 30 years, according to a new report. Availability and Affordability of Insurance Under Climate Change, commissioned by advocacy group Ceres, notes that if present trends continue, climate change could make insurance unavailable or unaffordable for businesses and consumers. Mindy Lubber, Ceres president. "Insurers and regulators have failed to adequately plan for these escalating weather events that scientists predict will intensify in the years ahead due to global warming." Consumers in the US face higher premiums, lowered limits and increased coverage restrictions thanks to recent weather-related losses, even before the devastation wrought by Hurricane Katrina in New Orleans, according to the report. For example, seven private insurance companies stopped providing homeowner insurance in Florida after last year's string of hurricanes, leaving the state as insurer of last resort, incurring $2.5 billion in losses. The report also notes that weather-related losses in the US have grown from "a few billion dollars a year in the 1970s to an average of $15 billion a year in the past decade." And this growth is 10 times faster than rises in insurance premiums since 1971.

Employer-sponsored health insurance is becoming scarcer and more costly according to the annual health coverage survey conducted by the Kaiser Family Foundation and Health Research & Educational Trust. Their report shows that premiums for job-based health insurance is rising 9.2 percent on average nationwide in 2005, about three times the general rate of inflation. More worrying, the slice of companies providing health benefits to employees has dropped to 60 percent in 2005, down from 69 percent in 2000.

US consumer spending fell 0.5% in August - the largest monthly fall in nearly four years - reflecting the recent rise in gasoline and domestic fuel prices. Petrol climbed above $3 a gallon for the first time after Hurricane Katrina. And the government estimated that the hurricane destroyed uninsured property worth $100billion in four Southern states. Consumer confidence, as surveyed by the University of Michigan, dropped by more than expected in September. The index of consumer sentiment dropped to 76.9 in September, from 89.1 in August, the biggest drop in two years. The Conference Board's Consumer Confidence Index sank 18.9 points to 86.6 from a revised 105.5 in August. Figures also showed a 0.1% fall in personal incomes, due largely to damage wrought by Katrina. When adjusted for inflation, consumer expenditure dropped 1%, the steepest monthly fall since the 11 September 2001 attacks. The higher cost of fuel also pushed up consumer inflation, which rose 0.5% last month. Other figures showed sales of new houses fell in August by their greatest amount in nine months - by a greater than expected 9.9%,however the rate was still 6.2% higher than a year previously, and prices were up 2.5% on July's rate to $220,300.

While the German economy is moving in the right direction, a new concern is rising. 1/7 of German labour is connected to the auto industry which is being forced to rebuild itself by the higher cost of oil and the availability of alternative fuels and transport systems. Nevertheless, it is likely that Germany will manage the change well because there is already a strong foundation of new thinkers. The German industry is more able to restructure itself to serve the new consumer and energy demands and business structures.

Japan's

economy continues to move in the right direction. In

August industrial output rebounded during the month, rising 1.2% in

August from July. Unemployment rate fell to 4.2% in August, from 4.4%

in July, raising hopes that an increase in the workforce could eventually

lead to higher consumer spending. Separate government figures

showed that spending by households headed by salaried workers rose by

3.2% in August from July. Overall consumer spending accounts for

about 55% of the Japanese economy.

Japan's

economy continues to move in the right direction. In

August industrial output rebounded during the month, rising 1.2% in

August from July. Unemployment rate fell to 4.2% in August, from 4.4%

in July, raising hopes that an increase in the workforce could eventually

lead to higher consumer spending. Separate government figures

showed that spending by households headed by salaried workers rose by

3.2% in August from July. Overall consumer spending accounts for

about 55% of the Japanese economy.

The general improvement seen this year have led to prospects that are better than for a very long time for an increase in Japanese institutional weightings to domestic equities. In the longer term, the case for an asset-allocation switch to equities in Japan remains strong given the demographic profile.

UNCTAD's World Investment Report 2005 presents the latest trends in foreign direct investment (FDI) and explores the internationalization of research and development by transnational corporations (TNCs) along with the development implications of this phenomenon.

A recent report illustrates the scale of corruption in China. Many Chinese officials and bankers have escaped prosecution by fleeing abroad with large sums of money, often to other parts of Asia or to North America. The Ministry of Commerce has estimated that 4,000 corrupt officials have fled the country with roughly $50billion in the past two decades.

The Pollution Control Board of Kerala in India has ordered

Coca Cola to close its major bottling plant with immediate

effect. The move comes after several years of protests against the plant

by local campaigners. Villagers in the nearby areas had accused Coke of

depleting local groundwater, and producing other local pollution. The

controversy has received considerable coverage and become a cause celebre

for anti-corporate activists. It is another illustration of "Enron" risk

- unethical behaviour by business leaders resulting in loss of reputation,

business and assets.

We are researching micro finance

with a view to investment. Our working notes are being uploaded

here.

Responsible Investing

Carbon Disclosure Project (CDP), an initiative backed by institutional investors controlling more than $ 21 trillion (£12 trillion) of assets, warns there is a huge and worrying gap between awareness among big companies of the risks posed by climate change and action to combat it. According to the report fewer than one in seven of the world's top 500 companies by market capitalisation has reduced carbon emissions in the past year and in more than one-sixth of cases emissions have gone up. In the most extreme circumstances the cost of meeting tougher curbs on carbon emissions could wipe as much as 45 per cent from the annual profits of some companies such as big American power producers. Steel and mining companies could see reductions in earnings of as much as 20 per cent while the chemicals sector could face annual compliance costs equal to nearly 4 per cent of net profits. Included in the 'blacklist' of companies that failed or declined to participate in the survey are Boeing, Home Depot, Wal-Mart, Apple, News Corporation and Carnival. Nearly half those surveyed refused to disclose any emissions data. CDP signatories have significantly increased from CDP2, when 95 institutional investors representing $10 trillion in assets signed on, to 155 signatories with $21 trillion in assets in CDP3. Most of the world's biggest companies are failing to cut their carbon emissions even though the long-term cost of complying with tougher rules to tackle global warming could have a devastating impact on their profitability.

Imperial Chemical Industries and the two German chemical groups BASF and Degussa have the edge over their competitors in the chemical industry when it comes to acting responsibly toward society and the environment, according to a recent industry survey. The rating agency oekom research took a close look at 23 companies from nine countries and, against almost 200 criteria, assessed how they cope with social challenges and environmental risks. On average, the companies achieve higher ratings on social issues than on environmental issues. The analysts are critical above all of the generally poor efforts to record and evaluate substance risks or to develop environmentally sustainable replacement substances. oekom research acknowledges, on the other hand, that the entire industry has made significant progress in areas which have been focal points of public concern for many years, for example in occupational safety or in plant and transport safety.

Fortune magazine has announced the results of its 2005 Accountability Rating, a rating of corporate responsibility of Fortune Global 100 companies. The Accountability Rating -- compiled by the London think tank AccountAbility and the consultancy CSRnetwork -- scores companies on how seriously their future decisions will consider nonfinancial matters. Topping the survey is BP, followed by Royal Dutch Shell Group (No. 2); Vodafone (No. 3); HSBC Holdings (No. 4); Carrefour (No. 5); Ford Motor (No. 6); Tokyo Electric Power (No. 7); Electricitede France (No. 8); Peugeot (No. 9); and Chevron (No. 10). The Accountability Rating is not an index of how much good the company does or how loud its critics are. "It doesn't seek to label the good or bad but rather to identify the smart," says Simon Zadek, chief executive of AccountAbility. "It's a business, not a moral, rating. It looks at the world's biggest corporations and asks, 'Do they understand how to create and exploit effective business opportunities by addressing the needs of the poor? Do they understand how to make money by investing in environmentally sound business practices? Are they, in short, prepared to maximize the opportunities for our changing world? It will be interesting to see which corporations get smart first in aligning their business strategies to emerging social and environmental risks and opportunities," concludes Zadek. "One thing is clear: Those that will not or cannot change their strategies will ultimately not maintain their rankings in the Fortune Global 100."

Ford seems to be a bit mixed up. On the one hand they invest in top advice from people like Bill McDonagh and Michael Braungart on organisation and infrastructure design and aim for a 10x increase in hybrid cars by 2010. William Ford even joined over 20 global corporate leaders in calling publicly for George Bush and the G8 to set climate-stabilisation targets and adopt cap-and-trade or other market-based mechanisms. But then they decide to fire 10,000 people because they can not think of a better option! They also agreed to sell rental car giant Hertz Corp. for $ 1.5 billion to private equity firms Clayton, Dubilier & Rice (CD&R), Carlyle Group and Merrill Lynch Global Private Equity.

The following hedge fund story is simply an illustrated warning "caveat emptor". The founder and chief executive of US hedge fund Bayou Group have pleaded guilty to a fraud which allegedly cost investors millions of dollars. Chief executive Samuel Israel and the fund's head of finance Daniel Marino admitted to defrauding investors by misrepresenting the value of the fund. They admitted reporting false rates of return on the fund as well as creating a phoney accounting firm as a cover. Bayou is the latest in a growing number of frauds involving hedge funds which are largely unregulated and traditionally serve institutions and wealthy investors - in the last five years, US regulators have unearthed 51 cases involving hedge fund advisers who have defrauded investors to the tune of $1 billion.

Richard Reed, founder and public face of smoothie brand, Innocent,

is one of the 10 finalists short listed for the UK's 2005 Grocer Cup,

awarded to leading industry figures for Outstanding Business Achievement.

Up against supermarket tycoons, such as Tesco’s chief executive, Sir

Terry Leahy, and Sainsbury’s chief executive, Justin King, Reed has

been praised for having “carved out a profitable niche” for innovative

brand Innocent, within the highly competitive drinks market.

Peter Kinder of KLD Research has released a paper

on the evolving SRI world, including a study of the language used

and its interpretation. It builds on some of the remarks made

by Paul Hawken that started a critical self review in the industry

at the end of last year. It also highlights the rapid pace of

change (another case supporting our perspective of accelerating change)

in investment behaviour.

SRI Notes and SRI-Extra, are two weblogs (or "blogs") devoted to SRI that have sprung up in the past year. They include topics such as a discussion tying game theory to socially responsible business practices, a review corralling recent developments on divestment from companies doing business with the genocidal government of Sudan and links to online resources on socially responsible investing (SRI) and corporate social responsibility (CSR).

Venture Capital

Almost everyone attending the Asian Venture Capital Journal forum had a comment about the huge buyout funds being raised in Asia, and a lack of deals to sustain the investments by those funds. Most of the attendees voiced concerns that these new funds are bidding up prices for deals in North Asia and India, and suggested the real problems may begin if a shortage of high-quality deals in those areas causes the large private equity players to fly into Southeast Asia to bid on the more visible deals. There was also concern that government investors have the ability to muddy waters further by their overbidding. Many think that the disparate markets in the region, the different languages and cultures, and the small size of the deals here, in both venture and buyouts, will prohibit the major firms without in-country staff from taking part in the most lucrative investment opportunities, but that does not mean they will not try to get in on the bidding game. And despite the problems caused by government regulatory intervention and other problems in markets such as Indonesia, Thailand and Vietnam, almost every speaker had positive deals to report over the past year.

While investors have justifiable concerns about these new funds, especially in Asia − where Affinity, Blackstone, Carlyle, CVC, KKR, Newbridge and now JP Morgan Partners Asia all have billion-dollar funds − they're still signing up for these funds with little restraint, pushing fund managers to take even more. It's turning the private equity environment in Asia into a pretty worrying place, where 20 and 30-something-year-old entrepreneurs and VCs suddenly have seven to eight-figure expectations for even the most unlikely business investments. We've seen it before and can only recommend care and pragmatism because even the best get burned in this kind of environment.

A China Venture Capital year book is now available, which includes:

-

More than 900 pages with over 400 easy reading charts & table

-

Full coverage of official policies, laws & regulations on venture capital in China

-

Independent reports on trend & prospect of China's venture capital markets & industry

-

Comprehensive statistical surveys of 144 venture capital firms from China's 24 regions

-

In-depth analysis of China's industries

-

Insightful research of venture capital hot issues in China

-

13 case studies on venture capital investments in China

-

Useful industry directory

For inquiries, please e-mail zhengwenfu@hotmail.com or call +8610-86426850

Interest Rates and Currencies

US Interest rates continue their rise as expected.

The possibility of a pause to breath for Katrina and Rita was not

necessary because of spending to rejuvenate affected areas.

The concerns about housing bubbles, inflation and government finances

continue.

The

chart to the right illustrates the decline of the dollar and its

current low level compared with the import price index, which has

naturally risen as the dollar has weakened. Normal equilibrium

tendency suggests that the dollar should appreciate, but it is being

held back. The imported inflation may be an increasing concern as

America is increasingly a service economy, importing manufactured

goods. It may also be that the low dollar value and rising

interest rates underpin the investment strategy of other central banks

- "the dollar must appreciate soon so we should hold dollars and sell

them when they are more valuable".

Certainly recent reports and analysis of currency flows indicate

that diversification from US dollars by central banks and others has

not happened this year. At the end of 2004 currency diversification

appeared to be happening, and for sound asset allocation reasons.

However, it has not continued this year and numbers by IMF indicate

that dollar holdings by Asian banks are robust. While we expect

diversification to continue to Euro and local currencies, it has not

been as quick or soon as at first anticipated, and this might affect

short term currency policy. As a medium to long term strategy

it remains appropriate to diversify currency exposure to local currencies

and to balance portfolios with Euros against US Dollars.

The notion that the US$ will lose its status as the world's main

reserve currency has been debated more vigorously recently,

as it is once a decade when the the dollar depreciates. What is

new today is that the Euro is offering a serious alternative because

of its stability and the volume of trade and business denominated in

Euro. While the main reserve currency is not likely to change

for some years, it does appear that prudent central bank policy is to

diversify reserves more to the Euro. This will accelerate over

the coming decade and should form a key part in long term planning.

Trade and FDI

According to the World Investment Report by UNCTAD FDI is up after

falling for three years, as this chart from The

Economist shows.

Following last month's note on Chinese banks some more statistics have arrived on our desk to colour the picture. From 1950 to 2003, foreign banks put a cumulative total of perhaps $ 2 billion into the Chinese banking system. In the past 12 months alone, foreign investors have committed nearly US$20 billion to direct equity stakes in Chinese banks - with more on the way. This figure does not even include another US$20 billion in actual and planned overseas listings. According to optimistic estimates, at this pace foreigners may own as much as one sixth of the entire mainland banking system by 2008. To some observers, this is a historic chance to buy into the greatest growth story in the world. To others, this is a pending disaster for foreign financial institutions. You know which camp our pragmatism puts us in.

A World Bank study Agricultural Trade Reform and the Doha Development Agenda examines why agricultural trade reform is critical to a favourable development outcome from the Doha Development Agenda. It builds up from the essential detail of the tariffs and other protection measures, and uses this information to provide an analysis of the big-picture implications of proposed reforms.

China's surging textile exports to the United States and Europe this year became a hot political issue during August, with Beijing at odds with Washington and Brussels over caps they imposed to protect domestic producers. The following is a summary of the key issues and stances from Reuters:

Global Trade Rules

The disputes stem from the January 1, 2005, expiration of a global quota system limiting textile trade between countries. Without the limits, U.S. and European retailers were free to buy as many garments as they wanted from China. But as part of its entry into the World Trade Organisation in late 2001, China agreed that the United States and Europe would have the right to invoke "safeguard measures" limiting growth in imports from China to 7.5 percent a year through to 2008 if it could be shown that such imports were causing market disruption.

EU

In June, China and the European Union agreed to limit growth in shipments of 10 lines of Chinese textile products to between 8.5 and 12 percent a year. But the quotas for 2005 were quickly filled, and 84 million trousers, blouses, and other clothing items are now held up in European ports. European Trade Commissioner Peter Mandelson is in Beijing to try to strike a deal during a summit between European leaders and Chinese President Hu Jintao in Beijing on Monday. Mandelson failed to secure backing in Brussels on Friday for the immediate release of about 80 million bras, sweaters and other goods piled up in ports and warehouses or en route for Europe. Countries with strong retail sectors, such as the Nordic states and Germany, have demanded the swift release of the goods, but face opposition from France, Italy, Spain and Portugal, which are still significant textile producers.

US

China's textile exports to the United States nearly doubled in the

first six months to $7.4 billion, causing alarm in textile-producing

states and heightening fears about the ballooning U.S. trade deficit

with China, which hit a record $162 billion in 2004. Earlier this year,

the Bush administration slapped safeguard curbs

on imports of Chinese-made trousers, shirts, underwear and cotton yarn.

It imposed extra curbs on bras and synthetic fabric last week just hours

after the failure of talks aimed at reaching a comprehensive deal governing

imports.

PRC

China says its textile export growth has been reasonable and stems

from competitive advantage provided by lower wages. It made 17 percent

of the world's clothing in 2003, and the WTO expects that share to climb

to 50 percent by 2008. The sector, which employs 19 million people,

is also an important source of jobs in a country whose Communist rulers

are highly concerned with social stability. In its talks with the European

Union, Beijing has been pushing to

have the quotas raised. In discussions with the United States, it is

seeking a long-term deal that will ensure it does not face future safeguard

measures.

Retailers

Retail associations oppose limits on imports, saying they result in higher prices and hurt consumers. U.S. retailers such as Wal-Mart and Gap Inc. and European ones like Sweden's Hennes and Mauritz and Spain's Inditex all source some clothing from China. The Netherlands, Denmark, Sweden and Finland have warned they face job losses and bankruptcies among retailers unless the curbs are eased. German retailers have raised the prospect of legal action.

Energy

Energy is in everything. Oil energy has replaced human

labour in most of the conveniences we take for granted. Instead

of 20 people harvesting wheat for a week or two, a single person drives

a combine harvester for a few hours. Instead of hand-working wood,

a factory produces lego furniture. As the value of oil goes

up, the value of money goes down. (And house values go up.)

This will change as alternative fuels become mainstream. This

process is accelerating, especially as climate change has blown through

the Texas oil fields. For example, car makers seemed all to be

trumpeting their hybrid initiatives in September.

Philips, the world leader in lighting, is finalising the launch of commercial

and retail LED lighting. This will revolutionise the industry

because LED lights, though more expensive than incandescent lights,

consumes 1/8 the power, is cool to the touch, robust, can be formed

in to different shapes and colours, and last 10- 20 years.

The market is expected to grow at 25% per year.

Climate Change and Environment

The effects of Katrina and Rita have helped wake up the oiloholics and the climate change naysayers. This satellite picture shows clearly the scale of impact by Rita which flooded the gulf coast. And you can see NOLA here.

Carbonfund is a US initiative to allow Americans to be proactive about climate change despite not being a signatory to Kyoto. Carbonfund reduces the threat of climate change by supporting energy efficiency, renewable energy, sequestration and other projects that reduce carbon dioxide.

We thought plants were good at reducing climate change by mopping up greenhouse gases (CO2) but new research by Laboratoire des Sciences du Climat et de l'Environnement (LSCE) in Gif-sur-Yvette near Paris, whose team published their study in the scientific journal Nature, suggests that even nature's homoeopaths may have been crippled by the fast rate of change. The new study shows that during the 2003 heatwave, European plants produced more carbon dioxide than they absorbed from the atmosphere. They produced nearly a tenth as much as fossil fuel burning globally. The study shows that ecosystems which currently absorb CO2 from the atmosphere may in future produce it, adding to the greenhouse effect. The 2003 European summer was abnormally hot; but other studies show that these temperatures could become commonplace. In some parts of Europe, 2003 saw temperatures soaring six degrees Celsius above normal; hot enough that estimates of the deaths which it caused run into the tens of thousands. It was also significantly drier than usual; and these two factors appear to have had a major impact on plant growth. The result coming from the 18 sites was that during 2003, plants took up less CO2 from the air and grew more slowly - a finding corroborated by satellite measurements of the area under leaf.

So much for natural ecosystems, but what about farmland? Here, the researchers drew on data from the UN Food and Agriculture Organisation, which showed a fall in European crop yields during the 2003 summer. Putting all the data together, the headline figure is that, overall, European lands were 20% less productive than during an average year. The really surprising finding came with the calculation that during the heatwave, European plants and their ecosystems were putting more carbon dioxide into the air than they were absorbing! "In the past we expected that climate change would benefit European ecosystems because growth tends to be limited by the short growing season," said Andrew Friend, "but this analysis hadn't taken into account the possibility of extreme events. "The conclusion of our study is that this extreme event meant a loss of carbon across Europe - a loss which undoes many years of net uptake." Plants can absorb and emit carbon dioxide and oxygen; the process of respiration takes oxygen in and releases CO2, whereas in photosynthesis, the reverse happens.

Other parts of the ecosystem such as soil bacteria can also contribute to the overall flow of these gases to and from the atmosphere. During an average year, the net effect is that European plants absorb around 125 million tonnes of carbon (MtC). But in 2003, according to this analysis, they released 500 MtC to the atmosphere. By comparison, global emissions from burning fossil fuels amounts to about 7,000 MtC; by giving rather than taking, European plants were adding about 10% to the global total.

The

area covered by sea ice in the Arctic has shrunk for a fourth consecutive

year, according to new data released by US scientists. This record

loss of sea ice in the Arctic

this summer has convinced scientists that the northern hemisphere

may have crossed a critical threshold

beyond which the climate may never recover. Scientists fear that the

Arctic has now entered an irreversible phase of warming which will

accelerate the loss of the polar sea ice which has kept the climate

stable for thousands of years. They believe global warming is melting

Arctic ice so rapidly that the region is now absorbing more heat from

the sun, causing the ice to melt further and reinforcing a cycle of

melting and heating. The greatest fear is that the Arctic has reached

a "tipping point" beyond which nothing can reverse the continual loss

of sea ice and the massive land glaciers of Greenland, which will

raise sea levels dramatically. Satellites monitoring the Arctic have

found that the extent of the sea ice this August has reached its lowest

monthly point on record, dipping an unprecedented 18.2pc below the

long-term average. They say that this month sees the lowest

extent of ice cover for more than a century. The Arctic climate varies

naturally, but the researchers conclude that human-induced global

warming is at least partially responsible.

They warn the shrinkage could lead to even faster melting in coming

years. The current rate of shrinkage they calculate at 8% per

decade; at this rate there may be no ice at all during the summer

of 2060.

The

area covered by sea ice in the Arctic has shrunk for a fourth consecutive

year, according to new data released by US scientists. This record

loss of sea ice in the Arctic

this summer has convinced scientists that the northern hemisphere

may have crossed a critical threshold

beyond which the climate may never recover. Scientists fear that the

Arctic has now entered an irreversible phase of warming which will

accelerate the loss of the polar sea ice which has kept the climate

stable for thousands of years. They believe global warming is melting

Arctic ice so rapidly that the region is now absorbing more heat from

the sun, causing the ice to melt further and reinforcing a cycle of

melting and heating. The greatest fear is that the Arctic has reached

a "tipping point" beyond which nothing can reverse the continual loss

of sea ice and the massive land glaciers of Greenland, which will

raise sea levels dramatically. Satellites monitoring the Arctic have

found that the extent of the sea ice this August has reached its lowest

monthly point on record, dipping an unprecedented 18.2pc below the

long-term average. They say that this month sees the lowest

extent of ice cover for more than a century. The Arctic climate varies

naturally, but the researchers conclude that human-induced global

warming is at least partially responsible.

They warn the shrinkage could lead to even faster melting in coming

years. The current rate of shrinkage they calculate at 8% per

decade; at this rate there may be no ice at all during the summer

of 2060.

The idea behind tipping-points is that at some stage the rate of global warming would accelerate, as rising temperatures break down natural restraints or trigger environmental changes which release further amounts of greenhouse gases. Possible tipping-points include

-

the disappearance of sea ice leading to greater absorption of solar radiation

-

a switch from forests being net absorbers of carbon dioxide to net producers

-

melting permafrost, releasing trapped methane

IT

eBay bought Skype for $ 2.6 billion, and another $ 1.5 billion if targets are met. Skype has got more subscribers at 54 million vs 50 million, though revenues are only $ 60 million. Other players in the online phone market include computer giants such as Google, Microsoft, AOL and Yahoo, all of whom may have bid on Skype pushing the price up. Google recently launched its Talk service, while Microsoft purchased leading player Teleo for an undisclosed sum.This has been big news because of the massive price, and also because it is the death knell of telephone charges - users can use VoIP like email - for free once you've paid your monthly ISP charges. The ability to make nearly free phone calls over the internet is fatally disruptive to the traditional pricing model. It is also shaking up advertising, specifically online advertising. The recent innovation of pay-per-click can now be enhanced to pay-per-call which leads to advertisers only paying for advertising that results in a purchase enquiry - now all your advertising dollars will bring value.

IT in China has received much press as companies like Yahoo, Google and MS have been forced to comply with central government demands. This has become more of a challenge for China because the internet has helped boost illegal demonstrations, which are estimated to have grown by half in 2004 and more this year. While companies will be lambasted for breach of privacy it is quite clear that in order to operate in China they must comply and that without them there would be little opportunity for the flowering of ideas that the web incubates.

Google and Sun Microsystems have joined forces to challenge the dominance of Microsuck's Office software. Google will offer Sun's OpenOffice software via its website, while people downloading Sun's Java program will get the option to take Google's toolbar.

A study by CEBR found that personal wealth has increased because

ebay has brought liquid value to things you do not really want anymore

in your home. They estimate that the new value of sellable items

in your home at about € 5,000.

The US has rejected calls by European Union (EU) officials to give control of the net over to a more representative United Nations (UN) body. Wrangling over who should essentially be the net police, managing domain names and net traffic routing fairly, has been going on for some time. The matter is supposed to be discussed at November's World Summit on the Information Society in Tunisia. But at a pre-Summit meeting in September, the US said it would resist the plans. Currently, the US Commerce Department approves any changes to the internet's core addressing systems, the root zone files, managed by Icann (Internet Corporation for Assigned Names and Numbers). Last month the UN's Working Group on Internet Governance (WGIG) published its proposals for reform of the way the net is run, which are to be debated at the Summit. Governance over the net - the management of its addressing systems and traffic routing - has historically been the role of the US because it largely funded and pushed its early development.The US argues that UN proposals would shift the regulatory approach from private sector leadership to government, top-down control. But many countries, particularly developing nations, have been calling for the US to relinquish control, or at least to come up with a compromise, to ensure the net is managed more equitably. As many developing countries seek to exploit the net for economic and social development, the issue has become more pressing.

The UN's WGIG has suggested four alternatives:

-

Option One - create a UN body known as the Global Internet Council that draws its members from governments and "other stakeholders" and takes over the US oversight role of Icann.

-

Option Two - no changes apart from strengthening Icann's Governmental Advisory Committee to become a forum for official debate on net issues.

-

Option Three - relegate Icann to a narrow technical role and set up an International Internet Council that sits outside the UN. US loses oversight of Icann.

-

Option Four - create three new bodies. One to take over from Icann and look after the net's addressing system. One to be a debating chamber for governments, businesses and the public; and one to co-ordinate work on "internet-related public policy issues".

Software giant Oracle is buying US rival Siebel Systems in a deal worth $5.85billion (£3.2billion) in cash and stock. Oracle is offering $10.66 per Siebel share, 16.8% more than Siebel's closing share price before the announcement. Siebel makes software to help companies manage their relationships with clients. The takeover by Oracle had long been predicted by analysts. It is the latest acquisition by Oracle which bought another rival, Peoplesoft, in December last year for $10billion.

Intel and Microsoft have said they will support Toshiba-led next generation DVD technology, HD DVD, over a rival Sony-led Blu-ray DVD technology. Toshiba, with NEC, Sanyo and others, is pushing HD DVD, while backers of Sony's Blu-ray discs include Dell and Apple. This may be another VHS/Betamax saga and the next year will indicate how it might play out. The next generation of DVDs will be able to store much more high-quality data, including high-definition video. Future discs will be able to hold about six times as much data as current DVDs. The next generation of DVDs will be very important for studios, technology manufacturers, and the games industry. Sony has already said its PlayStation 3 games console will support Blu-ray.

Integral Systems and LOHAS

According

to the Global Amphibian Assessment,

a vast and authoritative study which reported its findings last year,

almost a third of the 5,743 known species are at risk of extinction;

up to 122 have disappeared within the last 25 years. About a third

of all amphibian species are at a high risk of extinction. Chytridiomycosis,

a fungal disease which emerged in the 1970s as a consequence of environmental

degradation, occupied much of the delegates' attention.It has devastated

populations, particularly in south and central America, but is also

firmly established in Australia, Africa and Europe. "Many species

have already become extinct through habitat loss," Rohan Pethiyagoda,

deputy chair of IUCN's species survival commission, told the BBC News

website. "The extent of these declines and extinctions is without

precedent in any class of animals over the last few millennia."

A global action plan was drawn up during an expert summit in Washington

DC, and backed by the UN's biodiversity agency IUCN. The action plan

emerging from this meeting lists six major reasons behind the decline:

According

to the Global Amphibian Assessment,

a vast and authoritative study which reported its findings last year,

almost a third of the 5,743 known species are at risk of extinction;

up to 122 have disappeared within the last 25 years. About a third

of all amphibian species are at a high risk of extinction. Chytridiomycosis,

a fungal disease which emerged in the 1970s as a consequence of environmental

degradation, occupied much of the delegates' attention.It has devastated

populations, particularly in south and central America, but is also

firmly established in Australia, Africa and Europe. "Many species

have already become extinct through habitat loss," Rohan Pethiyagoda,

deputy chair of IUCN's species survival commission, told the BBC News

website. "The extent of these declines and extinctions is without

precedent in any class of animals over the last few millennia."

A global action plan was drawn up during an expert summit in Washington

DC, and backed by the UN's biodiversity agency IUCN. The action plan

emerging from this meeting lists six major reasons behind the decline:

-

habitat loss and degradation

-

climate change

-

chemical contamination

-

infectious disease, notably the fungal infection chytridiomycosis

-

invasive species

-

over-harvesting

Over the three days, working groups drawn from a wide range of scientific institutions and conservation organisations have established budgets for tackling each of these issues; the overall total comes to US$ 404 million.

Contemporaneously, the Zoological Society of London is to build a new centre for the conservation of frogs, toad and other amphibians.The £ 2.2 million project will include a public exhibit at London Zoo, laboratories for disease research, and captive breeding facilities. Scientists involved say it will be the first integrated amphibian conservation centre in the world.

Last month we learned of the increasing risk of extinction of apes. And now we have learned in September the genome of the chimpanzee (human's closest cousin) was sequenced. The genome of troglodytes (chimp) is only 1.2% different from sapiens (human), though other factors make the hereditary and evolutionary pathway more complex (as we learned in Darwin's Watch). This close similarity may prove valuable in understanding human intelligence, even though troglodytes may be extinct in 50 years!

Bird Flu is breaking out again in Indonesia. Half a dozen people have died this year so far and millions of birds have been culled. Concerned efforts to keep it under control are being taken by Indonesia and WHO. Asian Ministers made it a focus of their annual agri and forestry meeting at the end of September. Bird flu is becoming a global concern as it can be spread across borders by migratory birds. Experts say a lack of funds is hampering the fight against the virus which has killed more than 60 people in Asia in the last two years. More than a 140 million chickens, ducks and other birds have died or been slaughtered in the effort to contain outbreaks. Dr David Nabarro, a leading United Nations official, has warned there could be a new influenza outbreak at any time which could kill up to 150 million people, saying the influenza pandemic was likely to be caused by a mutation of the virus that is currently causing bird flu in Asia. Dr Nabarro has just been appointed to co-ordinate the UN's efforts to control the bird flu epidemic in Asia.

The Pennsylvania school boards case on teaching creationism is now in court. Defending the school district, Patrick Gillen said the case was about "free inquiry in education, not about a religious agenda". It remains surprising that the cradle of America and Ben Franklin's home state is dragging its feet on science.

Foods high in fat, salt or sugar are to be banned from vending machines and meals in English schools within a year. The junk food ban from next September is to be announced by Education Secretary Ruth Kelly at the Labour Party conference. Ministers had said vending machines could be excluded from a crackdown, but they will now be banned from stocking sweets, crisps and high-sugar drinks.

A University of Southern California team studied 49 people and found those known to be pathological liars had up to 26% more white cerebral matter than others. White matter transmits information and grey matter processes it. Having more white matter in the prefrontal cortex may aid lying, the researchers said. But the British Journal of Psychiatry said there were likely to be more differences in the brains of liars. Liars were found to have between 22 and 26% more white matter than either those with no history of lying or those in the anti-social group. The findings could not be explained by differences in age, ethnicity, IQ, head injury or substance misuse. This is the first study to show a brain abnormality in people who lie, cheat and manipulate others, the researchers said. They said the study could help research into areas such as people who feign illness. The findings are in line with previous studies which showed children with autism are less capable of lying than other children. Brain neurodevelopmental studies of autism show people with the condition have more grey matter than white matter - the opposite pattern to the liars in this study. The researchers say the link between white matter and a deceitful personality could be that white matter provides a person with the cognitive capacity to lie.

California governor Schwarzzenegger is losing his way. He has vetoed a bill allowing gay marriage. For an immigrant this discrimination is unexpected, even if he is "Republican". It appears that the pressure of political life is forcing a personal transformation in which he will regress in to conservatism, after which he will emerge seeking more external cohesion and community, but this may not happen for years.

Palm oil, a vegetable oil found in 1 in 10 supermarket

products, is the biggest threat to the survival of the orang-utan.

Today the greatest threat to orang-utan habitat is the continued expansion

of oil-palm plantations. See the report here and the short video here.

Palm oil, a vegetable oil found in 1 in 10 supermarket

products, is the biggest threat to the survival of the orang-utan.

Today the greatest threat to orang-utan habitat is the continued expansion

of oil-palm plantations. See the report here and the short video here.

Research by the Soil Association reveals that government testing found over 25% more pesticides in samples of fruit and vegetables supplied to school children, under the official School Fruit and Vegetable Scheme (SFVS), than in samples of the same fruit and vegetables on sale in shops. Nearly 30% more instances of multiple pesticides were found in the school fruit and vegetable samples. Following this discovery, the Soil Association has accused the UK government appointed Pesticide Residues Committee (PRC) of wrongly claiming that the pesticide residue profiles of school fruit and vegetables appear "similar" to residues found in fruit and vegetables sold in shops. Peter Melchett, policy director of the Soil Association, says: "The Soil Association strongly supports the school fruit scheme. But it is wrong for a scheme that provides fruit and vegetables to the most vulnerable in society to source lower quality fruit and vegetables, apparently containing a higher proportion of pesticides and pesticide cocktails, than the fruit and vegetables available in shops. It is vital that children eat more fruit and vegetables; to encourage this the school fruit scheme needs to focus on sourcing high-quality produce, wherever possible from the UK, and work towards achieving zero pesticides as quickly as they can."

Two new research studies confirm both the short and long-term

benefits of a plant based diet. A new report

from the US, published by the American Journal of Medicine has

found that women who stick to a low-fat vegan diet are more likely

to lose weight than those whose diets include meat. Half the 59

overweight volunteers in the study followed a strictly vegan diet

as part of the experiment conducted by Dr Neal Barnard, president

of the Physicians Committee for Responsible Medicine. The other

half were given food in line with a national programme designed

to reduce illness and death from coronary heart disease in the

US, which endorses the consumption of low-fat animal products.

Dr Barnard, working with Georgetown University Hospital and George

Washington University, found those on the vegan diet were able

to lose weight without feeling hungry. All the women were of post-menopausal

age.Mr Barnard said: "The study participants following the vegan

diet enjoyed unlimited servings of fruits, vegetables, whole grains,

and other healthy foods that enabled them to lose weight without

feeling hungry. As they began to experience the positive effects,

weight loss and improved insulin sensitivity, the women in the

intervention group became even more motivated to follow the plant-based

eating plan."

In a separate study carried out on 55,000 women, researchers at

Tufts University in Sweden found that of the group, 40% of meat-eaters

were overweight or obese compared to 25% to 29% of vegetarians

and vegans. The latest study involving more than 3,000 US people

found those who ate more of these foods were less likely to develop

lung cancer. The protective effect, thought to be down to oestrogen-like

compounds within the foods, appeared to reduce cancer risk by

as much as 46%. Phytoestrogens appeared to cut cancer risk between

about 20% and 45% in men and women. The research appears

in the Journal of the American Medical Association. "However,

it is essential not to forget that nine out of 10 cases of lung

cancer and a quarter of all cancer deaths are caused by smoking."

The Prince of Wales gave this closing speech at the Terra Madre conference in Turin, Italy. The conference, held in October 2004, brought together 5,000 small scale food producers and traders and was organized by the Slow Food movement. He talks about globalization, the homogenization of food and the manipulation of nature. He then warns of the dangers of imposing industrial farming systems on traditional agricultural economies, especially in the developing world. You can see Big Picture's "The Future of Food" (18m 59sec)video here.

The race is on to build the first 'space elevator' - long dismissed as science fiction - to carry people and materials into orbit along a cable thousands of miles long. In a significant step, American aviation regulators have just given permission for the opening trials of a prototype, while a competition to be launched next month follows in the wake of the $10million (€8.3million) "X Prize", which led to the first privately developed craft leaving the Earth's atmosphere, briefly, last year. Supporters of the concept promise a future in space that is both cheap and accessible, and contrast it to Nasa's announcement last week that it will be relying on 40-year-old technology from the Apollo programme for its $105billion plan to return to the Moon by 2018. The companies behind the space elevator say they will be able to lift material into orbit for as little as $400 a pound, compared with $20,000 a pound using existing rockets. That would open up the possibility of tourists visiting a sky hotel in stationary orbit 22,000 miles above the Earth, with a view previously enjoyed only by astronauts. Scientists now believe that a material known as carbon nanotubes could be bound together to make a ribbon, rather than a cable, three-feet across but just half the width of a pencil. Nanotubes, which are microscopic cylinders of carbon, are currently being developed by a number of companies, including GE and IBM. In one experiment, a sheet of nanotubes one-thousandth the thickness of a human hair could support 50,000 times its own mass. "Elevator 2010", which is to be launched on October 21 in California, will offer an annual first prize of $50,000 for the best design for both a tether - or ribbon - and a lightweight climber.

Activities, Books and Gatherings

The development of a simple integral modelling tool took a step forward in September. Graphic representation of emerging intelligences fell into place. A basic model is viewable here. Readers will recognise the elements of spiral dynamics, integral thinking, business consciousness and spiritual teaching. It is powerful because it is applicable across industries and sectors, lifestages, individuals and organisations and brings all elements together.

Our rediscovered aqueduct at Ballin Temple was covered in a feature in a local newspaper. (It was an unexpected encounter with local journalism.)

I'm afraid I've let Pratchett get the better of me again. Small Gods is TBL excellent.

Our websites have been slightly updated. The principal change has been to install news feeds on the home page and reorganise site section links thus making the home page a more useful daily launch pad for surfing. www.astraea.net www.griequity.com

Our friend Louise Smart's new website is up: www.emotional-detoxing.com. Louise is an executive coach.

Graham Wilson has shared an eye opening article on Jack Welch's management style. I recommend it to fans of Welch and executives building performance organisations.

Fortune's Formula by William Poundstone tells of a scientific betting system that can beat the market. It describes the story and use of physicists John Kelly's formula which tells you how much to bet based on your edge and the risk profile. It is said to appeal to readers of books like Bernstein's Against The Gods, one of our top recommendations, so its probably worth a look.

French speakers may enjoy www.defipourlaterre.org, an eco website with popular backing which was recommended by one of our friends.

Parents might enjoy Fluffledums a new interactive website which explores challenges of living with nature.

This report has been prepared for information purposes and is not an offer, or an invitation or solicitation to make an offer to buy or sell any securities. This report has not been made with regard to the specific investment objectives, financial situation or the particular needs of any specific persons who may receive this report. It does not purport to be a complete description of the securities, markets or developments or any other material referred to herein. The information on which this report is based, has been obtained from publicly available sources and private sources which may have vested interests in the material referred to herein. Although GRI Equity and the distributors have no specific reasons for believing such information to be false, neither GRI Equity nor the distributors have independently verified such information and no representation or warranty is given that it is up-to-date, accurate and complete. GRI Equity, associates of GRI Equity, the distributors, and/or their affiliates and/or their directors, officers and employees may from time to time have a position in the securities mentioned in this report and may buy or sell securities described or recommended in this report. GRI Equity, associates of GRI Equity, the distributors, and/or their affiliates may provide investment banking services, or other services, for any company and/or affiliates or subsidiaries of such company whose securities are described or recommended in this report. Neither GRI Equity nor the distributors nor any of their affiliates and/or directors, officers and employees shall in any way be responsible or liable for any losses or damages whatsoever which any person may suffer or incur as a result of acting or otherwise relying upon anything stated or inferred in or omitted from this report.

Home * About * Resources * Investors * Entrepreneurs * Members * Admin